What is Leverage in Forex? How It Works (With Real Examples) – 2026 Guide

Leverage is one of forex trading’s most powerful features—and simultaneously one of its most dangerous. It’s the reason why traders can control large positions with relatively small amounts of capital, but it’s also the primary reason why so many retail traders lose money quickly. Understanding leverage thoroughly before you start trading is absolutely crucial to your survival and success in the forex market.

In this comprehensive guide, you’ll learn exactly what leverage is, how it works in practical terms, see real-world examples with actual calculations, and discover how to use leverage responsibly to enhance your trading rather than destroy your account.

What is Leverage in Forex Trading?

Leverage is essentially borrowed capital provided by your broker that allows you to control a trading position much larger than your actual account balance. Think of it as a loan that magnifies your buying power in the forex market.

In simple terms, leverage lets you control more money than you actually have. With 100:1 leverage, for example, you can control $100,000 worth of currency with just $1,000 of your own money. The broker provides the other $99,000 as a temporary loan for the duration of your trade.

The Basic Leverage Concept

Imagine you want to buy a $300,000 house. Without leverage, you’d need $300,000 in cash. But with a mortgage (a form of leverage), you might put down $60,000 (20%) and borrow the remaining $240,000 from the bank. You now control a $300,000 asset with only $60,000 of your own money—that’s 5:1 leverage.

Forex leverage works similarly, except the “loan” from your broker is instant, interest-free (in most cases), and only lasts for the duration of your trade.

[IMAGE PLACEHOLDER: Infographic showing leverage concept with visual comparison of controlled position vs actual capital – Alt text: “How forex leverage works – controlling $100,000 with $1,000 using 100:1 leverage”]

Why Does Leverage Exist in Forex?

Leverage exists in forex for several important reasons:

- Currency movements are relatively small – Major currency pairs typically move only 0.5-1% per day, so without leverage, profits would be negligible for retail traders

- Makes forex accessible to retail traders – Without leverage, you’d need $100,000+ to make meaningful profits

- Increases market liquidity – More participants can trade, creating deeper, more liquid markets

- Standard in the industry – All major forex brokers offer leverage as a competitive necessity

How Leverage Works: The Mechanics

To understand leverage fully, you need to understand three connected concepts: leverage ratio, margin, and margin requirement.

Leverage Ratio Explained

The leverage ratio tells you how much buying power you have compared to your actual capital. It’s expressed as a ratio like 50:1, 100:1, or 500:1.

Common Leverage Ratios:

- 10:1 – Control $10 for every $1 you have

- 50:1 – Control $50 for every $1 you have (US maximum for major pairs)

- 100:1 – Control $100 for every $1 you have

- 200:1 – Control $200 for every $1 you have

- 500:1 – Control $500 for every $1 you have (common internationally)

Important: Just because your broker offers 500:1 leverage doesn’t mean you should use it. Available leverage and used leverage are two different things.

Margin Requirement

Margin is the amount of your own money required to open and maintain a leveraged position. It’s expressed as a percentage.

The Formula: Margin Requirement = 100 / Leverage Ratio

Examples:

- 50:1 leverage = 2% margin requirement (100 ÷ 50 = 2%)

- 100:1 leverage = 1% margin requirement (100 ÷ 100 = 1%)

- 200:1 leverage = 0.5% margin requirement (100 ÷ 200 = 0.5%)

- 500:1 leverage = 0.2% margin requirement (100 ÷ 500 = 0.2%)

This means with 100:1 leverage, you need to have at least 1% of your position size in your account as margin.

[LINK PLACEHOLDER: Internal link to “Understanding Forex Margin: Complete Guide”]

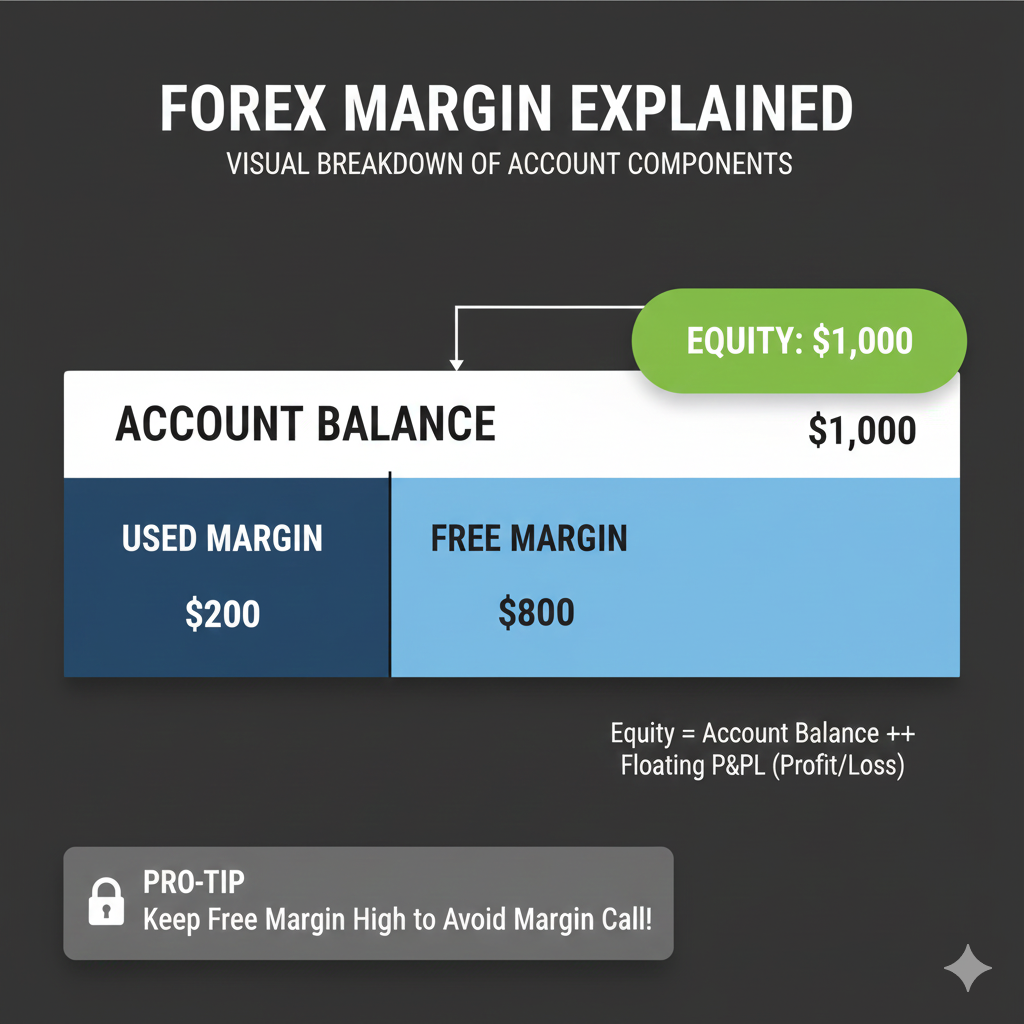

Used Margin vs. Free Margin

Used Margin – The amount currently “locked up” in your open positions Free Margin – The amount available to open new positions Equity – Your account balance plus/minus unrealized profits/losses

Formula: Free Margin = Equity – Used Margin

Understanding this distinction is crucial for managing multiple positions and avoiding margin calls.

Real-World Leverage Examples (Step-by-Step)

Let’s work through detailed examples to show exactly how leverage works in practice.

Example 1: Trading EUR/USD with 100:1 Leverage

Your Account:

- Balance: $5,000

- Leverage offered by broker: 100:1

Your Trade:

- Currency pair: EUR/USD

- Current price: 1.1000

- Position size: 1 standard lot (100,000 units)

- Direction: Buy (long)

Step 1: Calculate Required Margin Position value = 100,000 EUR × 1.1000 = $110,000 USD Margin requirement = $110,000 ÷ 100 = $1,100 (Or: $110,000 × 1% = $1,100)

Step 2: Your Account Status After Opening

- Account balance: $5,000

- Used margin: $1,100

- Free margin: $3,900 ($5,000 – $1,100)

Step 3: Profit/Loss Scenarios

If EUR/USD rises to 1.1050 (+50 pips):

- Profit = 50 pips × $10 per pip = $500

- Return on margin: $500 ÷ $1,100 = 45.5%

- Return on account: $500 ÷ $5,000 = 10%

- New balance: $5,500

If EUR/USD falls to 1.0950 (-50 pips):

- Loss = 50 pips × $10 per pip = -$500

- Loss on margin: -$500 ÷ $1,100 = -45.5%

- Loss on account: -$500 ÷ $5,000 = -10%

- New balance: $4,500

Without Leverage (No Loan from Broker): To control the same $110,000 position without leverage, you’d need $110,000 in your account. A 50-pip move would still give you $500 profit/loss, but that would represent only 0.45% of your $110,000 capital instead of 10% of your $5,000 capital.

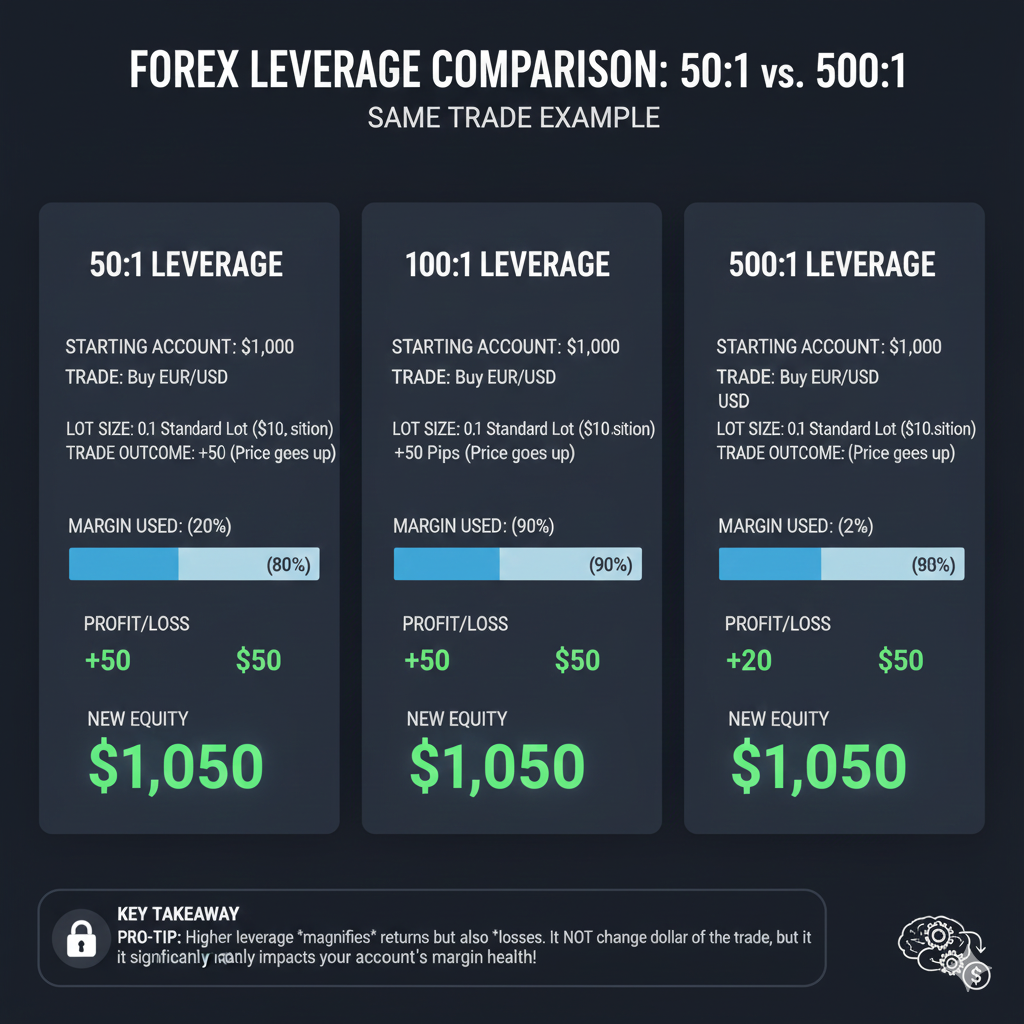

Example 2: Comparing Different Leverage Ratios

Same trade setup, different leverage ratios:

Position: 1 standard lot EUR/USD at 1.1000 ($110,000 position) Account Balance: $5,000 Price Movement: 50 pips = $500 profit/loss

With 50:1 Leverage (2% margin):

- Required margin: $2,200

- Free margin: $2,800

- 50-pip profit: $500 (10% of account)

- 50-pip loss: -$500 (-10% of account)

With 100:1 Leverage (1% margin):

- Required margin: $1,100

- Free margin: $3,900

- 50-pip profit: $500 (10% of account)

- 50-pip loss: -$500 (-10% of account)

With 500:1 Leverage (0.2% margin):

- Required margin: $220

- Free margin: $4,780

- 50-pip profit: $500 (10% of account)

- 50-pip loss: -$500 (-10% of account)

Key Insight: Notice that your actual profit/loss in dollars and percentage is THE SAME regardless of leverage ratio. Higher leverage doesn’t make you more profit—it just allows you to open larger positions with less margin.

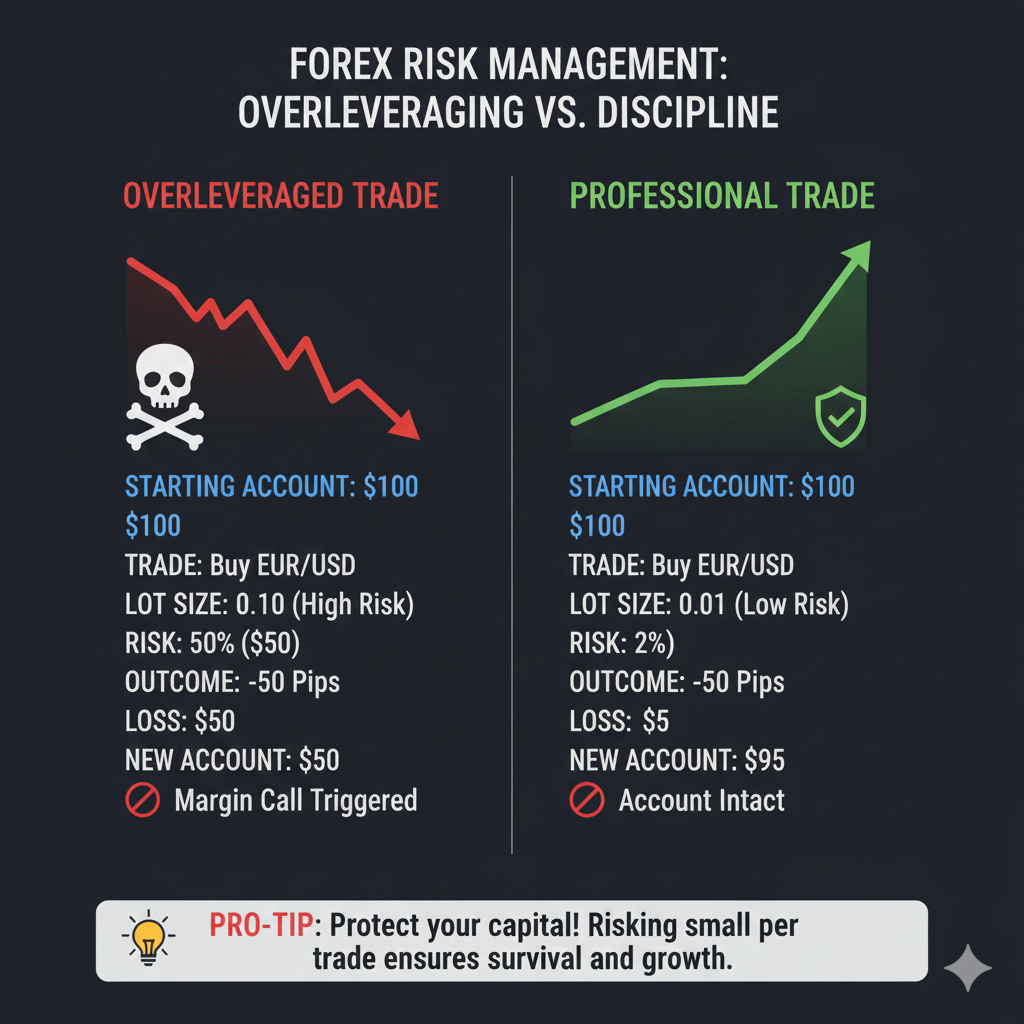

Example 3: The Danger of Overleveraging

Let’s see what happens when traders use high leverage recklessly.

Your Account:

- Balance: $1,000

- Leverage: 500:1

Reckless Trade:

- Position: 5 standard lots EUR/USD (500,000 units)

- Position value: $550,000 (controlling 550× your capital!)

- Required margin: $550,000 ÷ 500 = $1,100… but you only have $1,000!

You actually can’t open this position—you’d get a “insufficient margin” error. But let’s say you open the maximum possible:

Maximum Position:

- You can control approximately: $1,000 × 500 = $500,000

- That’s roughly 4.5 standard lots

- Required margin: Nearly your entire $1,000

The Disaster: With such extreme leverage, a mere 10-pip adverse move equals:

- Loss = 10 pips × $10 per pip × 4.5 lots = $450

- That’s 45% of your account gone in minutes!

- A 23-pip move against you would trigger a margin call and wipe out your account

[LINK PLACEHOLDER: Internal link to “What is a Margin Call and How to Avoid It”]

Example 4: Conservative Leverage Usage

Now let’s see how professional traders use leverage responsibly.

Your Account:

- Balance: $10,000

- Available leverage: 100:1

- Risk management: Risk only 1% per trade ($100)

Professional Trade:

- Pair: EUR/USD at 1.1000

- Strategy stop loss: 50 pips

- Position sizing: $100 risk ÷ 50 pips = $2 per pip

- Position size needed: 20,000 units (0.2 lots / 2 mini lots)

Actual Leverage Used:

- Position value: 20,000 × 1.1000 = $22,000

- Your capital: $10,000

- Effective leverage: 2.2:1 (only using 2.2× leverage despite having 100:1 available)

- Required margin: $22,000 ÷ 100 = $220 (2.2% of account)

Why This Works:

- Risking only $100 (1%) per trade

- Even if wrong, minimal impact on account

- Free margin of $9,780 allows for multiple positions

- Can withstand a series of losses without devastating the account

- Psychologically manageable risk

The Result: This trader has 100:1 leverage available but is only using 2.2:1 effective leverage based on their position size and risk management. This is the key distinction between available leverage and used leverage.

Understanding Effective Leverage vs. Maximum Leverage

This is perhaps the most important concept in this entire article.

Maximum Leverage (Offered by Broker)

This is the highest leverage ratio your broker allows—50:1, 100:1, 500:1, etc. It represents your maximum buying power but doesn’t dictate your actual position size.

Effective Leverage (Actually Used)

This is the leverage you’re actually using based on your position size relative to your account equity.

Formula: Effective Leverage = Total Position Value ÷ Account Equity

Example:

- Account equity: $5,000

- Open position: 0.5 standard lots EUR/USD (50,000 units)

- Position value: 50,000 × 1.1000 = $55,000

- Effective leverage: $55,000 ÷ $5,000 = 11:1

Even though your broker might offer 500:1 maximum leverage, you’re only using 11:1 effective leverage. This is responsible trading.

Professional Recommendations

Most professional traders recommend:

- Maximum effective leverage: 10:1 to 20:1

- Even more conservative: 5:1 to 10:1

- Aggressive but still reasonable: 20:1 to 30:1

- Dangerous territory: 50:1 and above

- Account suicide: 100:1+ effective leverage

[LINK PLACEHOLDER: Internal link to “Position Sizing Calculator for Forex Traders”]

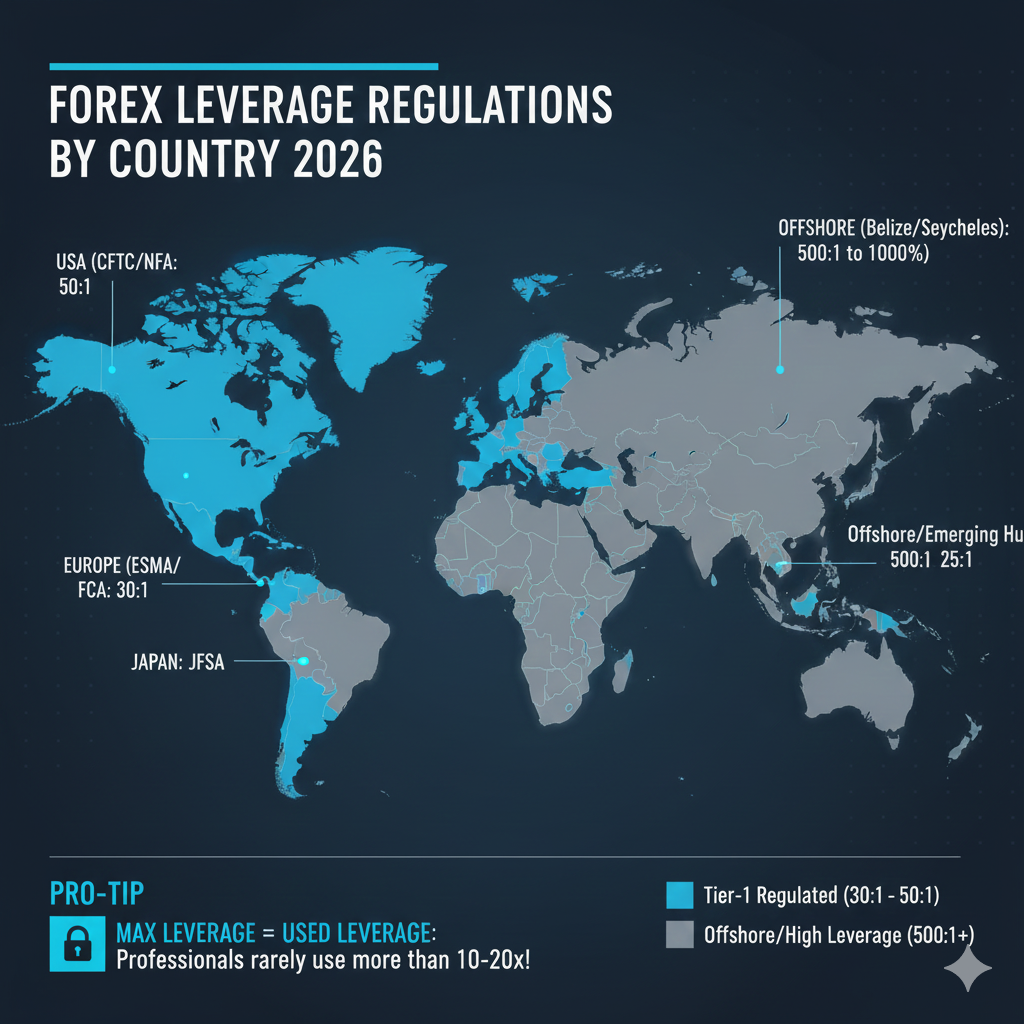

Leverage Regulations by Country (2026)

Leverage limits vary significantly by jurisdiction, designed to protect retail traders.

United States (CFTC/NFA Regulations)

Major Pairs: Maximum 50:1 leverage

- EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD

Minor Pairs: Maximum 20:1 leverage

- All other currency pairs

Why So Restrictive: US regulators determined that higher leverage contributes significantly to retail trader losses.

European Union (ESMA Regulations)

Major Pairs: Maximum 30:1 leverage Minor Pairs: Maximum 20:1 leverage Exotic Pairs: Maximum 10:1 leverage Gold: Maximum 20:1 leverage Cryptocurrencies: Maximum 2:1 leverage

Implementation: These rules apply to retail clients; professional traders can access higher leverage after qualification.

United Kingdom (FCA Regulations)

The UK follows similar regulations to the EU (post-Brexit):

- Major pairs: 30:1

- Minor pairs: 20:1

- Exotics: 10:1

Australia (ASIC Regulations)

Standard: Maximum 30:1 leverage for retail clients Professional Traders: Can access up to 500:1 after meeting criteria

Other Jurisdictions

Many offshore brokers offer:

- 500:1 leverage (common in Asia, Cyprus, some Caribbean nations)

- 1000:1 leverage (some unregulated brokers)

- Unlimited leverage (rare, highly dangerous)

Warning: Higher leverage isn’t necessarily better. Regulated brokers with lower leverage limits often provide better trader protection.

The Mathematics: How Leverage Amplifies Results

Understanding the math behind leverage helps you see both its power and danger.

Linear Amplification

Leverage amplifies your results linearly, not exponentially.

Without Leverage (1:1):

- $10,000 account

- 1% price movement = $100 profit/loss (1% of account)

With 10:1 Leverage:

- $10,000 account controlling $100,000

- 1% price movement = $1,000 profit/loss (10% of account)

With 100:1 Leverage:

- $10,000 account controlling $1,000,000

- 1% price movement = $10,000 profit/loss (100% of account)

Notice the pattern: 10× leverage = 10× profit/loss, 100× leverage = 100× profit/loss.

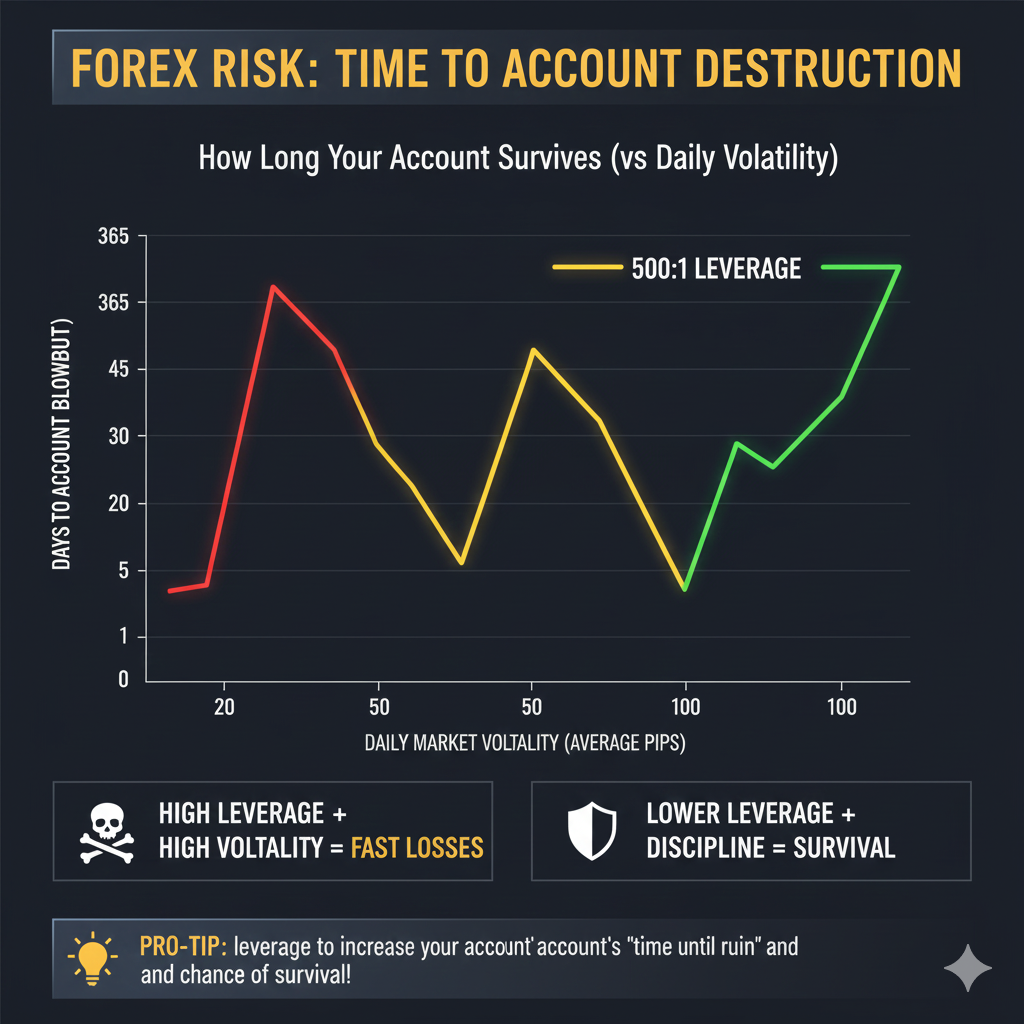

Time to Account Destruction

Here’s how quickly you can lose your account at different leverage levels:

10:1 Effective Leverage:

- Need 10% adverse price movement to lose entire account

- EUR/USD moves 0.7-1% daily on average

- Takes 10+ days of continuous adverse movement

- Highly unlikely scenario

50:1 Effective Leverage:

- Need 2% adverse price movement to lose entire account

- Could happen in 2-3 days of strong trends

- Possible but requires significant adverse movement

100:1 Effective Leverage:

- Need 1% adverse price movement to lose entire account

- Could happen in a single day or even hours

- Very realistic scenario

500:1 Effective Leverage:

- Need 0.2% adverse price movement to lose entire account

- That’s 20 pips on EUR/USD!

- Can happen in minutes during news releases

- Almost guaranteed account destruction

The Psychological Impact of Leverage

Leverage doesn’t just affect your account mathematically—it profoundly impacts your trading psychology.

False Sense of Wealth

High leverage creates the illusion that you’re trading with more money than you have. A $1,000 account with 500:1 leverage controls $500,000, making you feel like a high-roller. This psychological trap leads to:

- Overconfidence in trading decisions

- Taking positions too large for your actual capital

- Ignoring risk management because “big accounts don’t worry about small losses”

- Treating trades cavalierly because you don’t feel like you’re risking your own money

Anxiety and Emotional Decisions

Conversely, watching a highly leveraged position move against you creates extreme stress:

- Every pip movement represents a significant percentage of your account

- Fear causes premature exits from winning trades

- Panic leads to holding losing trades too long hoping for recovery

- Sleep loss from worrying about overnight positions

- Revenge trading after levered positions go wrong

The Addiction Cycle

High leverage can create a gambling-like addiction:

- Take highly leveraged position

- Experience massive win (occasionally)

- Get dopamine rush from huge percentage gain

- Chase that feeling with even riskier trades

- Experience devastating losses

- Attempt to “win it back” with more leverage

- Account destruction

[LINK PLACEHOLDER: Internal link to “Forex Trading Psychology: Mastering Your Emotions”]

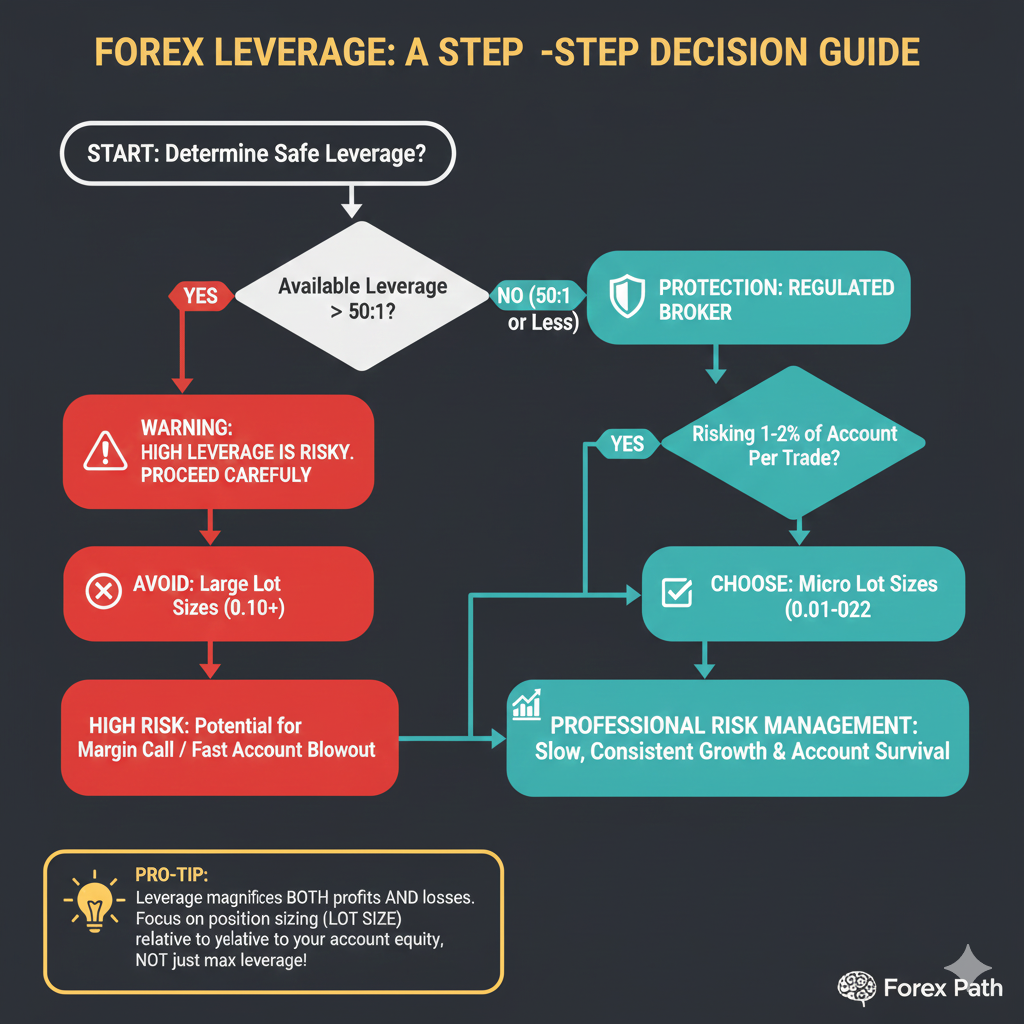

How to Use Leverage Safely

Leverage is a tool. Like a chainsaw, it’s extremely useful in skilled hands but dangerous when misused. Here’s how to use it responsibly.

Rule 1: Ignore Available Leverage

Just because your broker offers 500:1 leverage doesn’t mean you should use it. Think of it as a high credit limit on a credit card—having a $50,000 credit limit doesn’t mean you should max it out.

Practical Application:

- Focus on position sizing based on stop loss and risk percentage

- Let effective leverage fall where it may (usually 5:1 to 20:1)

- Never intentionally use high leverage to “make more money faster”

Rule 2: Calculate Effective Leverage

Before every trade, know your effective leverage.

Formula: Effective Leverage = Total Open Position Value ÷ Account Equity

Target Range:

- Conservative: 5:1 or less

- Moderate: 5:1 to 15:1

- Aggressive (but acceptable): 15:1 to 25:1

- Dangerous: 25:1 to 50:1

- Suicidal: Above 50:1

Rule 3: Use Position Sizing, Not Leverage, to Determine Trade Size

Wrong Approach: “I have 100:1 leverage, so I’ll trade 1 standard lot with my $1,000 account.”

Right Approach: “I have $1,000 and want to risk 1% ($10) on this trade. My stop loss is 20 pips away, so I need 50 cents per pip, which is 5,000 units (0.05 lots).”

The correct approach naturally results in low effective leverage (~5:1) without even thinking about leverage ratios.

[LINK PLACEHOLDER: Internal link to “How to Calculate Perfect Position Size for Every Trade”]

Rule 4: Never Let Margin Requirements Determine Position Size

Some traders think: “The broker only requires $100 margin for this trade, so I can afford it!”

This is backwards. Margin requirements tell you the minimum you need, not the appropriate position size. Just because you can open a position doesn’t mean you should.

Rule 5: Maintain a Cushion

Never use your entire account as margin for positions.

Recommended Margin Usage:

- Conservative: Use no more than 20% of account as margin

- Moderate: Use no more than 30-40% of account as margin

- Maximum: Use no more than 50% of account as margin

This cushion protects you from margin calls during drawdowns and allows for multiple positions.

Rule 6: Reduce Leverage During Drawdowns

If you’re going through a losing streak, reduce your effective leverage even further:

Standard trading: 10:1 effective leverage After 2-3 consecutive losses: Reduce to 5:1 effective leverage After 5+ consecutive losses: Reduce to 2:1 or stop trading temporarily

This prevents catastrophic losses during inevitable rough patches.

Common Leverage Mistakes (And How to Avoid Them)

Mistake 1: Confusing Leverage with Profit Potential

The Misconception: “Higher leverage = more profit potential”

The Reality: Leverage doesn’t increase profit potential—it only increases position size capability. Your actual profit depends on position size, pip movement, and whether you’re right about direction.

The Fix: Focus on win rate, risk-reward ratios, and strategy execution, not leverage ratios.

Mistake 2: Maximum Position Sizing

The Misconception: “I should open the largest position possible with my available margin.”

The Reality: Maximum position size has nothing to do with optimal position size. Professional traders typically use only 2-5% of their available leverage capacity.

The Fix: Size positions based on stop loss distance and risk percentage (typically 1-2% of account).

Mistake 3: Leverage Shopping

The Misconception: “I should find the broker with the highest leverage—1000:1 is better than 100:1!”

The Reality: Higher leverage is a marketing gimmick that primarily benefits the broker. It enables you to overtrade and lose money faster.

The Fix: Choose brokers based on regulation, spread costs, execution quality, and customer service—not leverage offerings.

Mistake 4: Thinking Leverage is “Free Money”

The Misconception: “The broker is giving me free money to trade with!”

The Reality: Leverage is a loan that must be “repaid” when you close your position. If you lose money, you still owe the broker (it comes from your margin/account balance).

The Fix: Treat leveraged trading as controlling borrowed money that must be returned, not as free capital to gamble with.

Mistake 5: Overleveraging Small Accounts

The Misconception: “My account is small, so I need high leverage to make meaningful profits.”

The Reality: Small accounts need even more conservative leverage because they have no buffer to withstand losses. A $100 account with 500:1 leverage can be destroyed in seconds.

The Fix: If your account is small, either accept small dollar gains while you learn, or save for a larger account before trading. Never compensate for small capital with excessive leverage.

[LINK PLACEHOLDER: Internal link to “Can You Start Forex Trading with $100? (Honest Answer)”]

Leverage in Different Trading Styles

Different trading approaches require different leverage considerations.

Scalping (Very Short-Term)

Typical timeframes: Seconds to minutes Typical targets: 5-15 pips Typical stops: 5-10 pips

Leverage Considerations:

- Tighter stops allow for larger positions

- But more trades = more spread costs

- Recommended effective leverage: 10:1 to 20:1

- Higher leverage acceptable due to tight risk control

- Still maintain overall account risk under 3%

Day Trading

Typical timeframes: Minutes to hours Typical targets: 20-80 pips Typical stops: 15-40 pips

Leverage Considerations:

- Moderate stops require moderate position sizing

- Multiple trades daily possible

- Recommended effective leverage: 5:1 to 15:1

- Never exceed 20:1 effective leverage

- Maximum 2% risk per trade

Swing Trading

Typical timeframes: Days to weeks Typical targets: 50-300 pips Typical stops: 30-100 pips

Leverage Considerations:

- Wider stops require smaller positions

- Fewer trades, longer holding periods

- Recommended effective leverage: 3:1 to 10:1

- Perfect for lower leverage usage

- 1-2% risk per trade ideal

Position Trading

Typical timeframes: Weeks to months Typical targets: 200-1000+ pips Typical stops: 100-300+ pips

Leverage Considerations:

- Very wide stops require small positions

- Overnight and weekend risk

- Recommended effective leverage: 2:1 to 5:1

- Should feel almost like spot forex trading

- Maximum 1% risk per trade

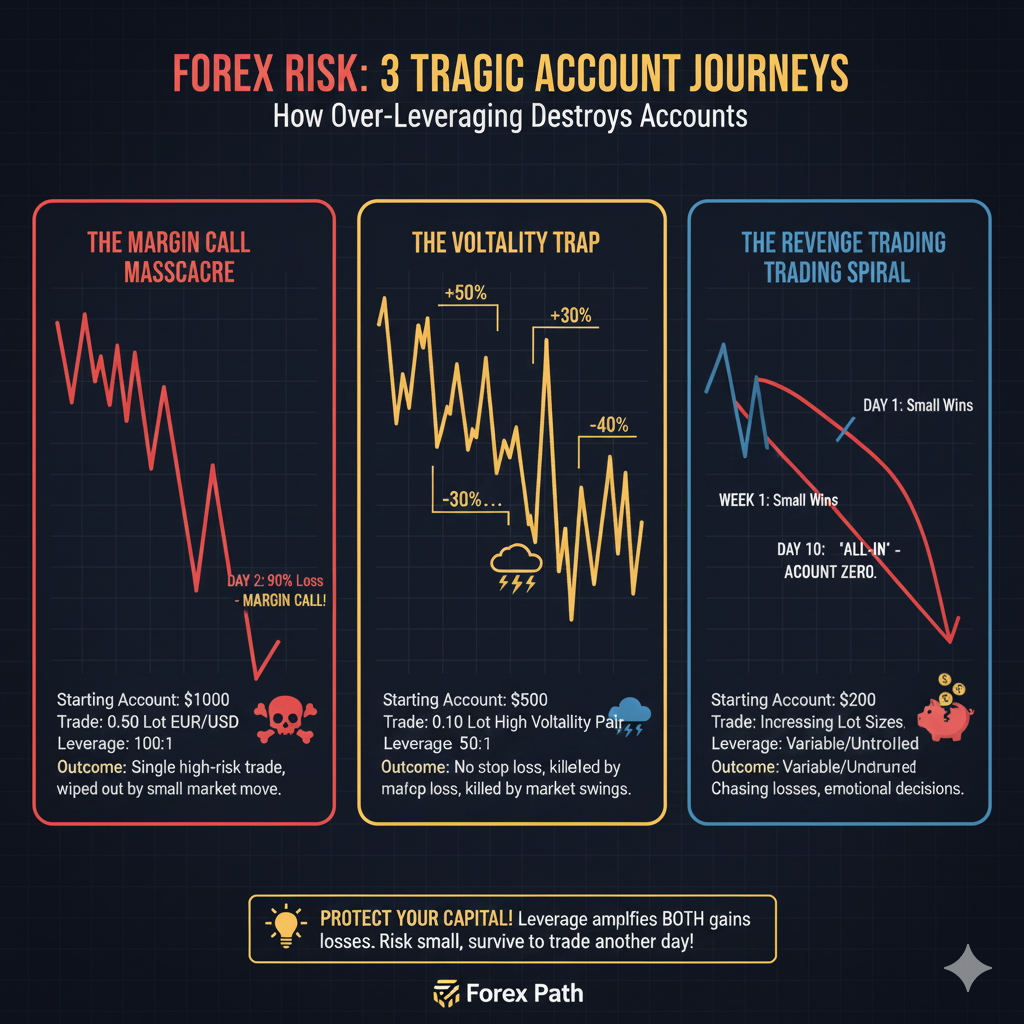

Real Stories: How Leverage Destroyed Accounts

Understanding real scenarios helps drive home leverage’s dangers.

Story 1: The $10,000 That Became $0 in One Day

Trader Profile: Intermediate trader with 6 months experience Account: $10,000 Leverage Used: 100:1 effective

The Trade:

- Shorted GBP/USD at 1.2500 with 10 standard lots

- Position value: $1,250,000 (125× account size!)

- Required margin: ~$12,500 (used 125:1 leverage despite “only” 100:1 available by opening in increments)

- Stop loss: None (“I’ll watch it”)

What Happened:

- Bank of England surprise interest rate hike

- GBP/USD spiked 250 pips in 30 minutes

- Loss: 250 pips × $100 per pip (10 lots) = $25,000

- Margin call triggered, position closed

- Account balance: $0 (plus $15,000 owed to broker in some jurisdictions)

Story 2: Death by a Thousand Cuts

Trader Profile: Beginner with $500 account Leverage Used: 200:1 effective

The Pattern:

- Consistently traded 2 mini lots (20,000 units)

- Position value: $22,000 (44× account size)

- Each loss of 25 pips = $50 (10% of account)

- Won 40% of trades but couldn’t overcome the large losses

- After 30 trades over 2 months: Account blown

The Lesson: High leverage turns even small pip losses into large percentage losses. This trader needed 2.5:1 winners to break even—nearly impossible to maintain.

Story 3: The Weekend Gap Disaster

Trader Profile: Part-time trader, $5,000 account Leverage Used: 50:1 effective

The Setup:

- Long USD/JPY at 150.00 going into weekend

- Position: 2.5 standard lots (250,000 units)

- Stop loss: 149.50 (50 pips)

What Happened:

- Major earthquake in Japan over weekend

- Market opened Monday at 147.00 (300-pip gap!)

- Stop loss skipped, position closed at open

- Loss: 300 pips × $25 per pip = $7,500

- Broker demanded additional $2,500 to cover loss

The Lesson: Leverage amplifies gap risk. Weekend holding with high leverage is extremely dangerous.

Tools and Calculators for Managing Leverage

Leverage Calculator

Most brokers provide calculators that show:

- Required margin for a position size

- Effective leverage of a trade

- Maximum position size with current balance

Position Size Calculator

More important than leverage calculators:

- Input: Account size, risk percentage, stop loss distance

- Output: Optimal position size (lots/units)

- Automatically results in appropriate leverage

Margin Calculator

Shows exactly how much margin you need:

- Position size

- Currency pair

- Account currency

- Current exchange rate

- Results in required margin amount

Excel/Google Sheets

Create your own tracking spreadsheet:

- Current account balance

- Open positions and their values

- Effective leverage calculation

- Margin usage percentage

- Risk per trade and total risk

[LINK PLACEHOLDER: Internal link to “Best Forex Trading Tools and Calculators for 2026”]

Leverage and Different Account Sizes

Leverage considerations change based on your account size.

Small Accounts ($100-$500)

Leverage Reality:

- Need some leverage just to trade meaningful sizes

- Micro/nano lots essential

- Can’t follow 1% risk rule strictly with minimum position sizes

Recommended Approach:

- Accept that leverage will be higher (20:1 to 50:1 effective)

- Trade only during high-liquidity sessions (tighter spreads)

- Use wider stops to trade smaller position sizes

- Focus on learning, not earning

- Plan to add capital as you improve

Medium Accounts ($1,000-$10,000)

Leverage Reality:

- Can follow proper risk management

- Flexibility in position sizing

- Good balance of risk and opportunity

Recommended Approach:

- Maintain 5:1 to 15:1 effective leverage

- Strict 1-2% risk per trade

- Can trade multiple pairs simultaneously

- Focus on consistency and steady growth

Large Accounts ($10,000+)

Leverage Reality:

- Don’t need high leverage at all

- Can make meaningful income with low leverage

- Risk management much easier

Recommended Approach:

- Maintain 2:1 to 10:1 effective leverage

- Can be even more conservative (1:1 to 5:1)

- Multiple positions easily managed

- Focus on capital preservation and consistent returns

Frequently Asked Questions

What is the best leverage for forex trading?

There’s no single “best” leverage because it depends on your strategy, risk tolerance, and account size. However, most professional traders recommend using 10:1 to 30:1 maximum effective leverage regardless of what your broker offers. Conservative traders use 5:1 or less.

Is 1:500 leverage good?

No, 1:500 leverage is not “good”—it’s extremely dangerous and primarily a marketing gimmick. While having access to high leverage gives you flexibility, actually using 500:1 leverage means a mere 0.2% adverse price movement (20 pips on EUR/USD) would wipe out your entire account. Professional traders rarely use more than 20:1 effective leverage.

How much leverage should a beginner use?

Beginners should use very conservative leverage—no more than 10:1 effective leverage, ideally 5:1 or less. This means if you have $1,000, your total open position value shouldn’t exceed $5,000-$10,000. Focus on learning proper risk management and trading psychology before even considering higher leverage.

Can you lose more money than you deposit with leverage?

Yes, in some jurisdictions and with some brokers. If your position loses more than your account balance (due to gaps, extreme volatility, or weekend events), you may owe money to your broker. However, many regulated brokers now offer “negative balance protection,” which means you cannot lose more than your deposit. Always verify your broker’s policy.

Does leverage affect spreads or trading costs?

No, leverage doesn’t directly affect spreads or commissions. The spread remains the same whether you use 10:1 or 500:1 leverage. However, leverage affects how much spread cost represents as a percentage of your margin—with high leverage, spreads become more significant relative to your invested capital.

Is it better to have high or low leverage?

Lower leverage is almost always better for long-term success. High leverage is the primary reason why 70-80% of retail forex traders lose money. Lower leverage means smaller position sizes, which means you can withstand normal market volatility without getting margin called. Professional traders consistently use lower effective leverage than available maximum leverage.

Conclusion: Respect Leverage or It Will Destroy You

Leverage is forex trading’s ultimate double-edged sword. It enables retail traders to participate in the forex market and make meaningful returns with modest capital. But it’s also the number one reason traders lose their accounts, sometimes spectacularly and sometimes slowly through death by a thousand cuts.

Key principles to remember:

- Available leverage ≠ Used leverage – Just because you can use 500:1 doesn’t mean you should

- Leverage amplifies everything – Both profits and losses increase proportionally

- Position sizing matters more than leverage – Focus on risk percentage and stop loss distance

- Lower leverage = longer survival – Professional traders use far less leverage than beginners

- Leverage isn’t profit potential – It’s simply buying power; profits come from good trading decisions

Your action plan:

- Calculate your effective leverage before every trade (target 10:1 or less)

- Size positions based on stop loss distance and 1-2% risk rule

- Ignore your broker’s maximum leverage offerings

- Maintain at least 50% of your account as free margin

- Reduce leverage during losing streaks

- Never compensate for small accounts with excessive leverage

Think of leverage like driving a sports car. A 500-horsepower car (500:1 leverage) has incredible power, but most drivers will crash if they use all that power all the time. Professional racing drivers (professional traders) use that power strategically, carefully, and with extensive training. They know when to accelerate and when to slow down.

As a trader, you need the same wisdom. Use leverage as a tool for efficient capital deployment, not as a shortcut to riches. The traders who survive and thrive in forex are those who respect leverage’s power and use it conservatively, not those who try to maximize it.

Start your forex journey with the right leverage approach. Focus on developing solid trading skills, consistent risk management, and emotional control. When these fundamentals are in place, leverage becomes what it should be—a useful tool that enhances your trading rather than a loaded gun pointed at your account.