5-Minute Scalping Strategy for Forex Beginners (Step-by-Step Guide) – 2026

Scalping is one of the most exciting and potentially profitable forex trading strategies, but it’s also one of the most demanding. If you’re looking for a straightforward, beginner-friendly scalping strategy that you can start using today, you’re in the right place. This comprehensive guide will walk you through a proven 5-minute scalping strategy, complete with exact entry and exit rules, risk management guidelines, and practical examples.

By the end of this guide, you’ll have a complete scalping system that you can implement immediately—whether you have 30 minutes or 3 hours to trade each day.

What is Scalping in Forex Trading?

Scalping is a trading style that focuses on making numerous small profits from minor price movements throughout the day. Scalpers typically hold positions for just a few minutes (sometimes seconds), targeting gains of 5-20 pips per trade.

Key Characteristics of Scalping

Trading Timeframe: 1-minute to 5-minute charts Position Duration: Seconds to 15 minutes (rarely longer) Profit Targets: 5-20 pips per trade Daily Trades: 10-50+ trades per day Win Rate Required: Typically 60-70%+ for profitability Best Sessions: High liquidity periods (London/New York overlap)

Is Scalping Right for You?

Before diving into the strategy, ask yourself these questions:

✅ You’re a good candidate for scalping if:

- You can dedicate focused time blocks for trading (minimum 30-60 minutes)

- You make decisions quickly without second-guessing

- You can handle rapid-fire trading without emotional stress

- You have a reliable internet connection and fast execution broker

- You’re comfortable with high trade frequency and constant monitoring

❌ Scalping might not suit you if:

- You have a full-time job with no trading time during market hours

- You prefer “set it and forget it” trading styles

- You get stressed by fast-paced environments

- You have a slow internet connection or high-latency broker

- You’re impatient and might overtrade

[LINK PLACEHOLDER: Internal link to “Different Forex Trading Styles: Which One Fits You?”]

Why the 5-Minute Chart?

The 5-minute chart is the sweet spot for beginner scalpers because it:

- Provides enough price data to identify trends without excessive noise

- Allows time to think unlike 1-minute charts that demand split-second decisions

- Generates sufficient signals for active trading (10-20 signals per session)

- Balances speed and accuracy – fast enough to scalp, slow enough to analyze

- Works with simple indicators that beginners can understand and apply

Many professional scalpers eventually graduate to 1-minute or tick charts, but the 5-minute timeframe is perfect for learning the fundamentals.

The Complete 5-Minute Scalping Strategy

This strategy uses three simple indicators that work together to identify high-probability scalping opportunities. It’s designed specifically for beginners and requires no complex technical analysis skills.

Required Indicators

1. 20 EMA (Exponential Moving Average) – Blue Line

- Identifies the short-term trend

- Acts as dynamic support/resistance

- Price above = bullish bias, below = bearish bias

2. 50 EMA (Exponential Moving Average) – Red Line

- Confirms the overall trend direction

- Provides additional support/resistance

- Acts as trend filter

3. Stochastic Oscillator (14, 3, 3) – Below Chart

- Identifies overbought/oversold conditions

- Signals potential reversal points

- Confirms entry timing

Note: These indicators are available on every major trading platform (MetaTrader 4/5, TradingView, cTrader) and are completely free to use.

Chart Setup Instructions

Step-by-Step Setup:

- Open your trading platform

- Select your currency pair (EUR/USD recommended to start)

- Switch to the 5-minute timeframe

- Add 20 EMA (color: blue, apply to close)

- Add 50 EMA (color: red, apply to close)

- Add Stochastic Oscillator (14, 3, 3) in a separate window below the chart

- Remove any other indicators to keep your chart clean

Your chart should now show price candles, two moving average lines, and the stochastic indicator below.

[LINK PLACEHOLDER: Internal link to “How to Set Up Your Forex Trading Platform for Success”]

The Buy (Long) Setup – Step by Step

Entry Conditions (ALL Must Be Met)

Condition 1: Trend Direction

- Price must be above BOTH the 20 EMA (blue) and 50 EMA (red)

- The 20 EMA must be above the 50 EMA

- This confirms we’re in an uptrend

Condition 2: Pullback

- Price pulls back to touch or slightly penetrate the 20 EMA

- This is our “buy the dip” opportunity

- We’re waiting for a bounce off the moving average

Condition 3: Stochastic Confirmation

- Stochastic must be in the oversold zone (below 20)

- Stochastic crosses up (blue line crosses above red line)

- This signals momentum is turning bullish

Condition 4: Candle Confirmation

- Wait for a bullish candle to close (green/white candle)

- The candle should close above the 20 EMA

- This confirms buyers are stepping in

Entry Rules

Enter LONG when:

- All 4 conditions above are satisfied

- Enter at the OPEN of the next candle after the bullish confirmation candle

- Or enter immediately if you can quickly place the order

Stop Loss Placement

Conservative Stop Loss:

- Place 2-3 pips below the recent swing low

- Or 10-15 pips below your entry (whichever is closer)

Aggressive Stop Loss:

- Place 5-8 pips below your entry

- Only use this if you’re trading during very high liquidity (London/NY overlap)

Take Profit Targets

Target 1: 10 pips (close 50% of position) Target 2: 15-20 pips (close remaining 50%)

Alternative Single Target: 12-15 pips (close entire position)

Trade Management

- Once price moves 5-7 pips in profit, move stop loss to break-even

- This creates a “risk-free” trade

- Let Target 2 run but don’t get greedy—if price stalls near your target, take profit

The Sell (Short) Setup – Step by Step

Entry Conditions (ALL Must Be Met)

Condition 1: Trend Direction

- Price must be below BOTH the 20 EMA (blue) and 50 EMA (red)

- The 20 EMA must be below the 50 EMA

- This confirms we’re in a downtrend

Condition 2: Pullback

- Price pulls back up to touch or slightly penetrate the 20 EMA

- This is our “sell the rally” opportunity

- We’re waiting for a rejection from the moving average

Condition 3: Stochastic Confirmation

- Stochastic must be in the overbought zone (above 80)

- Stochastic crosses down (blue line crosses below red line)

- This signals momentum is turning bearish

Condition 4: Candle Confirmation

- Wait for a bearish candle to close (red/black candle)

- The candle should close below the 20 EMA

- This confirms sellers are in control

Entry Rules

Enter SHORT when:

- All 4 conditions above are satisfied

- Enter at the OPEN of the next candle after the bearish confirmation candle

- Or enter immediately if you can quickly place the order

Stop Loss Placement

Conservative Stop Loss:

- Place 2-3 pips above the recent swing high

- Or 10-15 pips above your entry (whichever is closer)

Aggressive Stop Loss:

- Place 5-8 pips above your entry

- Only use during very high liquidity periods

Take Profit Targets

Target 1: 10 pips (close 50% of position) Target 2: 15-20 pips (close remaining 50%)

Alternative Single Target: 12-15 pips (close entire position)

Trade Management

- Move stop loss to break-even after 5-7 pips profit

- Trail stop loss if price continues moving favorably

- Close entire position if price returns to 20 EMA

Best Currency Pairs for This Strategy

Not all currency pairs are suitable for scalping. You want pairs with tight spreads, high liquidity, and predictable volatility.

Highly Recommended (Best for Beginners)

EUR/USD – The Perfect Scalping Pair

- Tightest spreads (typically 0.5-1.5 pips)

- Highest liquidity globally

- Predictable movements

- Abundant trading signals

- Best during London/NY overlap (8 AM – 12 PM EST)

GBP/USD – “The Cable”

- Good liquidity and volume

- Slightly wider spreads (1-2 pips)

- More volatile than EUR/USD

- Great for experienced scalpers

- Avoid during low liquidity Asian session

Also Suitable (With Experience)

USD/JPY

- Tight spreads (1-2 pips)

- Good liquidity

- Excellent during Asian and US sessions

- Different market personality to learn

AUD/USD

- Moderate spreads (1.5-2.5 pips)

- Best during Sydney/Tokyo overlap

- Good for Asian session traders

AVOID for Scalping

EUR/GBP, GBP/JPY, EUR/JPY – Too slow-moving or too erratic Exotic Pairs – Wide spreads kill scalping profitability CHF pairs during low liquidity – Can have sudden violent moves

Pro Tip: Master EUR/USD first before exploring other pairs. Most profitable scalpers specialize in 1-2 pairs rather than trading everything.

[LINK PLACEHOLDER: Internal link to “Best Currency Pairs for Beginner Forex Traders”]

Best Times to Trade This Strategy

Timing is critical for scalping success. You need high liquidity for tight spreads and sufficient volatility for profitable moves.

Optimal Trading Sessions

Best Time: London/New York Overlap (8:00 AM – 12:00 PM EST)

- Highest trading volume of the day

- Tightest spreads

- Most scalping opportunities

- All major pairs active

- 10-20 quality setups during this 4-hour window

Good Time: London Session Opening (3:00 AM – 8:00 AM EST)

- High European volume

- Good EUR and GBP movement

- 5-10 quality setups

- Watch for London open volatility spike

Acceptable: New York Afternoon (12:00 PM – 3:00 PM EST)

- Moderate activity after London close

- Fewer but still tradeable setups

- 3-5 quality signals

Times to AVOID

Asian Session (7:00 PM – 3:00 AM EST)

- Low volume except for JPY pairs

- Wider spreads

- Choppy, range-bound movement

- Better for range trading, not this strategy

Friday After 12:00 PM EST

- Volatility drops significantly

- Position squaring before weekend

- Unpredictable moves

- Better to close out and wait for Monday

Major News Releases (During and 15 minutes after)

- Extreme volatility

- Spread widening (sometimes 5-10x normal)

- Slippage can destroy scalping profits

- Wait for conditions to normalize

[LINK PLACEHOLDER: Internal link to “Forex Trading Hours: Best Time to Trade Each Currency Pair”]

Position Sizing and Risk Management for Scalping

Proper risk management is even more critical for scalping because of high trade frequency.

The 1% Risk Rule

Never risk more than 1% of your account on a single scalp.

Example:

- Account balance: $5,000

- Maximum risk per trade: $50 (1%)

- Stop loss: 10 pips

- Position size: $50 ÷ 10 pips = $5 per pip = 50,000 units (0.5 lots)

Position Sizing Formula

Position Size (units) = (Account × Risk %) ÷ Stop Loss (pips) ÷ Pip Value

Quick Reference Table:

| Account | 1% Risk | 10-Pip SL | 15-Pip SL | 20-Pip SL |

|---|---|---|---|---|

| $1,000 | $10 | 0.10 lots | 0.067 lots | 0.05 lots |

| $2,500 | $25 | 0.25 lots | 0.167 lots | 0.125 lots |

| $5,000 | $50 | 0.50 lots | 0.33 lots | 0.25 lots |

| $10,000 | $100 | 1.00 lot | 0.67 lots | 0.50 lots |

Maximum Daily Risk Limit

Set a maximum daily loss limit to protect against bad days:

- Maximum daily loss: 3% of account

- After 3 consecutive losses, STOP trading for the day

- After losing your daily limit, stop until tomorrow

- This prevents emotional revenge trading

Scaling In and Out

Recommended for beginners:

- Close 50% at Target 1 (10 pips)

- Close 50% at Target 2 (15-20 pips)

- This secures partial profits while allowing winners to run

Alternative for consistency:

- Close 100% at a fixed target (12-15 pips)

- Simpler to manage

- More consistent results

Trading Psychology for Scalping

Scalping is mentally demanding. Here’s how to maintain the right mindset.

Mental Preparation

Before Each Session:

- Review your trading rules

- Accept that losses are part of the process

- Commit to following your plan exactly

- Set realistic expectations (aim for 60-70% win rate)

During Trading

Stay Disciplined:

- Only take setups that meet ALL conditions

- Don’t “force” trades when conditions aren’t right

- Accept missed opportunities without regret

- Stick to your stop losses—no moving them wider

Manage Emotions:

- After a loss: Take a 15-30 minute break

- After 2 losses: Review what went wrong, then break

- After 3 losses: Done for the day

- After a big win: Don’t immediately jump into next trade

Common Psychological Traps

Overtrading

- Taking marginal setups because you’re bored

- Trading outside your designated time windows

- Forcing trades when the market isn’t cooperating

Revenge Trading

- Trying to “make back” a loss immediately

- Increasing position size after losses

- Abandoning your strategy after losses

Profit Protection Anxiety

- Closing winners too early out of fear

- Not letting Target 2 run as planned

- Constantly checking unrealized P&L

The Fix: Write down your rules, put them on your monitor, and check them before EVERY trade. If a trade doesn’t meet all conditions, don’t take it—period.

[LINK PLACEHOLDER: Internal link to “Forex Trading Psychology: Master Your Emotions”]

Example Trades – Step by Step

Let’s walk through real trade examples to see the strategy in action.

Example Trade #1: EUR/USD Long Setup

Date: Typical Tuesday, 9:30 AM EST (London/NY overlap) Pair: EUR/USD on 5-minute chart Account: $5,000

Setup Development:

9:25 AM: EUR/USD is trending higher. Price is above both the 20 EMA and 50 EMA. The 20 EMA is above the 50 EMA. ✅ Condition 1 met.

9:30 AM: Price pulls back and touches the 20 EMA at 1.0850. ✅ Condition 2 met.

9:32 AM: Stochastic drops into oversold territory (below 20) and crosses upward. ✅ Condition 3 met.

9:35 AM: A strong bullish 5-minute candle closes at 1.0856, above the 20 EMA. ✅ Condition 4 met.

Trade Execution:

Entry: 1.0857 (open of next candle) Stop Loss: 1.0847 (10 pips below entry, below the pullback low) Target 1: 1.0867 (10 pips – 50% position) Target 2: 1.0872 (15 pips – remaining 50%)

Position Size Calculation:

- Risk: $50 (1% of $5,000)

- Stop loss: 10 pips

- Position size: $50 ÷ 10 = $5 per pip = 0.5 lots (50,000 units)

Trade Management:

9:40 AM: Price reaches 1.0862 (+5 pips). Move stop loss to 1.0857 (break-even).

9:45 AM: Price hits 1.0867. Close 50% of position (0.25 lots) for +$25 profit.

9:52 AM: Price hits 1.0872. Close remaining 50% for +$37.50 profit.

Total Profit: $62.50 (1.25% account growth in 17 minutes)

Example Trade #2: EUR/USD Short Setup

Date: Same Tuesday, 11:15 AM EST Pair: EUR/USD on 5-minute chart Account: $5,062.50 (after previous trade)

Setup Development:

11:00 AM: EUR/USD has reversed into a downtrend. Price is below both EMAs, and 20 EMA is below 50 EMA. ✅ Condition 1 met.

11:10 AM: Price rallies back up to the 20 EMA at 1.0878. ✅ Condition 2 met.

11:13 AM: Stochastic rises into overbought territory (above 80) and crosses downward. ✅ Condition 3 met.

11:15 AM: A strong bearish candle closes at 1.0872, below the 20 EMA. ✅ Condition 4 met.

Trade Execution:

Entry: 1.0871 (open of next candle) Stop Loss: 1.0881 (10 pips above entry) Target 1: 1.0861 (10 pips – 50% position) Target 2: 1.0856 (15 pips – remaining 50%)

Position Size: 0.5 lots (maintaining consistent risk)

Trade Management:

11:20 AM: Price drops to 1.0866 (+5 pips). Move stop to 1.0871 (break-even).

11:23 AM: Price hits 1.0861. Close 50% for +$25 profit.

11:28 AM: Price hits 1.0856. Close remaining 50% for +$37.50.

Total Profit: $62.50 (additional 1.23% gain)

Session Total: Two trades, two winners, +$125 profit (2.5% account growth in 2 hours)

Example Trade #3: False Signal – Losing Trade

Date: Wednesday, 10:00 AM EST Pair: EUR/USD Account: $5,187.50

Setup Development:

All four conditions appear to be met for a long trade. Price is above EMAs, pulls back to 20 EMA, stochastic oversold and crosses up, bullish candle closes.

Entry: 1.0895 Stop Loss: 1.0885 (10 pips) Targets: 1.0905 / 1.0910

What Went Wrong:

10:08 AM: Instead of rallying, price consolidates sideways for 2 candles, then breaks down through the 20 EMA.

10:13 AM: Stop loss hit at 1.0885.

Loss: -$50 (0.96% of account)

Analysis: This was a valid setup that simply didn’t work out. The stochastic showed some weakness after entry (failed to stay in bullish territory). In scalping, you’ll have losing trades—this is normal and why risk management is crucial.

Response: Took a 20-minute break. Reviewed the chart. No obvious mistake—sometimes valid setups fail. Waited for the next valid setup rather than revenge trading.

This example demonstrates:

- Not every setup wins (even when conditions are met)

- Proper stop losses protect your account

- A 1% loss is manageable and part of trading

- Emotional control after losses is essential

Common Mistakes and How to Avoid Them

Mistake #1: Taking Marginal Setups

The Problem: “The setup is close enough—3 out of 4 conditions are met, I’ll take it anyway.”

Why It Fails: Cherry-picking conditions dramatically reduces your win rate. The strategy works because all conditions filter for high-probability setups.

The Fix: Create a checklist. Check every box before entering. If even one condition is missing, skip the trade. Be patient—another setup is coming.

Mistake #2: Not Using Stop Losses

The Problem: “I’ll just watch this trade and close it manually if it goes against me.”

Why It Fails: You’ll hesitate, hope for recovery, and turn a 10-pip loss into a 30-50 pip disaster. Emotional decisions always increase losses.

The Fix: Set your stop loss the INSTANT you enter the trade. Treat it as non-negotiable. If stopped out, accept it and move on.

Mistake #3: Moving Stop Losses Wider

The Problem: “Price is only 2 pips from my stop loss—maybe it will reverse. Let me move my stop wider.”

Why It Fails: You’ve already been proven wrong. Moving stops turns small losses into large ones. This is how accounts get blown.

The Fix: Never, ever move a stop loss further away. You can move it closer (to break-even or trailing) but never wider. If your stop is hit, your analysis was wrong—accept it.

Mistake #4: Overtrading

The Problem: Taking 50+ trades per day because you’re excited or trying to “make up” for losses.

Why It Fails: Spread costs accumulate rapidly. Mental fatigue leads to mistakes. Most extra trades violate your rules.

The Fix: Set a maximum daily trade limit (10-20 trades for beginners). Quality over quantity. After 3 losses, stop for the day.

Mistake #5: Scalping with Wide Spreads

The Problem: Trading during low liquidity when EUR/USD spread widens to 3-5 pips.

Why It Fails: You need 5+ pips of favorable movement just to break even. Your 10-pip target becomes a 15-pip target. Profit targets become nearly impossible.

The Fix: Only trade during high liquidity sessions (London/NY overlap). Check your spread before every trade—if it’s over 2 pips on EUR/USD, wait.

Mistake #6: Ignoring Break-Even Moves

The Problem: Not moving stop loss to break-even after reaching +5-7 pips profit.

Why It Fails: Winning trades can reverse and hit your original stop, turning winners into losers. This is psychologically devastating.

The Fix: Create a hard rule: At +5 pips (or after hitting Target 1), immediately move stop to break-even. This creates “risk-free” trades.

Advanced Tips for Better Results

Once you’ve mastered the basics, these advanced techniques can improve your results.

Tip #1: Add Volume/Volatility Filter

Avoid trading during extremely low volume periods by adding an ATR (Average True Range) indicator:

- Add ATR (14) to your chart

- Only trade when ATR is above 0.0008 (8 pips) for EUR/USD

- This ensures sufficient volatility for your profit targets

Tip #2: Use Support and Resistance Confluence

The strongest setups occur when your 20 EMA pullback coincides with a key support or resistance level:

- Mark major support/resistance zones on higher timeframes (1-hour, 4-hour)

- When your 5-minute setup occurs at these levels, increase confidence

- Consider slightly larger position sizes for these A+ setups

Tip #3: Avoid the First 15 Minutes After Session Open

The first 15 minutes after London open (3:00-3:15 AM EST) and New York open (8:00-8:15 AM EST) can be erratic:

- Wait for the initial volatility spike to settle

- False breakouts are common in this window

- Start actively trading after 3:15 AM or 8:15 AM EST

Tip #4: Correlate with Price Action

Pay attention to candlestick patterns for additional confirmation:

- Bullish setups with pin bars, engulfing candles, or hammer patterns = stronger

- Bearish setups with shooting stars or bearish engulfing = stronger

- Doji candles or indecision = skip the trade

Tip #5: Track Your Statistics

Keep a detailed trading journal tracking:

- Win rate by session (London vs NY)

- Average winner size vs average loser size

- Best performing currency pairs

- Win rate by day of week

- Time of day with best results

Use this data to refine when and what you trade.

[LINK PLACEHOLDER: Internal link to “How to Keep a Forex Trading Journal That Improves Results”]

Broker Requirements for Scalping

Not all brokers allow or are suitable for scalping. Here’s what you need.

Essential Broker Features

1. Scalping Allowed

- Some brokers prohibit scalping in their terms

- Verify this before opening an account

- ECN/STP brokers are generally scalping-friendly

2. Tight Spreads

- EUR/USD: 0.5-1.5 pips maximum

- GBP/USD: 1-2 pips maximum

- Spreads above these make scalping unprofitable

3. Fast Execution

- Order execution under 100 milliseconds

- No requotes on your orders

- Slippage should be minimal (0-0.5 pips average)

4. No Commissions (or very low)

- Many scalpers prefer spread-only accounts

- If commission-based: under $3-4 per lot round-trip

- Calculate total cost per trade (spread + commission)

5. Reliable Platform

- MetaTrader 4/5, cTrader, or proprietary platforms

- No frequent disconnections or freezing

- Mobile trading capability for emergencies

6. Sufficient Leverage

- Minimum 50:1 for scalping comfort

- 100:1 is ideal for flexibility

- Remember: having leverage doesn’t mean using it all

Recommended Broker Types

ECN/STP Brokers – Best for scalping

- Direct market access

- Tightest spreads

- Fast execution

- No conflict of interest

Avoid Market Makers – Often problematic for scalpers

- May requote orders

- Potential conflict of interest

- Can be slower execution

[LINK PLACEHOLDER: Internal link to “Best Forex Brokers for Scalping in 2026”]

Tools and Platform Setup

Optimize your trading environment for scalping success.

Essential Tools

1. Multiple Monitor Setup (Recommended)

- Monitor 1: Your trading chart (5-minute)

- Monitor 2: Economic calendar and news feeds

- Monitor 3: Other timeframes (15-min, 1-hour) for context

- Can work with one monitor, but multiple improve efficiency

2. Economic Calendar

- Forex Factory, Investing.com, or broker-provided

- Filter for high-impact news only

- Set alerts 15 minutes before releases

- Avoid trading during and 15 minutes after major news

3. Stable Internet

- Minimum 10 Mbps download speed

- Wired connection preferred over WiFi

- Backup connection (mobile hotspot) for emergencies

- Consider VPS (Virtual Private Server) for serious scalpers

4. One-Click Trading

- Enable on MetaTrader or cTrader

- Speeds up order execution

- Pre-set stop loss and take profit distances

- Reduces emotional hesitation

Chart Template Setup

Save your chart setup as a template for quick access:

Template includes:

- 20 EMA (blue)

- 50 EMA (red)

- Stochastic (14, 3, 3)

- Clean white background

- Appropriate zoom level

- Saved as “5-Min Scalping Template”

Load this template on any currency pair instantly to start trading.

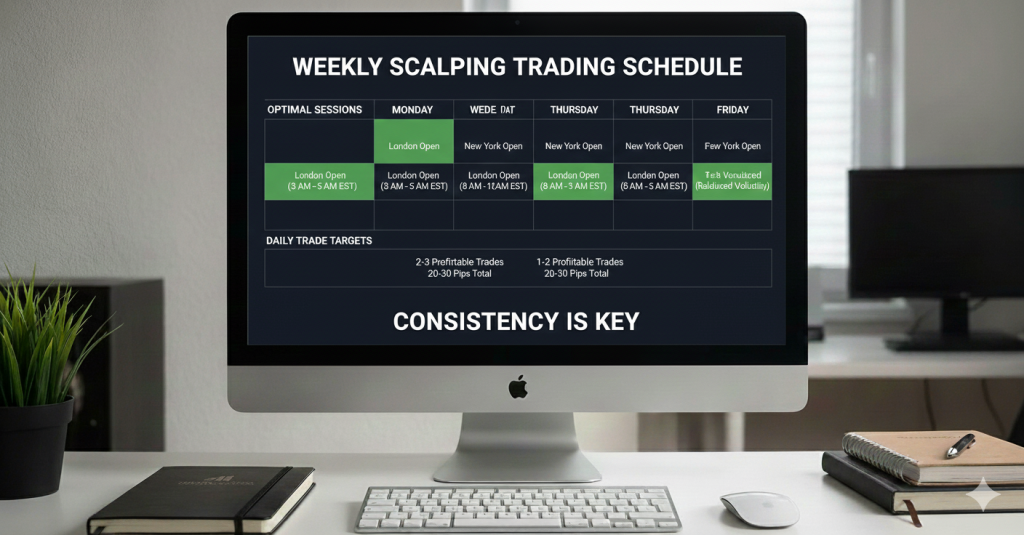

Weekly Trading Schedule Example

Here’s a realistic scalping schedule for part-time traders:

Monday

- 8:00-10:00 AM EST: Active trading (NY open overlap)

- Target: 4-6 trades

- Goal: 40-60 pips gross profit

Tuesday

- 8:00-11:00 AM EST: Active trading (full overlap period)

- Target: 6-10 trades

- Goal: 60-80 pips gross profit

Wednesday

- 9:00-11:00 AM EST: Active trading (avoiding 8:30 AM high-impact news)

- Target: 4-6 trades

- Goal: 40-60 pips gross profit

Thursday

- 8:00-10:00 AM EST: Active trading

- Target: 5-8 trades

- Goal: 50-70 pips gross profit

Friday

- 8:00-11:00 AM EST: Active trading (stop by noon)

- Target: 4-6 trades

- Goal: 40-60 pips gross profit

- Close all positions by 12:00 PM EST

Weekly Goals

- Total trades: 23-36

- Win rate target: 65%+

- Gross profit target: 230-330 pips

- Net profit (after spreads): 180-280 pips

- Account growth: 3-5% per week

Weekend:

- Review all trades from the week

- Update trading journal

- Analyze statistics and patterns

- Prepare for next week

- No trading—rest and recharge

Frequently Asked Questions

Is scalping profitable for beginners?

Scalping can be profitable, but it’s challenging for complete beginners due to its fast-paced nature. Success requires discipline, quick decision-making, and strict risk management. Most traders should gain 3-6 months of experience with swing trading before attempting scalping. However, with the structured strategy in this guide, motivated beginners can succeed if they follow the rules precisely.

How much money do I need to start scalping?

Minimum $500-$1,000 for micro account scalping, though $2,000-$5,000 is more comfortable. With proper risk management (1% risk per trade), smaller accounts can work but limit your position sizing flexibility. Remember that spread costs represent a larger percentage of small accounts, making profitability more challenging below $1,000.

Can I scalp with a full-time job?

Yes, but with limitations. You need access to your trading platform during high-liquidity sessions (8:00 AM – 12:00 PM EST). Options include: trading during lunch breaks, waking up early to catch the London/NY overlap, or focusing on swing trading instead. Many successful scalpers trade 1-2 hours daily rather than all day.

What’s a realistic profit target for scalping?

Realistic expectations: 3-7% monthly account growth for beginners, 7-15% for experienced scalpers. Daily targets of 20-40 pips net (after spreads) are achievable with this strategy. Avoid unrealistic goals like “double my account in a month”—that mindset leads to overleveraging and account destruction.

How many trades should I take per day?

Quality over quantity. With this 5-minute strategy, expect 8-15 quality setups during a 3-4 hour trading session. Beginners should aim for 5-10 trades daily maximum. Taking 50+ trades daily usually indicates overtrading and violating entry rules.

Is this strategy better than swing trading?

Neither is inherently “better”—they suit different personalities and schedules. Scalping offers more frequent feedback and faster results but requires more screen time and mental energy. Swing trading requires less monitoring but needs patience to hold through overnight swings. Try both to discover your preference.

Do I need expensive indicators or robots?

No. This strategy uses free, standard indicators available on all platforms. Expensive “magic” indicators or Expert Advisors (robots) aren’t necessary. Success comes from discipline and execution, not fancy tools. Save your money for trading capital.

Conclusion: Your Path to Scalping Success

You now have a complete, actionable 5-minute scalping strategy that you can implement immediately. This isn’t a “holy grail” system that never loses—no such thing exists—but it’s a proven, beginner-friendly approach that works when applied with discipline and proper risk management.

Your next steps:

Week 1-2: Demo Trading

- Set up your charts with the indicators

- Practice identifying setups

- Take 20-30 practice trades

- Track results without risking real money

Week 3-4: Small Live Positions

- Start with minimum position sizes

- Trade only during London/NY overlap

- Focus on execution, not profits

- Aim for consistency, not big wins

Month 2-3: Build Experience

- Gradually increase position sizes (within 1% risk rule)

- Refine entry timing

- Develop your scalping rhythm

- Track statistics religiously

Month 4+: Optimize and Scale

- Analyze what works best for you

- Focus on your highest-win-rate sessions

- Consider adding a second currency pair

- Scale position sizes as account grows

Critical reminders:

✅ Follow ALL four entry conditions—no exceptions ✅ Risk only 1% per trade, maximum 3% daily ✅ Stop after 3 consecutive losses ✅ Trade only during high-liquidity sessions ✅ Use stop losses on every single trade ✅ Keep a detailed trading journal ✅ Be patient—quality setups are worth waiting for

Scalping isn’t easy, but it’s learnable. The traders who succeed are those who follow their strategy with unwavering discipline, manage risk religiously, and continuously learn from both winners and losers. This strategy gives you the framework—your execution determines the results.

Ready to start scalping? Open your demo account, set up your charts, and start identifying setups today. When you’ve proven consistency in demo trading, transition to live trading with small positions. Your scalping journey begins with a single trade—make it a disciplined one.