Can You Start Forex Trading with $100? (Honest Answer + Tips for 2026)

You’ve seen the flashy ads: “Turn $100 into $10,000 in 30 days!” or “Start trading forex with just $100!” But is it really possible to start forex trading with only $100, and more importantly, should you? The short answer is yes, you can—but there’s a lot more to the story that those advertisements won’t tell you.

In this brutally honest guide, we’ll explore the reality of trading with $100, what you can realistically achieve, the challenges you’ll face, and proven strategies to maximize your chances of success with a small account. No hype, no false promises—just the truth about small account forex trading in 2026.

The Honest Truth: Yes, You Can Start with $100 (But It’s Challenging)

Let’s start with the facts: many forex brokers now accept minimum deposits as low as $10 to $100, so technically, you absolutely can start trading with $100. The barrier to entry has never been lower, which is both a blessing and a curse.

The blessing: Anyone can access the forex market and start learning real trading with minimal financial risk.

The curse: The low barrier creates unrealistic expectations and leads many beginners to lose money quickly because they’re undercapitalized and unprepared.

Trading with $100 is possible, but it’s drastically different from trading with $1,000 or $10,000. You’ll face unique challenges that well-capitalized traders never encounter, and your approach must be carefully tailored to your account size.

[IMAGE PLACEHOLDER: Reality vs expectation comparison showing realistic $100 account growth vs common myths – Alt text: “Realistic forex trading expectations with $100 starting capital versus common myths”]

What $100 Can (and Cannot) Do in Forex Trading

What You CAN Do with $100

1. Learn Real Trading Fundamentals A $100 account provides invaluable real-market experience that demo trading can’t replicate. You’ll experience actual emotions—fear, greed, excitement, disappointment—that come with risking real money, even if it’s a small amount.

2. Practice Risk Management You can learn proper position sizing, stop loss placement, and risk-reward calculations with actual consequences for mistakes. This practice is priceless for your future trading career.

3. Test Trading Strategies $100 allows you to validate whether your trading strategy actually works in live market conditions with real execution, spreads, and slippage.

4. Build Trading Psychology You’ll develop emotional control and decision-making skills that are essential for successful trading, without risking amounts that could financially harm you.

5. Understand Broker Execution Experience how your broker executes orders during different market conditions, including how they handle stop losses and take profits.

What You CANNOT Do with $100

1. Generate Meaningful Income Even with exceptional trading—20% monthly returns—you’d only make $20 per month from a $100 account. After months of work, this won’t meaningfully impact your finances.

2. Trade Comfortably with Proper Risk Management Following the standard 1-2% risk rule means risking only $1-$2 per trade, which severely limits your position sizing options and flexibility.

3. Withstand Normal Drawdowns A typical drawdown of 15-20% (which is normal even for good traders) means losing $15-$20, which is a significant percentage of your capital and psychologically difficult.

4. Diversify Across Multiple Pairs With $100, you can realistically only trade one currency pair at a time while maintaining proper risk management.

5. Overcome Spread Costs Easily With such a small account, spread costs represent a much larger percentage of your capital, making profitability more challenging.

[LINK PLACEHOLDER: Internal link to “How Much Money Do You Need to Start Forex Trading in 2026”]

The Mathematics: Breaking Down a $100 Account

Let’s do some realistic math to understand what you’re working with.

Position Sizing with $100

Using the 1% risk rule (which is essential for survival):

- 1% of $100 = $1 risk per trade

If you’re trading EUR/USD with a 20-pip stop loss:

- $1 risk ÷ 20 pips = $0.05 per pip

- This equals 500 units (0.005 lots or 5 micro lots)

With many brokers, this is actually the minimum position size, so you have zero flexibility in your risk management.

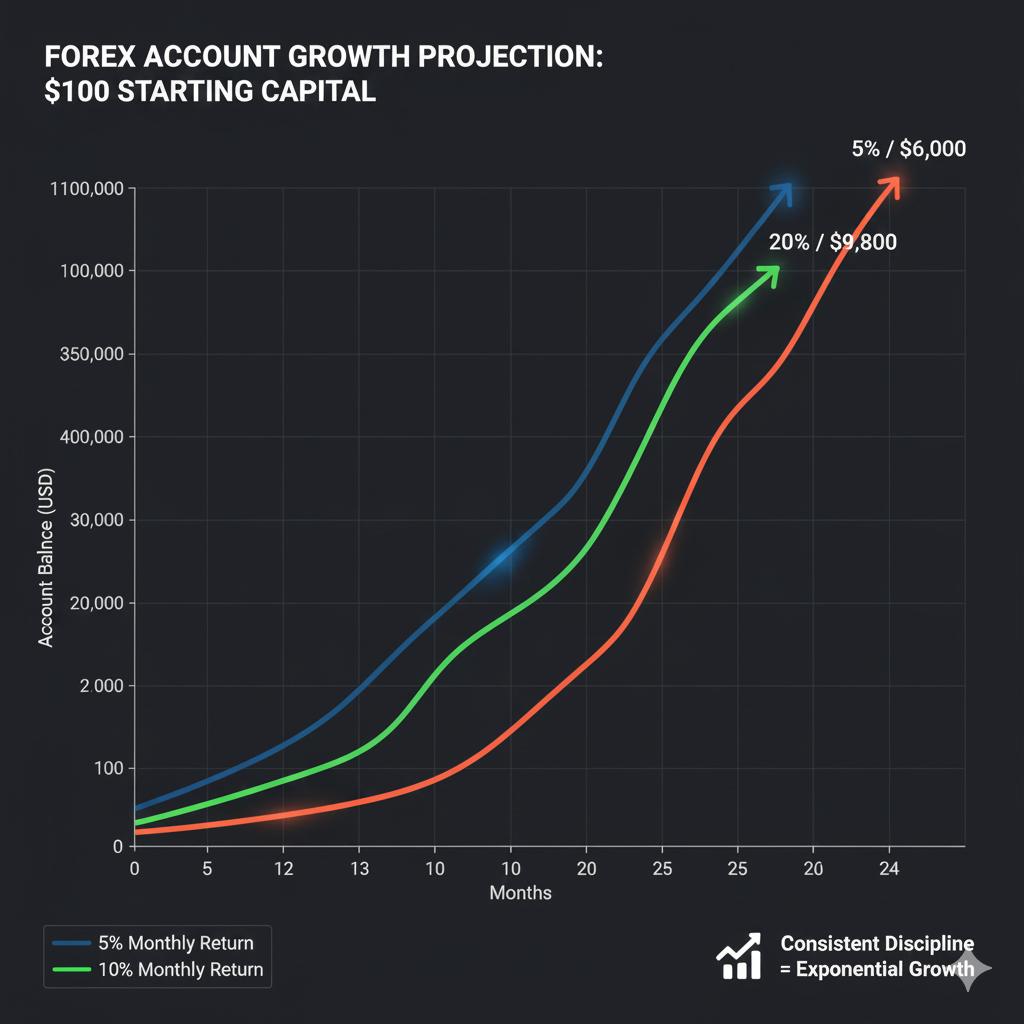

Realistic Profit Scenarios

Conservative Scenario (5% monthly return):

- Month 1: $100 → $105

- Month 3: $100 → $115.76

- Month 6: $100 → $134.01

- Month 12: $100 → $179.59

- Month 24: $100 → $322.51

Moderate Scenario (10% monthly return):

- Month 1: $100 → $110

- Month 3: $100 → $133.10

- Month 6: $100 → $177.16

- Month 12: $100 → $313.84

- Month 24: $100 → $985.47

Aggressive Scenario (20% monthly return):

- Month 1: $100 → $120

- Month 3: $100 → $172.80

- Month 6: $100 → $298.60

- Month 12: $100 → $891.61

- Month 24: $100 → $7,949.55

The Reality Check

While the 20% monthly return scenario looks exciting, consider these facts:

- 20% monthly is extraordinarily difficult – Most professional traders aim for 5-10% monthly

- Consistency is nearly impossible – You’ll have losing months that reset progress

- Psychological pressure increases – As your account grows, the dollar amounts at risk become more meaningful

- One bad streak can wipe you out – A series of 5-7 losing trades at 2% risk each can devastate a small account

The Biggest Challenges of Trading with $100

Challenge 1: Spread Costs Are Proportionally Massive

Spreads that seem insignificant to larger accounts become major obstacles for $100 accounts.

Example:

- EUR/USD average spread: 1-2 pips

- Trading 1 micro lot (1,000 units): Spread cost = $0.10-$0.20

- This represents 0.1-0.2% of your $100 account PER TRADE

- Make 20 trades in a month = 2-4% lost to spreads alone

Compare this to a $10,000 account where the same spread cost represents only 0.001-0.002% per trade. This massive proportional difference makes profitability significantly harder for small accounts.

Challenge 2: Limited Position Sizing Options

With only $100, you’re forced to trade the absolute minimum position sizes, giving you no flexibility to adjust risk based on trade quality or market conditions.

If a trade setup has exceptional quality with a tight stop loss, you can’t increase your position size to capitalize on the opportunity. You’re stuck with the same micro-position for every trade, regardless of the setup’s strength.

Challenge 3: Psychological Pressure

A $100 account creates unique psychological challenges:

- Every loss feels significant – Losing $2 is “only 2% mathematically but feels like a lot on a $100 account

- Impatience for growth – The slow growth rate tempts you to overtrade or take excessive risks

- Fear of being “stopped out” – With such small capital, you might place stops too tight to avoid larger losses

- Temptation to overlever – The desire to “catch up” or “make real money” pushes traders to use excessive leverage

[LINK PLACEHOLDER: Internal link to “Forex Trading Psychology: Master Your Emotions”]

Challenge 4: Broker Limitations

Some challenges come from broker restrictions:

- Minimum position sizes – Many brokers won’t allow positions smaller than 1 micro lot (1,000 units)

- Minimum stop loss distances – Some brokers enforce minimum stop distances of 10-15 pips

- Withdrawal minimums – Many brokers require minimum withdrawals of $50-$100

- Margin call thresholds – Small accounts hit margin calls much more easily

Challenge 5: Emotional Trading Becomes More Likely

When you can see your entire account balance on one screen and watch it fluctuate, emotional decision-making becomes harder to avoid:

- Revenge trading after losses

- Prematurely closing winning trades

- Moving stop losses when trades go against you

- Overtrading to “make back” losses quickly

How to Maximize Success with a $100 Account

Despite the challenges, traders have successfully grown $100 accounts. Here’s how to maximize your chances.

Strategy 1: Treat It as an Educational Investment

Mindset Shift: Think of your $100 as tuition for your forex education, not as seed capital for wealth building.

Action Steps:

- Focus on learning rather than earning

- Keep detailed trading journals

- Study your winning AND losing trades

- Practice emotional control

- Perfect your risk management

- Test different strategies

If you lose the entire $100 while learning valuable lessons, that’s far cheaper than any quality trading course and infinitely more educational than demo trading.

[IMAGE PLACEHOLDER: Checklist infographic showing learning objectives for small account traders – Alt text: “Educational goals and milestones for forex traders starting with $100”]

Strategy 2: Follow Strict Risk Management

This cannot be emphasized enough. With a small account, strict risk management is your only path to survival.

Non-Negotiable Rules:

- Risk only 1% per trade – With $100, that’s $1 per trade maximum

- Never risk more than 5% total – Have no more than 5 open positions at once

- Use stop losses on every trade – No exceptions, ever

- Maintain 2:1 or better risk-reward ratios – If risking $1, target at least $2 profit

- Track your risk exposure – Always know your total account risk

Strategy 3: Focus on One or Two Currency Pairs

With limited capital, specialization is key.

Best Pairs for Small Accounts:

- EUR/USD – Tightest spreads, highest liquidity, most predictable

- GBP/USD – Good volatility, decent spreads during London/New York overlap

- USD/JPY – Alternative Asian session option with moderate volatility

Why limit yourself:

- Learn these pairs’ personalities intimately

- Reduce analysis paralysis

- Lower spread costs by trading only during optimal sessions

- Develop expertise rather than mediocrity across many pairs

[LINK PLACEHOLDER: Internal link to “Best Currency Pairs for Beginner Forex Traders”]

Strategy 4: Trade Less, Trade Better

Quality over quantity is essential for small accounts.

Trading Frequency Guidelines:

- Aim for 5-10 high-quality trades per month, not 50-100 mediocre ones

- Wait for A+ setups that meet all your criteria

- Skip marginal setups – they’re not worth the spread costs

- Focus on key trading sessions when your pairs are most active

- Avoid revenge trading or trading out of boredom

Every trade costs you money in spreads, so each one must be worth taking.

Strategy 5: Use Swing Trading or Position Trading

Day trading and scalping are nearly impossible to profit from with a $100 account due to spread costs.

Why Swing Trading Works Better:

- Fewer trades = Lower total spread costs

- Larger pip targets = Better spread-to-profit ratios

- Less screen time = Lower psychological pressure

- Works with a full-time job

- Allows overnight holding for larger moves

Typical Swing Trade:

- Entry: EUR/USD at 1.0800

- Stop Loss: 1.0750 (50 pips)

- Take Profit: 1.0900 (100 pips)

- Risk-Reward: 2:1

- Hold time: 2-7 days

With proper position sizing (risking $1 on 50 pips = $0.02 per pip = 2,000 units), a winning trade yields $2 profit on $1 risk.

[LINK PLACEHOLDER: Internal link to “Swing Trading Forex: Complete Strategy Guide”]

Strategy 6: Compound Aggressively (Initially)

Since you’re starting with minimal capital, reinvest every penny of profit, at least initially.

Compounding Plan:

- Don’t withdraw anything until you reach $500-$1,000

- Reinvest all profits to accelerate growth

- Once you hit $500, consider taking out your initial $100

- From $500-$1,000, continue compounding

- Above $1,000, you can start taking small withdrawals

Remember: $20 profit on a $100 account (20% gain) is far more valuable when reinvested than when withdrawn.

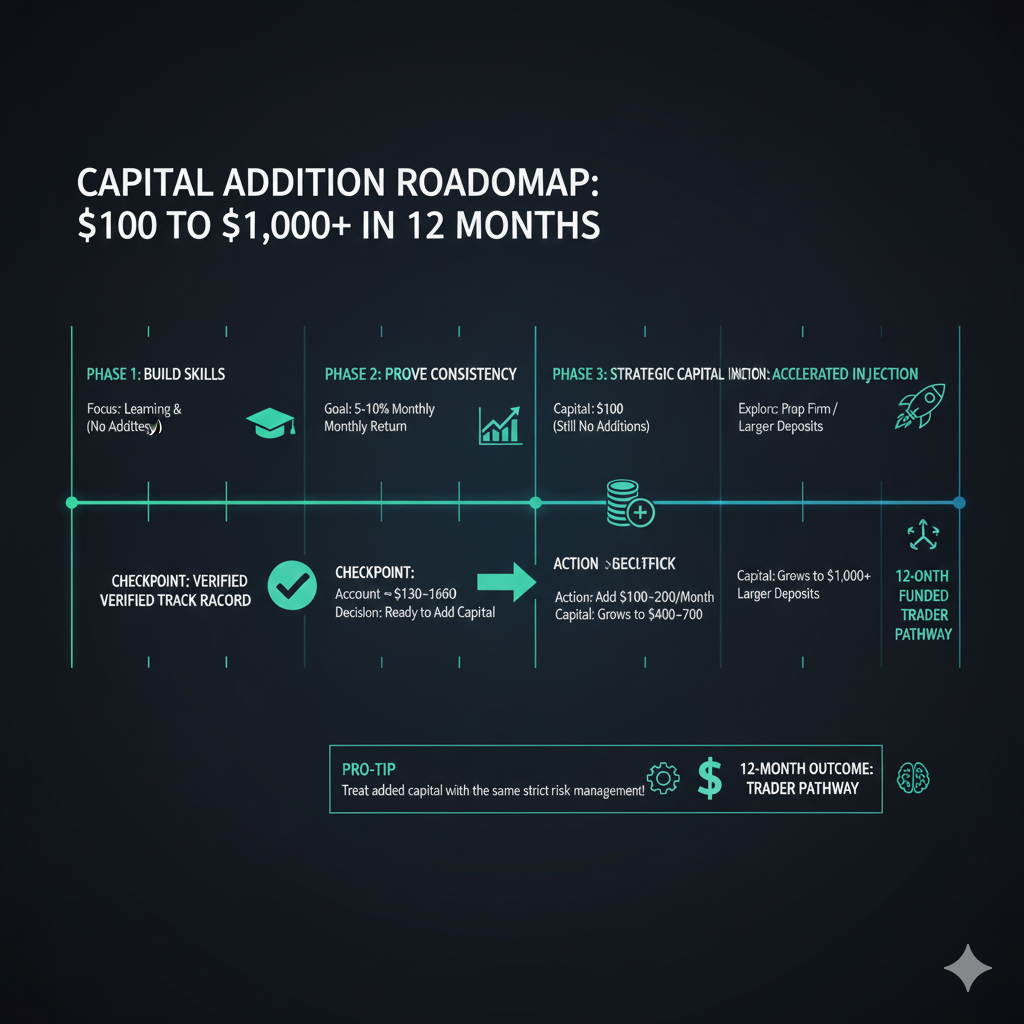

Strategy 7: Plan to Add Capital

Have a plan to add more money to your account as you prove yourself.

Sample Capital Addition Plan:

Phase 1: Prove Your System (Months 1-3)

- Trade your $100 account

- Goal: Stay above $90 (max 10% drawdown)

- Focus on consistency, not profits

Phase 2: Add Capital After Consistency (Months 4-6)

- If you’re consistently profitable (even small gains)

- Add $200-$300 more

- Now trading with $300-$400 total

Phase 3: Scale Gradually (Months 7-12)

- Continue adding $100-$200 monthly if profitable

- By month 12, target account size of $1,000-$1,500

- Now you can trade more comfortably with better risk management

This approach combines the learning benefits of starting small with the practical benefits of proper capitalization.

Strategy 8: Use a Reputable Micro Account Broker

Not all brokers are created equal, especially for small accounts.

What to Look For:

- True micro lots – Ability to trade 1,000 units (or even nano lots of 100 units)

- Tight spreads – Even 1 pip difference matters significantly

- No minimum deposit requirements or very low minimums

- Regulation – ASIC, FCA, CySEC, NFA regulated brokers

- No commissions on micro accounts – Or very low commissions

- Good execution – No suspicious slippage or stop hunting

Red Flags to Avoid:

- Unregulated offshore brokers

- Brokers with withdrawal complaints

- Minimum position sizes above 0.01 lots

- Spreads wider than 2-3 pips on EUR/USD

- Bonuses that lock your funds with impossible conditions

Common Mistakes Small Account Traders Make

Mistake 1: Overleveraging to “Make Real Money”

The Temptation: “If I just use higher leverage, I can make meaningful profits even with $100!”

The Reality: Higher leverage magnifies losses just as much as profits. Most traders who overlever blow up their accounts within weeks.

The Fix: Use no more than 10:1 to 20:1 effective leverage regardless of what your broker offers. Your position size should be determined by your stop loss distance and 1% risk rule, not by maximum leverage available.

Mistake 2: Trying to Scalp or Day Trade

The Temptation: “If I make 10-20 small trades per day, I can accumulate profits quickly!”

The Reality: With 10 trades per day at 1-2 pip spreads, you’re losing $1-$2 daily just to spreads (1-2% of your account). You must win at a very high rate just to break even.

The Fix: Focus on swing trading with 5-10 trades monthly. Each trade should target 50-150 pips, making spread costs negligible (1-2 pips on a 100-pip trade is only 1-2% of the move).

Mistake 3: Not Using Stop Losses

The Temptation: “My stop loss is so small anyway ($1), I’ll just watch the trade and close it manually if needed.”

The Reality: You’ll hesitate, hope for recovery, and end up losing $10-$20 instead of $1. Emotional decision-making always increases losses.

The Fix: Set your stop loss immediately when you enter every trade. Treat it as non-negotiable. If your analysis was wrong, accept the small loss and move on.

Mistake 4: Chasing Losses

The Temptation: “I lost $2 on that trade. I need to make it back immediately!”

The Reality: Revenge trading leads to impulsive decisions, poor analysis, and typically larger losses. Five revenge trades can quickly devastate your account.

The Fix: Implement a “loss limit” rule: After 2 consecutive losses, stop trading for the day. After 3 total losses in a week, stop until the following week. This prevents emotional spirals.

Mistake 5: Ignoring Trading Costs

The Temptation: “Spreads are only 1-2 pips, that’s nothing!”

The Reality: For a $100 account trading micro lots, 2 pips = $0.20, which is 0.2% of your account per trade. Make 20 trades monthly = 4% lost to spreads before you even consider wins and losses.

The Fix: Calculate total monthly spread costs and factor them into your trading plan. Trade only during high-liquidity sessions when spreads are tightest, and avoid excessive trading.

Alternative Options to Starting with $100

If you’re considering starting with $100, here are some alternatives worth exploring:

Option 1: Save for a Few More Months

Instead of starting with $100 today, save $100-$200 monthly for 3-6 months:

3-month plan: Start with $300-$600 6-month plan: Start with $600-$1,200

During this saving period:

- Trade on demo accounts

- Study trading courses and books

- Develop and backtest your strategy

- Join trading communities

- When you start with real money, you’re better prepared AND better capitalized

This patience dramatically increases your probability of success.

Option 2: Funded Trader Programs

Proprietary trading firms offer an increasingly popular alternative:

How It Works:

- Pay $100-$300 for an evaluation account

- Trade a simulated account with $10,000-$50,000

- Meet profit targets with specific rules (max drawdown, etc.)

- Pass evaluation, receive a real funded account

- Keep 70-90% of profits you generate

Popular Programs:

- FTMO

- The5%ers

- TopstepFX

- MyForexFunds

- Funded Trading Plus

Pros:

- Trade much larger capital than you could afford

- Risk only evaluation fee ($100-$300)

- Keep majority of profits

- No risk to your own capital beyond evaluation

Cons:

- Strict rules during evaluation

- Must pass evaluation (many don’t)

- Ongoing rules even after funding

- May have profit withdrawal restrictions

[LINK PLACEHOLDER: Internal link to “Forex Prop Trading Firms: Complete Guide for 2026”]

Option 3: Build Capital Through Side Hustles

While learning forex trading, build your trading capital simultaneously:

Ideas to Generate $500-$1,000 for Trading:

- Freelancing (writing, design, coding)

- Part-time gigs (food delivery, rideshare)

- Selling items you don’t need

- Online surveys and tasks

- Overtime at your job

Dedicate this side income specifically to building your trading account. Within 3-6 months, you can have $500-$1,000, which makes trading far more viable.

Real Stories: What Actually Happens with $100 Accounts

Let’s look at realistic scenarios based on typical trader experiences:

Scenario 1: The Learning Curve (Most Common – 70% of Traders)

Month 1-2: Account: $100 → $85 Experience: Initial excitement, several wins, but more losses. Spread costs add up. Learning about position sizing.

Month 3-4: Account: $85 → $70 Experience: Frustration sets in. Tries riskier trades to “catch up.” Learns painful lessons about emotional trading.

Month 5-6: Account: $70 → $50 Experience: Down 50% overall. Considers quitting but decides to refocus on education and proper risk management.

Outcome: Lost $50 but gained invaluable experience worth far more than $50. Many traders in this category add more capital around month 6-7 after learning essential lessons and becoming consistently break-even or slightly profitable.

Scenario 2: The Cautious Learner (20% of Traders)

Month 1-3: Account: $100 → $95 → $105 → $98 Experience: Careful, methodical trading. Focuses on learning. Small wins and losses. Takes breaks after losses.

Month 4-6: Account: $98 → $110 → $115 → $125 Experience: Develops consistency. Refines strategy. Still makes mistakes but learns from them. Growth accelerates.

Month 7-12: Account: $125 → $180 Experience: Adds $200 more capital (now trading $380). Better risk management with larger account. Steady 5-8% monthly growth.

Outcome: Successful long-term trajectory. The $100 served its purpose as a learning vehicle, then was supplemented with additional capital as skills developed.

Scenario 3: The Aggressive Trader (10% of Traders)

Month 1-2: Account: $100 → $150 → $95 Experience: Makes aggressive trades with too much risk. Has early success through luck. Gives back gains plus principal. Doesn’t adjust approach.

Month 3: Account: $95 → $20 Experience: Revenge trading after big loss. Overleverages trying to recover. Account nearly blown.

Outcome: Lost 80% of capital. Either quits trading or (hopefully) learns lesson and starts over with better discipline.

When Is $100 Actually Enough?

There are specific situations where starting with $100 makes perfect sense:

Situation 1: You’re a Complete Beginner

If you’ve never traded before and want to transition from demo to real money, $100 is perfect. You get real experience without risking significant capital while you learn the fundamentals.

Situation 2: You’re Testing a New Strategy

If you’re an experienced trader with capital elsewhere, a $100 account is ideal for testing new strategies in real market conditions before risking larger amounts.

Situation 3: You’re Young and Building Skills

If you’re a student or young person with limited income, $100 lets you start building trading skills early. By the time you have more capital later, you’ll have years of experience.

Situation 4: You’re Financially Limited Right Now

If $100 represents meaningful capital for your current financial situation, it’s better to start small than to wait indefinitely. Just understand the limitations and set realistic expectations.

Situation 5: You’re Exploring If Trading Is Right for You

If you’re curious about trading but unsure if it’s for you, $100 is a minimal investment to discover whether you enjoy the process and have the discipline required.

Your $100 Account Action Plan

If you’ve decided to start with $100, here’s your step-by-step plan:

Week 1-2: Setup and Preparation

Day 1-3: Choose Your Broker

- Research regulated brokers offering micro accounts

- Compare spreads on EUR/USD (should be 1-2 pips)

- Verify they allow micro lots (1,000 units minimum)

- Read reviews about withdrawal experiences

Day 4-7: Account Setup

- Open and fund your account ($100)

- Download and familiarize yourself with the trading platform

- Set up your charts and indicators

- Practice placing orders without executing

Day 8-14: Create Your Trading Plan

- Define your strategy (swing trading recommended)

- Set risk parameters (1% = $1 per trade)

- Choose your primary currency pair (EUR/USD recommended)

- Identify your trading times (London/NY overlap best)

- Set weekly/monthly goals

[LINK PLACEHOLDER: Internal link to “How to Create a Forex Trading Plan That Actually Works”]

Month 1: Initial Live Trading

Weeks 1-2:

- Make 2-3 trades maximum

- Focus on process, not profits

- Journal every trade with screenshots

- Risk exactly $1 per trade, no more

Weeks 3-4:

- Continue with 2-3 trades

- Review journal and identify patterns

- Adjust strategy based on what you’re learning

- Stay disciplined with risk management

Goal for Month 1: Stay above $90 (max 10% loss). Prove you can follow your plan.

Months 2-3: Building Consistency

Weekly Routine:

- Trade 1-2 times per week (4-8 trades monthly)

- Review all trades in your journal

- Study one new trading concept each week

- Focus on emotional control

Goal: Achieve break-even or slight profitability (even $5-$10 gain is success). Perfect your process.

Months 4-6: Proving Your System

If Profitable (Even Small Gains):

- Consider adding $200-$300 capital

- Continue same strategy with slightly larger account

- Maintain strict risk management

- Build confidence in your system

If Still Learning/Losing:

- Continue with what remains of your $100

- Identify specific weaknesses in your trading

- Consider additional education or mentorship

- Don’t add more money until consistently break-even

Frequently Asked Questions

Can you really make money with $100 in forex?

Yes, but “making money” needs context. You can achieve percentage gains (5-20% monthly is possible with good trading), but the dollar amounts will be very small ($5-$20 monthly). You won’t generate meaningful income until you build the account larger through compounding and capital additions.

How much can I make per day with $100 in forex?

Realistically, with proper risk management (1% risk per trade), you might make $1-$3 per winning trade. Making consistent daily profits is extremely difficult even for experienced traders. A more realistic goal is 5-10% monthly ($5-$10 per month), which averages less than $0.50 per day.

What lot size should I trade with $100?

With proper 1% risk management and a 20-pip stop loss, you should trade approximately 500 units (0.005 lots or 5 micro lots). This means if your stop loss is hit, you lose $1, which is exactly 1% of your account. Never trade larger than this to “make more money faster.”

Is $100 enough to learn forex trading?

Yes, $100 is actually an excellent amount for learning. It’s enough to experience real market conditions and emotions, but not so much that losses will be financially devastating. Many successful traders started with $100-$500 and used it as educational capital.

How long does it take to turn $100 into $1,000 in forex?

With realistic 10% monthly returns and perfect compounding, it would take approximately 24 months to turn $100 into $1,000. With 20% monthly returns (very aggressive and difficult to maintain), it would take about 12 months. However, most traders find it faster to add capital along the way rather than rely solely on compounding profits.

Should I use high leverage with a small account?

No, absolutely not. Even though your broker may offer 500:1 leverage, you should limit yourself to 10:1 or 20:1 effective leverage based on your position sizing. High leverage is the fastest way to blow up a small account. Your position size should be determined by your stop loss distance and risk percentage, not by maximum available leverage.

Conclusion: The $100 Truth

Can you start forex trading with $100? Absolutely yes. Should you start with only $100? It depends on your goals and expectations.

Start with $100 if:

- You’re treating it as educational capital and learning experience

- You can afford to lose it without financial hardship

- You want to transition from demo to real trading gradually

- You’re testing whether forex trading is right for you

- You have a plan to add more capital as you prove yourself

Consider saving for more if:

- You expect to generate meaningful income immediately

- You want to trade comfortably without severe position size restrictions

- You’re looking to trade full-time or replace income

- You have expenses that make $100 a significant amount for you

- You want to follow professional-level risk management with flexibility

The most successful approach is usually to start with $100-$500 for learning, then add capital gradually as you prove consistent profitability. Treat your initial capital as tuition for the best trading education possible—real market experience.

Remember: No amount of capital guarantees success, and larger accounts don’t make bad traders good. Focus on developing your skills, mastering risk management, and controlling your emotions. Whether you start with $100, $1,000, or $10,000, these fundamentals determine your long-term success.

Ready to start your forex journey? Choose a reputable broker, fund your $100 account, and commit to learning rather than earning. Your future trading success begins with the disciplined approach you develop today.