Digital Options vs Binary Options: Complete Comparison Guide (2026)

If you’re researching digital options vs binary options, you’re likely confused by conflicting information online. Many traders mistakenly use these terms interchangeably, but understanding the crucial differences between digital options trading and binary options trading can mean the difference between legal trading and regulatory trouble—or between controlled risk and total capital loss.

This comprehensive guide on digital options vs binary options will clarify:

- What exactly digital options and binary options are

- Key differences between digital options vs binary options

- Legality: Why binary options are banned while digital options aren’t

- Profitability and risk comparisons

- Which option is better for your trading style

- Real examples of digital options trading vs binary options trading

Critical clarification: While both fall under “exotic options,” the difference between digital and binary options is substantial—affecting legality, risk management, and profit potential.

Let’s dive into the complete digital options vs binary options comparison.

Digital Options vs Binary Options: Quick Overview

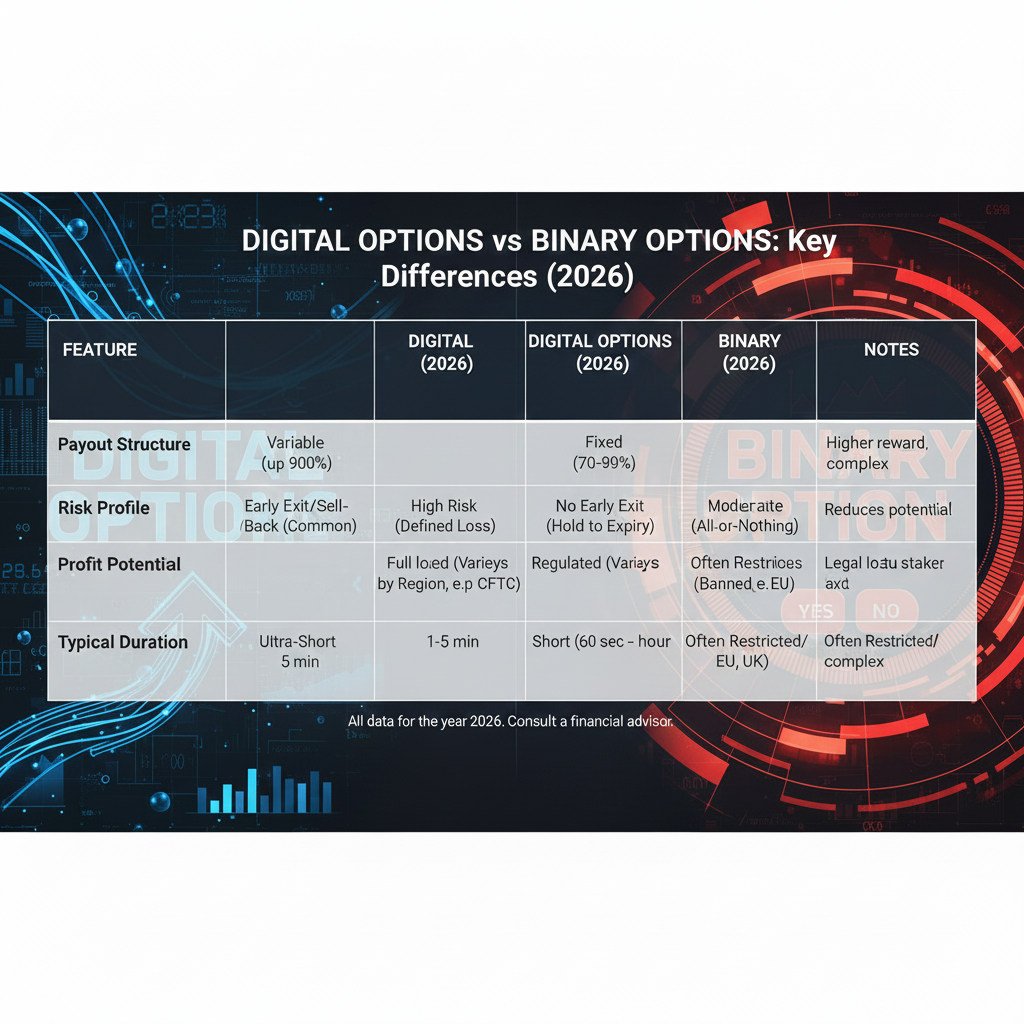

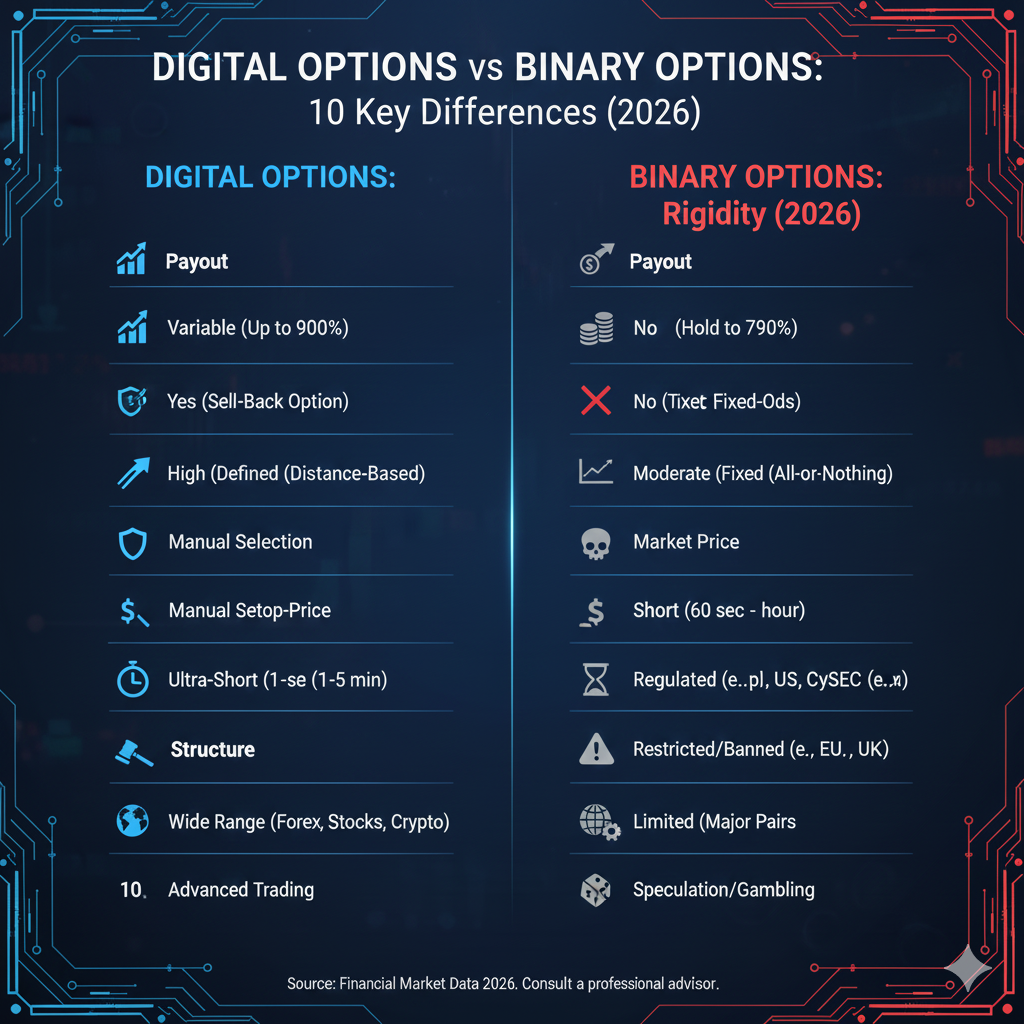

Before diving deep into digital options vs binary options, here’s a quick comparison table:

| Feature | Binary Options | Digital Options |

|---|---|---|

| Payout Structure | Fixed (e.g., 80%) | Variable (scales with price movement) |

| Exit Before Expiry | ❌ No | ✅ Yes |

| Profit Calculation | All-or-nothing | Proportional to price change |

| Loss Limitation | 100% of investment | Capped at investment |

| Legality (Major Markets) | ❌ Banned (EU, UK, US, Australia) | ✅ Legal in more jurisdictions |

| Risk Management | ❌ None (no stop loss) | ✅ Can exit early |

| Typical Expiry Times | 60 seconds to hours | Minutes to weeks |

| Minimum Price Movement | Any (0.0001 is enough) | Larger moves = larger profits |

| Gambling Classification | ✅ Considered gambling | ⚠️ Speculation (more legitimate) |

| Broker Regulation | Offshore only | Offshore primarily, some regulated |

| Complexity | Very simple | Slightly more complex |

| Professional Use | ❌ Avoided by professionals | ⚠️ Niche use by some traders |

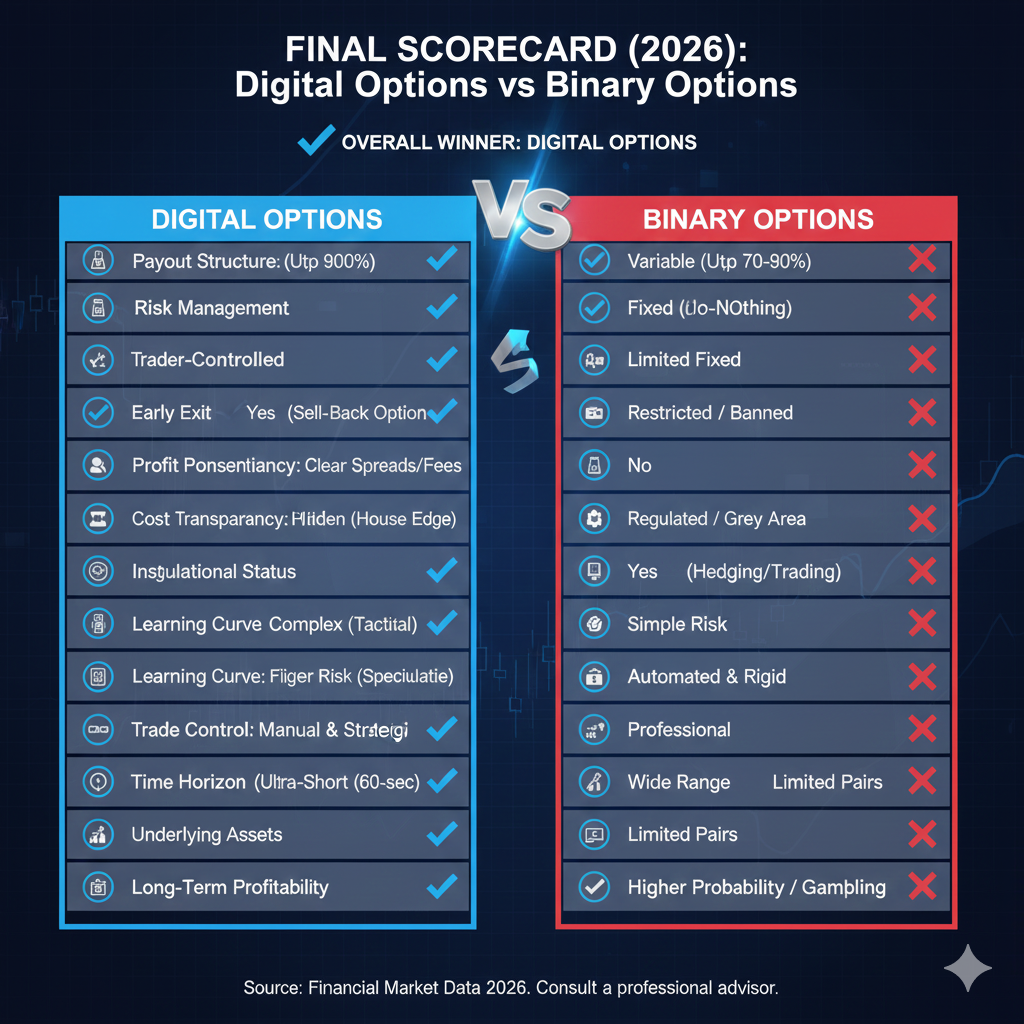

Quick Verdict: Digital Options vs Binary Options

Binary Options:

- ❌ Banned in most developed countries

- ❌ All-or-nothing risk (no exit)

- ❌ Fixed payout (doesn’t reward larger moves)

- ❌ Gambling-like characteristics

- ❌ Scam prevalence high

Digital Options:

- ✅ Legal in more jurisdictions

- ✅ Can exit early (risk management)

- ✅ Variable profit (rewards accuracy)

- ✅ More legitimate trading tool

- ⚠️ Still high risk

The bottom line on digital options vs binary options: Digital options are significantly better than binary options, but both are high-risk instruments that most retail traders should avoid in favor of regulated forex or stock trading.

What Are Binary Options? Complete Explanation

To understand digital options vs binary options, let’s first define binary options clearly.

Binary Options Definition

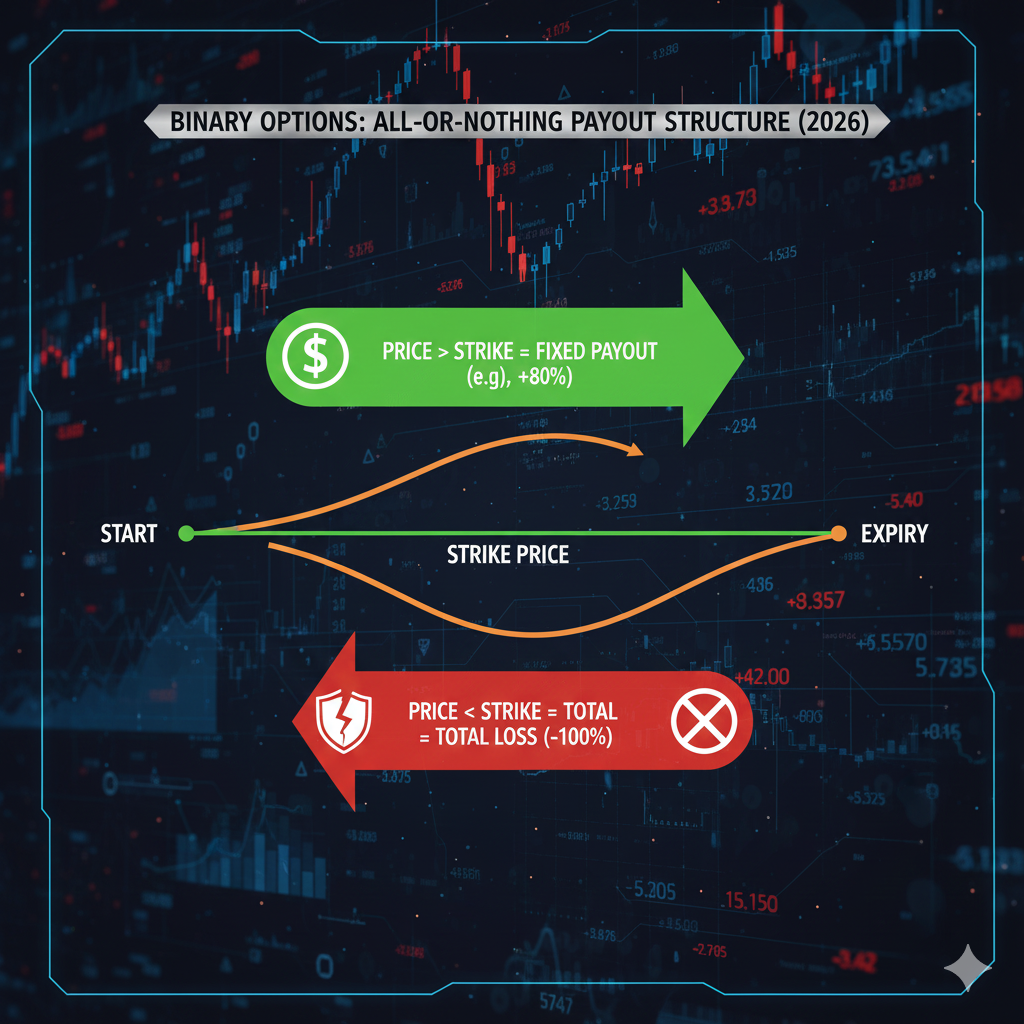

Binary options (also called “all-or-nothing options” or “fixed-return options”) are financial derivatives where the payout is either:

- Fixed amount (if prediction correct)

- Nothing (if prediction wrong)

The term “binary” comes from the two possible outcomes: win or lose, with no middle ground.

How Binary Options Trading Works

Binary Options Trading Process:

- Choose Asset: EUR/USD, gold, Apple stock, etc.

- Predict Direction: Will price go UP (Call) or DOWN (Put)?

- Set Investment: Choose how much to risk (e.g., $100)

- Select Expiry: When trade ends (60 seconds, 5 minutes, 1 hour, etc.)

- Wait: Cannot exit early or adjust

- Outcome: Win fixed % (80-95%) or lose 100%

Binary Options Example

Scenario:

- Asset: EUR/USD at 1.1000

- Prediction: Price will go UP in next 5 minutes

- Investment: $100

- Payout: 85% if correct

- Expiry: 5 minutes

Outcome A (Price at 1.1001 or higher):

- You WIN

- Receive: $185 ($100 investment + $85 profit)

- Net profit: $85

Outcome B (Price at 1.0999 or lower):

- You LOSE

- Receive: $0

- Net loss: $100

Critical Point: Whether EUR/USD goes to 1.1001 or 1.1500, you get the same $85 profit. Whether it goes to 1.0999 or 1.0500, you lose the same $100.

Binary Options Characteristics

Fixed Payout:

- Win = always the same % (typically 80-95%)

- Doesn’t matter how much price moves

- EUR/USD up 0.0001 = same profit as up 0.0100

All-or-Nothing:

- No partial wins

- No scaling with accuracy

- Binary outcome (hence the name)

No Early Exit:

- Once trade placed, you’re locked in

- Cannot close position before expiry

- No stop loss possible

- No risk management tools

Short Timeframes:

- Common: 60 seconds, 5 minutes, 15 minutes

- Some offer hours or days

- Ultra-short timeframes encourage gambling behavior

Why Binary Options Are Controversial

1. Mathematical Disadvantage:

Win rate needed to break even:

- Payout: 85%

- Win: +$85

- Loss: -$100

- Break-even: Need 54% win rate (not 50%)

2. Gambling-Like Nature:

- Short timeframes (60 seconds)

- No skill advantage

- Emotional/impulsive trading

- Addictive qualities

3. No Risk Management:

- Cannot use stop loss

- Cannot exit early

- Cannot hedge

- All-or-nothing risk

4. Scam Prevalence:

- Many binary brokers proved fraudulent

- Withdrawal issues widespread

- Price manipulation allegations

- Weak regulation (offshore only)

5. Banned Worldwide:

- EU banned 2018 (ESMA)

- UK banned 2019 (FCA)

- Australia banned 2021 (ASIC)

- Canada effectively banned

- US restricted (NADEX only)

Binary Options Trading Verdict

Binary options represent the least sophisticated, highest-risk form of derivatives trading. The lack of exit options, fixed payouts, and gambling-like structure led to worldwide bans. In the digital options vs binary options comparison, binary options are clearly inferior.

[INTERNAL LINK: “Why Binary Options Are Banned: Complete Regulatory History”]

What Are Digital Options? Complete Explanation

Now let’s examine digital options to understand the difference between digital and binary options.

Digital Options Definition

Digital options (also called “cash-or-nothing options” or “digital contracts”) are financial derivatives where:

- Payout is variable based on how far price moves

- Can exit before expiry

- Profit scales with accuracy of prediction

- Loss is capped at investment

While similar to binary options in some ways, the difference between digital and binary options is substantial.

How Digital Options Trading Works

Digital Options Trading Process:

- Choose Asset: EUR/USD, stocks, commodities, crypto

- Set Strike Price: Your target price level

- Choose Direction: Higher or Lower than strike

- Set Investment: Amount to risk

- Select Expiry: When trade ends

- Monitor: Can exit early if desired

- Outcome: Profit scales with price movement; loss capped

Digital Options Example

Scenario:

- Asset: EUR/USD at 1.1000

- Prediction: Price will go UP

- Investment: $100

- Expiry: 30 minutes

- Strike: 1.1000

Outcome A (Price moves to 1.1010):

- Small move (10 pips)

- Profit: ~$30-40

- Total received: $130-140

Outcome B (Price moves to 1.1050):

- Large move (50 pips)

- Profit: ~$150-200

- Total received: $250-300

Outcome C (Price moves to 1.0990):

- Wrong direction (10 pips against)

- Loss: Limited to investment

- Total received: $0-20 (some platforms offer small rebate)

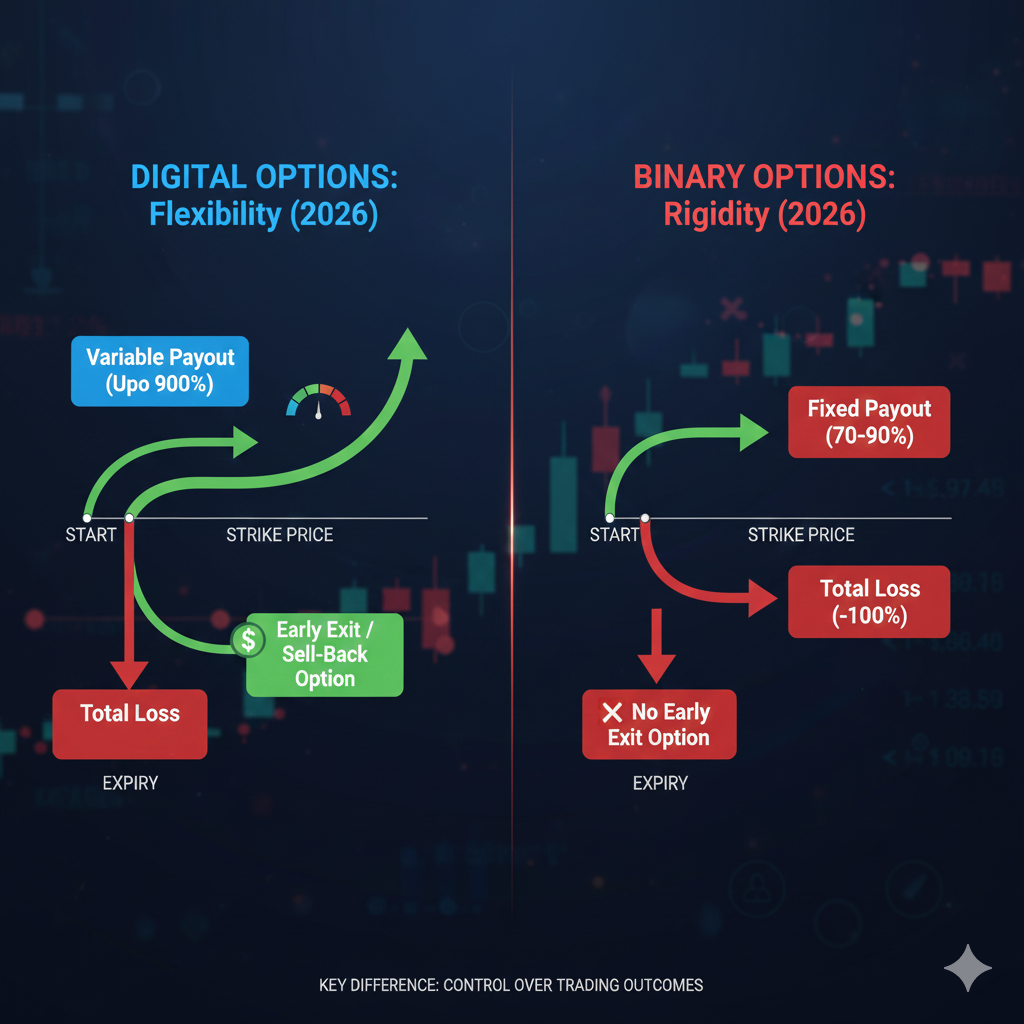

Outcome D (Exit at 1.1020 after 15 minutes):

- Partial profit taken

- Profit: ~$50-70

- Exited early, avoided risk of reversal

Digital Options Characteristics

Variable Payout:

- Profit scales with price movement

- Larger moves = larger profits

- Rewards accurate predictions more

- More closely resembles traditional options

Early Exit Capability:

- Can close position anytime before expiry

- Take partial profits

- Cut losses early

- Risk management possible

Flexible Strike Prices:

- Choose your target level

- Multiple strike prices available

- Can trade at-the-money, in-the-money, out-of-the-money

Loss Limitation:

- Maximum loss = investment amount

- Some platforms offer small rebate (5-15%)

- Risk is known upfront

- Cannot lose more than invested

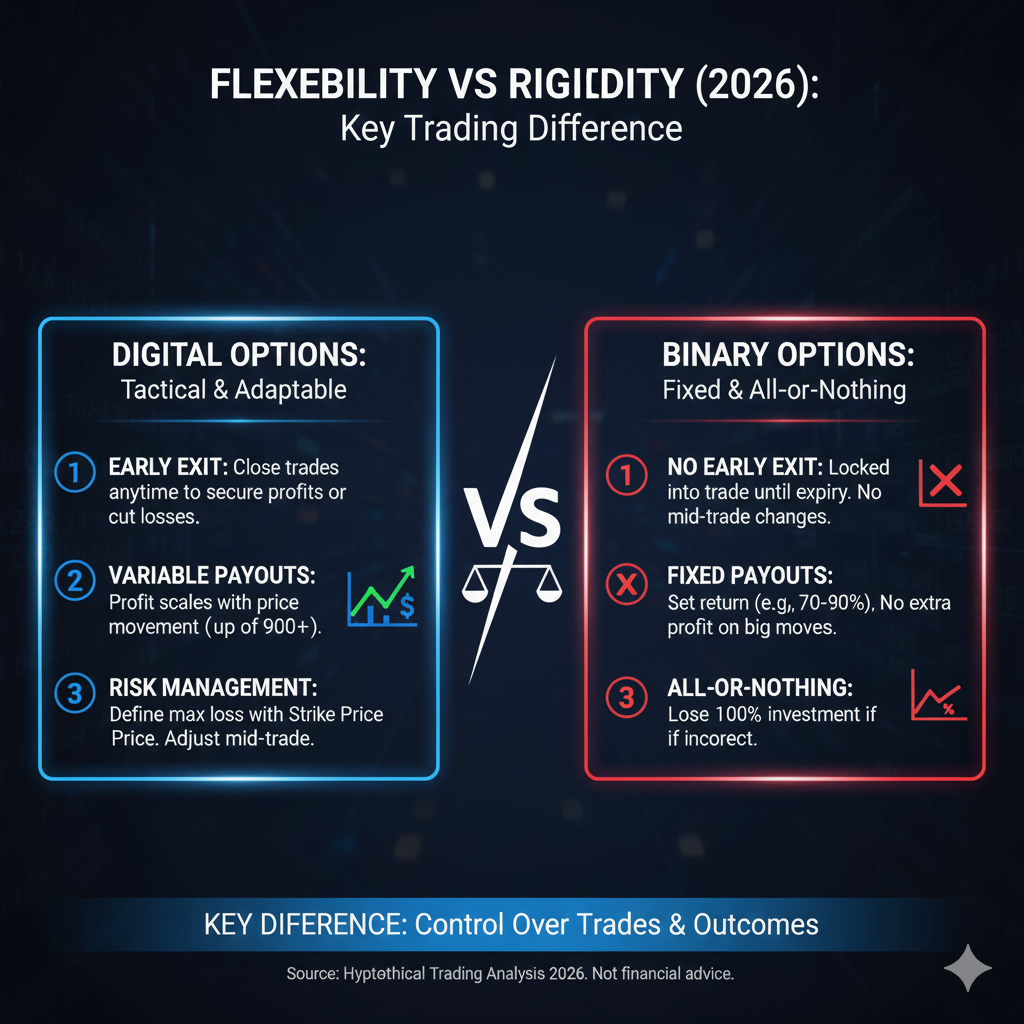

Key Advantages of Digital Options Over Binary

Digital Options vs Binary Options Advantages:

- Risk Management:

- Digital: Can exit early ✅

- Binary: Locked in until expiry ❌

- Profit Scaling:

- Digital: Larger moves = larger profits ✅

- Binary: Fixed payout regardless ❌

- Flexibility:

- Digital: Multiple strike prices ✅

- Binary: Simple higher/lower ❌

- Legitimacy:

- Digital: More accepted by regulators ✅

- Binary: Banned worldwide ❌

- Professional Use:

- Digital: Some institutional use ✅

- Binary: Avoided entirely ❌

Digital Options Trading Verdict

Digital options are a more sophisticated and flexible instrument compared to binary options. The ability to exit early, variable profit potential, and better regulatory standing make digital options significantly superior in the digital options vs binary options debate.

However, digital options trading still carries high risk and is not suitable for most retail traders.

[INTERNAL LINK: “Digital Options Trading Strategy: Complete Beginner’s Guide”]

Key Differences: Digital Options vs Binary Options

Let’s examine the core differences between digital and binary options in detail.

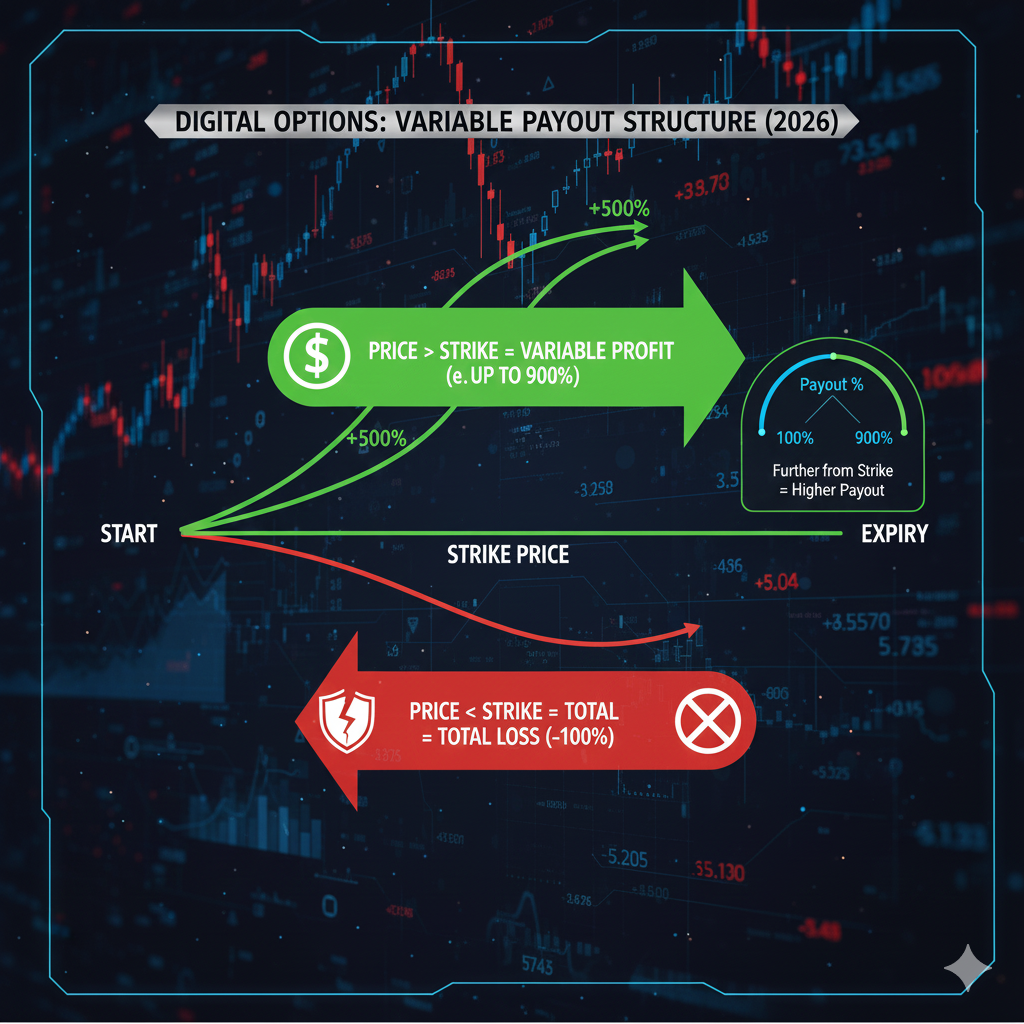

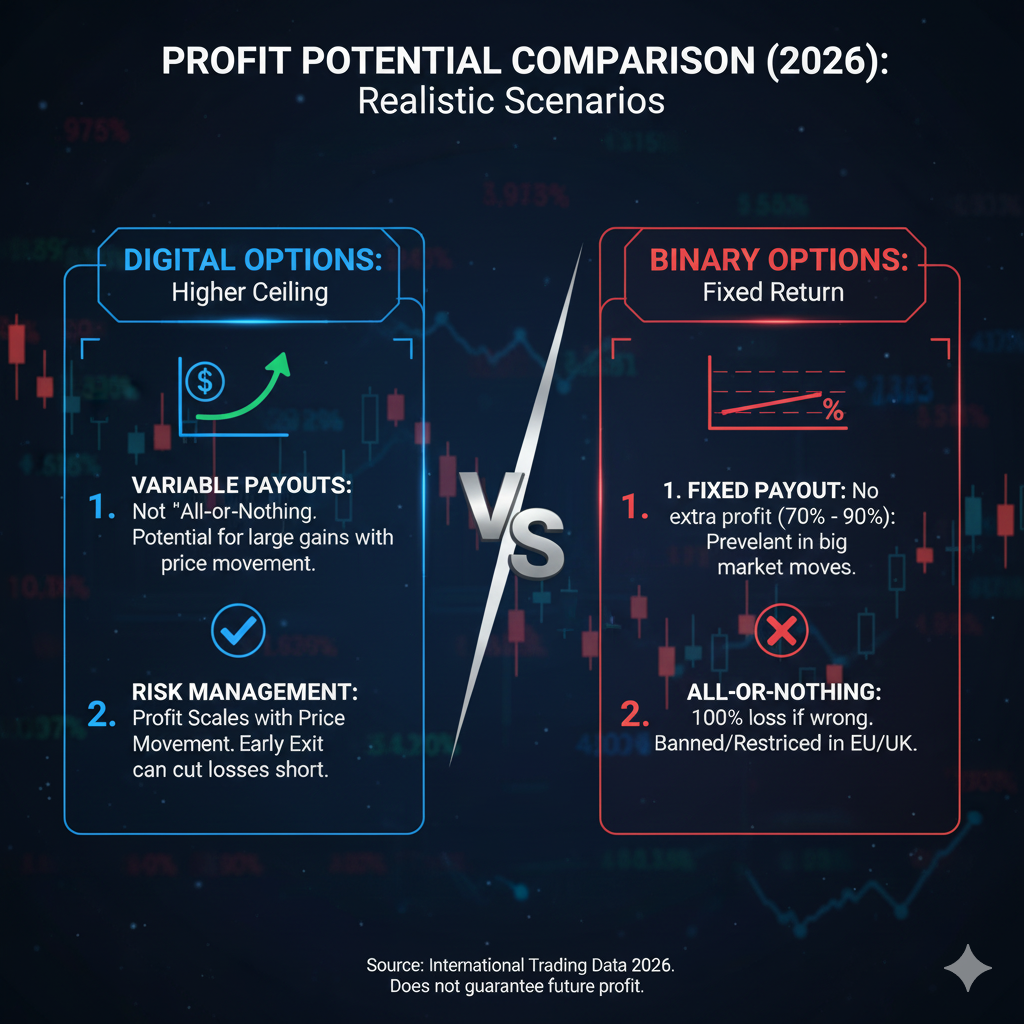

1. Payout Structure (Critical Difference)

Binary Options:

- Fixed payout percentage (80-95%)

- Same profit whether price moves 1 pip or 100 pips

- Example: $100 trade, 85% payout = always $85 profit if correct

Digital Options:

- Variable payout based on price movement

- Larger price moves = larger profits

- Example: $100 trade could return $30 (small move) to $200+ (large move)

Winner: Digital options (rewards accuracy and larger moves)

2. Early Exit Capability (Critical Difference)

Binary Options:

- ❌ Cannot exit before expiry

- Locked in once trade placed

- No way to cut losses or take partial profits

- All-or-nothing until expiry time

Digital Options:

- ✅ Can exit anytime before expiry

- Close position to take profits

- Cut losses if trade going wrong

- Gives trader control and risk management

Winner: Digital options (risk management essential)

3. Profit Calculation

Binary Options:

Profit = Fixed % of investment (if correct)

Loss = 100% of investment (if wrong)

Example:

Trade: $100

Payout: 85%

Win: $85 profit (whether price moves 0.0001 or 0.0100)

Lose: $100 loss

Digital Options:

Profit = Variable, based on:

- How far price moves

- How far from strike price

- Time to expiry

- Volatility

Example:

Trade: $100

Small move: $30-50 profit

Medium move: $80-120 profit

Large move: $150-250 profit

Wrong: $0-100 loss (some rebate possible)

Winner: Digital options (better risk/reward scaling)

4. Risk Management Tools

Binary Options:

- ❌ No stop loss possible

- ❌ No take profit (fixed anyway)

- ❌ No hedging capability

- ❌ No position adjustment

- ❌ No risk management whatsoever

Digital Options:

- ✅ Can exit early (manual stop loss)

- ✅ Can take partial profits

- ✅ Can hedge with other positions

- ✅ Can adjust strategy mid-trade

- ✅ Some risk management possible

Winner: Digital options (risk management crucial for longevity)

5. Legality and Regulation

Binary Options:

- ❌ Banned: EU, UK, Australia, Canada

- ❌ Restricted: USA (NADEX only)

- ❌ Offshore only: Remaining markets

- ❌ No tier-1 regulation possible

- ❌ Associated with scams

Digital Options:

- ✅ Legal in more jurisdictions

- ⚠️ Still mostly offshore regulated

- ✅ Some regulated platforms exist

- ✅ Not explicitly banned in major markets

- ✅ Better regulatory acceptance

Winner: Digital options (legal in more places)

6. Timeframes Available

Binary Options:

- Ultra-short: 60 seconds, 2 minutes

- Short: 5 minutes, 15 minutes, 30 minutes

- Medium: 1 hour, 4 hours

- Occasional: End of day, week

- Focus: Very short timeframes (gambling-like)

Digital Options:

- Short: 5 minutes, 15 minutes, 30 minutes

- Medium: 1 hour, 4 hours, daily

- Long: Weekly, monthly available

- Focus: More diverse timeframes

Winner: Digital options (less gambling-focused)

7. Complexity and Learning Curve

Binary Options:

- Extremely simple (higher or lower)

- No options theory needed

- Minimal learning required

- Anyone can understand in 5 minutes

- Simplicity = illusion of easy money

Digital Options:

- Slightly more complex

- Some options concepts helpful

- Understanding of strike prices needed

- Requires more learning

- Complexity = better filtering of gamblers

Winner: Tie (simplicity isn’t always good)

8. Platform Availability

Binary Options:

- IQ Option (restricted)

- Pocket Option (offshore)

- Quotex (offshore)

- Deriv (offshore)

- All offshore regulated

Digital Options:

- ExpertOption (VFSC)

- Some traditional brokers offer digital options

- Fewer pure digital options platforms

- Mix of offshore and some regulated

Winner: Binary options (ironically, more platforms—but that’s not good)

9. Professional Trader Usage

Binary Options:

- ❌ Avoided by all professional traders

- ❌ No institutional use

- ❌ Not taught in trading education

- ❌ Considered gambling, not trading

- ❌ Zero credibility in finance community

Digital Options:

- ⚠️ Niche use by some professional traders

- ⚠️ Limited institutional applications

- ⚠️ Occasionally mentioned in derivatives education

- ⚠️ More respected than binary (but still niche)

- ⚠️ Some credibility as exotic option variant

Winner: Digital options (marginally more professional acceptance)

10. Scam Prevalence

Binary Options:

- ❌ Extremely high scam rate

- ❌ Numerous documented frauds

- ❌ Withdrawal issues widespread

- ❌ Platform manipulation common

- ❌ Industry-wide reputation damage

Digital Options:

- ⚠️ Lower scam rate (but still present)

- ⚠️ Some legitimate platforms exist

- ⚠️ Withdrawal issues less common

- ⚠️ Better overall reputation

- ⚠️ Still offshore = still risky

Winner: Digital options (significantly better reputation)

Digital Options vs Binary Options Summary Table

| Category | Binary Options | Digital Options | Winner |

|---|---|---|---|

| Payout | Fixed | Variable | Digital |

| Early Exit | No | Yes | Digital |

| Risk Management | None | Some | Digital |

| Legality | Banned widely | Legal more places | Digital |

| Regulation | Offshore only | Offshore mostly | Digital |

| Professional Use | None | Niche | Digital |

| Scam Risk | Very high | High | Digital |

| Learning Curve | Very easy | Easy | Tie |

| Platforms | Many offshore | Fewer | Binary |

| Overall | ❌ Inferior | ✅ Better | Digital |

Legality: Why Binary Options Are Banned But Digital Options Aren’t

The legality aspect is crucial in the digital options vs binary options comparison.

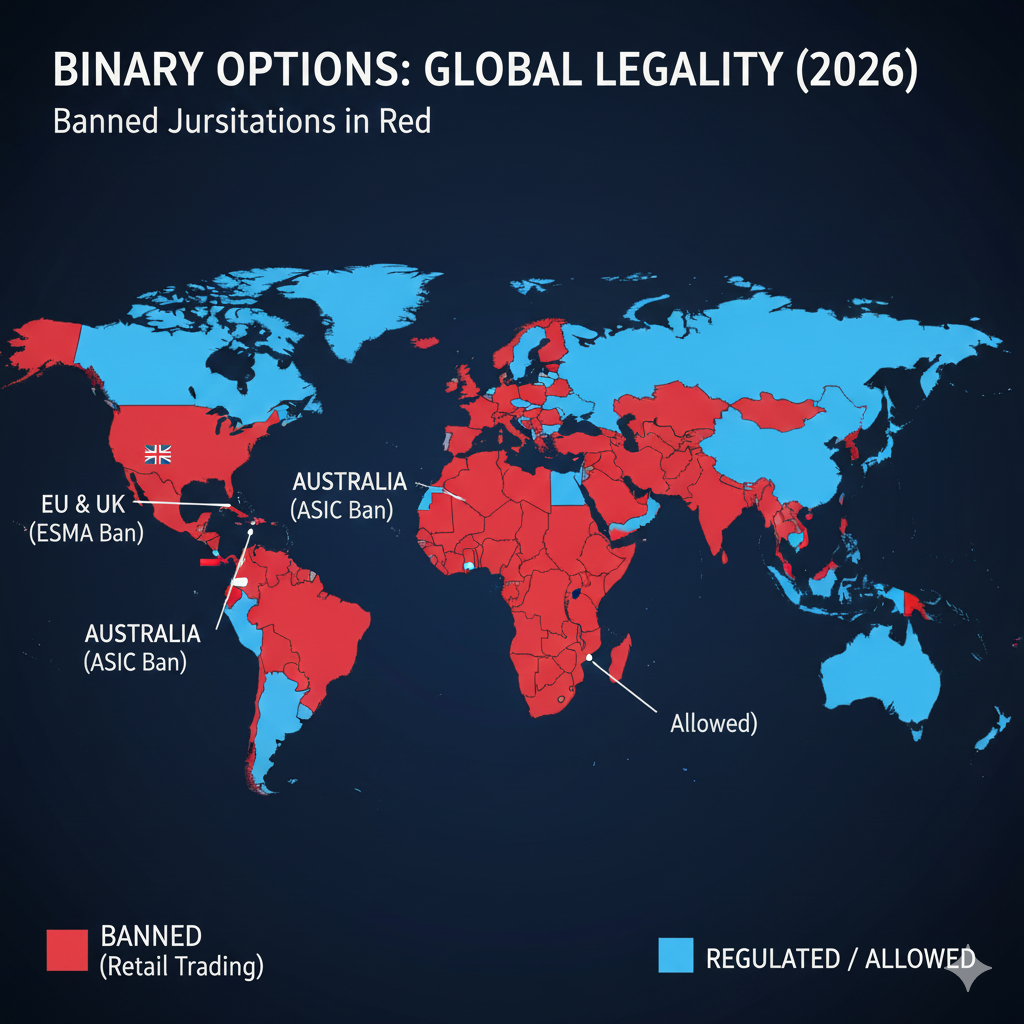

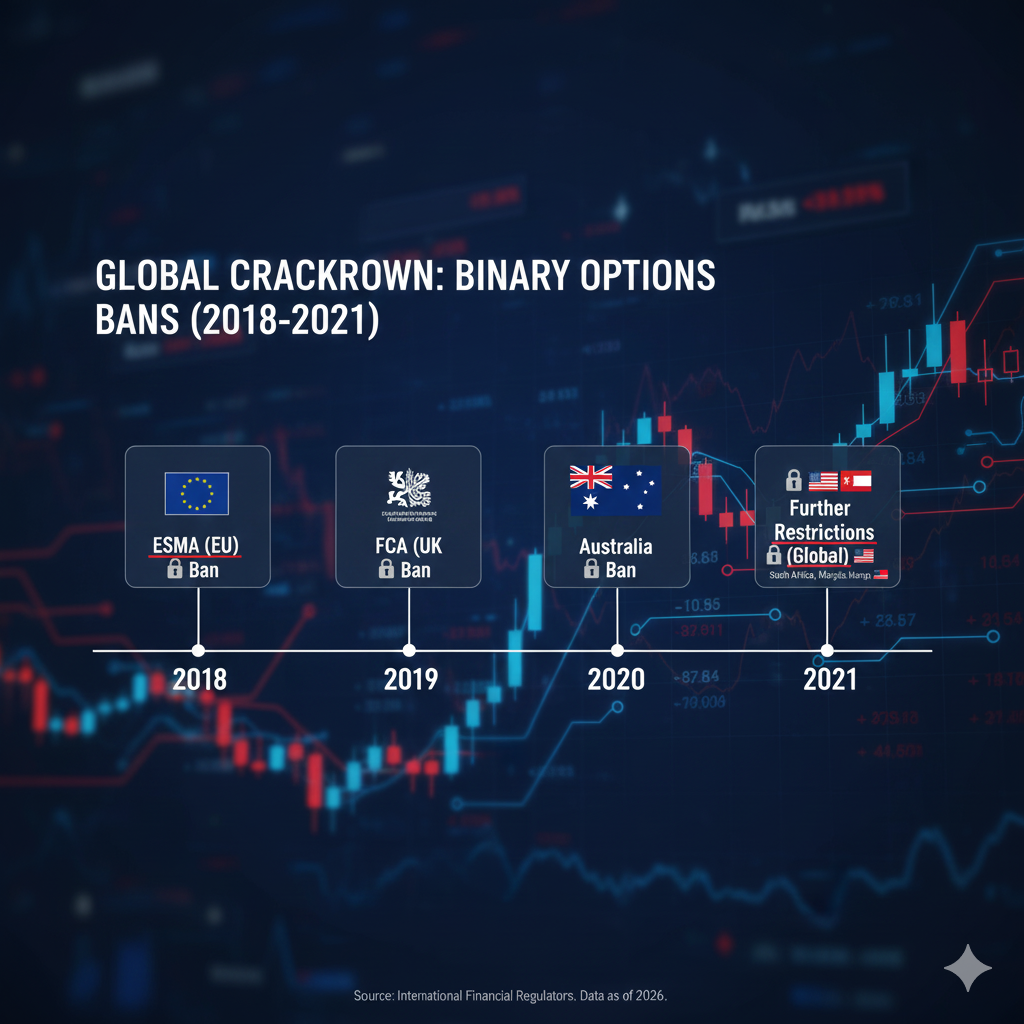

Binary Options Bans: Complete Timeline

2018 – European Union (ESMA):

- March 2018: ESMA (European Securities and Markets Authority) announces binary options ban

- Reason: “Gambling characteristics,” high consumer losses

- Impact: All EU27 countries

- Enforcement: July 2018 (temporary), made permanent 2019

2019 – United Kingdom (FCA):

- April 2019: FCA (Financial Conduct Authority) permanent ban

- Reason: “Unsuitable for retail clients,” 80% loss rate

- Impact: All UK residents

- Enforcement: Immediate, no grace period

2021 – Australia (ASIC):

- March 2021: ASIC (Australian Securities and Investments Commission) ban

- Reason: “Gambling-like characteristics,” consumer harm

- Impact: All Australian residents

- Enforcement: Immediate

Canada:

- Multiple provinces banned binary options

- CSA (Canadian Securities Administrators) warnings

- Effectively unavailable for Canadians

United States:

- Binary options restricted to NADEX (CFTC-regulated exchange)

- All offshore binary options illegal for US residents

- SEC and CFTC joint enforcement actions

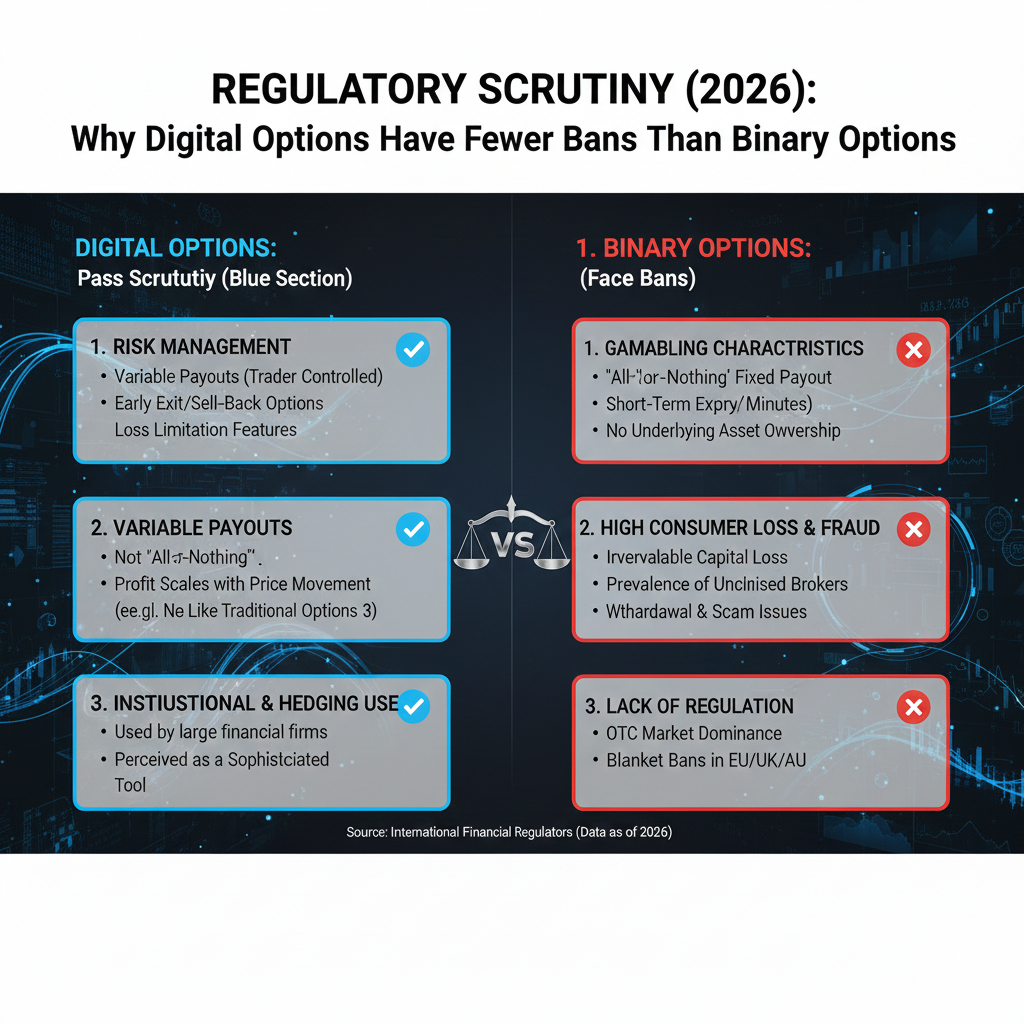

Why Regulators Banned Binary Options

1. Gambling-Like Characteristics:

- Short timeframes (60 seconds) = no analysis possible

- All-or-nothing outcomes = betting, not investing

- Addictive design features

- High-frequency trading encourages impulsive behavior

2. Extreme Consumer Losses:

- ESMA study: 74-89% of retail traders lose money

- FCA research: Average loss of €2,000 per client

- ASIC findings: 80% loss rate among Australian traders

- Systematic retail trader losses

3. Mathematical Disadvantage:

- Built-in house edge (need 54%+ win rate for break-even)

- Fixed payouts less than 100% (80-95%)

- Losses always 100%

- Impossible for sustainable profitability

4. Fraud and Scams:

- Numerous documented fraudulent binary options brokers

- Withdrawal refusals widespread

- Price manipulation allegations

- Fake platforms and fake profits

- Estimated €5+ billion in consumer losses

5. No Investment Purpose:

- Doesn’t serve hedging function

- No institutional use case

- Purely speculative (gambling)

- No economic value creation

Why Digital Options Remain Legal (Mostly)

Digital options haven’t faced the same regulatory crackdown as binary options because:

1. Risk Management Capability:

- Early exit = traders can manage risk

- Not completely locked in

- Shows more responsibility in design

- Regulators appreciate risk control

2. Variable Payouts:

- Profit scales with accuracy

- Not purely binary win/lose

- More closely resembles traditional options

- Less gambling-like characteristics

3. Less Scam Association:

- Fewer fraudulent digital options platforms

- Better industry reputation overall

- Withdrawal issues less common

- Not synonymous with scams (unlike binary)

4. Institutional Use Cases:

- Some derivatives desks use digital options

- Hedging applications exist

- Not purely retail speculation

- Some legitimate financial function

5. Not Explicitly Targeted:

- Regulators specifically banned “binary options”

- Digital options fall in gray area

- Not mentioned in most bans

- Legal by omission in many jurisdictions

Where Each Type Is Legal

Binary Options Legal Status 2026:

- ❌ Banned: EU, UK, Australia, Canada, Israel

- ❌ Restricted: USA (NADEX only)

- ⚠️ Offshore Only: Some Asian, African, Latin American countries

- Verdict: Unavailable in all major regulated markets

Digital Options Legal Status 2026:

- ✅ Legal: Most countries (not explicitly banned)

- ⚠️ Gray Area: Many jurisdictions (no specific regulation)

- ⚠️ Offshore Regulated: Most platforms

- ⚠️ Restricted: Some countries include them in binary options bans

- Verdict: Available in more markets, but still mostly offshore

Legal Risk for Traders

Trading Binary Options:

- In banned countries: Illegal, potential fines

- Platforms: All offshore, no legal protection

- Disputes: No regulatory recourse

- Taxes: Gray area reporting

Trading Digital Options:

- In most countries: Legal (gray area)

- Platforms: Mostly offshore (limited protection)

- Disputes: Limited regulatory recourse

- Taxes: Must report gains (capital gains typically)

[INTERNAL LINK: “Binary Options Legality: Complete Country-by-Country Guide 2026”]

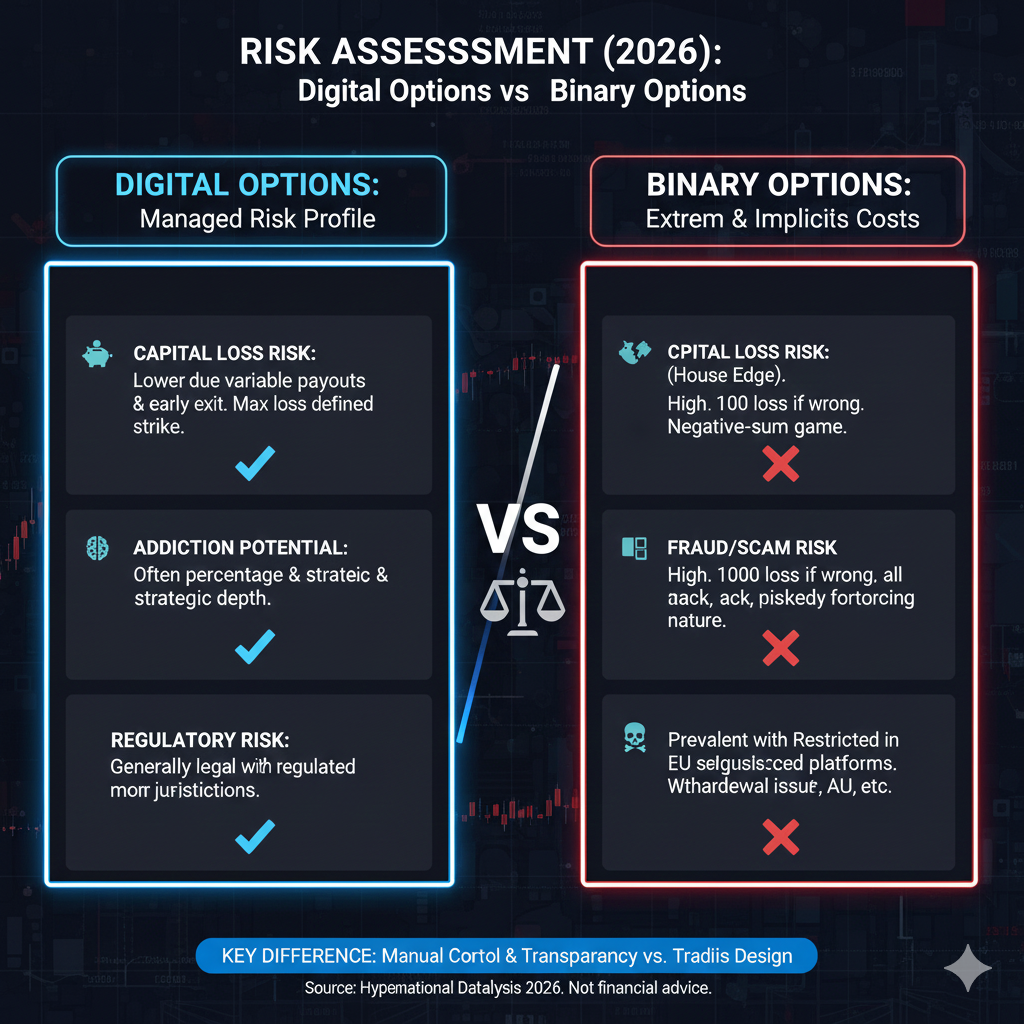

Risk Comparison: Digital vs Binary Options {#risk-comparison}

Let’s compare the risk profiles of digital options vs binary options.

Capital Loss Risk

Binary Options:

- Maximum Loss: 100% of investment per trade

- Cannot Exit: Locked in until expiry

- No Stop Loss: All-or-nothing structure

- High Frequency: Short timeframes encourage overtrading

- Typical Outcome: 74-89% of traders lose money

- Risk Level: ⚠️⚠️⚠️⚠️⚠️ EXTREME

Digital Options:

- Maximum Loss: 100% of investment per trade (same as binary)

- Can Exit Early: Limit losses if trade goes wrong

- Manual Stop Loss: Close position anytime

- Varied Timeframes: Less pressure to overtrade

- Typical Outcome: 70-80% of traders lose money (estimate)

- Risk Level: ⚠️⚠️⚠️⚠️☆ VERY HIGH

Winner: Digital options (slightly better due to exit capability)

Addiction Risk

Binary Options:

- 60-Second Trades: Extreme gambling-like structure

- Immediate Feedback: Win/lose in seconds

- Dopamine Hits: Rapid reward cycles

- Designed for Addiction: Intentional game-ification

- Psychological Hooks: Sounds, visuals, notifications

- Risk Level: ⚠️⚠️⚠️⚠️⚠️ EXTREME

Digital Options:

- Longer Timeframes: Less immediate gratification

- More Complexity: Less slot-machine-like

- Strategy Focus: Some skill component

- Less Game-ified: More professional interface

- Lower Addiction: Still present but reduced

- Risk Level: ⚠️⚠️⚠️☆☆ MODERATE-HIGH

Winner: Digital options (significantly less addictive design)

Scam Risk

Binary Options:

- Scam Prevalence: Extremely high (50%+ of platforms)

- Withdrawal Issues: Widespread across industry

- Price Manipulation: Common allegations

- Fraud Cases: Thousands documented

- No Legal Recourse: Offshore = no protection

- Risk Level: ⚠️⚠️⚠️⚠️⚠️ EXTREME

Digital Options:

- Scam Prevalence: Lower but present (20-30% estimate)

- Withdrawal Issues: Less common but exist

- Price Manipulation: Less frequent

- Fraud Cases: Some documented

- Limited Recourse: Still mostly offshore

- Risk Level: ⚠️⚠️⚠️☆☆ MODERATE-HIGH

Winner: Digital options (better industry reputation)

Regulatory Risk

Binary Options:

- Legal Status: Banned in major markets

- Platform Shutdowns: Frequent

- Account Closures: Common for residents of banned countries

- Regulatory Actions: Ongoing enforcement

- Future Outlook: More bans likely

- Risk Level: ⚠️⚠️⚠️⚠️⚠️ EXTREME

Digital Options:

- Legal Status: Gray area in most markets

- Platform Stability: More stable

- Account Safety: Less likely to be closed

- Regulatory Climate: Watchful but not hostile

- Future Outlook: May face restrictions

- Risk Level: ⚠️⚠️⚠️☆☆ MODERATE

Winner: Digital options (better legal standing)

Liquidity and Execution Risk

Binary Options:

- Liquidity: Depends entirely on broker (no real market)

- Execution: Can be manipulated by broker

- Price Feeds: Often only broker’s own pricing

- Slippage: Controlled by broker

- Transparency: Very low

- Risk Level: ⚠️⚠️⚠️⚠️☆ VERY HIGH

Digital Options:

- Liquidity: Also broker-dependent

- Execution: Similar manipulation potential

- Price Feeds: Usually from legitimate sources

- Slippage: Present but slightly better

- Transparency: Low but better than binary

- Risk Level: ⚠️⚠️⚠️⚠️☆ VERY HIGH

Winner: Digital options (marginally better transparency)

Overall Risk Verdict

Binary Options:

- Total Risk Score: 24/25 (⚠️⚠️⚠️⚠️⚠️)

- Assessment: EXTREME RISK

- Recommendation: AVOID COMPLETELY

Digital Options:

- Total Risk Score: 17/25 (⚠️⚠️⚠️☆☆)

- Assessment: HIGH RISK

- Recommendation: APPROACH WITH EXTREME CAUTION

Both carry significant risks. Digital options are better than binary options, but that’s like saying “falling from the 5th floor is better than falling from the 10th floor”—both are dangerous.

[INTERNAL LINK: “High-Risk Trading: Understanding and Managing Options Trading Risk”]

Profit Potential: Digital Options vs Binary Options

Let’s analyze the profit potential in digital options vs binary options trading.

Maximum Profit Per Trade

Binary Options:

- Fixed Payout: 80-95% typically (average 85%)

- Best Case: 95% return per winning trade

- $100 trade: Maximum $95 profit

- Doesn’t Scale: Same profit whether price moves 1 pip or 100 pips

Digital Options:

- Variable Payout: Can range from 30% to 300%+ per trade

- Small Move: 30-50% return

- Medium Move: 80-150% return

- Large Move: 200-300%+ return possible

- Scales: Larger accurate predictions = larger profits

Winner: Digital options (higher profit potential on large moves)

Break-Even Analysis

Binary Options Break-Even:

Payout: 85%

Win: +$85

Loss: -$100

Break-even win rate: 54.05%

Calculation:

Win rate needed = 1 / (1 + payout)

= 1 / (1 + 0.85)

= 54.05%

Digital Options Break-Even:

Varies by strategy and price movement

Average scenario:

Small win: +$40

Loss: -$100

Break-even: ~71% (very difficult)

But with better accuracy/larger moves:

Large win: +$150

Loss: -$100

Break-even: ~40% (more achievable)

Winner: Digital options (better break-even possible with skill)

Realistic Profit Expectations

Binary Options:

- Beginner (3 months): -100% (total loss likely)

- Intermediate (6 months): -80% (still losing)

- Advanced (1 year): -50% (less losses, but still losing)

- Expert (2+ years): -20% to +10% (very rare to be profitable)

Estimated % of Profitable Traders: <5% (and those barely profitable)

Digital Options:

- Beginner (3 months): -80% (losses but some wins)

- Intermediate (6 months): -50% (learning slowly)

- Advanced (1 year): -20% to +10% (occasionally profitable)

- Expert (2+ years): +20% to +50% (very rare, with skill and luck)

Estimated % of Profitable Traders: 10-15% (slightly better than binary)

Real-World Profit Examples

Scenario: EUR/USD Trade

Binary Options:

- Entry: 1.1000

- Prediction: UP in 5 minutes

- Investment: $100

- Payout: 85%

Case 1: Price moves to 1.1010 (+10 pips)

- Result: WIN

- Profit: $85

- ROI: 85%

Case 2: Price moves to 1.1100 (+100 pips)

- Result: WIN

- Profit: $85 (same as 10 pips!)

- ROI: 85%

Case 3: Price moves to 1.0995 (-5 pips)

- Result: LOSE

- Loss: $100

- ROI: -100%

Digital Options:

- Entry: 1.1000

- Prediction: UP in 30 minutes

- Investment: $100

- Variable Payout

Case 1: Price moves to 1.1010 (+10 pips)

- Result: SMALL WIN

- Profit: $35

- ROI: 35%

Case 2: Price moves to 1.1100 (+100 pips)

- Result: LARGE WIN

- Profit: $220

- ROI: 220%

Case 3: Price moves to 1.0995 (-5 pips)

- Result: SMALL LOSS

- Can exit early, lose $40-60

- ROI: -40% to -60%

Case 4: Exit at 1.1050 (+50 pips) after 15 minutes

- Result: EARLY EXIT WIN

- Profit: $120

- ROI: 120%

Profit Potential Verdict

Binary Options:

- ❌ Fixed profits don’t reward skill/accuracy

- ❌ Mathematical disadvantage built-in

- ❌ Tiny % of traders actually profitable

- ❌ Impossible to sustain long-term profitability

Digital Options:

- ✅ Variable profits reward accuracy

- ✅ Larger moves = larger gains

- ⚠️ Still difficult to be profitable

- ⚠️ Still only 10-15% make money

Winner: Digital options (better profit scaling, but still high difficulty)

Reality Check: Both have negative expected value for most traders. Digital options are better, but “better” doesn’t mean “good.”

[INTERNAL LINK: “Can You Make Money Trading Options? Realistic Profit Expectations”]

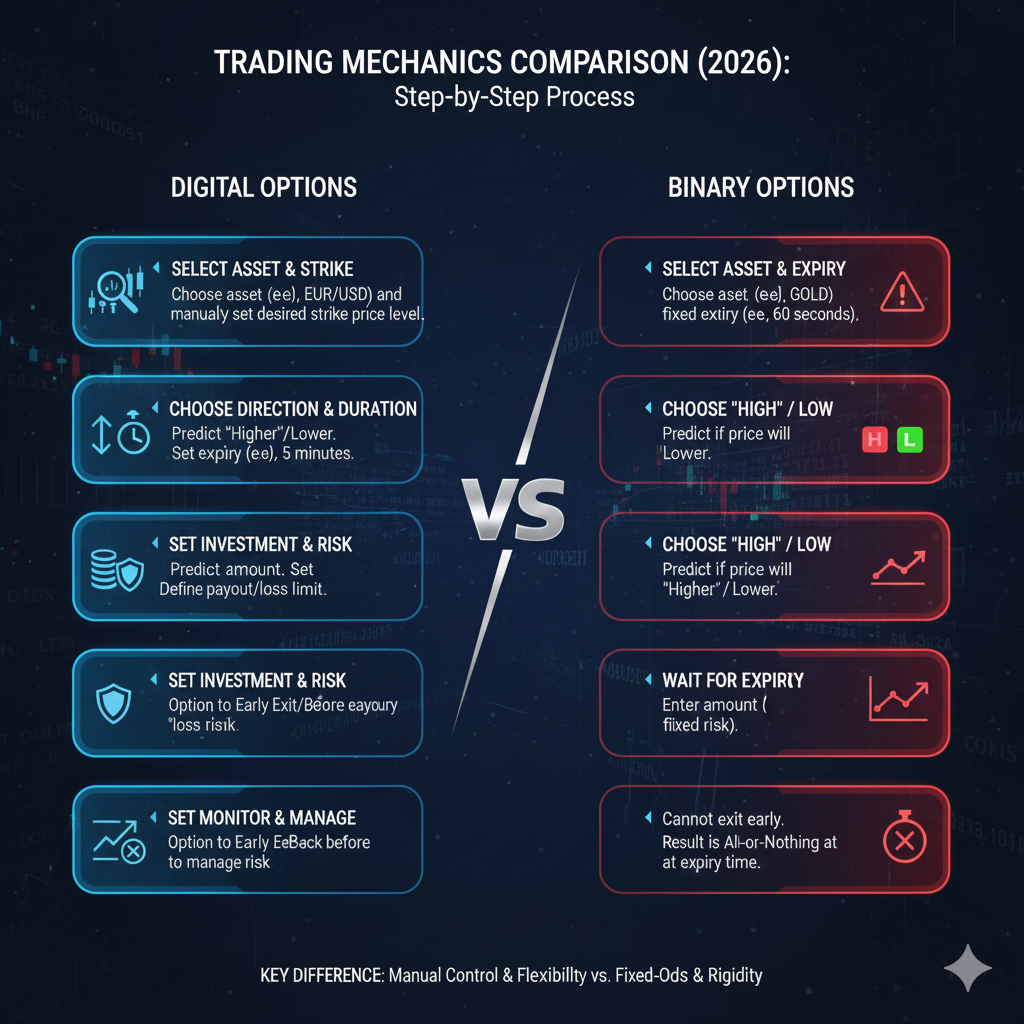

Trading Mechanics: How Each Type Works

Let’s examine the actual trading mechanics of digital options vs binary options.

Binary Options Trading Mechanics

Step 1: Choose Asset

- Select from available assets (EUR/USD, gold, stocks, etc.)

- Typically 50-100 assets available

- Asset availability depends on market hours

Step 2: Select Expiry Time

- Choose when trade will end

- Options: 60 seconds, 5 min, 15 min, 30 min, 1 hour, etc.

- Cannot change once selected

Step 3: Choose Direction

- CALL (Higher): Predicting price will go up

- PUT (Lower): Predicting price will go down

- Binary choice—one or the other

Step 4: Set Investment Amount

- Choose how much to risk

- Typical minimum: $1-10

- Typical maximum: $1,000-5,000

Step 5: Place Trade

- Click “Buy” or “Trade Now”

- Trade is locked in

- Cannot exit or modify

Step 6: Wait for Expiry

- Watch price movement (but cannot act)

- No control once trade placed

- Automatic settlement at expiry

Step 7: Outcome

- If correct: Receive investment + profit (e.g., $185 on $100 trade)

- If wrong: Lose entire investment ($0)

- No middle ground

Digital Options Trading Mechanics

Step 1: Choose Asset

- Select from available assets

- Similar selection to binary options

- Market hours apply

Step 2: Set Strike Price

- Choose target price level

- Multiple strike prices available

- Closer to current price = lower profit potential, higher probability

- Further from current price = higher profit potential, lower probability

Step 3: Select Expiry Time

- Choose trade duration

- Options: 5 min to weeks

- Generally longer timeframes than binary options

Step 4: Choose Direction

- HIGHER: Predicting price above strike at expiry

- LOWER: Predicting price below strike at expiry

- Similar to binary options

Step 5: Set Investment Amount

- Choose risk amount

- Minimum: $1-10 typically

- Maximum: Varies by platform

Step 6: Place Trade

- Click “Buy” or “Open Position”

- Trade is active but can be closed

Step 7: Monitor Position

- Watch price movement

- See real-time P&L

- Can exit anytime before expiry

Step 8: Decision Point

- Continue holding until expiry, OR

- Exit early to take profit/cut loss

- Trader has control

Step 9: Outcome

- If held to expiry:

- Correct: Variable profit based on how far price moved

- Wrong: Loss (possibly with small rebate)

- If exited early:

- Current P&L realized

- Risk reduced

Key Mechanical Differences

| Aspect | Binary Options | Digital Options |

|---|---|---|

| Strike Price | Automatic (current price) | Chosen by trader |

| Exit Control | None | Full |

| Profit Calculation | Fixed at open | Variable, shown live |

| Position Modification | Impossible | Can close early |

| Risk Management | None | Manual (exit early) |

| Complexity | Very simple | Slightly more complex |

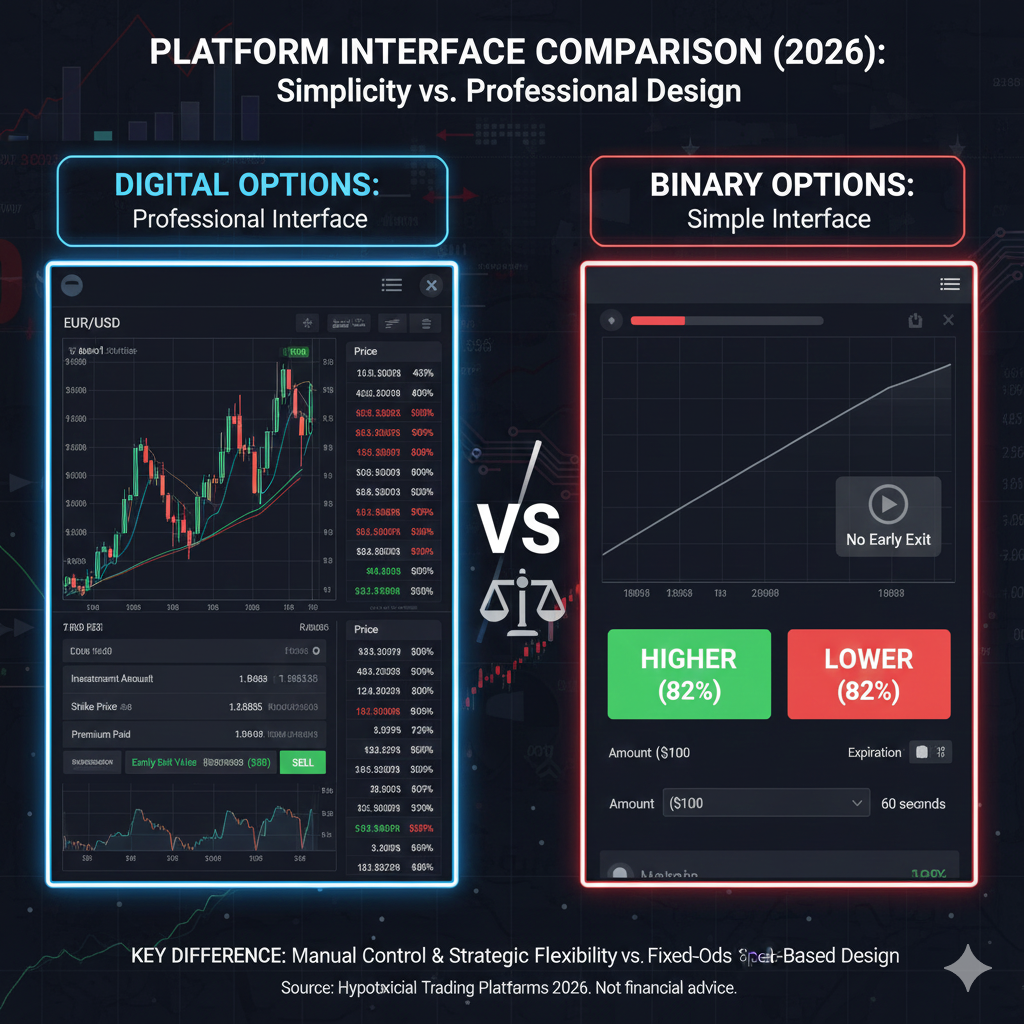

Trading Interface Comparison

Binary Options Platform:

- Very simple interface

- Large “HIGHER” / “LOWER” buttons

- Timer countdown prominent

- Game-like appearance

- Minimal information displayed

Digital Options Platform:

- More professional interface

- Strike price selector

- P&L shown in real-time

- Close position button available

- More trading information

Order Types Available

Binary Options:

- Only type: Simple HIGHER/LOWER

- No variations

- No advanced orders

- No hedging options

Digital Options:

- Primary: HIGHER/LOWER with strike selection

- Some platforms offer:

- One Touch (reach target price)

- No Touch (don’t reach target)

- Range (stay within boundaries)

- Boundary (break out of range)

Winner: Digital options (more variety and sophistication)

Real Examples: Digital Options vs Binary Options Trades

Let’s examine real-world trading examples comparing digital options vs binary options.

![examples with charts and outcomes for both types] Alt Text: Real trading examples comparing binary options vs digital options trades with actual price charts and results](https://forex-brokers.me/wp-content/uploads/2026/01/Gemini_Generated_Image_5xkenp5xkenp5xke.png)

Example 1: Profitable Trade

Scenario: EUR/USD at 1.1000, expecting upward move

Binary Options Trade:

- Asset: EUR/USD

- Entry: 1.1000

- Direction: HIGHER (Call)

- Investment: $100

- Expiry: 15 minutes

- Payout: 85%

Outcome:

- Price at expiry: 1.1035 (+35 pips)

- Result: WIN ✅

- Profit: $85

- Total received: $185

- ROI: 85%

Digital Options Trade:

- Asset: EUR/USD

- Entry: 1.1000

- Strike: 1.1000

- Direction: HIGHER

- Investment: $100

- Expiry: 30 minutes

Outcome:

- Price at 15 minutes: 1.1025 (+25 pips)

- Current P&L: +$65

- Decision: Hold or exit?

- Held to expiry

- Price at expiry: 1.1045 (+45 pips)

- Result: MEDIUM WIN ✅

- Profit: $135

- Total received: $235

- ROI: 135%

Comparison:

- Binary options: $85 profit

- Digital options: $135 profit

- Digital wins by $50 (59% more profit)

Analysis: Digital options rewarded the larger price movement more. Binary options paid same amount whether price moved 1 pip or 100 pips.

Example 2: Losing Trade

Scenario: GBP/USD at 1.2500, expecting downward move (but wrong)

Binary Options Trade:

- Asset: GBP/USD

- Entry: 1.2500

- Direction: LOWER (Put)

- Investment: $100

- Expiry: 5 minutes

- Payout: 85%

Outcome:

- Price at expiry: 1.2505 (+5 pips—wrong direction!)

- Result: LOSE ❌

- Loss: $100

- Total received: $0

- ROI: -100%

Digital Options Trade:

- Asset: GBP/USD

- Entry: 1.2500

- Strike: 1.2500

- Direction: LOWER

- Investment: $100

- Expiry: 15 minutes

Outcome:

- Price at 3 minutes: 1.2510 (+10 pips—wrong way!)

- Current P&L: -$35

- Decision: Exit early to cut loss? OR wait and hope?

- Smart move: EXIT EARLY

- Closed position at 1.2508

- Result: EARLY EXIT LOSS ❌

- Loss: $40

- Total received: $60

- ROI: -40%

Comparison:

- Binary options: -$100 loss

- Digital options: -$40 loss (exited early)

- Digital saves $60 (60% less loss)

Analysis: Digital options allowed trader to cut loss early when trade went wrong. Binary options forced 100% loss despite small adverse move.

Example 3: Volatile Market

Scenario: Bitcoin/USD at $45,000, high volatility expected

Binary Options Trade:

- Asset: BTC/USD

- Entry: $45,000

- Direction: HIGHER

- Investment: $200

- Expiry: 1 hour

- Payout: 90%

Outcome:

- Price at 15 min: $46,000 (+$1,000—winning!)

- Price at 30 min: $47,000 (+$2,000—still winning!)

- Price at 45 min: $44,500 (-$500—now losing!)

- Price at expiry: $44,800 (-$200—lost!)

- Result: LOSE ❌ (despite being up +$2,000 at one point)

- Loss: $200

- Total received: $0

- ROI: -100%

Digital Options Trade:

- Asset: BTC/USD

- Entry: $45,000

- Strike: $45,000

- Direction: HIGHER

- Investment: $200

- Expiry: 1 hour

Outcome:

- Price at 15 min: $46,000 (+$1,000)

- Current P&L: +$160

- Price at 30 min: $47,000 (+$2,000!)

- Current P&L: +$340 (great profit!)

- Decision: Take profit now or wait for expiry?

- Smart move: EXIT at $47,000 and lock in profit

- Result: EARLY EXIT WIN ✅

- Profit: $340

- Total received: $540

- ROI: 170%

Comparison:

- Binary options: -$200 loss (price reversed before expiry)

- Digital options: +$340 profit (exited at optimal time)

- Digital wins by $540 difference

Analysis: This example showcases the critical difference. Binary options forced trader to hold through reversal and lose everything. Digital options allowed profit-taking at optimal moment.

Example 4: News Event

Scenario: NFP (Non-Farm Payrolls) data release, USD/JPY at 150.00

Binary Options Trade:

- Asset: USD/JPY

- Entry: 150.00

- Direction: HIGHER

- Investment: $50

- Expiry: 30 minutes

- Payout: 85%

Outcome:

- News released: Strong data (good for USD)

- Initial spike: 150.00 → 150.80 (+80 pips—winning!)

- But then: Profit-taking and reversal

- Price at expiry: 149.90 (-10 pips—lost by 10 pips!)

- Result: LOSE ❌

- Loss: $50

- ROI: -100%

Digital Options Trade:

- Asset: USD/JPY

- Entry: 150.00

- Strike: 150.00

- Direction: HIGHER

- Investment: $50

- Expiry: 1 hour

Outcome:

- News released: Strong data

- Initial spike: 150.00 → 150.80 (+80 pips)

- Current P&L: +$95 (190% profit!)

- Decision: Exit immediately on spike or hold?

- Smart move: EXIT at 150.75 before reversal

- Result: EARLY EXIT WIN ✅

- Profit: $92

- ROI: 184%

Comparison:

- Binary options: -$50 loss (reversal before expiry killed trade)

- Digital options: +$92 profit (exited on spike)

- Digital wins by $142 difference

Analysis: News trading with binary options is extremely risky—one reversal and you lose everything. Digital options allow capitalizing on initial move before reversal.

Summary of Real Examples

Binary Options Results:

- Example 1: +$85

- Example 2: -$100

- Example 3: -$200

- Example 4: -$50

- Total: -$265 (net loss)

Digital Options Results:

- Example 1: +$135

- Example 2: -$40 (loss cut early)

- Example 3: +$340 (profit taken early)

- Example 4: +$92 (spike captured)

- Total: +$527 (net profit)

Difference: $792 better performance with digital options across identical scenarios, primarily due to early exit capability.

[INTERNAL LINK: “Binary Options Trading Strategy: Why Most Strategies Fail”]

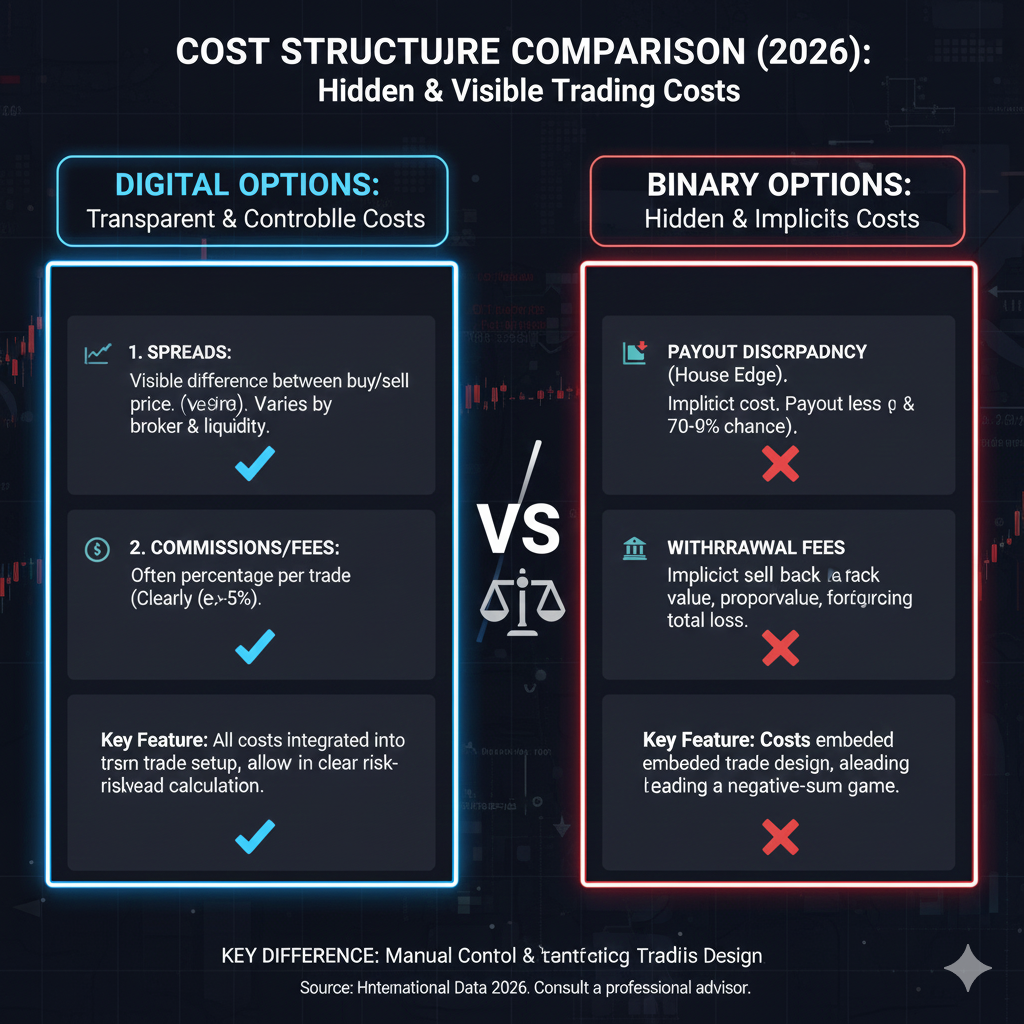

Cost Structure: Fees and Spreads Comparison

Understanding the cost structure is essential in the digital options vs binary options comparison.

Binary Options Costs

Visible Costs:

- Trading Commission: $0 (no explicit commission)

- Platform Fee: $0 (seemingly free)

- Withdrawal Fee: Varies (often 2% or $10+)

Hidden Costs (The Real Costs):

1. House Edge (Built into Payout):

Investment: $100

Payout: 85% if correct

Loss: 100% if wrong

House edge calculation:

Expected value = (0.5 × $85) - (0.5 × $100)

= $42.50 - $50

= -$7.50 per trade (assuming 50/50 odds)

House edge = 7.5%

2. Spread (Bid-Ask Difference):

- Binary options have invisible spread in pricing

- Broker’s price may differ from true market price by 1-3%

- Estimated cost: 1-3% per trade

3. Bonus Turnover Requirements:

- Accept bonus = must trade 30-40x volume

- Example: $50 bonus = must trade $1,500-2,000 volume

- This forces overtrading = more losses

Total Effective Cost (Binary Options):

- House edge: 7.5%

- Spread: 1-3%

- Total: 8.5-10.5% per trade (hidden in structure)

Digital Options Costs

Visible Costs:

- Trading Commission: $0 (typically)

- Platform Fee: $0

- Withdrawal Fee: Varies (2% or $10+ after first monthly withdrawal)

Hidden Costs:

1. Spread (Bid-Ask):

- Digital options have spread in pricing

- Typically 1-2% on entry

- Can be verified against external price feeds

2. Variable Payout Means Variable Cost:

- Smaller moves = lower payout (broker keeps difference)

- Larger moves = higher payout (but still house edge)

- Estimated spread cost: 2-4% per trade

3. Early Exit Cost:

- Exiting before expiry incurs additional spread

- Broker may charge 1-2% to close position

- This is the cost of risk management

Total Effective Cost (Digital Options):

- Spread: 2-4%

- Early exit (if used): +1-2%

- Total: 3-6% per trade (better than binary)

Inactivity and Other Fees

Both Types:

- Inactivity Fee: Typically $10/month after 30 days of no trading

- Currency Conversion: 0.5-2% if depositing/withdrawing in different currency

- Deposit Fees: Usually $0, but payment processor may charge

- Withdrawal Fees: $0 for first monthly withdrawal, then 2%+

Cost Comparison Table

| Cost Type | Binary Options | Digital Options | Winner |

|---|---|---|---|

| Explicit Commission | $0 | $0 | Tie |

| House Edge | 7.5% | N/A | Digital |

| Spread Cost | 1-3% | 2-4% | Binary |

| Total Hidden Cost | 8.5-10.5% | 3-6% | Digital |

| Withdrawal Fee | 2%+ | 2%+ | Tie |

| Inactivity Fee | $10/mo | $10/mo | Tie |

Break-Even Requirement With Costs

Binary Options:

Payout: 85%

Win rate needed (no costs): 54.05%

With costs (10% total): Need 58-60% win rate

Conclusion: Nearly impossible to break even

Digital Options:

Average payout: Variable (40-150%)

With costs (5% total): Need 52-55% win rate (achievable on larger moves)

Conclusion: Difficult but more realistic than binary

Cost Verdict

Binary Options:

- ❌ Highest hidden costs (8.5-10.5%)

- ❌ House edge built into payout

- ❌ Nearly impossible to overcome costs

- ❌ Break-even requires 58-60% win rate

Digital Options:

- ✅ Lower hidden costs (3-6%)

- ✅ No fixed house edge (profit scales)

- ⚠️ Still difficult to overcome costs

- ⚠️ Break-even requires 52-55% win rate

Winner: Digital options (significantly lower total costs)

[INTERNAL LINK: “Hidden Forex Broker Costs: What They Don’t Tell You About Spreads”]

Which Is Better: Digital Options or Binary Options?

After comprehensive analysis, let’s definitively answer: Which is better—digital options or binary options?

Overall Comparison Scorecard

| Category | Binary Options | Digital Options | Winner |

|---|---|---|---|

| Payout Structure | Fixed (poor) | Variable (better) | Digital ✅ |

| Early Exit | ❌ No | ✅ Yes | Digital ✅ |

| Risk Management | ❌ None | ✅ Some | Digital ✅ |

| Profit Potential | Limited | Higher | Digital ✅ |

| Costs | Very High (10.5%) | High (6%) | Digital ✅ |

| Legality | Banned widely | Legal more | Digital ✅ |

| Regulation | Offshore only | Offshore mostly | Digital ✅ |

| Scam Risk | Extreme | High | Digital ✅ |

| Professional Use | None | Minimal | Digital ✅ |

| Learning Curve | Too simple | Appropriate | Digital ✅ |

| Addiction Risk | Extreme | Moderate | Digital ✅ |

| Platform Quality | Game-like | Professional | Digital ✅ |

| Transparency | Very Low | Low | Digital ✅ |

| Industry Reputation | Terrible | Poor | Digital ✅ |

| Long-term Viability | None (banned) | Uncertain | Digital ✅ |

Score: Digital Options 15, Binary Options 0

Clear Winner: Digital Options

Digital options are objectively better than binary options in every measurable category. The key advantages:

- ✅ Exit capability = risk management possible

- ✅ Variable payouts = rewards skill/accuracy

- ✅ Legal in more places = less regulatory risk

- ✅ Lower costs = better break-even odds

- ✅ Less scams = better industry reputation

- ✅ Professional use = some legitimacy

- ✅ Not banned = can actually access

BUT… (Important Caveat)

While digital options are better than binary options, this is like saying “being shot in the foot is better than being shot in the chest.”

Both are still:

- ❌ High-risk speculation

- ❌ Mostly offshore regulated

- ❌ Difficult to profit from long-term

- ❌ Not suitable for most retail traders

- ❌ Inferior to regulated forex/stock trading

The Realistic Recommendation

If you MUST choose between digital options vs binary options: Choose digital options (significantly better)

Better recommendation: Avoid both and trade with regulated forex/CFD brokers (Pepperstone, IC Markets, eToro, etc.)

When Digital Options Might Be Acceptable

Digital options could be considered only if:

- ✅ You’re in a country where they’re legal

- ✅ You’ve exhausted all educational resources

- ✅ You’re using a demo account to test

- ✅ You risk only $50-100 you can afford to lose 100%

- ✅ You never accept bonuses

- ✅ You treat it as high-risk speculation, not investing

- ✅ You have experience with other trading instruments

- ✅ You understand the odds are against you

Even then, regulated forex/CFD trading is still better.

When Binary Options Might Be… (Never)

Binary options should be avoided under ALL circumstances:

- ❌ They’re banned in major markets (illegal for many readers)

- ❌ The highest costs and risks

- ❌ Designed to be addictive

- ❌ No professional use case

- ❌ Zero legitimate purpose

There is no scenario where binary options are the right choice.

[INTERNAL LINK: “Forex vs Options Trading: Which is Better for Beginners?”]

Safer Alternatives to Both Digital and Binary Options

Instead of digital options or binary options, consider these better alternatives:

1. Regulated Forex Trading

Best Brokers:

- Pepperstone (ASIC, FCA regulated)

- IC Markets (ASIC, CySEC regulated)

- OANDA (CFTC regulated – US)

Advantages over Digital/Binary Options:

- ✅ Tier-1 regulation (FCA/ASIC)

- ✅ Client fund protection

- ✅ Full risk management (stop loss, take profit)

- ✅ Can exit anytime

- ✅ No house edge

- ✅ Fair pricing (interbank)

- ✅ Professional trading tool

Who it’s for: Anyone wanting currency trading with proper protection

2. Stock CFD Trading

Best Platforms:

- eToro (FCA, ASIC regulated – social trading)

- Interactive Brokers (SEC regulated – professional)

- Trading 212 (FCA regulated – beginners)

Advantages:

- ✅ Trade real stocks or CFDs

- ✅ Full regulation

- ✅ Risk management tools

- ✅ Company fundamentals analyzable

- ✅ No binary all-or-nothing

Who it’s for: Those wanting stock market exposure with flexibility

3. Traditional Stock Options (Not Binary/Digital)

Best Platforms:

- Interactive Brokers (full options chain)

- Tastyworks (options-focused)

- TD Ameritrade (educational resources)

Advantages:

- ✅ Real exchange-traded options

- ✅ Full regulation (SEC/CFTC)

- ✅ True options strategies (spreads, straddles, etc.)

- ✅ Professional trading tool

- ✅ Risk management capabilities

Who it’s for: Experienced traders wanting sophisticated options strategies

4. Cryptocurrency Trading

Best Exchanges:

- Coinbase (Regulated, beginner-friendly)

- Kraken (Regulated, advanced features)

- Binance (High liquidity, many coins)

Advantages:

- ✅ Ownership of actual asset

- ✅ Can hold long-term

- ✅ Potentially high volatility (for traders)

- ✅ Emerging asset class

- ✅ No broker risk (self-custody possible)

Who it’s for: Those comfortable with crypto volatility and tech

5. Index Funds / ETFs (Long-term)

Best Platforms:

- Vanguard (Low-cost index funds)

- Fidelity (Zero-fee index funds)

- Charles Schwab (Broad selection)

Advantages:

- ✅ Lowest risk option here

- ✅ Long-term wealth building

- ✅ Diversification built-in

- ✅ Minimal time required

- ✅ Proven historical returns (~10%/year)

Who it’s for: Most people (seriously, this is the best choice for 95% of people)

Comparison: Alternatives vs Digital/Binary Options

| Feature | Digital Options | Binary Options | Forex (Regulated) | Stock Options | Index Funds |

|---|---|---|---|---|---|

| Regulation | Offshore | Offshore | Tier-1 ✅ | Tier-1 ✅ | Tier-1 ✅ |

| Fund Protection | None | None | £85K+ ✅ | SIPC ✅ | SIPC ✅ |

| Risk Management | Limited | None | Full ✅ | Full ✅ | Low Risk ✅ |

| Profitability | Very Difficult | Nearly Impossible | Difficult | Difficult | Proven ✅ |

| Suitable for Beginners | ❌ | ❌ | ⚠️ | ❌ | ✅ |

| Long-term Viable | ⚠️ | ❌ | ✅ | ✅ | ✅ |

Recommendation Priority

Priority 1 (Best): Index Funds / ETFs for long-term wealth building Priority 2: Regulated Forex with proper broker (Pepperstone, IC Markets) Priority 3: Stock trading (real shares or CFDs) via regulated broker Priority 4: Cryptocurrency (if you understand the risks) Priority 5: Traditional options (if experienced) Priority 6: Digital options (only if you ignore all above) Priority 7: Binary options (NEVER—they’re banned for a reason)

[INTERNAL LINK: “Best Forex Brokers 2026: Complete Guide to Regulated Trading”]

FAQs: Digital Options vs Binary Options

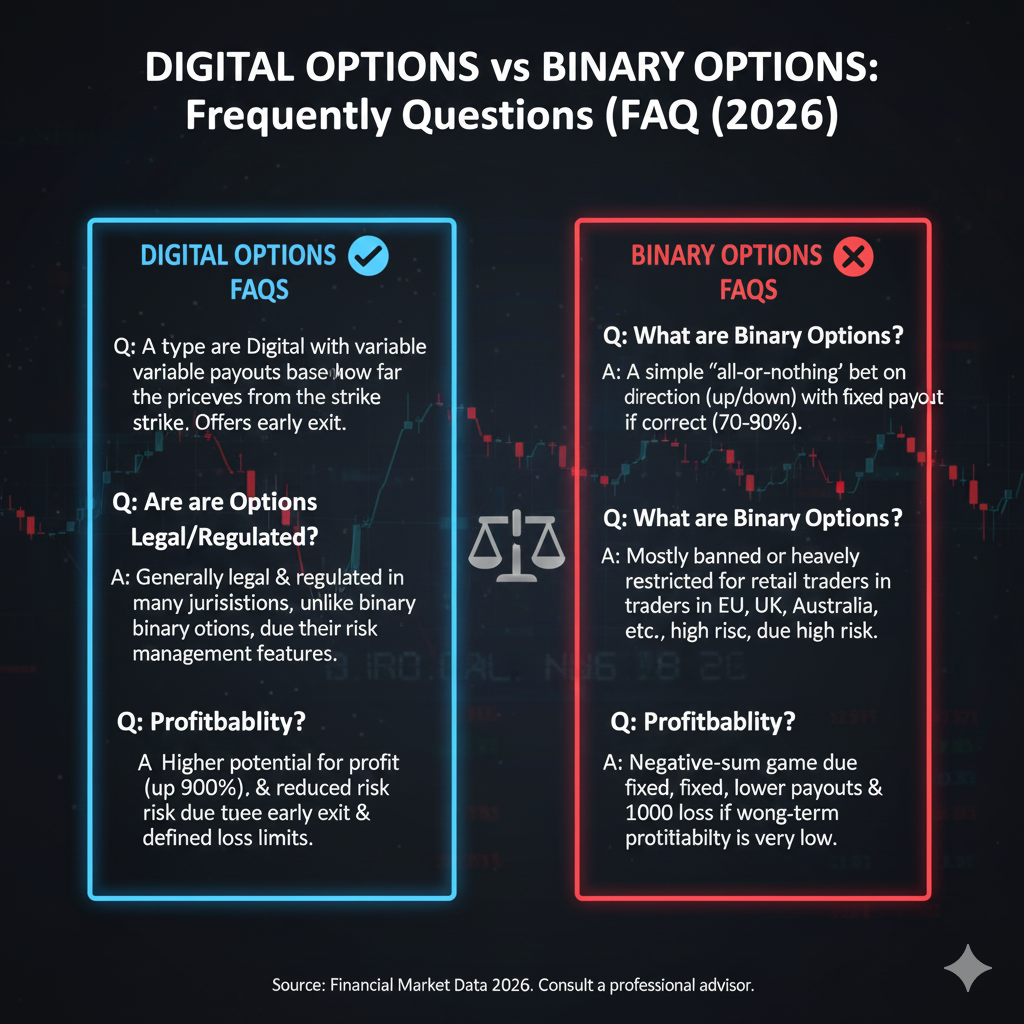

What is the main difference between digital options and binary options?

The main difference between digital and binary options is payout structure and exit capability. Binary options offer fixed payouts (e.g., 80%) with no ability to exit before expiry—it’s all-or-nothing. Digital options offer variable payouts that scale with price movement and allow early exit. Digital options also have flexible strike prices, while binary options use the current price. This makes digital options significantly more flexible and less gambling-like than binary options.

Are digital options the same as binary options?

No, digital options are NOT the same as binary options, despite common confusion. While both are exotic options derivatives, key differences include:

- Binary options: Fixed payout, no early exit, all-or-nothing, banned in most developed countries

- Digital options: Variable payout, can exit early, profit scales with movement, legal in more jurisdictions

Many brokers and articles incorrectly use these terms interchangeably, causing confusion. In the digital options vs binary options comparison, digital options are clearly superior.

Which is better: digital options or binary options?

Digital options are objectively better than binary options in every measurable way:

- ✅ Early exit capability (risk management)

- ✅ Variable payouts (rewards accuracy)

- ✅ Legal in more countries

- ✅ Lower costs (6% vs 10.5%)

- ✅ Better industry reputation

- ✅ Not banned by major regulators

However, both are still high-risk and inferior to regulated forex/stock trading. If choosing between the two, choose digital options. But better yet, choose regulated alternatives like Pepperstone or IC Markets.

Are binary options banned?

Yes, binary options are banned in most developed countries:

- ❌ EU: Banned by ESMA (2018, permanent)

- ❌ UK: Banned by FCA (2019, permanent)

- ❌ Australia: Banned by ASIC (2021)

- ❌ Canada: Effectively banned

- ❌ USA: Restricted to NADEX only (CFTC-regulated)

Binary options are only available through offshore brokers in countries without strong financial regulation. This is a major red flag. Digital options are NOT banned in most places, giving them a significant advantage in the digital options vs binary options comparison.

Are digital options legal?

Digital options are legal in most countries because they haven’t been explicitly banned like binary options. They exist in a regulatory gray area:

- ✅ Legal: Most countries (not explicitly prohibited)

- ⚠️ Gray area: No specific regulation in many jurisdictions

- ⚠️ Offshore regulated: Most platforms (VFSC, etc.)

- ❌ Some restrictions: A few countries include them in binary options bans

Always check your local regulations before digital options trading. While more legal than binary options, they’re still mostly offered by offshore brokers with weak regulation.

Can you make money with binary options?

Realistically, NO—you cannot make money with binary options long-term. Statistics show:

- 74-89% of traders lose money (regulatory studies)

- Mathematical house edge (need 54%+ win rate just to break even)

- Fixed payouts don’t reward skill

- No risk management tools

- Short timeframes (60 seconds) make analysis impossible

Less than 5% of binary options traders are profitable, and even those barely break even. The structure is designed for trader losses—that’s why they’re banned. Digital options have slightly better odds (10-15% profitable) but are still difficult.

Can you make money with digital options?

Digital options are slightly less difficult than binary options, but still very challenging:

- Estimated 10-15% of traders profitable (better than binary’s 5%)

- Variable payouts can reward skill and accuracy

- Early exit allows risk management

- Longer timeframes permit some analysis

However, making consistent money is still unlikely. The offshore regulation, costs (3-6% per trade), and inherent difficulties mean most traders lose. Digital options trading should be treated as high-risk speculation, not a reliable income source.

Why are binary options banned but not digital options?

Binary options were banned by regulators (ESMA, FCA, ASIC) due to:

- Extreme consumer losses (74-89% of traders)

- Gambling-like characteristics (60-second trades)

- No risk management (all-or-nothing structure)

- Widespread fraud in the industry

- No legitimate economic purpose

Digital options haven’t been banned because:

- Early exit capability = some risk management

- Variable payouts = less gambling-like

- Better industry reputation (fewer scams)

- Some institutional use cases exist

- Not explicitly targeted by regulators (yet)

However, digital options are still high-risk and mostly offshore regulated. They’re better than binary options, but that’s a low bar.

What broker offers digital options?

Digital options brokers include:

- ExpertOption (VFSC regulated)

- IQ Option (CySEC – limited)

- Deriv (FSC Labuan, Vanuatu)

- Some traditional brokers offer digital options as exotic products

Warning: Most digital options platforms are offshore regulated (VFSC, FSC, etc.), offering minimal client protection. Better alternatives:

- Pepperstone (ASIC/FCA – regulated forex)

- IC Markets (ASIC – regulated CFDs)

- eToro (FCA/ASIC – stocks, crypto, forex)

Prioritize tier-1 regulated brokers over offshore digital options platforms.

Is trading digital options gambling?

Digital options walk the line between trading and gambling:

Arguments it’s gambling:

- High risk, high volatility

- Short timeframes limit analysis

- Most traders lose money

- Some addictive qualities

- Offshore regulation

Arguments it’s trading:

- Early exit = risk management

- Variable payouts = skill rewarded

- Some professional use

- Technical analysis applicable

- Can be approached strategically

Verdict: Digital options are sophisticated speculation—better than binary options (pure gambling) but worse than regulated forex/stocks (legitimate trading). Treat digital options trading as high-risk speculation requiring skill, not gambling or investment.

How are digital options taxed?

Digital options taxation depends on your country:

USA:

- Likely treated as capital gains

- Short-term (<1 year): Ordinary income rates (up to 37%)

- Long-term (>1 year): Capital gains rates (0-20%)

- Report on Schedule D

UK:

- Spread betting: Tax-free (if qualified)

- CFDs/options: Capital Gains Tax (£6,000 allowance, then 10-20%)

EU:

- Varies by country

- Generally capital gains (15-30%)

- Some countries have favorable trader tax status

Australia:

- Capital Gains Tax (50% discount if held >12 months)

- Day traders may be taxed as business income

Consult a tax professional familiar with digital options trading in your jurisdiction. Keep detailed records of all trades.

What’s the minimum deposit for digital options?

Digital options minimum deposit varies by broker:

- ExpertOption: $10 minimum

- IQ Option: $10 minimum

- Deriv: $5 minimum

- Others: $10-50 typically

Low minimum deposits make digital options accessible, but don’t confuse accessibility with safety. Even $10 can be lost in seconds. Start with:

- Demo account first (free, risk-free practice)

- Minimum deposit only after extensive practice

- Never deposit more than you can afford to lose 100%

Better alternatives like Pepperstone ($0 minimum) or XM ($5 minimum) offer regulated forex trading with similar or lower minimums.

Conclusion: Making the Right Choice

After this comprehensive digital options vs binary options comparison, let’s summarize the key takeaways.

The Clear Verdict: Digital Options vs Binary Options

Winner: Digital Options (by significant margin)

Digital options are superior to binary options across every category:

- ✅ Early exit capability

- ✅ Variable payouts

- ✅ Better legality

- ✅ Lower costs

- ✅ Risk management possible

- ✅ Professional credibility

- ✅ Not banned worldwide

Binary options are:

- ❌ Banned in most developed countries

- ❌ All-or-nothing structure (no risk management)

- ❌ Fixed payouts (don’t reward skill)

- ❌ Gambling-like characteristics

- ❌ Highest costs and worst odds

If forced to choose, choose digital options—but…

The Better Recommendation

BOTH digital options and binary options are inferior to regulated forex/CFD/stock trading.

Instead of digital options vs binary options, choose:

Priority 1: Regulated Forex Brokers

- Pepperstone (ASIC/FCA regulated)

- IC Markets (ASIC regulated)

- OANDA (CFTC regulated – US)

- Benefit: Tier-1 regulation, fund protection, full risk management

Priority 2: Stock/CFD Trading Platforms

- eToro (FCA/ASIC – social trading)

- Interactive Brokers (SEC regulated)

- Benefit: Real ownership or regulated CFDs, comprehensive tools

Priority 3: Index Funds (For Most People)

- Vanguard, Fidelity, Schwab

- Benefit: Long-term wealth building with proven returns

When Digital Options Might Be Acceptable

Digital options trading could be considered ONLY if:

- ✅ You’re in a country where they’re legal

- ✅ You’ve tried demo accounts extensively

- ✅ You understand you’ll likely lose money

- ✅ You risk only $50-100 you can completely afford to lose

- ✅ You NEVER accept bonuses

- ✅ You have prior trading experience

- ✅ You treat it as high-risk speculation

- ✅ You’re doing it for learning, not profit

Even then, regulated alternatives are better choices.

When Binary Options Are Acceptable

Never. Under no circumstances should you trade binary options.

They’re:

- Banned for consumer protection reasons

- Mathematically designed for you to lose

- Illegal in most developed countries

- Surrounded by scams and fraud

- Have no legitimate use case

Final Thoughts

The digital options vs binary options comparison reveals that while digital options are clearly superior, neither should be your first choice for trading.

The uncomfortable truth: The forex/CFD/options trading industry has a long history of complex products that benefit brokers more than traders. Both digital options and binary options fall into this category.

For serious wealth building: Choose regulated brokers with tier-1 oversight (FCA, ASIC, CFTC), full risk management tools, transparent pricing, and client fund protection.

For speculation: If you insist on options trading, choose digital options over binary options (significantly better), but understand the odds are still against you.

For most people: Low-cost index funds and long-term investing beat 90% of active traders. The boring approach usually wins.