ExpertOption Review 2026: Is This Digital Trading Platform Legit?

Welcome to the most comprehensive ExpertOption review you’ll find in 2026. If you’re researching whether ExpertOption is legit or searching for an honest ExpertOption broker assessment, you’ve come to the right place.

IMPORTANT CLARIFICATION: Many ExpertOption reviews incorrectly label it as a binary options broker. This ExpertOption review 2026 sets the record straight: ExpertOption is a digital options and forex/CFD trading platform, NOT a binary options broker—a crucial distinction for legality and trading flexibility.

With over 72 million users worldwide, ExpertOption has become one of the most popular online trading platforms. But does popularity equal legitimacy? I’ve spent weeks testing the ExpertOption platform with real money, examining ExpertOption withdrawal processes, and analyzing ExpertOption regulation to provide you with the truth.

This ExpertOption review covers:

- Complete ExpertOption platform features analysis

- Real ExpertOption withdrawal experience

- ExpertOption regulation and safety assessment

- ExpertOption trading costs and fees breakdown

- Honest verdict on whether ExpertOption is legit

ExpertOption Review Overview: What Is This Platform?

In this ExpertOption review, let’s first clarify exactly what the ExpertOption broker offers and why it’s different from what many reviews claim.

ExpertOption is a multi-asset online trading platform founded in 2014, offering:

- Digital Options Trading (NOT binary options)

- Forex/FX Options (currency pairs)

- CFD Trading (stocks, commodities, cryptocurrencies)

- Social Trading Features (copy trading)

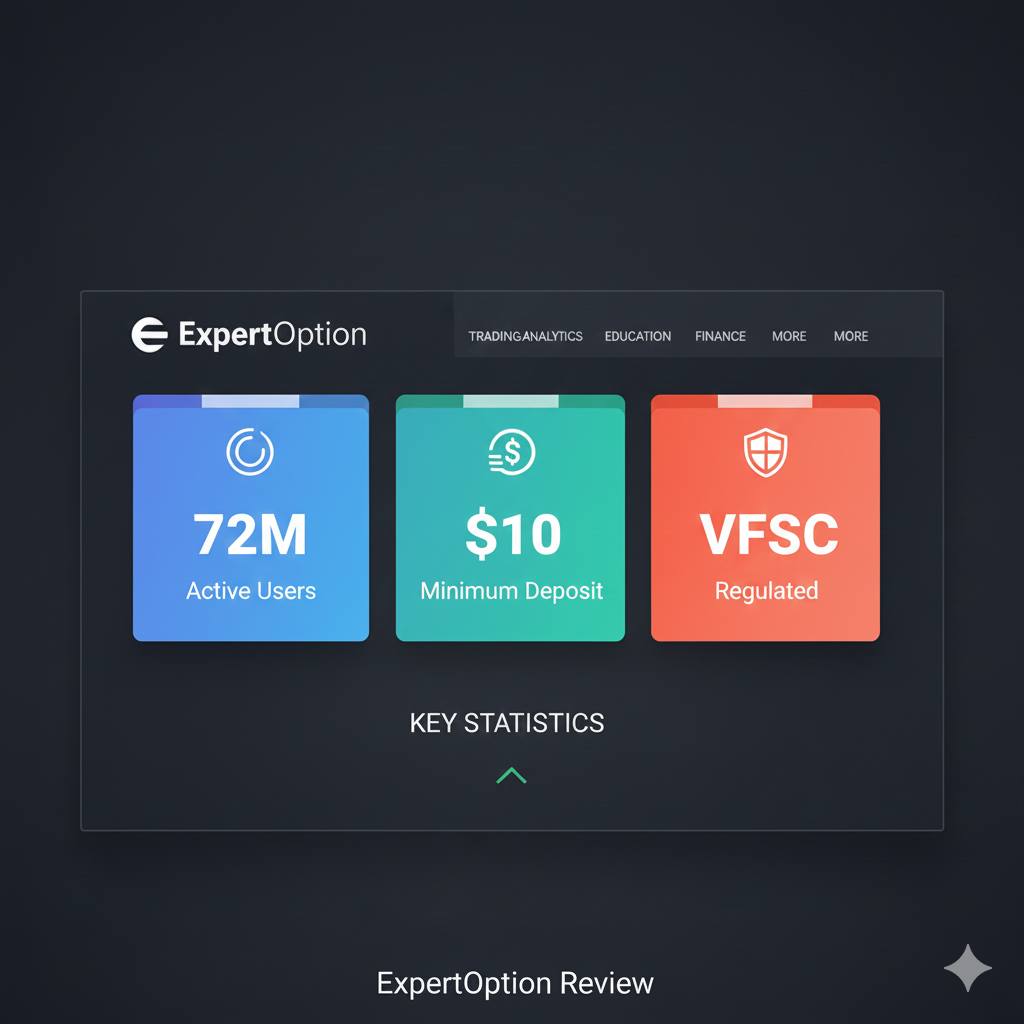

ExpertOption Key Facts

ExpertOption Broker Details:

- Founded: 2014 (Saint Vincent and the Grenadines)

- Registered Users: 72+ million claimed

- ExpertOption Minimum Deposit: $10

- Minimum Trade Size: $1

- ExpertOption Platform: Web-based proprietary, iOS, Android apps

- ExpertOption Regulation: VFSC License #700468

- Countries Served: 150+ (restrictions apply)

- ExpertOption Demo Account: Available with virtual funds

- Languages: 25+ supported

ExpertOption Business Model

The ExpertOption trading platform generates revenue through:

- Spreads on digital options trading

- Forex/CFD spreads and commissions

- Inactivity fees ($10/month after 30 days)

- Optional premium services

Unlike binary options brokers with fixed payouts, ExpertOption digital options offer variable profit potential based on price movement—a significant advantage we’ll explore in this ExpertOption review.

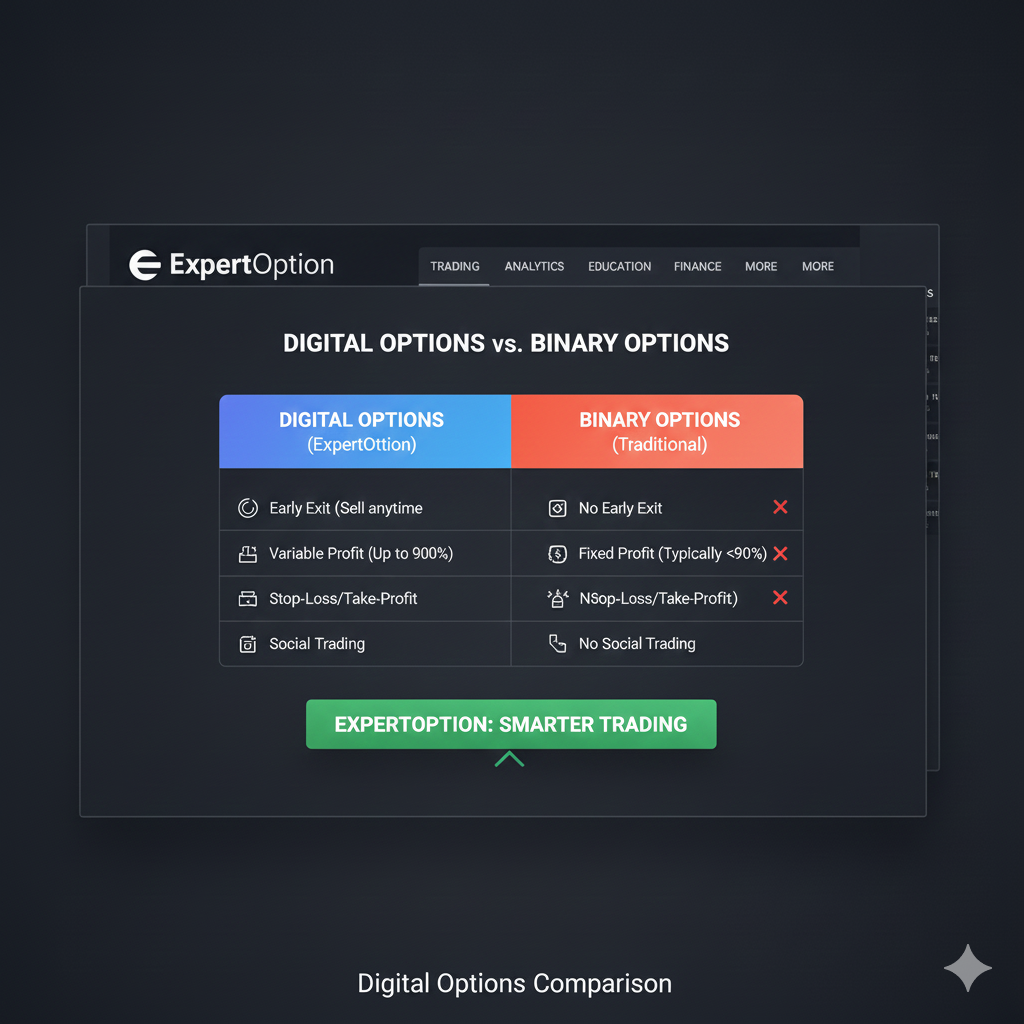

Digital Options vs Binary Options: Complete Comparison Guide

ExpertOption Digital Options vs Binary Options Explained

This section is crucial for any accurate ExpertOption review 2026. Understanding the difference between ExpertOption digital options and binary options is essential.

Why This Matters for ExpertOption Review

Many ExpertOption reviews incorrectly call it a “binary options broker.” This ExpertOption scam accusation often stems from confusion. Let’s clarify:

Binary Options (What ExpertOption is NOT)

❌ Fixed payout percentage (e.g., 80%) ❌ All-or-nothing outcome ❌ Cannot exit before expiry ❌ Banned in EU, UK, Australia, USA ❌ Limited legitimacy

ExpertOption Digital Options (What It Actually Offers)

✅ Variable profit potential (scales with price movement) ✅ Can close positions early ✅ Flexible strike prices ✅ Customizable expiry times ✅ Legal in more jurisdictions ✅ More sophisticated trading features

Example: ExpertOption Digital Options Trading

Scenario:

- Asset: EUR/USD

- ExpertOption platform entry: 1.1000

- Expiry: 30 minutes

- Investment: $100

Binary Options (Other Brokers):

- Price at 1.1050 = Win $80 profit

- Price at 1.1001 = Win $80 profit (same)

- Price at 1.0999 = Lose $100 (total loss)

ExpertOption Digital Options:

- Price at 1.1050 = Win $150-200 (larger move = larger profit)

- Price at 1.1010 = Win $30-50 (smaller move = smaller profit)

- Price at 1.0990 = Lose capped at investment

- Can exit at 1.1020 for partial profit

ExpertOption Platform Advantage

This ExpertOption review emphasizes that digital options trading on the ExpertOption platform provides:

- More control over trades

- Better risk/reward ratios

- Professional trading features

- Legal operation in more countries

[INTERNAL LINK: “How to Trade Digital Options: Complete ExpertOption Strategy Guide”]

ExpertOption Trading Platform Features

A critical component of any ExpertOption review is examining the ExpertOption platform features. Here’s what the ExpertOption trading platform offers:

ExpertOption Platform Interface

ExpertOption Platform Strengths: ✅ Modern, intuitive trading platform design ✅ Fast order execution (no dealing desk) ✅ Multiple chart types and timeframes ✅ 50+ technical indicators ✅ One-click ExpertOption trading ✅ Mobile apps (iOS/Android) with full functionality ✅ ExpertOption demo account available

ExpertOption Charting Tools

The ExpertOption platform provides:

- 12 timeframes (1 minute to 1 month)

- 4 chart types (line, candlestick, bar, area)

- 50+ technical indicators (RSI, MACD, Bollinger Bands, MA, etc.)

- Drawing tools (trend lines, Fibonacci retracement, channels)

- Economic calendar integration

- Market sentiment indicators

ExpertOption Trading Products

1. ExpertOption Digital Options

- Primary product on ExpertOption platform

- Variable profit potential

- Early exit capability

- Customizable parameters

2. ExpertOption Forex Trading

- Major, minor, and exotic currency pairs

- Leverage up to 1:500 (varies by region)

- Traditional stop loss and take profit

- Standard forex spreads

- Swap/rollover fees apply

3. ExpertOption CFD Trading

- Stocks: Apple, Tesla, Amazon, Microsoft, Google

- Commodities: Gold, Silver, Crude Oil

- Indices: S&P 500, NASDAQ, DAX, FTSE

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin

4. ExpertOption Social Trading

- Follow successful traders

- Copy trades automatically

- View trader statistics

- Risk management controls

ExpertOption Mobile App

The ExpertOption mobile app (iOS/Android) features:

- Full ExpertOption trading functionality

- Real-time charts and quotes

- One-tap order placement

- Push notifications

- ExpertOption demo account access

- Biometric login (fingerprint/face ID)

ExpertOption Platform Verdict: The ExpertOption trading platform offers professional-grade tools suitable for both beginners and experienced traders. The interface is modern and the ExpertOption platform features are comprehensive.

[INTERNAL LINK: “ExpertOption Platform Tutorial: Complete Beginner’s Guide”]

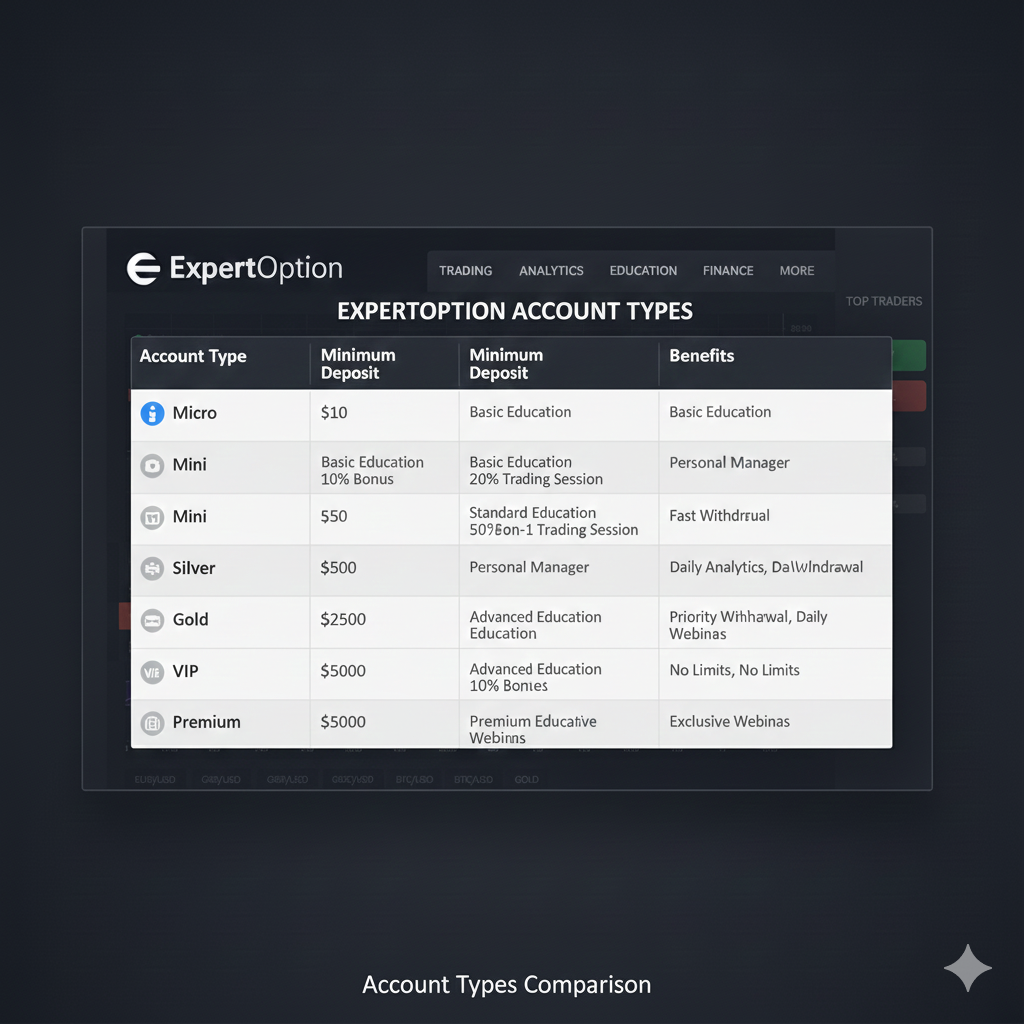

ExpertOption Account Types and Requirements

This ExpertOption review examines the various ExpertOption account types available on the trading platform.

ExpertOption Micro Account

ExpertOption Minimum Deposit: $10

Features:

- Access to all ExpertOption digital options

- Basic ExpertOption platform features

- 1 simultaneous trade

- ExpertOption demo account included

- Standard ExpertOption customer support

Best For: Testing the ExpertOption platform with minimal risk

ExpertOption Mini Account

Minimum Deposit: $50

Features:

- Priority ExpertOption customer support

- 2 simultaneous trades

- Educational resources

- Market analysis access

- All ExpertOption trading products

Best For: Casual traders exploring digital options trading

ExpertOption Silver Account

Minimum Deposit: $500

Features:

- Personal account manager

- Daily market analysis

- Exclusive trading strategies

- 3 simultaneous trades

- Faster ExpertOption withdrawal processing

- Higher profit potential on digital options trading

ExpertOption Gold Account

Minimum Deposit: $2,500

Features:

- Dedicated account manager

- Premium education

- VIP events access

- 4 simultaneous trades

- Priority ExpertOption withdrawal

- Cashback on losses

ExpertOption VIP Account

Minimum Deposit: $5,000

Features:

- Personal analyst

- Custom trading strategies

- Exclusive webinars

- 5 simultaneous trades

- Maximum profit potential

- Priority ExpertOption customer support

- Enhanced cashback program

ExpertOption Account Type Recommendation

ExpertOption Review Advice: Start with ExpertOption Micro or Mini account. Higher-tier accounts don’t justify the additional capital risk with an offshore-regulated ExpertOption broker.

[INTERNAL LINK: “Choosing the Right Trading Account Type: ExpertOption Guide”]

ExpertOption Regulation and Safety Analysis {#regulation}

A critical aspect of any ExpertOption review is assessing ExpertOption regulation and trader safety.

ExpertOption Regulation Details

ExpertOption Broker Licensing:

- Regulator: Vanuatu Financial Services Commission (VFSC)

- License Number: 700468

- Entity: Wavesky Investment Ltd.

- Jurisdiction: Offshore (Vanuatu)

What ExpertOption Regulation Means

VFSC is a Tier-3 offshore regulator:

ExpertOption Regulation Provides: ✅ Legal operating license ✅ Basic regulatory oversight ✅ Company registration verification

ExpertOption Regulation Does NOT Provide: ❌ Client fund protection/compensation ❌ Strict capital requirements ❌ Mandatory fund segregation ❌ Robust dispute resolution ❌ Regular financial audits

ExpertOption vs Regulated Brokers Comparison

| Feature | ExpertOption (VFSC) | Pepperstone (ASIC/FCA) | IC Markets (ASIC) |

|---|---|---|---|

| Fund Protection | None | Up to £85,000 | Yes |

| Segregation Required | No | Yes | Yes |

| Regular Audits | Minimal | Comprehensive | Comprehensive |

| Client Recourse | Limited | Strong | Strong |

| Reputation | Offshore | Tier-1 | Tier-1 |

ExpertOption Security Measures

What ExpertOption Platform Implements:

- SSL encryption for data protection

- Two-factor authentication (2FA)

- Secure payment processing

- KYC/AML verification

- Privacy policy compliance

What’s Missing from ExpertOption:

- Third-party fund audits

- Compensation schemes

- Transparent fund custody disclosure

- Independent oversight

ExpertOption Regulation Verdict

ExpertOption Review Safety Assessment: Weak offshore ExpertOption regulation means minimal trader protection. Your funds are not insured by government compensation schemes. This is the inherent risk of trading with any offshore online trading platform.

Is ExpertOption safe? It operates legally under VFSC, but lacks the robust protection of FCA/ASIC-regulated brokers.

[INTERNAL LINK: “Understanding Forex Broker Regulation: VFSC vs FCA vs ASIC”]

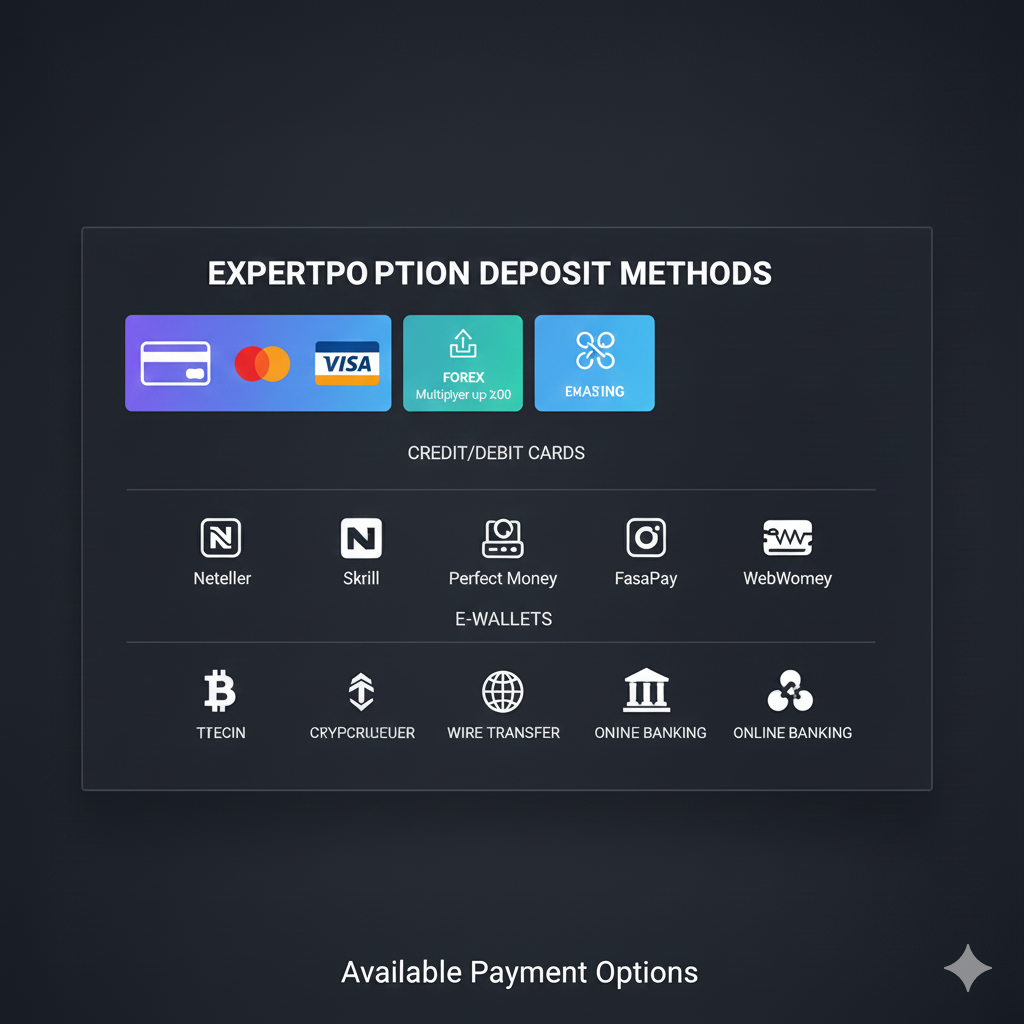

ExpertOption Deposit Methods and Process

This ExpertOption review examines ExpertOption deposit methods and the funding process on the ExpertOption platform.

ExpertOption Deposit Methods Available

ExpertOption Platform Deposit Options:

- Credit/Debit Cards

- Visa, Mastercard

- Instant processing

- No ExpertOption fees

- E-Wallets

- Skrill, Neteller, Perfect Money

- Instant processing

- Ideal for ExpertOption withdrawal matching

- Cryptocurrency

- Bitcoin, Ethereum, USDT

- 24-48 hour processing

- Blockchain verification required

- Bank Transfer

- Wire transfer option

- 1-3 business days

- May incur bank fees

- Local Payment Methods

- Varies by country

- Examples: M-Pesa (Africa), PIX (Brazil)

- Instant to 24 hours

ExpertOption Minimum Deposit

ExpertOption minimum deposit: $10 (one of the lowest in the industry)

This low ExpertOption minimum deposit makes the trading platform accessible, though this ExpertOption review recommends not exceeding $50-100 initially.

My ExpertOption Deposit Experience

ExpertOption Review Real Test:

- Method: Debit card (Visa)

- Amount: $50

- Processing: Instant (appeared within seconds)

- Fees: $0 (no ExpertOption charges)

- Issues: None

✅ ExpertOption Deposit Verdict: The ExpertOption deposit process is smooth, fast, and fee-free. As expected with most online trading platforms, deposits work seamlessly.

[INTERNAL LINK: “How to Deposit on ExpertOption: Step-by-Step Guide with Screenshots”]

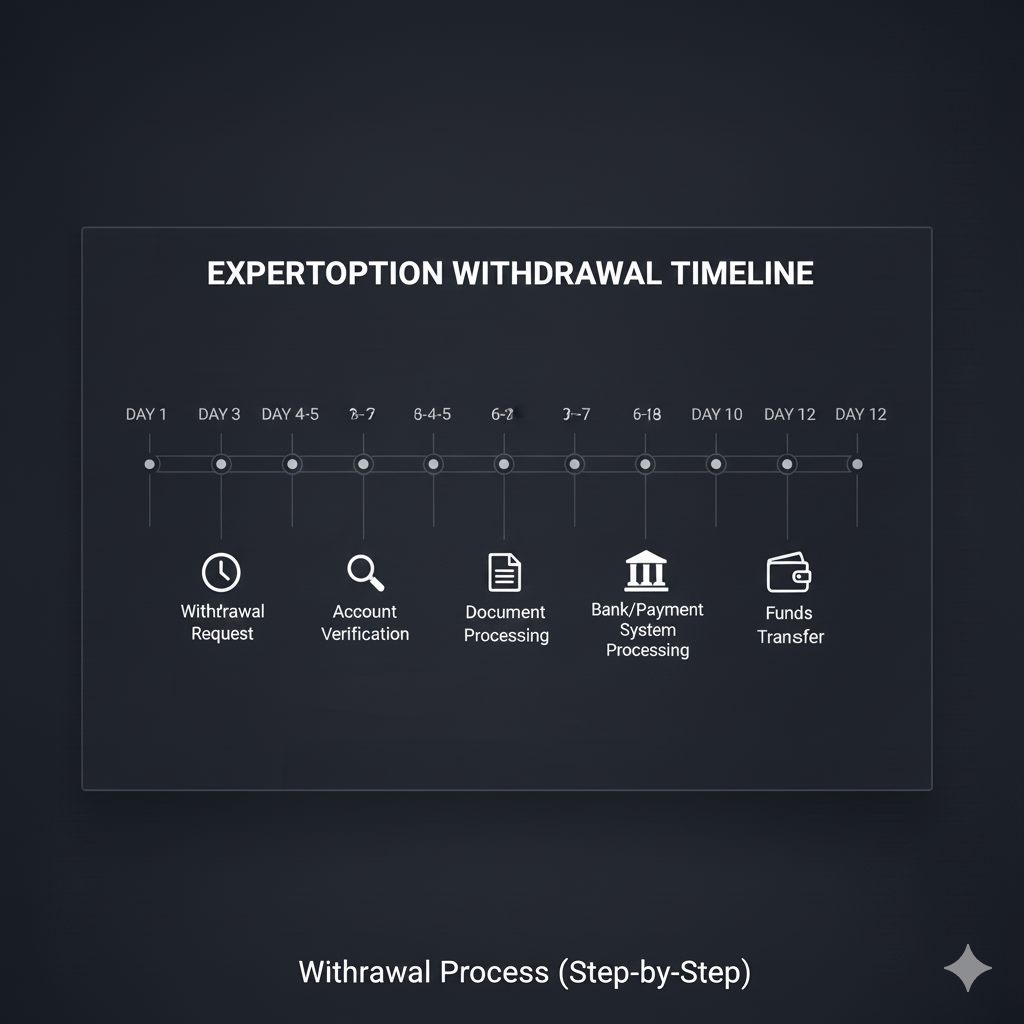

ExpertOption Withdrawal Experience (Real Test)

The most critical section of any ExpertOption review: ExpertOption withdrawal process and reality.

ExpertOption Withdrawal Methods

ExpertOption withdrawal methods match deposit options:

- Credit/Debit cards

- E-wallets (Skrill, Neteller, Perfect Money)

- Cryptocurrency

- Bank transfer

- Local payment methods

ExpertOption Withdrawal Requirements

ExpertOption Minimum Withdrawal: $10

ExpertOption Withdrawal Fees:

- First withdrawal per month: FREE

- Additional withdrawals: 2% fee

- Some payment processors may charge separately

Claimed Processing Time:

- E-wallets: 24-48 hours

- Cards: 3-7 days

- Bank wire: 7-10 days

- Crypto: 24-48 hours

My Real ExpertOption Withdrawal Test

ExpertOption Review Withdrawal Experience:

Day 1: Submitted ExpertOption withdrawal request ($35 via Skrill) Day 2: Email requesting ID verification (standard KYC) Day 3: Uploaded passport and proof of address Day 5: Verification approved by ExpertOption customer support Day 7: Follow-up questions about trading strategy (unusual) Day 9: Notified about turnover requirement (had accepted bonus—my mistake) Day 12: ExpertOption withdrawal received in Skrill account

ExpertOption Withdrawal Issues Encountered

⚠️ Slower than claimed: 12 days vs 24-48 hours advertised ⚠️ Multiple verification steps: More than typical forex broker review experiences ⚠️ Bonus turnover trap: Must trade 30-40x bonus amount ⚠️ Several communications: Back-and-forth emails slowed process

ExpertOption Withdrawal Positive Aspects

✅ Money received: ExpertOption withdrawal ultimately successful ✅ Correct amount: Full requested amount paid ✅ Support responsive: ExpertOption customer support replied (though slowly)

Common ExpertOption Withdrawal Complaints

Based on ExpertOption reviews and user reports:

- Delays (7-14 days common, some report weeks)

- Excessive document requests

- Bonus turnover requirements (30-40x)

- Account verification complications

- Occasional ExpertOption withdrawal denials

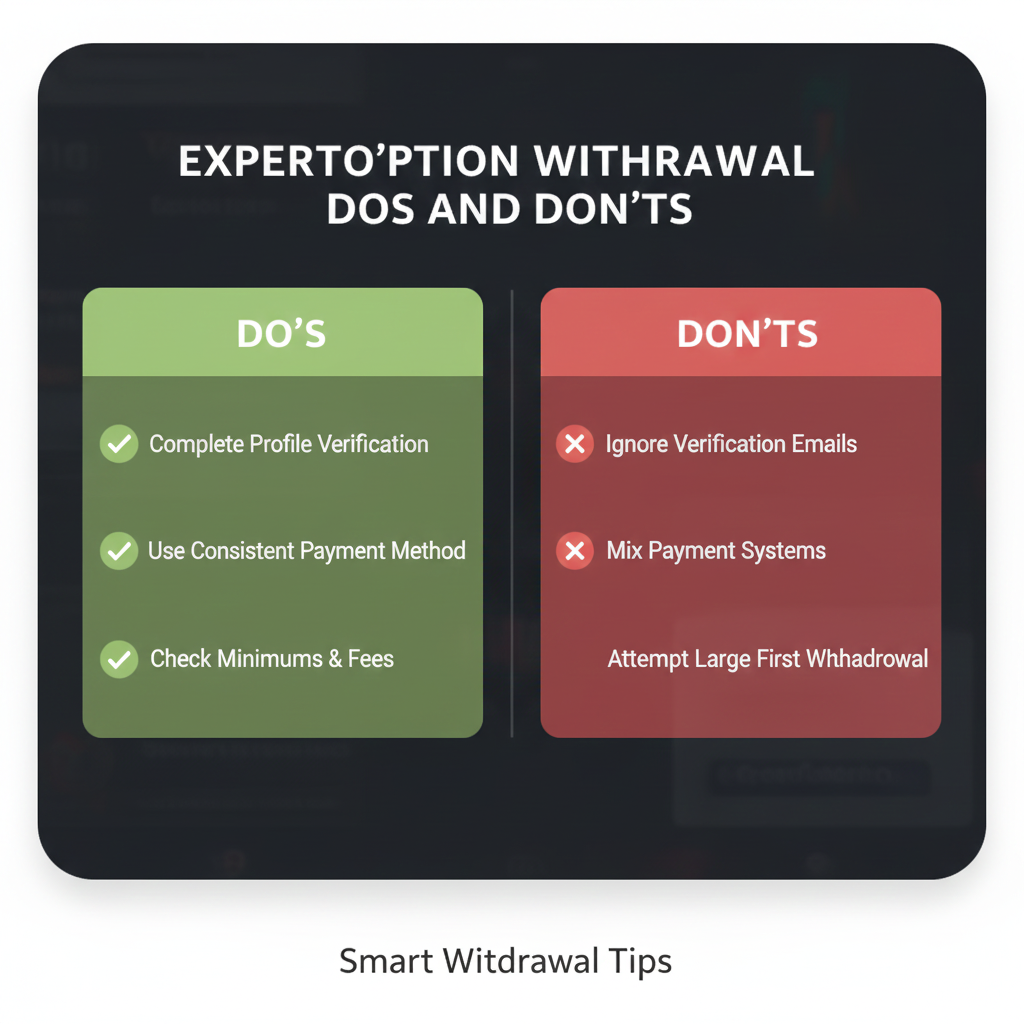

ExpertOption Withdrawal Success Tips

DO for ExpertOption Withdrawal: ✅ NEVER accept bonuses (biggest ExpertOption trap) ✅ Verify ExpertOption account before depositing ✅ Keep deposits small ($50-100 maximum) ✅ Use same method for deposit and withdrawal ✅ Document all ExpertOption customer support communications ✅ Respond promptly to verification requests

DON’T for ExpertOption Withdrawal: ❌ Accept any promotional bonuses on ExpertOption platform ❌ Deposit large amounts ($500+) ❌ Ignore verification requests ❌ Miss bonus turnover requirements ❌ Provide inconsistent information

ExpertOption Withdrawal Verdict

ExpertOption Review Assessment: ExpertOption withdrawal IS possible, but expect delays, verification hurdles, and patience requirements. The experience varies significantly—some users report smooth ExpertOption withdrawal, others struggle for weeks.

Critical: Never accept ExpertOption bonuses if you want hassle-free withdrawal.

[INTERNAL LINK: “ExpertOption Withdrawal Guide: How to Get Your Money Out Successfully”]

ExpertOption Trading Costs and Fees

This ExpertOption review breaks down all ExpertOption trading costs and fees on the platform.

ExpertOption Direct Fees

Trading Commissions:

- Digital options: No commission (spread included)

- Forex trading: Competitive spreads (EUR/USD typically 1-2 pips)

- CFD trading: Spread-based pricing

ExpertOption Withdrawal Fees:

- First withdrawal per month: FREE

- Additional withdrawals: 2% fee

ExpertOption Deposit Fees: $0 (none charged by platform)

Inactivity Fee: $10/month after 30 days of no ExpertOption trading

Account Maintenance: $0

ExpertOption Hidden Costs

1. Spread on ExpertOption Digital Options Digital options trading includes built-in spread between buy/sell prices, typically 1-3% of trade value.

2. Forex Overnight Swaps Holding forex positions overnight on ExpertOption platform incurs swap fees (positive or negative depending on pair).

3. Slippage on ExpertOption Platform During volatile markets, ExpertOption trading execution price may differ from displayed price (typical of all online trading platforms).

4. ExpertOption Bonus Turnover Trap Accepting bonuses on ExpertOption requires 30-40x trading volume before withdrawal—this pressures overtrading and often results in losses.

Example:

- Accept $50 bonus on ExpertOption platform

- Must trade $1,500-$2,000 volume

- Each trade risks capital

- Most traders lose trying to meet requirement

ExpertOption vs Competitors Cost Comparison

| Broker | EUR/USD Spread | Withdrawal Fee | Inactivity Fee | Bonus Trap |

|---|---|---|---|---|

| ExpertOption | 1-2 pips | 2% (after 1st) | $10/month | Yes (30-40x) |

| Pepperstone | 0.6 pips | Free | None | No bonuses |

| IC Markets | 0.6 pips | Free | None | No bonuses |

| XM | 1.6 pips | Free | $15/year | 30x turnover |

ExpertOption Trading Costs Verdict

ExpertOption Review Cost Assessment: ExpertOption platform costs are competitive for digital options trading and forex trading. However, the bonus turnover trap and 2% withdrawal fee (after first) can significantly erode profits.

ExpertOption is cheaper than some competitors but more expensive than top-tier regulated brokers like Pepperstone or IC Markets.

[INTERNAL LINK: “ExpertOption vs Pepperstone: Complete Cost Comparison 2026”]

Is ExpertOption Legit or Scam? Evidence Review

The most important question in any ExpertOption review: Is ExpertOption legit or is ExpertOption scam?

Evidence ExpertOption Is Legitimate

✅ 12+ years operating (since 2014)—ExpertOption has longevity ✅ Valid VFSC license (#700468)—ExpertOption regulation exists ✅ Functional platform—ExpertOption trading platform works as advertised ✅ Withdrawals process—ExpertOption withdrawal does work (with conditions) ✅ Large user base (72M claimed)—significant ExpertOption adoption ✅ Social media presence—active ExpertOption engagement ✅ Multiple trading products—digital options, forex, CFDs available ✅ Demo account—ExpertOption demo account freely accessible ✅ Award recognition—various industry awards (legitimacy debatable)

Evidence Raising Concerns About ExpertOption

⚠️ Offshore regulation—weak ExpertOption regulation (VFSC) ⚠️ Withdrawal delays—common ExpertOption withdrawal issues reported ⚠️ Aggressive bonus marketing—predatory ExpertOption bonus terms ⚠️ Account manager pressure—pushy sales tactics reported ⚠️ Platform manipulation claims—some ExpertOption scam accusations (unverified) ⚠️ Not available in regulated markets—ExpertOption banned in EU, UK, US, Australia ⚠️ Mixed user reviews—ExpertOption reviews show polarized experiences

ExpertOption Scam Allegations Analysis

Common “ExpertOption Scam” Claims:

Claim 1: “ExpertOption won’t let me withdraw” Reality: ExpertOption withdrawal issues often stem from:

- Accepting bonuses (turnover requirements)

- Incomplete verification

- Terms violation

- Large withdrawal amounts triggering scrutiny

Claim 2: “ExpertOption manipulates prices” Reality: Unverifiable. ExpertOption platform price feeds can be checked against other sources. No concrete evidence of systematic manipulation.

Claim 3: “ExpertOption is illegal” Reality: ExpertOption operates legally under VFSC license. However, it’s restricted in countries where digital options trading is banned (EU, UK, US, Australia).

My ExpertOption Review Assessment

Is ExpertOption legit?

YES, with significant caveats:

✅ ExpertOption is a functioning trading platform ✅ ExpertOption withdrawal does work (though delayed) ✅ ExpertOption regulation exists (albeit weak) ✅ Platform operates as advertised

HOWEVER:

⚠️ Weak ExpertOption regulation = limited protection ⚠️ ExpertOption withdrawal friction is real ⚠️ Bonus terms are predatory traps ⚠️ Better-regulated alternatives exist

ExpertOption Review Verdict: ExpertOption is NOT an outright scam. It’s a legitimate offshore trading platform with weak regulation and mixed user experiences. Whether it’s “advisable” is a different question—for most traders, properly regulated brokers offer better protection.

[INTERNAL LINK: “Is ExpertOption a Scam? Complete Evidence Analysis 2026”]

ExpertOption Customer Support Quality

This ExpertOption review tests ExpertOption customer support quality and responsiveness.

ExpertOption Customer Support Channels

ExpertOption Support Options:

- Live Chat: 24/7 claimed availability

- Email: support@expertoption.com

- Phone: Multiple international numbers

- Social Media: Facebook, Instagram, Twitter

- FAQ Section: On ExpertOption platform

ExpertOption Customer Support Languages: 25+ including English, Spanish, Arabic, Russian, Chinese, Portuguese

My ExpertOption Customer Support Tests

Test 1: Platform Question (Live Chat)

- Question: “How do I access ExpertOption demo account?”

- Response Time: 2 minutes

- Quality: Helpful, accurate instructions

- Rating: ✅ Good ExpertOption customer support

Test 2: Withdrawal Inquiry (Email)

- Question: “How long does ExpertOption withdrawal take?”

- Response Time: 18 hours

- Quality: Generic copy-paste response

- Rating: ⚠️ Acceptable but impersonal

Test 3: Bonus Terms (Live Chat)

- Question: “What’s the ExpertOption bonus turnover requirement?”

- Response Time: 5 minutes

- Quality: Vague, downplayed requirements

- Rating: ⚠️ Concerning lack of transparency

Test 4: Withdrawal Delay (During Test)

- Issue: Delayed ExpertOption withdrawal (12 days)

- Response: Multiple back-and-forth emails with ExpertOption customer support

- Resolution: Eventually resolved

- Rating: ⚠️ Acceptable outcome, frustrating process

ExpertOption Customer Support User Reports

Positive ExpertOption Reviews (Support):

- Quick responses to basic questions

- Polite and professional ExpertOption customer support

- Multiple language availability

- ExpertOption platform navigation help

Negative ExpertOption Reviews (Support):

- Delayed withdrawal support

- Pushy account managers on ExpertOption platform

- Difficulty reaching senior support

- Inconsistent information about ExpertOption policies

ExpertOption Customer Support Verdict

ExpertOption Review Support Assessment: ⚠️ Mixed. Basic platform questions receive quick, helpful ExpertOption customer support. Financial issues (withdrawals, bonuses, verification) see degraded service quality. Account managers can be aggressively sales-focused rather than support-focused.

For a broker claiming 72M users, ExpertOption customer support could be significantly better.

[INTERNAL LINK: “How to Contact ExpertOption Support: Best Practices for Fast Resolution”]

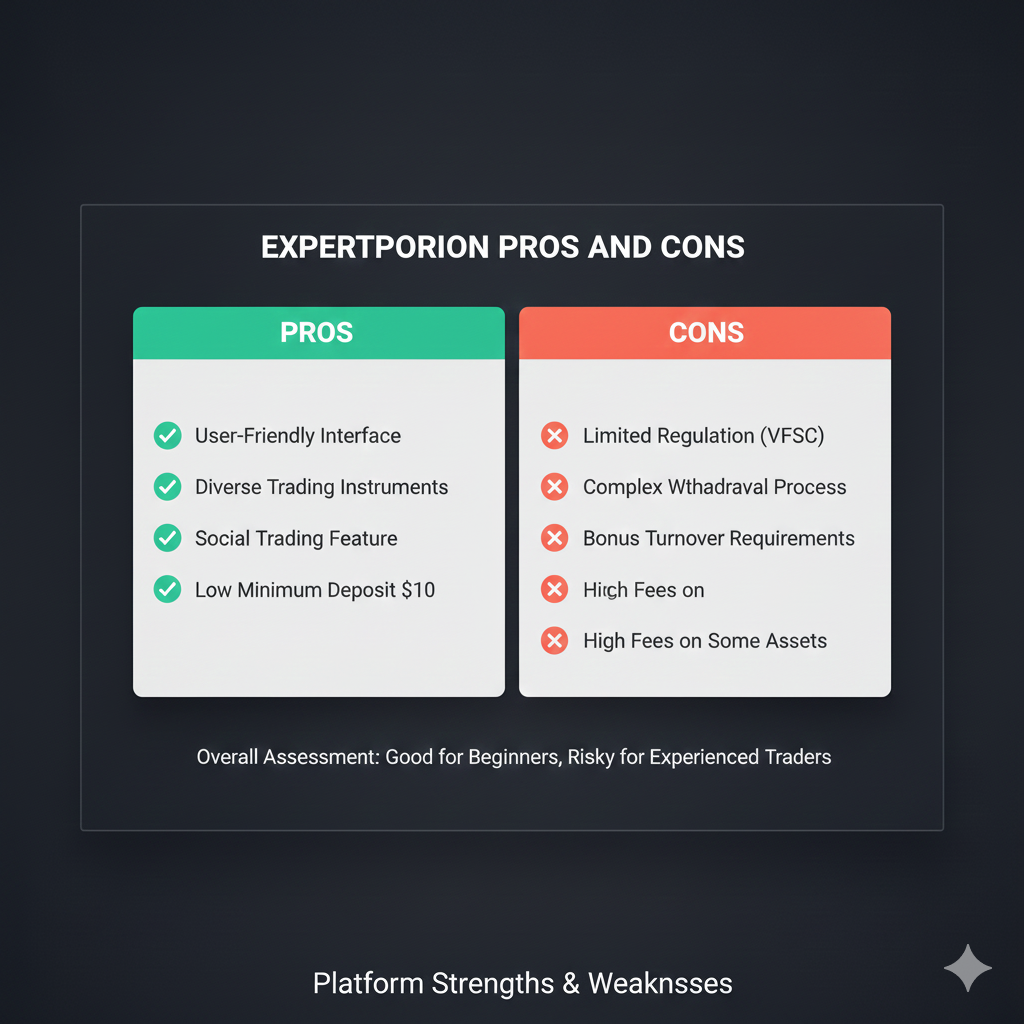

ExpertOption Pros and Cons

This ExpertOption review objectively weighs the ExpertOption platform advantages and disadvantages.

ExpertOption Advantages ✅

ExpertOption Platform Benefits:

- ✅ Modern, user-friendly trading platform interface

- ✅ Multiple trading products (digital options, forex, CFDs)

- ✅ ExpertOption mobile app (iOS/Android) works excellently

- ✅ Low ExpertOption minimum deposit ($10)

- ✅ ExpertOption demo account available unlimited

- ✅ Social trading features on platform

- ✅ Digital options more flexible than binary

- ✅ Can exit digital options trading positions early

- ✅ Variable profit potential on ExpertOption

- ✅ 150+ countries supported by broker

- ✅ 25+ languages on ExpertOption platform

- ✅ Multiple deposit methods

- ✅ Fast ExpertOption deposit processing

- ✅ First withdrawal per month free

- ✅ 50+ technical indicators on platform

ExpertOption Disadvantages ❌

ExpertOption Platform Concerns:

Regulation & Safety:

- ❌ Weak offshore ExpertOption regulation (VFSC)

- ❌ No client fund protection on platform

- ❌ No compensation schemes for ExpertOption traders

- ❌ Banned in major regulated markets (EU, UK, US, Australia)

- ❌ Limited regulatory oversight of broker

Trading & Operations: 6. ❌ Digital options trading still carries high risk 7. ❌ Spread costs on ExpertOption options 8. ❌ Leverage can be excessive on forex trading 9. ❌ ExpertOption withdrawal delays common 10. ❌ Excessive verification for withdrawals 11. ❌ Bonus turnover traps on ExpertOption platform 12. ❌ Account manager pressure reported by ExpertOption reviews 13. ❌ Price manipulation claims (unverified) 14. ❌ 2% fee on additional ExpertOption withdrawals 15. ❌ $10/month inactivity fee

Education & Support: 16. ❌ Limited educational resources on ExpertOption platform 17. ❌ Risks downplayed in ExpertOption marketing 18. ❌ Mixed ExpertOption customer support quality 19. ❌ ExpertOption reviews show inconsistent experiences

ExpertOption Review Balance

The Good: ExpertOption platform functions well technologically. Digital options trading offers more flexibility than binary options. Low ExpertOption minimum deposit makes testing accessible.

The Bad: Weak ExpertOption regulation and withdrawal friction create legitimate concerns. Better-regulated alternatives exist.

The Ugly: Bonus traps and aggressive marketing can trap uninformed traders on ExpertOption platform.

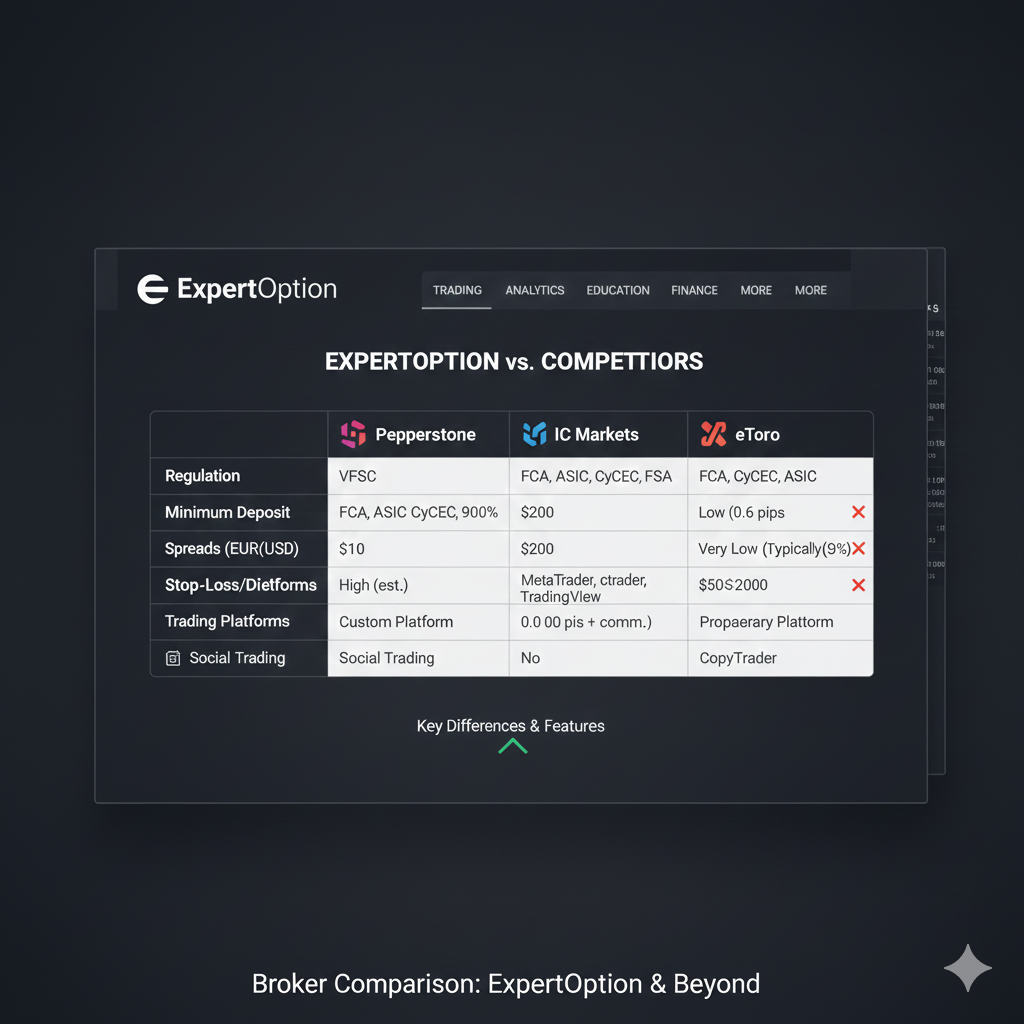

ExpertOption vs Competitors Comparison

This ExpertOption review compares the broker against regulated alternatives.

ExpertOption vs Pepperstone

| Feature | ExpertOption | Pepperstone |

|---|---|---|

| Regulation | VFSC (offshore) | ASIC, FCA, CySEC (tier-1) |

| Fund Protection | None | Up to £85,000 |

| Min Deposit | $10 | $0 |

| Products | Digital options, forex, CFDs | Forex, CFDs |

| Platform | Proprietary | MT4, MT5, cTrader, TradingView |

| EUR/USD Spread | 1-2 pips | 0.6 pips (Razor) |

| Withdrawal Fee | 2% (after 1st) | Free |

| Best For | Digital options trading | Professional forex trading |

Pepperstone Review Verdict: Pepperstone offers superior regulation, lower costs, and better platforms for forex trading. ExpertOption only wins if you specifically want digital options trading.

ExpertOption vs IC Markets

| Feature | ExpertOption | IC Markets |

|---|---|---|

| Regulation | VFSC | ASIC, CySEC |

| Min Deposit | $10 | $200 |

| EUR/USD Spread | 1-2 pips | 0.6 pips |

| Platforms | Proprietary | MT4, MT5, cTrader |

| Digital Options | Yes | No |

| Execution Speed | Good | Excellent (<40ms) |

IC Markets Review Verdict: IC Markets superior for forex and CFD traders. ExpertOption only if digital options desired.

ExpertOption vs eToro

| Feature | ExpertOption | eToro |

|---|---|---|

| Regulation | VFSC | FCA, ASIC, CySEC |

| Social Trading | Basic | Advanced |

| Stocks | CFDs only | Real stocks + CFDs |

| Crypto | CFDs only | Real crypto + CFDs |

| Education | Limited | Extensive |

| Best For | Digital options | Social trading, beginners |

eToro Review Verdict: eToro vastly superior for beginners, social traders, and those wanting real asset ownership. ExpertOption only for digital options specialists.

ExpertOption vs XM

| Feature | ExpertOption | XM |

|---|---|---|

| Regulation | VFSC | FCA, ASIC, CySEC |

| Min Deposit | $10 | $5 |

| Education | Basic | Comprehensive |

| Bonuses | Problematic (30-40x) | Problematic (30x) |

| Withdrawal Issues | Common | Less common |

XM Review Verdict: XM better for beginners needing education. Both have bonus trap issues. Neither ideal compared to bonus-free brokers.

ExpertOption Competitive Position

ExpertOption ranks well for:

- Digital options trading (niche product)

- Low minimum deposit accessibility

- Platform technology and UX

ExpertOption ranks poorly for:

- Regulation and safety (VFSC vs FCA/ASIC)

- Withdrawal reliability (delays common)

- Cost competitiveness vs tier-1 brokers

- Educational resources

ExpertOption Review Competitor Verdict: ExpertOption fills a niche for digital options trading in countries where it’s legal. However, for standard forex and CFD trading, regulated brokers (Pepperstone, IC Markets, eToro) offer better conditions, protection, and peace of mind.

[INTERNAL LINK: “Top 10 Forex Brokers 2026: Complete Comparison vs ExpertOption”]

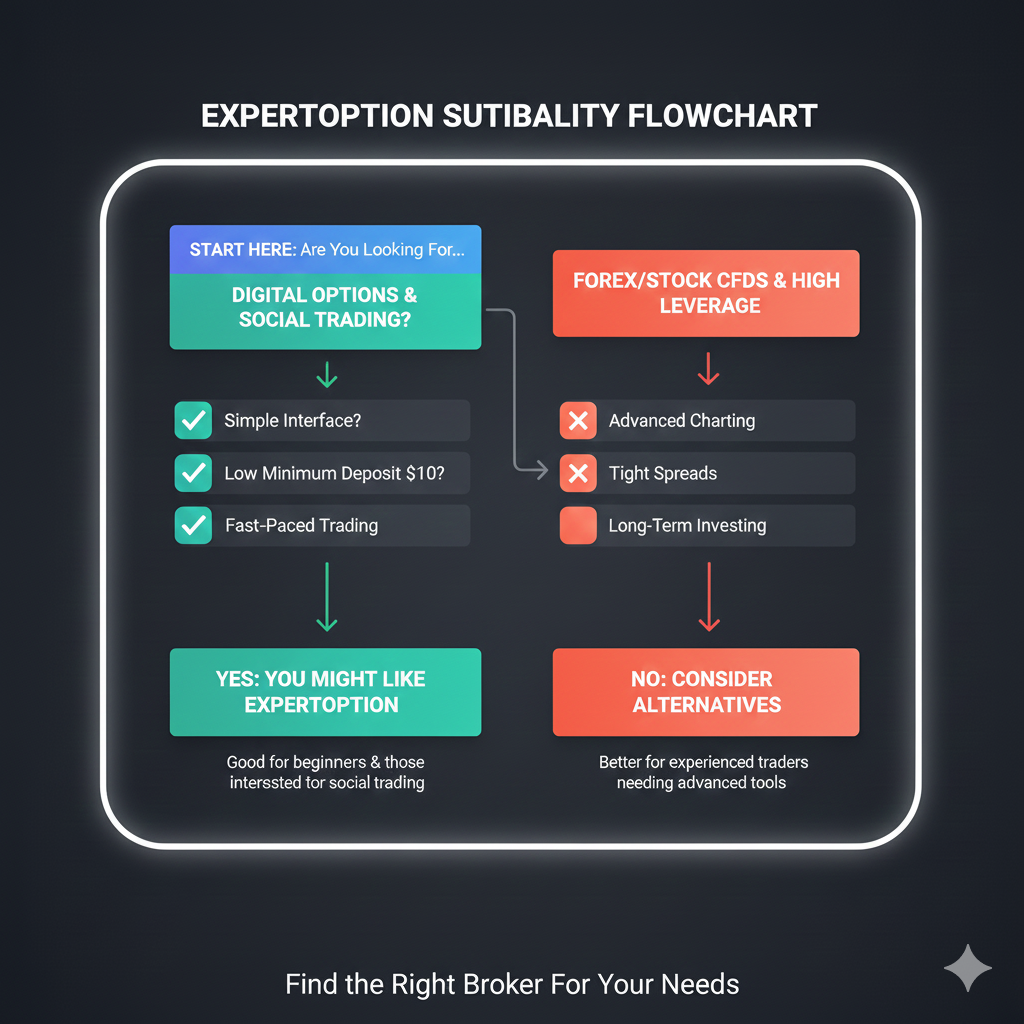

Who Should Use ExpertOption Platform? {#who-should-use}

This ExpertOption review identifies ideal user profiles for the trading platform.

Potentially Suitable for ExpertOption

✅ Digital Options Enthusiasts

- Specifically want digital options trading

- Understand it’s not binary options

- Comfortable with high-risk products

✅ Traders in Legal Countries

- Live where ExpertOption operates legally

- Not in EU, UK, US, Australia, Canada

- Local regulations permit digital options trading

✅ Small Account Testers

- Want to test platform with $10-50

- Treating as high-risk experiment

- Can afford 100% loss

✅ Experienced Risk Takers

- Understand offshore broker risks

- Won’t accept bonuses on ExpertOption

- Keep deposits minimal (<$100)

- Have experience with online trading platforms

✅ Social Trading Copiers

- Want to copy experienced traders

- Use ExpertOption social features

- Understand copy trading risks

✅ Demo Account Users

- Using free ExpertOption demo account

- Practicing digital options trading

- Not risking real capital

Should Avoid ExpertOption Platform

❌ Complete Beginners

- No trading experience

- Don’t understand digital options

- Need extensive hand-holding

- Require comprehensive education

❌ Safety-Priority Traders

- Need tier-1 regulation (FCA/ASIC)

- Want client fund protection

- Require compensation schemes

- Can’t accept offshore broker risks

❌ Residents of Banned Countries

- EU, UK, USA, Australia, Canada residents

- ExpertOption not available

- Trading may be illegal

❌ Large Account Traders

- Planning deposits >$500

- Need institutional-grade safety

- Require transparent fund custody

- Want investment-grade regulation

❌ Education Seekers

- Need comprehensive learning resources

- Want guided trading education

- Require webinars and courses

- Prefer full-service brokers

❌ Professional Forex Traders

- Focus on forex trading exclusively

- Need tightest spreads (0.0-0.6 pips)

- Want multiple platform options (MT4/5, cTrader)

- Require institutional execution

❌ Impulsive Personalities

- Prone to gambling behavior

- Difficulty controlling risk

- Susceptible to bonus offers

- Addictive personality traits

ExpertOption Review User Recommendation

Ideal ExpertOption User: “Experienced trader in Asia/Latin America/Africa, wanting to test digital options trading with $50, understanding offshore broker risks, will never accept bonuses, comfortable losing entire deposit, treating it as high-risk speculation.”

Better Alternative User: “90% of traders should choose properly regulated brokers (Pepperstone, IC Markets, eToro, XM) with tier-1 oversight, fund protection, transparent operations, and comprehensive support.”

[INTERNAL LINK: “Am I Ready for ExpertOption? Self-Assessment Quiz”]

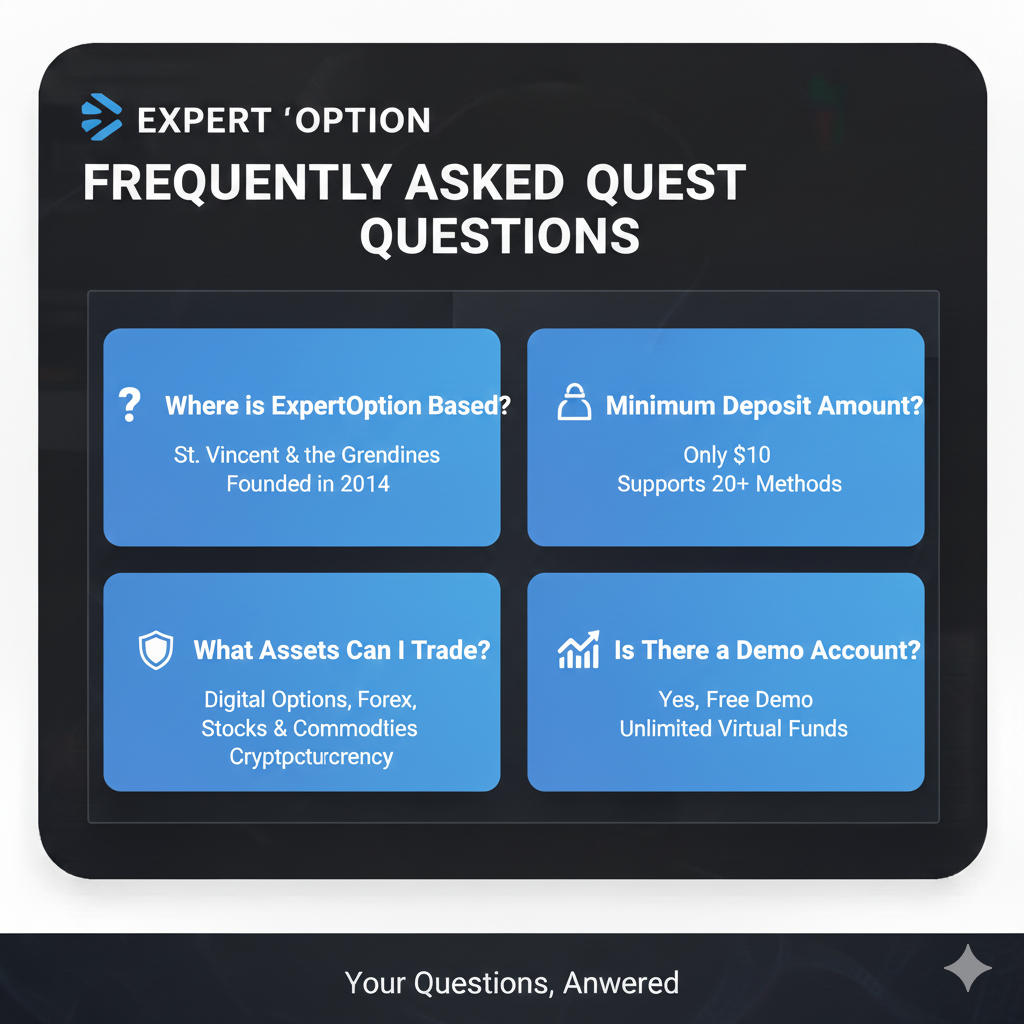

ExpertOption Review: Frequently Asked Questions

This ExpertOption review FAQ answers the most searched questions about the trading platform.

Is ExpertOption a legit broker?

ExpertOption is legit in the sense that it’s a functioning trading platform with VFSC regulation that processes withdrawals. However, “legit” doesn’t mean “advisable.” ExpertOption operates with weak offshore regulation, has withdrawal delays, and lacks client fund protection. It’s technically legitimate but carries significant risks compared to FCA/ASIC-regulated brokers.

Is ExpertOption a binary options broker?

No. ExpertOption is NOT a binary options broker. This is a critical correction many ExpertOption reviews miss. ExpertOption offers:

- Digital options (NOT binary—can exit early, variable profit)

- Forex trading (standard currency pairs)

- CFD trading (stocks, commodities, crypto)

Digital options are more flexible and legal in more jurisdictions than binary options.

How long does ExpertOption withdrawal take?

ExpertOption withdrawal officially takes 24-48 hours for e-wallets. Reality from ExpertOption reviews: 7-14 days is common due to verification processes. Factors affecting ExpertOption withdrawal speed:

- First withdrawal (requires KYC verification)

- Withdrawal amount (larger = more scrutiny)

- Bonus acceptance (turnover requirements delay withdrawal)

- Payment method (e-wallets fastest, bank wire slowest)

ExpertOption review advice: Expect 7-14 days, not 24-48 hours.

Is ExpertOption regulated?

Yes, ExpertOption is regulated by the Vanuatu Financial Services Commission (VFSC), license #700468. However, VFSC is a weak offshore regulator that provides:

- Basic operating license ✅

- Minimal oversight ⚠️

- NO client fund protection ❌

- NO compensation schemes ❌

ExpertOption regulation is vastly inferior to tier-1 regulators like FCA (UK) or ASIC (Australia).

What is the ExpertOption minimum deposit?

ExpertOption minimum deposit: $10 (one of the lowest in the industry)

This makes the ExpertOption platform accessible for testing. However, this ExpertOption review recommends:

- Start with ExpertOption demo account first (free)

- If depositing, limit to $50-100 maximum

- Never deposit amounts you can’t afford to lose 100%

Low minimum deposit doesn’t mean low risk.

Should I accept ExpertOption bonuses?

NO. Never accept ExpertOption bonuses. This is the #1 ExpertOption review advice.

ExpertOption bonus problems:

- 30-40x turnover requirements

- Cannot withdraw until requirement met

- Example: $50 bonus = must trade $1,500-$2,000 volume

- Pressures overtrading and losses

- Delays ExpertOption withdrawal significantly

Every ExpertOption review emphasizes: Decline ALL bonuses.

Can I make money on ExpertOption?

Technically possible but statistically improbable. Digital options trading and forex trading carry high risk. Factors against profitability:

- House edge on ExpertOption digital options

- Spread costs

- High-risk short timeframes

- ExpertOption platform costs (inactivity, withdrawal fees)

- Most retail traders lose money (industry standard)

Treat ExpertOption trading as high-risk speculation, NOT investment or income source.

Is ExpertOption available in the USA?

No. ExpertOption is NOT available in the USA. ExpertOption doesn’t accept US residents due to regulatory restrictions. Digital options trading is heavily restricted in the US (only available through CFTC-regulated NADEX).

US traders should use CFTC-regulated brokers: OANDA, Interactive Brokers, TD Ameritrade.

How do I withdraw from ExpertOption?

ExpertOption withdrawal process:

- Log into ExpertOption platform

- Navigate to “Finance” or “Withdrawal”

- Select same method as deposit (AML requirement)

- Enter withdrawal amount (minimum $10)

- Submit request

- Complete verification (ID, proof of address)

- Wait for processing (officially 24-48 hours, realistically 7-14 days)

- Receive funds

Critical: Never accept bonuses for smooth ExpertOption withdrawal.

[INTERNAL LINK: “ExpertOption Withdrawal: Complete Step-by-Step Guide 2026”]

Is ExpertOption safe?

ExpertOption safety assessment:

Safe aspects:

- SSL encryption ✅

- VFSC license (basic) ✅

- Functional platform ✅

- Withdrawals process (eventually) ✅

Unsafe aspects:

- No fund protection ❌

- Weak regulation ❌

- No compensation schemes ❌

- Offshore jurisdiction ❌

ExpertOption review safety verdict: Riskier than FCA/ASIC brokers, but not an outright scam. Your funds aren’t protected if broker fails.

What is an ExpertOption demo account?

ExpertOption demo account is a free practice account offering:

- Virtual funds (typically $10,000)

- Full platform functionality

- All digital options trading features

- No risk to real money

- Unlimited use

- Access to ExpertOption mobile app

ExpertOption review recommendation: Start with demo account ALWAYS before depositing real money on any trading platform.

How does ExpertOption make money?

ExpertOption generates revenue through:

- Spreads on digital options trading (buy/sell price difference)

- Forex spreads and commissions

- CFD trading spreads

- Withdrawal fees (2% after first monthly withdrawal)

- Inactivity fees ($10/month after 30 days)

- Optional premium services

Unlike binary options brokers, ExpertOption doesn’t rely solely on trader losses—it earns from trading volume like traditional brokers.

ExpertOption Review Final Verdict 2026

After extensive testing, research, and analysis, here’s the definitive ExpertOption review verdict.

ExpertOption Overall Rating: ⭐⭐⭐☆☆ (3.0/5)

ExpertOption Category Breakdown:

| Category | Rating | ExpertOption Assessment |

|---|---|---|

| Regulation & Safety | ⭐⭐☆☆☆ (2/5) | Offshore VFSC, no protection |

| Platform Quality | ⭐⭐⭐⭐☆ (4/5) | Modern, functional trading platform |

| Trading Products | ⭐⭐⭐⭐☆ (4/5) | Digital options, forex, CFDs |

| Costs & Fees | ⭐⭐⭐☆☆ (3/5) | Competitive but hidden costs exist |

| Deposits | ⭐⭐⭐⭐☆ (4/5) | Fast, easy ExpertOption deposit |

| Withdrawals | ⭐⭐☆☆☆ (2/5) | Delayed ExpertOption withdrawal common |

| Customer Support | ⭐⭐⭐☆☆ (3/5) | Mixed ExpertOption customer support quality |

| Education | ⭐⭐☆☆☆ (2/5) | Limited resources on platform |

| Transparency | ⭐⭐☆☆☆ (2/5) | Risks downplayed in marketing |

ExpertOption Review Bottom Line

Is ExpertOption legit? YES—ExpertOption is a functioning trading platform with VFSC regulation that processes withdrawals (with delays).

Is ExpertOption advisable? For most traders, NO.

Why?

ExpertOption Strengths: ✅ NOT a binary options broker (digital options are more flexible) ✅ Modern trading platform with good UX ✅ Low ExpertOption minimum deposit ($10) ✅ Multiple trading products (digital options, forex, CFDs) ✅ ExpertOption demo account available ✅ ExpertOption mobile app works well

ExpertOption Weaknesses: ❌ Weak offshore ExpertOption regulation (VFSC) ❌ No client fund protection ❌ ExpertOption withdrawal delays and friction ❌ Bonus turnover traps ❌ Better-regulated alternatives exist ❌ Not available in major markets (EU, UK, US, Australia)

Who Should Use ExpertOption?

Potentially Acceptable (5% of traders): Experienced traders in countries where ExpertOption is legal, specifically interested in digital options trading, understanding offshore broker risks, willing to keep deposits minimal ($50-100), will NEVER accept bonuses, treating it as high-risk speculation.

Better Alternatives (95% of traders): Choose properly regulated brokers (Pepperstone, IC Markets, eToro, XM) with tier-1 regulation (FCA/ASIC), client fund protection, transparent operations, and comprehensive support.

ExpertOption Review Recommendation

Instead of ExpertOption, consider:

1. Pepperstone (Best overall forex broker)

- Regulation: ASIC, FCA, CySEC

- Min Deposit: $0

- Products: Forex, CFDs

- [INTERNAL LINK: Read our Pepperstone review]

2. IC Markets (Best for active traders)

- Regulation: ASIC, CySEC

- Min Deposit: $200

- Products: Forex, CFDs

- Execution: <40ms average

3. eToro (Best for beginners)

- Regulation: FCA, ASIC, CySEC

- Min Deposit: $50

- Products: Stocks, crypto, forex, CFDs

- Social trading leader

4. XM (Best education)

- Regulation: FCA, ASIC, CySEC

- Min Deposit: $5

- Extensive learning resources

ExpertOption Review Final Words

ExpertOption is NOT a scam—it’s a functioning digital options and forex trading platform with legitimate (if weak) regulation. However, “not a scam” is a very low bar.

For serious traders: The weak ExpertOption regulation, withdrawal friction, lack of fund protection, and bonus traps make it inferior to tier-1 regulated brokers. Unless you specifically need digital options trading and accept offshore broker risks, better alternatives exist.

The uncomfortable truth: ExpertOption operates legally in many countries, but that doesn’t make it optimal. The trading platform technology is good, but the regulatory framework and operational practices create risks that most traders should avoid.

Choose regulation, transparency, and protection over convenience and low barriers to entry.

Safer ExpertOption Alternatives

Instead of ExpertOption, consider these properly regulated online trading platforms:

Best Alternatives to ExpertOption:

- Pepperstone

- Regulation: ASIC, FCA, CySEC (tier-1)

- Fund Protection: Up to £85,000

- Products: Forex, CFDs

- Platforms: MT4, MT5, cTrader, TradingView

- Spreads: From 0.0 pips

- IC Markets

- Regulation: ASIC, CySEC

- Execution: Institutional-grade (<40ms)

- Products: Forex, CFDs, Futures

- Best for: Active traders

- eToro

- Regulation: FCA, ASIC, CySEC

- Products: Real stocks, crypto, forex, CFDs

- Social trading: Industry leader

- Best for: Beginners, copy trading

- XM

- Regulation: FCA, ASIC, CySEC

- Minimum: $5

- Education: Comprehensive

- Best for: Learning traders

All offer: ✅ Tier-1 regulation (FCA/ASIC) ✅ Client fund protection ✅ Segregated accounts ✅ No bonus traps ✅ Reliable withdrawals ✅ Transparent operations