De-Dollarization Impact: Trading Emerging Market Currencies in 2026

Introduction: The Seismic Shift in Global Currency Markets

The financial world is witnessing a historic transformation. For decades, the US dollar has reigned supreme as the world’s reserve currency, dominating international trade, central bank reserves, and currency markets. But 2026 marks a turning point—de-dollarization is no longer a theoretical discussion among economists; it’s a tangible reality reshaping how traders approach emerging market currencies.

If you’re a forex trader, investor, or financial professional, understanding the de-dollarization impact on emerging market currencies isn’t optional anymore—it’s essential. The question is no longer if de-dollarization will affect your trading strategy, but how you’ll capitalize on this monumental shift.

In this comprehensive guide, we’ll explore the mechanics of de-dollarization, identify the emerging market currencies gaining traction, reveal actionable trading strategies for 2026, and help you navigate the risks and opportunities in this new currency landscape.

What Is De-Dollarization and Why Does It Matter Now?

Understanding De-Dollarization in Simple Terms

De-dollarization refers to the process by which countries reduce their dependence on the US dollar for international trade, foreign exchange reserves, and financial transactions. This involves diversifying into alternative currencies, establishing bilateral trade agreements in local currencies, and creating parallel payment systems that bypass dollar-dominated infrastructure like SWIFT.

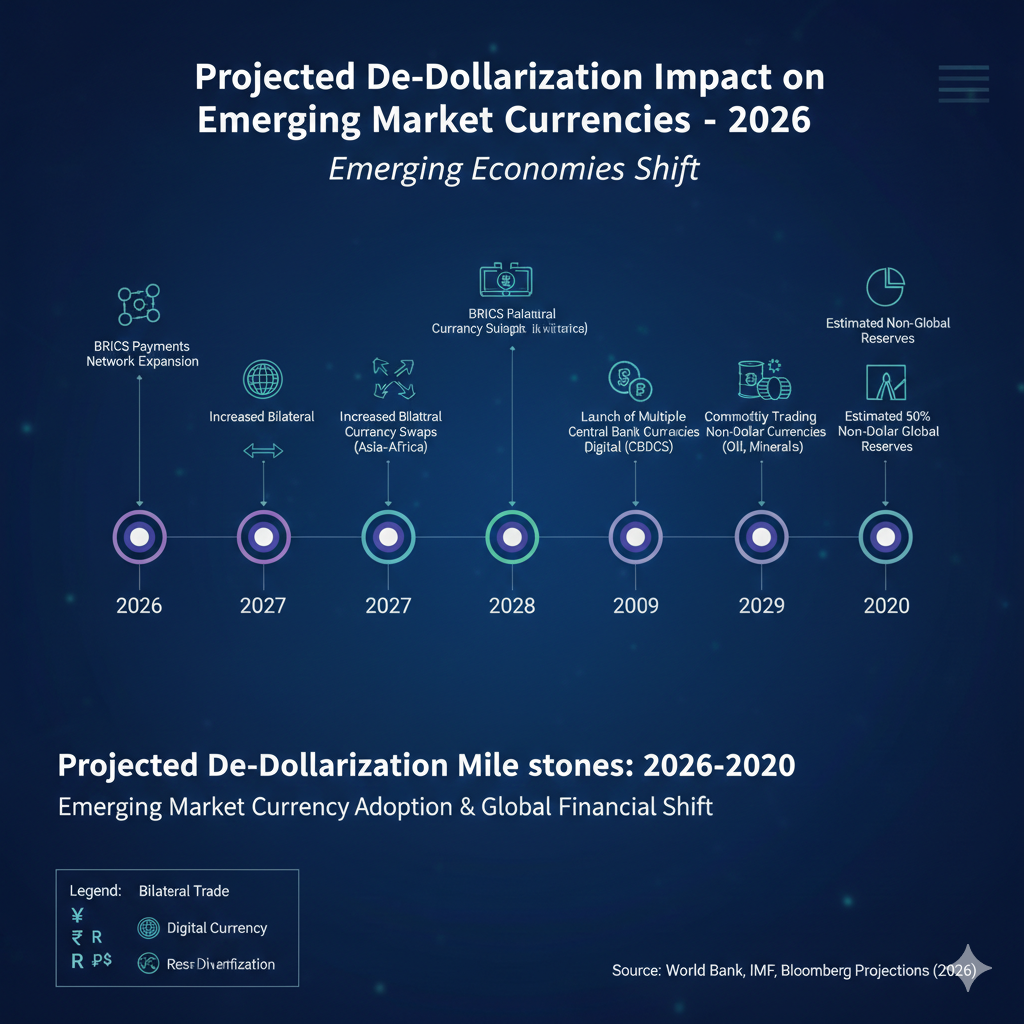

The Accelerating Timeline: Why 2026 Is Critical

Several converging factors have accelerated de-dollarization efforts in 2026:

Geopolitical Tensions: Sanctions and trade disputes have motivated nations to seek alternatives to dollar dependency. Countries want financial sovereignty and protection from potential economic weaponization of the dollar.

BRICS Expansion and Influence: The BRICS bloc (Brazil, Russia, India, China, and South Africa) has expanded its membership and strengthened initiatives to facilitate trade in local currencies. The group’s combined economic weight now represents over 35% of global GDP.

Digital Currency Development: Central bank digital currencies (CBDCs) have matured significantly, providing practical alternatives for cross-border transactions without dollar intermediation.

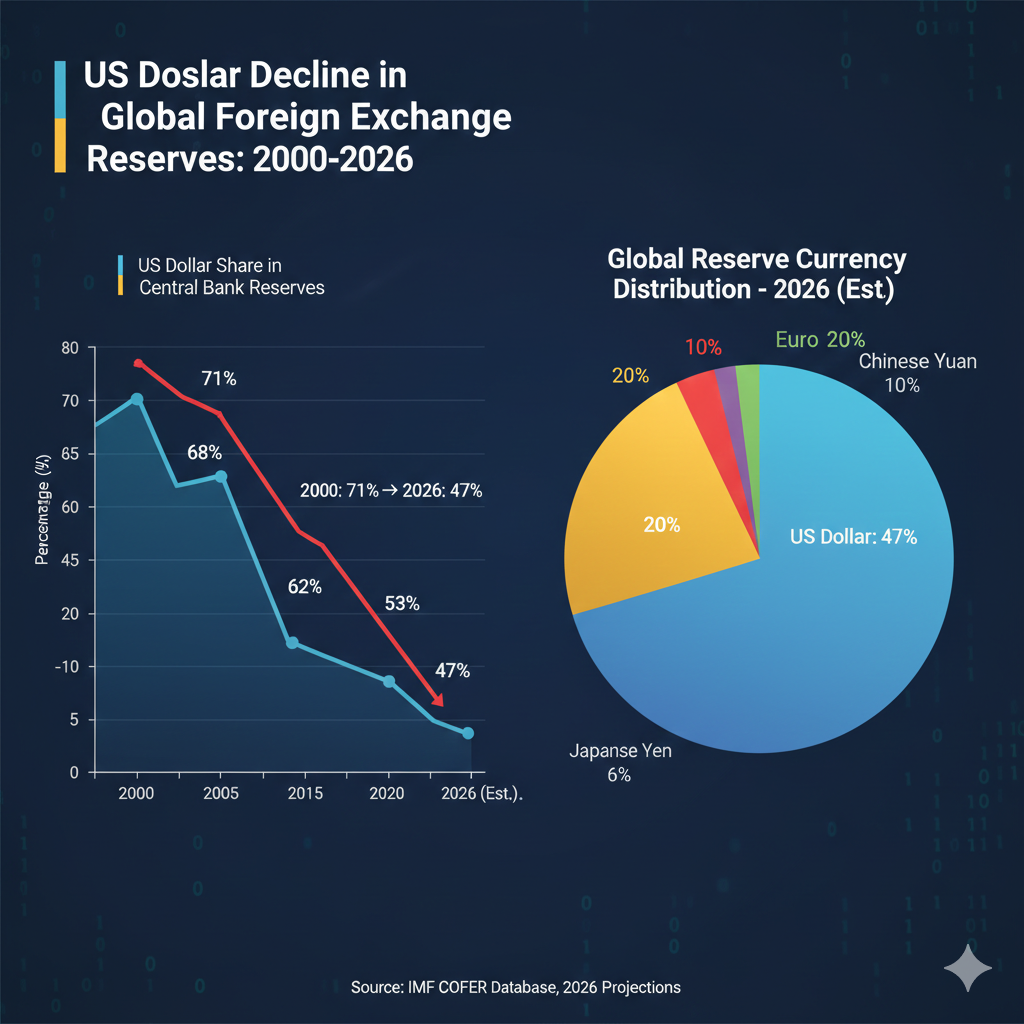

Reserve Diversification: Central banks worldwide have been steadily reducing dollar holdings in favor of gold, euro, yuan, and other assets. The dollar’s share of global reserves has declined from approximately 71% in 2000 to under 58% in recent data.

[INTERNAL LINK SUGGESTION: Link to “Understanding Central Bank Digital Currencies: A Trader’s Guide”]

The Dollar’s Diminishing Dominance: What the Data Shows

Recent statistics reveal the scale of this transition. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) reports that the dollar’s share of international payments has decreased, while the Chinese yuan has climbed to become the fourth most-used currency for global payments. Bilateral trade agreements bypassing the dollar have increased by over 40% since 2023.

Which Emerging Market Currencies Are Benefiting Most?

The Chinese Yuan (CNY/RMB): The Frontrunner

The Chinese yuan has emerged as the primary beneficiary of de-dollarization. China’s strategic initiatives—including the Belt and Road Initiative, yuan-denominated oil contracts (petroyuan), and extensive bilateral currency swap agreements—have positioned the yuan as a viable alternative reserve currency.

Trading Opportunities: The yuan has shown increased stability and liquidity in 2026, making it attractive for both speculation and hedging. The offshore yuan (CNH) offers greater flexibility for international traders compared to the onshore yuan (CNY).

Key Considerations: Despite its growth, the yuan still faces limitations due to capital controls and transparency concerns. However, China’s gradual financial market liberalization continues to expand yuan accessibility.

The Indian Rupee (INR): The Rising Star

India’s emergence as the world’s most populous nation and its rapid economic growth trajectory have elevated the rupee’s profile. India has actively pursued rupee-denominated trade agreements with multiple nations, particularly for energy imports and technology exports.

Trading Opportunities: The rupee’s volatility presents opportunities for skilled traders. India’s digital payment infrastructure and expanding role in global supply chains support long-term rupee strength.

Key Considerations: The rupee remains susceptible to oil price fluctuations and India’s current account dynamics. Traders should monitor monsoon seasons, policy announcements from the Reserve Bank of India, and geopolitical developments in South Asia.

[INTERNAL LINK SUGGESTION: Link to “Top 5 Asian Currency Pairs Every Trader Should Watch”]

The Brazilian Real (BRL): Commodity-Backed Potential

Brazil’s resource wealth and agricultural dominance position the real as a commodity-backed currency gaining attention. Brazil’s participation in BRICS and agreements to trade with China in local currencies have reduced its dollar dependence.

Trading Opportunities: The real correlates strongly with commodity prices, particularly soybeans, iron ore, and oil. Traders can leverage commodity market trends to inform real trading strategies.

Key Considerations: Political stability and fiscal policy remain critical factors. The real’s high volatility requires robust risk management but also creates profit opportunities for experienced traders.

The Russian Ruble (RUB): The Sanctions-Driven Alternative

Extensive sanctions have forced Russia to pioneer alternative payment systems and currency arrangements. The ruble’s use in energy transactions with select nations has increased, though under constrained conditions.

Trading Opportunities: The ruble offers high-risk, high-reward scenarios. Energy price movements significantly impact ruble valuation.

Key Considerations: Geopolitical risks are substantial. Limited liquidity and regulatory uncertainties make the ruble suitable primarily for sophisticated traders with high risk tolerance.

Other Notable Currencies: UAE Dirham, Saudi Riyal, and South African Rand

The UAE dirham and Saudi riyal benefit from Gulf states’ efforts to diversify their economies and establish themselves as global financial hubs. The South African rand, despite challenges, remains significant as a BRICS currency and African financial leader.

How De-Dollarization Creates Trading Opportunities

Increased Volatility and Price Discovery

As emerging market currencies gain independence from dollar pegs and become more freely traded, volatility naturally increases. While this presents risks, it also creates opportunities for traders who thrive on price movements.

Strategy Application: Volatility trading strategies, including straddles, strangles, and breakout trading, become more viable with emerging market currency pairs.

New Currency Pairs and Cross Rates

De-dollarization has led to increased liquidity in non-dollar pairs, such as CNY/INR, BRL/ZAR, and CNY/RUB. These cross rates previously had limited liquidity but are now becoming mainstream trading instruments.

Strategy Application: Traders can exploit arbitrage opportunities and correlation strategies between emerging market currencies rather than always trading against the dollar.

[INTERNAL LINK SUGGESTION: Link to “Mastering Currency Cross Rates: Advanced Forex Strategies”]

Carry Trade Reimagined

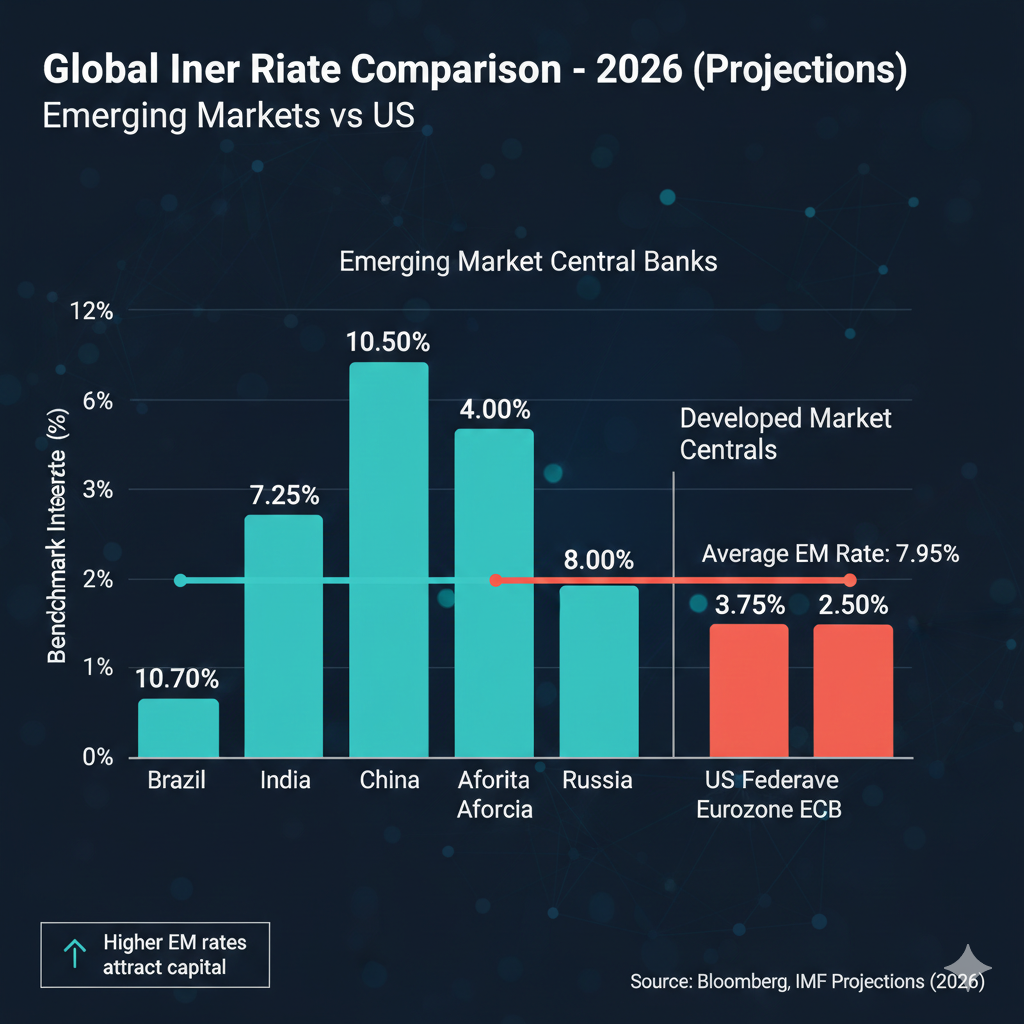

Traditional carry trades involved borrowing low-yielding currencies (like the yen) to invest in higher-yielding currencies (often denominated in dollars). De-dollarization enables carry trades between emerging markets directly, potentially offering superior risk-adjusted returns.

Strategy Application: Consider carry trades using yuan as the funding currency for investments in higher-yielding rupee or real-denominated assets, bypassing dollar conversion costs.

Central Bank Policy Divergence

As emerging market central banks gain monetary policy independence from the US Federal Reserve’s influence, policy divergence creates trading opportunities. Different interest rate cycles across emerging markets allow for strategic positioning.

Strategy Application: Monitor central bank communications and position ahead of policy announcements that may diverge from US monetary policy.

Practical Trading Strategies for Emerging Market Currencies in 2026

Strategy 1: Trend Following with BRICS Currencies

Implementation: Use technical analysis to identify long-term trends in BRICS currencies against the dollar and against each other. Moving averages, trend lines, and momentum indicators work well with these currencies as they establish new trading ranges.

Risk Management: Use trailing stops to protect profits as trends develop. Position sizing should account for higher volatility compared to major currency pairs.

Best For: Swing traders and position traders with medium to long-term horizons.

Strategy 2: Event-Driven Trading on De-Dollarization Announcements

Implementation: Monitor news of bilateral trade agreements, BRICS summit outcomes, and announcements of new currency swap lines. These events often trigger immediate price movements in affected currencies.

Risk Management: Use limit orders and be prepared for rapid reversals. News-driven moves can be volatile, so scale in gradually rather than committing full position sizes immediately.

Best For: News traders and those who can react quickly to fundamental developments.

[INTERNAL LINK SUGGESTION: Link to “Economic Calendar Mastery: Trading Major Global Events”]

Strategy 3: Commodity-Currency Correlation Trading

Implementation: Trade emerging market currencies based on their correlation with commodity prices. For example, long Brazilian real positions when agricultural commodity prices strengthen, or long Russian ruble when energy prices rise.

Risk Management: Monitor correlation breakdowns, which can occur during political events or policy changes. Use correlation coefficients to validate strategy effectiveness.

Best For: Traders with knowledge of commodity markets and multi-asset analysis capabilities.

Strategy 4: Yuan-Centric Pair Trading

Implementation: As the yuan becomes increasingly central to emerging market trade, trading yuan pairs against other emerging currencies offers opportunities. The CNY/INR, CNY/BRL, and CNY/ZAR pairs reflect direct trade relationships.

Risk Management: Understand both economies in the pair. Yuan pairs require monitoring of Chinese economic data, policy announcements, and bilateral trade developments.

Best For: Traders seeking to diversify beyond dollar-denominated pairs and those following Asian market developments.

Strategy 5: Options Strategies for Uncertainty

Implementation: Use currency options to profit from or hedge against uncertainty surrounding de-dollarization. Straddles and strangles work well when direction is uncertain but volatility is expected.

Risk Management: Options limit downside risk to premium paid while offering unlimited upside potential. Suitable for periods of high uncertainty around policy announcements or geopolitical events.

Best For: Sophisticated traders comfortable with options mechanics and those seeking defined-risk strategies.

Risk Management: Navigating the Dangers of Emerging Market Currency Trading

Understanding the Unique Risks

Emerging market currencies carry risks that differ significantly from major currency pairs:

Political Risk: Government changes, policy shifts, and geopolitical conflicts can dramatically impact currency values overnight.

Liquidity Risk: Lower trading volumes mean wider spreads and potential slippage, especially during off-hours or crisis periods.

Regulatory Risk: Capital controls, conversion restrictions, and sudden regulatory changes can trap positions or prevent profit repatriation.

Information Risk: Less transparent economic data and financial reporting can lead to information asymmetry and sudden surprises.

Counterparty Risk: When trading less-liquid emerging market currencies, broker and counterparty reliability becomes crucial.

Essential Risk Management Techniques

Position Sizing: Never risk more than 1-2% of your trading capital on a single emerging market currency trade. The higher volatility justifies more conservative position sizing.

Stop-Loss Discipline: Always use stop-loss orders, but place them wider than you would for major pairs to accommodate normal volatility. Consider using time-based stops as well.

Diversification: Don’t concentrate exposure in a single emerging market currency or region. Spread risk across multiple currencies and economic zones.

Leverage Limitation: Use less leverage with emerging market currencies than with major pairs. The increased volatility means lower leverage still provides sufficient exposure.

Continuous Monitoring: Emerging market currencies require more active monitoring than major pairs. Political events can unfold rapidly and require quick responses.

[INTERNAL LINK SUGGESTION: Link to “Risk Management Fundamentals Every Forex Trader Must Master”]

Tools and Resources for Emerging Market Currency Traders

Economic Calendars: Track emerging market central bank meetings, GDP releases, inflation data, and political events that impact currencies.

News Services: Subscribe to regional news services and analysis platforms that cover emerging markets in depth, not just headline summaries.

Technical Analysis Platforms: Ensure your charting platform provides reliable data feeds for emerging market currency pairs with sufficient historical depth.

Broker Selection: Choose brokers with strong emerging market currency offerings, competitive spreads, reliable execution, and adequate regulatory protection.

The Future Outlook: Where Is De-Dollarization Heading?

Likely Scenarios for the Next 3-5 Years

Gradual Transition: The most probable scenario involves continued gradual de-dollarization rather than an abrupt collapse of dollar dominance. The dollar will remain important but increasingly share space with alternative currencies.

Multi-Currency World: Rather than one currency replacing the dollar as the global reserve, we’re heading toward a multi-currency system where regional powers use their own currencies for regional trade.

Technology-Driven Change: Blockchain technology, CBDCs, and digital payment platforms will accelerate the ability to conduct cross-border transactions without dollar intermediation.

Fragmentation Risk: Geopolitical tensions could lead to competing currency blocs—a Western system centered on the dollar and euro, and an Eastern system built around the yuan and other emerging currencies.

What This Means for Traders

The trading landscape will continue evolving. Traders who adapt their strategies, expand their currency pair knowledge beyond traditional majors, and develop expertise in emerging market fundamentals will find abundant opportunities.

Skills to Develop:

- Multi-asset analysis combining currencies, commodities, and geopolitics

- Technical analysis adapted for higher volatility environments

- Fundamental analysis of emerging market economies

- Risk management in less liquid markets

- Understanding of regional political dynamics

[INTERNAL LINK SUGGESTION: Link to “Building a Forex Trading Education Plan for Long-Term Success”]

Potential Catalysts to Monitor

BRICS Currency Launch: Discussions of a BRICS common currency or payment system could dramatically accelerate de-dollarization if implemented.

Major Economy Shift: If a large economy like Saudi Arabia or Indonesia makes a decisive move away from dollar trade, it could trigger cascading effects.

US Policy Response: How the United States responds to de-dollarization through monetary policy, trade policy, or diplomatic initiatives will significantly impact the transition’s pace.

Financial Crisis: A major financial crisis could either accelerate flight to dollar safety or, if the crisis originates in the US, accelerate de-dollarization efforts.

Frequently Asked Questions About De-Dollarization and Emerging Market Currency Trading

Is the US dollar going to collapse because of de-dollarization?

No, the dollar is not likely to collapse. De-dollarization represents a gradual erosion of dollar dominance rather than an imminent collapse. The US economy’s size, deep financial markets, and established infrastructure mean the dollar will remain important for decades, even as its market share declines.

Which emerging market currency is the safest to trade?

The Chinese yuan typically offers the most stability among emerging market currencies due to China’s managed exchange rate policy, large reserves, and economic size. However, “safest” is relative—all emerging market currencies carry more risk than major currencies like the euro or yen.

Can retail traders access emerging market currency pairs easily?

Yes, most major forex brokers now offer emerging market currency pairs, though liquidity and spreads vary. Some exotic pairs may have limited availability or wider spreads. Retail traders should verify that their broker offers the specific pairs they want to trade with acceptable trading conditions.

How much capital do I need to start trading emerging market currencies?

While you can technically start with a small amount, emerging market currency volatility and risk management requirements mean $5,000-$10,000 is a more realistic minimum for sustainable trading. This allows proper position sizing while accommodating the larger stop-losses these currencies require.

Do I need to trade during Asian or emerging market hours?

Trading during the hours when the relevant emerging market is open typically provides better liquidity and tighter spreads. However, major price movements can occur at any time due to global interconnectedness. Overnight risk management is particularly important with these currencies.

What’s the best way to stay informed about emerging market developments?

Follow reputable financial news services with emerging market focus, monitor central bank websites and announcements, join trading communities focused on emerging markets, and consider subscriptions to specialized emerging market analysis services. Regional news sources provide earlier signals than Western media.

Conclusion: Positioning Yourself for the De-Dollarization Era

De-dollarization isn’t a future possibility—it’s happening right now, reshaping currency markets as you read this. The emerging market currencies that were once exotic, illiquid afterthoughts are becoming mainstream trading instruments with substantial volumes and opportunities.

For traders willing to expand beyond the comfort zone of EUR/USD and GBP/USD, the de-dollarization trend offers a generational opportunity. Yes, the risks are higher. Yes, the learning curve is steeper. But the potential rewards—both in terms of profits and professional development—are substantial.

The question isn’t whether de-dollarization will continue; it’s whether you’ll be prepared when emerging market currencies become as common in trading portfolios as major pairs are today. Start educating yourself now. Begin with small positions to gain experience. Develop your understanding of the political, economic, and technical factors that drive these currencies.

The traders who thrive in 2026 and beyond will be those who recognized this shift early and positioned themselves accordingly. Which side of history will you be on?

[INTERNAL LINK SUGGESTION: Link to “Getting Started with Forex Trading: A Complete Beginner’s Roadmap”]

Take Action: Start Trading Emerging Market Currencies Today

Ready to capitalize on the de-dollarization opportunity? Here’s your action plan:

- Educate Yourself: Continue reading our comprehensive guides on emerging market economies and currency trading strategies

- Choose the Right Broker: Select a forex broker with strong emerging market currency offerings and competitive pricing

- Start Small: Open a demo account or trade with minimal capital as you develop your strategies

- Stay Informed: Subscribe to our newsletter for weekly updates on de-dollarization trends and emerging market currency analysis

- Join Our Community: Connect with other traders navigating the emerging market currency space

[CTA BUTTON SUGGESTION: “Download Our Free Emerging Market Currency Trading Checklist”]

The de-dollarization era has arrived. Your trading strategy should evolve with it.