XM Broker Review: Can You Really Start Trading with $5?

In the world of online trading, finding a broker that lets you start with minimal capital can feel like searching for a needle in a haystack. That’s where XM Broker comes in, claiming you can begin your trading journey with just $5. But is this too good to be true? In this comprehensive XM Broker review, we’ll dive deep into whether this ultra-low minimum deposit is legitimate, what trading conditions you’ll face, and if XM is truly the best choice for beginners in 2026.

Whether you’re a complete novice looking to dip your toes into forex trading or an experienced trader seeking a backup account, this review covers everything you need to know about XM’s $5 minimum deposit offer.

[INTERNAL LINK: Link to ‘How to Choose a Forex Broker for Beginners’ or ‘Understanding Forex Trading: Complete Guide’]

Quick Verdict: XM Broker at a Glance

| Minimum Deposit | $5 (Micro Account) |

| Regulation | CySEC, ASIC, IFSC |

| Trading Platforms | MT4, MT5, XM WebTrader |

| Best For | Beginners, Low-capital traders |

| Overall Rating | 4.2/5.0 |

What is XM Broker?

XM, operating under the Trading Point Holdings Ltd umbrella, is a globally recognized forex and CFD broker that has been serving traders since 2009. With over 15 years in the industry and more than 10 million clients worldwide, XM has established itself as one of the most accessible brokers for retail traders.

What sets XM Broker apart from competitors is its commitment to lowering entry barriers. While most brokers require $100 to $500 minimum deposits, XM’s Micro Account genuinely allows you to start trading with just $5, making it an attractive option for beginners who want to learn without risking substantial capital.

XM’s Regulatory Status: Is Your Money Safe?

Before depositing any amount, even $5, regulatory oversight matters. XM Group holds licenses from multiple tier-1 regulators:

- CySEC (Cyprus Securities and Exchange Commission) – License No. 120/10

- ASIC (Australian Securities and Investments Commission) – License No. 443670

- IFSC (International Financial Services Commission, Belize)

These regulations mean your funds are held in segregated accounts, separate from XM’s operational funds, providing an essential layer of protection. CySEC regulation also means eligible traders receive compensation up to €20,000 through the Investor Compensation Fund if the broker fails.

The $5 Minimum Deposit: Reality vs Marketing

Here’s the truth: Yes, you can open an XM trading account with just $5, but there are important caveats you need to understand before getting excited.

Understanding XM’s Account Types

XM offers three main account types, each with different minimum deposit requirements:

| Account Type | Min. Deposit | Lot Size | Best For |

| Micro | $5 | 0.01 (Micro) | Absolute beginners |

| Standard | $5 | 0.01 (Standard) | Most retail traders |

| XM Ultra Low | $50 | 0.01 | Low-spread seekers |

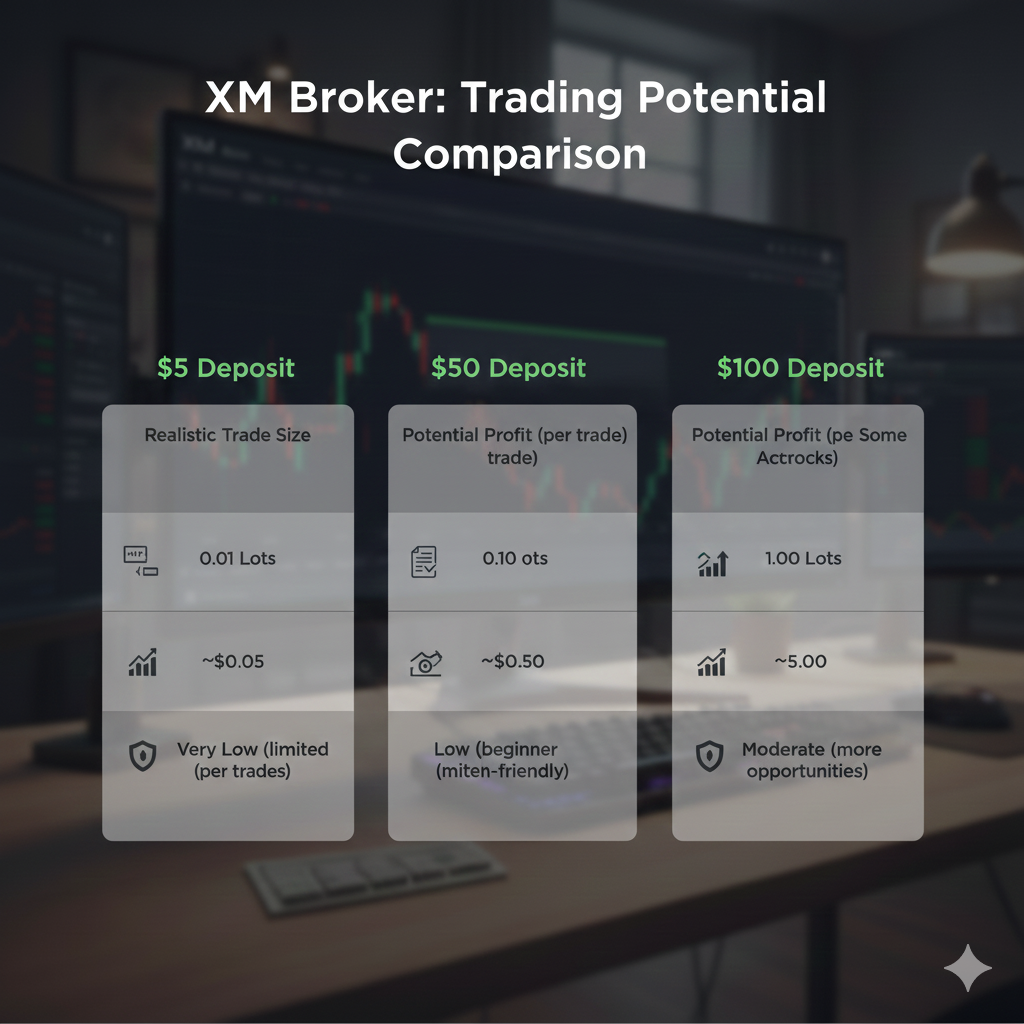

What Can You Actually Do with $5?

Let’s be realistic. While XM’s $5 minimum deposit is technically accurate, trading with such a small amount has serious limitations:

- Limited position sizes: With $5 and proper risk management (1-2% per trade), you can only risk $0.05-$0.10 per trade

- Minimal profit potential: Even a 10% return on $5 is just $0.50

- Psychological pressure: Small accounts create stress as every pip movement feels significant

- Learning curve: Better to practice proper position sizing with more capital

Realistic recommendation: While you can start with $5, most traders find $50-$100 more practical for genuine learning and maintaining proper risk management. However, the $5 option remains excellent for testing the platform before committing more capital.

[INTERNAL LINK: Link to ‘Forex Risk Management: How Much Should You Risk Per Trade?’]

XM Trading Platforms: What You Get

XM doesn’t compromise on technology despite its low barrier to entry. The broker offers multiple professional-grade trading platforms:

MetaTrader 4 (MT4)

MT4 remains the most popular forex trading platform globally, and XM’s implementation is excellent. Even with a $5 account, you get full access to:

- Advanced charting with 30+ technical indicators

- Expert Advisors (EAs) for automated trading

- 9 timeframes for analysis

- Mobile apps for iOS and Android

MetaTrader 5 (MT5)

MT5 offers additional features over MT4, including more order types, additional timeframes, and better tools for analyzing multiple markets. XM provides both platforms, letting you choose based on your trading style and experience.

XM WebTrader

For traders who prefer not to download software, XM WebTrader runs directly in your browser with similar functionality to the desktop platforms. Perfect for trading from public computers or trying the platform before installation.

[IMAGE: Screenshot montage showing MT4, MT5, and WebTrader interfaces side by side. Alt text: ‘XM Broker trading platforms MT4 MT5 and WebTrader comparison’]

Trading Conditions: Spreads, Leverage, and Fees

Low minimum deposit means nothing if trading costs are prohibitive. Here’s what you’ll actually pay with XM Broker:

Spreads

XM operates on a floating spread model:

- EUR/USD: From 0.6 pips (typically 0.8-1.0 pips during normal hours)

- GBP/USD: From 0.9 pips (typically 1.2-1.5 pips)

- USD/JPY: From 0.7 pips (typically 0.9-1.2 pips)

These spreads are competitive but not the tightest in the industry. ECN accounts from other brokers may offer narrower spreads, but XM’s no-commission structure on Micro and Standard accounts makes calculations simple for beginners.

Leverage

XM offers leverage up to 1:1000 on forex pairs, though actual available leverage depends on your regulatory jurisdiction:

- EU/UK traders: Maximum 1:30 (ESMA regulations)

- Australian traders: Maximum 1:30 (ASIC regulations)

- Other jurisdictions: Up to 1:1000

Important warning: High leverage magnifies both profits and losses. Just because XM offers 1:1000 doesn’t mean you should use it. Most professional traders use far less, typically 1:10 to 1:50.

Additional Fees

XM maintains transparent fee structures with minimal hidden costs:

- Deposit fees: None on most payment methods

- Withdrawal fees: Free for most methods; $5 for bank wire under $200

- Inactivity fee: $5 per month after 90 days of inactivity

- Swap/overnight fees: Applied on positions held overnight (varies by instrument)

[INTERNAL LINK: Link to ‘Understanding Forex Leverage: A Beginner’s Guide’ or ‘Hidden Broker Fees You Should Watch Out For’]

Account Opening Process: How to Start with $5

Opening an XM trading account takes about 10 minutes. Here’s the complete step-by-step process:

Step 1: Register Your Account

Visit the XM website and click the registration button. You’ll need to provide basic information including your name, email, country of residence, and phone number. Choose your preferred base currency at this stage—you cannot change it later without opening a new account.

Step 2: Choose Your Account Type

Select the Micro Account for the $5 minimum deposit option. You’ll also choose your leverage preference and platform (MT4 or MT5).

Step 3: Complete Verification

XM requires identity verification before you can deposit or trade. Upload:

- Proof of identity (passport, driver’s license, or national ID)

- Proof of address (utility bill, bank statement dated within 6 months)

Verification typically takes 24 hours but can be faster during business hours.

Step 4: Make Your First Deposit

Once verified, you can deposit using various methods:

- Credit/debit cards (Visa, Mastercard): Instant processing

- E-wallets (Skrill, Neteller): Instant processing

- Bank wire: 2-5 business days

- Local payment methods: Varies by country

For the $5 minimum deposit, credit/debit cards or e-wallets are most practical given their instant processing and lack of minimum transfer requirements.

Step 5: Download Platform and Start Trading

Download your chosen platform (MT4 or MT5), log in with your credentials, and you’re ready to trade. XM provides comprehensive video tutorials if you’re new to MetaTrader platforms.

Educational Resources and Support

XM recognizes that many of its $5 account holders are beginners and provides substantial educational content:

Free Educational Materials

- Daily market analysis and trading signals

- Forex video tutorials covering basics to advanced strategies

- Free webinars hosted by professional traders

- Comprehensive trading glossary and FAQ section

- Demo accounts with virtual funds for risk-free practice

Customer Support

XM offers 24/5 multilingual customer support through multiple channels:

- Live chat (fastest response, typically under 2 minutes)

- Email support (response within 24 hours)

- Phone support in 30+ languages

- Local offices in major financial centers

Support quality remains consistent regardless of account size—your $5 account receives the same level of service as accounts with thousands of dollars.

[INTERNAL LINK: Link to ‘Essential Forex Trading Education Resources for Beginners’ or ‘How to Use a Demo Trading Account Effectively’]

XM Broker Pros and Cons

After thoroughly testing XM Broker, here’s an honest assessment of its strengths and weaknesses:

Advantages

- Genuine $5 minimum deposit with full platform access

- Strong regulation from CySEC, ASIC, and IFSC

- No deposit or withdrawal fees on most methods

- Professional MT4 and MT5 platforms with full functionality

- Extensive educational resources suitable for beginners

- 24/5 multilingual customer support

- Over 1,000 trading instruments (forex, commodities, indices, stocks)

- Fast execution speeds and reliable platform performance

Disadvantages

- Spreads are competitive but not the tightest in the industry

- $5 is impractical for serious trading due to position size limitations

- Inactivity fee of $5/month kicks in after 90 days (can deplete small accounts)

- No proprietary trading platform (relies entirely on MetaTrader)

- High leverage options may encourage risky behavior in inexperienced traders

- Limited advanced order types compared to specialized platforms

[IMAGE: Visual pros and cons comparison with icons and brief text. Alt text: ‘XM Broker advantages and disadvantages comparison chart’]

Who Should Choose XM Broker?

XM Broker’s $5 minimum deposit isn’t universally beneficial. Here’s who will benefit most from this broker:

Ideal For:

- Complete beginners who want to test live trading with minimal risk

- Traders in developing countries with limited capital access

- Anyone wanting to trial XM’s platform before depositing larger amounts

- Traders who prioritize regulatory security over ultra-tight spreads

- Those who value comprehensive educational resources

Not Ideal For:

- High-frequency scalpers who need the absolute tightest spreads

- Professional traders managing substantial capital (consider institutional accounts)

- Traders specifically seeking ECN/STP execution with commission structure

- Those who prefer proprietary trading platforms over MetaTrader

Frequently Asked Questions

Can I withdraw my $5 deposit immediately after funding my account?

Yes, XM doesn’t have any holding periods or trading volume requirements before withdrawal. You can withdraw your deposit at any time, though you should check if your payment method has minimum withdrawal amounts (some e-wallets require $10 minimum).

Is there a bonus on the $5 deposit?

XM occasionally offers welcome bonuses, but these typically have minimum deposit requirements higher than $5 (usually $50+). The $5 account is designed purely as an entry point without promotional incentives. Always read bonus terms carefully, as they often come with trading volume requirements before withdrawal.

How long does account verification take?

Standard verification takes 24-48 hours. During peak times (end of month, tax season), it might extend to 72 hours. You can expedite the process by ensuring your documents are clear, fully visible, and within the validity period. Submit both proof of identity and address simultaneously rather than separately.

What happens if my $5 account balance falls to zero?

If you lose your entire deposit, the account remains open but inactive. You can deposit again at any time to resume trading. XM doesn’t close accounts due to zero balance, but remember the $5 monthly inactivity fee starts after 90 days of no trading activity, which would require maintaining a positive balance.

Can I upgrade from a $5 Micro Account to a different account type?

You cannot directly convert account types, but you can open additional accounts under the same XM profile. Many traders maintain multiple account types simultaneously—a $5 Micro Account for testing strategies and a Standard or Ultra Low account with larger capital for serious trading.

Does XM allow scalping on $5 accounts?

Yes, XM permits all trading strategies including scalping, hedging, and automated trading on all account types, regardless of deposit size. However, with only $5 capital, scalping becomes mathematically challenging due to position size limitations and the need to maintain appropriate risk management.

Is XM Broker a scam?

No, XM is a legitimate, regulated broker operating since 2009. It holds licenses from CySEC, ASIC, and IFSC—serious regulatory bodies with strict compliance requirements. With over 10 million clients and 15+ years of operation, XM has established credibility. The $5 minimum deposit is a genuine offering, not a deceptive marketing tactic.

[INTERNAL LINK: Link to ‘How to Spot Forex Trading Scams’ or ‘Understanding Forex Broker Regulations’]

XM Broker Alternatives to Consider

While XM offers an excellent low-barrier entry point, comparing alternatives helps you make an informed decision:

| Broker | Min. Deposit | EUR/USD Spread | Best For |

| XM Broker | $5 | 0.6 pips | Absolute beginners |

| Exness | $10 | 0.3 pips | Tight spreads seekers |

| IC Markets | $200 | 0.1 pips | Professional traders |

| Pepperstone | $200 | 0.2 pips | Serious retail traders |

Each broker has unique strengths. XM stands out for accessibility, while IC Markets and Pepperstone excel in execution quality and spreads for higher-capital traders.

[INTERNAL LINK: Link to individual reviews – ‘Exness Review’, ‘IC Markets Review’, ‘Pepperstone Review’]

Final Verdict: Should You Start Trading with XM’s $5 Deposit?

After comprehensive testing and analysis, here’s the bottom line: Yes, you can genuinely start trading with XM Broker for just $5, but whether you should depends entirely on your objectives.

The $5 minimum deposit excels as:

- A risk-free platform trial before committing larger capital

- An introduction to live trading psychology without financial pressure

- An accessible entry point for traders in regions with limited financial resources

However, realistic expectations matter: You won’t build wealth with $5. The account serves educational purposes—learning order execution, understanding spreads, experiencing slippage, and getting comfortable with the platform interface.

For serious trading, consider depositing at least $50-$100. This provides sufficient capital for proper risk management (1-2% per trade) while maintaining realistic position sizes. XM’s strong regulation, comprehensive educational resources, and reliable platform performance justify this commitment.

The verdict: XM Broker delivers on its $5 minimum deposit promise without hidden catches. It’s a legitimate, well-regulated broker offering genuine value for beginners. Start with $5 to test the waters, but plan to scale up once you’re comfortable with the platform and have developed basic trading competence.

Ready to Start Your Trading Journey?

Open your XM Micro Account today and experience professional trading platforms with minimal risk. Remember, education and practice are more valuable than rushing in with large capital.