EUR/USD Forecast 2026: Will We See Parity Again or Rally to 1.22?

EUR/USD, the world’s most traded currency pair, stands at a critical juncture as we navigate through 2026. After years of volatility, including the dramatic fall to parity in 2022 and subsequent recovery, traders worldwide are asking: What’s next for the euro against the dollar? Will we see another test of parity (1.0000), or could EUR/USD rally toward 1.2200?

In this comprehensive forecast, we’ll analyze the fundamental drivers, technical outlook, central bank policies, geopolitical factors, and expert predictions to help you understand where EUR/USD might be headed in 2026. Whether you’re a day trader, swing trader, or long-term investor, this analysis will provide the insights you need to position yourself appropriately.

Important Disclaimer: This is analysis and educational content, not financial advice. Forex trading involves substantial risk. All forecasts are inherently uncertain and based on current information that may change. Always conduct your own research and manage risk appropriately.

EUR/USD: Current State of Play (January 2026)

Where We Are Now

Current Price Range: 1.0400 – 1.0650 (as of January 2026) 52-Week Range: 1.0350 – 1.1150 Average Daily Range: 70-90 pips Key Support: 1.0350 (2025 low), 1.0000 (psychological/parity) Key Resistance: 1.0850, 1.1000 (psychological), 1.1150 (2025 high)

Recent Price Action Context

2022: EUR/USD fell to parity (1.0000) for first time in 20 years

- Energy crisis in Europe

- Aggressive Fed rate hikes

- Strong dollar dominance

2023: Recovery rally to 1.1150

- Peak Fed rates reached

- ECB continuing rate hikes

- Energy crisis easing

2024: Consolidation and volatility

- Range-bound between 1.05-1.11

- Central banks holding rates elevated

- Geopolitical tensions ongoing

2025: Gradual weakening pressure

- Fed maintaining higher-for-longer stance

- ECB considering rate cuts amid growth concerns

- Eurozone manufacturing weakness

2026 Setup: EUR/USD faces critical decision point between two scenarios.

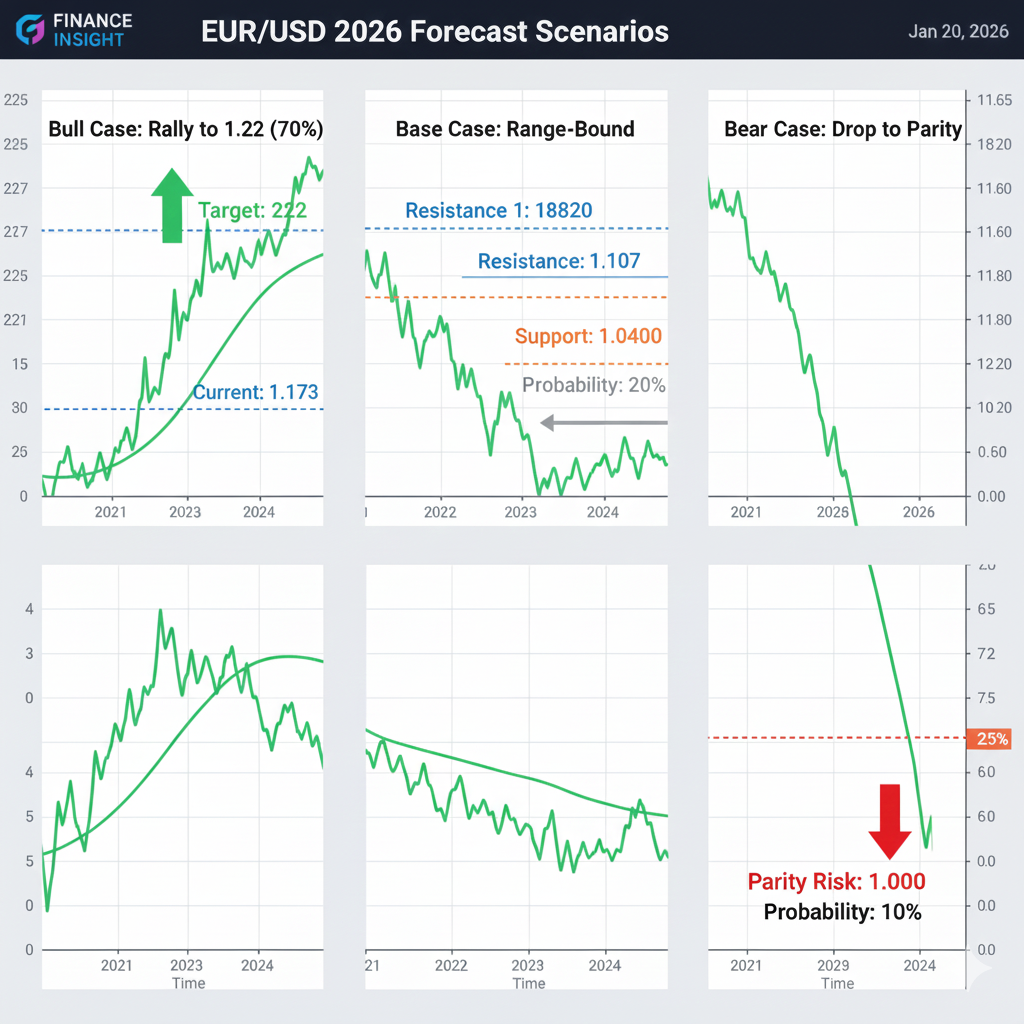

The Bull Case: Rally to 1.2200

Let’s examine the fundamental and technical factors that could drive EUR/USD to 1.2200 (approximately 15% gain from current levels).

Fundamental Drivers for Strength

1. Federal Reserve Pivot to Rate Cuts

The Scenario:

- US inflation falls to 2% target by Q2 2026

- Fed begins cutting rates (3-4 cuts of 25bps each)

- Market prices in dovish Fed through 2027

- Real yields on US Treasuries decline

Impact on EUR/USD:

- Interest rate differential narrows (supports EUR)

- Dollar loses yield advantage

- Capital flows shift toward Europe

- Historical precedent: When Fed cuts, EUR/USD typically rallies

Probability Assessment: 40% (Fed has signaled reluctance to cut quickly)

2. Eurozone Economic Recovery

The Scenario:

- Manufacturing sector rebounds (PMI > 50)

- Germany exits technical recession

- Consumer spending strengthens

- Fiscal stimulus programs boost growth

- Energy prices remain stable/low

Impact on EUR/USD:

- Improved growth outlook supports euro

- ECB maintains rates longer than expected

- Foreign investment into European assets increases

- Risk-on sentiment benefits EUR

Probability Assessment: 35% (Structural issues remain challenging)

3. ECB Maintains Higher-for-Longer Stance

The Scenario:

- Eurozone inflation proves sticky (above 2.5%)

- ECB delays rate cuts until late 2026/2027

- Interest rate differential favors EUR vs USD

- ECB signals commitment to price stability

Impact on EUR/USD:

- Positive carry trade for EUR

- Attracts yield-seeking investors

- Supports currency strength

Probability Assessment: 30% (Growth concerns may force earlier cuts)

4. Dollar Weakness from US Fiscal Concerns

The Scenario:

- US budget deficit exceeds $2 trillion

- Debt-to-GDP ratio concerns mount

- Foreign holders reduce Treasury purchases

- Dollar loses safe-haven premium

Impact on EUR/USD:

- Dollar weakens across all pairs

- EUR benefits as alternative reserve currency

- Flight from dollar assets

Probability Assessment: 25% (Dollar remains dominant reserve currency)

5. Positive European Political Developments

The Scenario:

- EU achieves greater fiscal integration

- France/Germany relations strengthen

- Progress on EU defense cooperation

- Populist movements lose momentum

Impact on EUR/USD:

- Reduced political risk premium

- Increased confidence in European project

- Foreign investment increases

Probability Assessment: 20% (Political integration remains slow)

Technical Case for 1.2200

Chart Analysis:

Monthly Chart Pattern:

- EUR/USD forming large inverse head and shoulders

- Neckline at 1.0850

- Breakout above 1.0850 targets 1.1400

- Further breakout above 1.1500 opens path to 1.2200

Key Technical Levels:

- Break above 1.0850: First confirmation of bullish trend

- Break above 1.1000: Strong psychological confirmation

- Break above 1.1150: 2023 highs, major resistance cleared

- Break above 1.1500: Opens path to 1.2000+

Moving Averages:

- 200-week MA currently at 1.0950

- Price needs to reclaim and hold above this level

- Golden cross (50-MA above 200-MA) would confirm bull trend

Fibonacci Retracements:

- 1.2200 represents 61.8% retracement of 2021 high (1.2350) to 2022 low (0.9535)

- Strong confluence with previous support zone from 2021

[LINK PLACEHOLDER: Internal link to “Fibonacci Retracement Strategy for Swing Trading”]

Bull Case Timeline

Q1 2026: Consolidation between 1.04-1.08 Q2 2026: Breakout above 1.0850 on positive data Q3 2026: Rally toward 1.1200-1.1400 Q4 2026: Push toward 1.1800-1.2200 if momentum sustains

Overall Bull Case Probability: 30%

The Bear Case: Return to Parity (1.0000)

Now let’s examine factors that could drive EUR/USD back to parity or below.

Fundamental Drivers for Weakness

1. Eurozone Recession

The Scenario:

- Germany remains in recession through 2026

- Manufacturing continues declining (PMI < 45)

- High energy costs return

- Consumer spending collapses

- Unemployment rises above 7%

Impact on EUR/USD:

- Forces ECB into emergency rate cuts

- Economic divergence with US widens

- Capital flight from European assets

- EUR loses appeal as investment destination

Probability Assessment: 45% (Structural weaknesses evident)

2. ECB Forced into Aggressive Rate Cuts

The Scenario:

- ECB cuts rates 5-6 times in 2026 (125-150bps total)

- Returns to near-zero or negative rates

- Considers restarting QE (quantitative easing)

- Growth concerns override inflation fears

Impact on EUR/USD:

- Negative interest rate differential (USD yields > EUR yields)

- Carry trade favors shorting EUR

- Currency weakness becomes self-reinforcing

Probability Assessment: 40% (Growth concerns mounting)

3. Federal Reserve Remains Restrictive

The Scenario:

- US inflation remains above 3%

- Fed maintains rates at 5.00-5.25% through 2026

- “Higher-for-longer” becomes “higher-for-even-longer”

- No rate cuts in 2026

Impact on EUR/USD:

- Wide interest rate differential favors USD

- Dollar strength continues

- Capital flows to US seeking yields

Probability Assessment: 45% (Fed has been resolute on inflation target)

4. European Political Crisis

The Scenario:

- Far-right parties gain power in major elections

- France or Italy threatens EU membership

- Nord Stream pipeline issues resurface

- EU unity fractures on key issues

Impact on EUR/USD:

- Risk premium increases dramatically

- Capital flight to safety (USD)

- Euro confidence shattered

- Existential EU concerns return

Probability Assessment: 25% (EU has weathered many crises)

5. Renewed Energy Crisis

The Scenario:

- Russia reduces gas supplies further

- Middle East conflicts disrupt oil supply

- Energy prices surge (oil >$120/barrel)

- Europe forced into energy rationing

Impact on EUR/USD:

- Eurozone competitiveness damaged

- Trade deficit widens significantly

- Economic crisis forces policy errors

- EUR weakens dramatically

Probability Assessment: 20% (Europe has diversified energy sources)

6. Dollar Strength from Safe-Haven Flows

The Scenario:

- Global recession fears intensify

- Emerging markets face crisis

- Geopolitical tensions escalate

- China economic slowdown deepens

Impact on EUR/USD:

- Flight to safety = dollar strength

- EUR loses ground despite no European weakness

- Dollar appreciates across all pairs

Probability Assessment: 35% (Global risks remain elevated)

Technical Case for Parity

Chart Analysis:

Monthly Chart Pattern:

- EUR/USD forming descending triangle

- Support at 1.0350 (2025 low)

- Break below 1.0350 targets 1.0000 (parity)

- Further break targets 0.9500

Key Technical Levels:

- Break below 1.0350: Confirms bearish trend resumption

- Break below 1.0250: Accelerates toward parity

- Break of 1.0000: Opens path to 0.9500-0.9000

Moving Averages:

- Death cross (50-MA below 200-MA) would confirm bear trend

- Price trading below 200-week MA = long-term bearish

RSI Divergence:

- If price makes new lows but RSI doesn’t = potential reversal

- But absence of divergence confirms downtrend strength

[LINK PLACEHOLDER: Internal link to “RSI Divergence Trading Strategy: How to Spot Reversals”]

Bear Case Timeline

Q1 2026: Test of 1.0350 support Q2 2026: Break below 1.0350 on weak data Q3 2026: Decline toward 1.0150-1.0000 Q4 2026: Test or break of parity if momentum continues

Overall Bear Case Probability: 45%

The Neutral Case: Range-Bound 1.04-1.10

The most likely scenario may be continued consolidation.

Why Range-Bound is Probable

1. Policy Uncertainty

- Both ECB and Fed in wait-and-see mode

- Data-dependent approach creates whipsaw

- No clear policy divergence

2. Balanced Economic Risks

- US showing resilience but risks remain

- Europe weak but avoiding recession

- Neither economy clearly outperforming

3. Technical Equilibrium

- Current range reflects fair value

- Strong support at 1.04 and resistance at 1.10

- Market needs catalyst for breakout

4. Geopolitical Offsetting

- Multiple risk factors cancel each other out

- No single dominant narrative

- Uncertainty breeds consolidation

Range Trading Strategy

Support Levels: 1.0350, 1.0400, 1.0500 Resistance Levels: 1.0850, 1.0950, 1.1000

Trading Approach:

- Buy near support (1.04-1.05)

- Sell near resistance (1.09-1.10)

- Tight stops outside range

- Scale out at profit targets

[LINK PLACEHOLDER: Internal link to “Price Action Trading Without Indicators”]

Range-Bound Case Probability: 25%

Central Bank Policy: The Deciding Factor

Monetary policy will be the primary driver of EUR/USD direction.

Federal Reserve Outlook 2026

Current Situation:

- Fed Funds Rate: 5.00-5.25%

- Core PCE Inflation: ~2.8%

- Unemployment: ~3.8%

- GDP Growth: +2.1%

Likely Scenarios:

Dovish Fed (30% probability):

- 3-4 rate cuts in 2026 (75-100bps)

- Inflation at target, no recession

- Supports EUR/USD rally

Neutral Fed (50% probability):

- 0-2 rate cuts maximum

- Maintaining restrictive stance longer

- EUR/USD range-bound

Hawkish Fed (20% probability):

- No cuts or additional hike

- Inflation remains stubborn

- Strong dollar, EUR/USD toward parity

European Central Bank Outlook 2026

Current Situation:

- ECB Deposit Rate: 4.00%

- Core CPI Inflation: ~3.2%

- Unemployment: ~6.5%

- GDP Growth: +0.6%

Likely Scenarios:

Hawkish ECB (25% probability):

- Maintains rates through Q3 2026

- 0-1 cuts maximum

- Supports EUR strength

Neutral ECB (45% probability):

- 2-3 rate cuts (50-75bps)

- Gradual normalization

- EUR/USD range-bound to slight weakness

Dovish ECB (30% probability):

- 4-6 cuts (100-150bps)

- Growth fears dominate

- EUR weakness toward parity

Policy Divergence Matrix

| Fed Policy | ECB Policy | EUR/USD Impact |

|---|---|---|

| Dovish | Hawkish | Strong EUR rally (1.15+) |

| Dovish | Neutral | Moderate EUR strength (1.10-1.12) |

| Dovish | Dovish | Neutral/slight EUR strength |

| Neutral | Hawkish | EUR strength (1.08-1.12) |

| Neutral | Neutral | Range-bound (1.04-1.10) ← Most likely |

| Neutral | Dovish | EUR weakness (1.00-1.04) |

| Hawkish | Hawkish | USD strength (policy follows data) |

| Hawkish | Neutral | Strong USD (1.00-1.04) |

| Hawkish | Dovish | Strong USD, parity test |

Most Likely Combination: Neutral Fed + Neutral/Dovish ECB = EUR weakness or range-bound

Economic Indicators to Watch

These data points will signal which scenario is unfolding.

United States

Critical Indicators:

- Non-Farm Payrolls (Monthly): <150k = recession fears, EUR/USD up

- Core PCE Inflation (Monthly): <2.5% = Fed cuts likely, EUR/USD up

- GDP Growth (Quarterly): <1% = recession risk, EUR/USD mixed

- Unemployment Rate (Monthly): >4.5% = Fed dovish, EUR/USD up

- Consumer Confidence (Monthly): Sharp drops = recession signal

Eurozone

Critical Indicators:

- Manufacturing PMI (Monthly): >50 = expansion, EUR/USD up

- German GDP (Quarterly): Positive growth = EUR strength

- Core CPI (Monthly): <2.5% = ECB cuts, EUR/USD down

- Unemployment Rate (Monthly): >7.5% = crisis signal, EUR down

- Retail Sales (Monthly): Strength = growth resumption, EUR up

Relative Performance

Watch for divergence:

- US growing while Europe contracts = EUR/USD down

- Europe recovering while US slows = EUR/USD up

- Both weak = slight USD advantage (safe haven)

- Both strong = depends on rate differentials

[LINK PLACEHOLDER: Internal link to “Forex Economic Calendar: How to Trade the News”]

Geopolitical Factors

Non-economic events can significantly impact EUR/USD.

Key Risk Factors

Ukraine/Russia Situation:

- Prolonged conflict = EUR weakness (energy, defense costs)

- Peace settlement = EUR strength (reduced uncertainty)

- Escalation = flight to USD safety

US Elections/Politics:

- Fiscal policy changes impact dollar

- Trade policy affects both currencies

- Political instability = variable impact

China Economic Outlook:

- Slowdown hurts European exports more than US

- Recovery benefits EUR (trade links stronger)

- Crisis = flight to USD

Middle East Tensions:

- Oil price spikes hurt Europe more (energy dependent)

- Regional instability = safe-haven USD flows

EU Political Risks:

- France, Germany, Italy elections critical

- Populist gains = EUR weakness

- Mainstream stability = EUR support

Geopolitical Scenario Matrix

Low Risk Environment (20% probability):

- All conflicts de-escalate

- Political stability globally

- EUR/USD determined by fundamentals alone

- Likely outcome: Range-bound or slight EUR strength

Moderate Risk (60% probability):

- Current tensions continue but don’t escalate

- Periodic flare-ups cause volatility

- EUR/USD driven primarily by economics with risk episodes

- Likely outcome: Range-bound with volatility

High Risk (20% probability):

- Major escalation in Ukraine, Middle East, or China

- Global crisis unfolds

- Flight to safety dominates

- Likely outcome: USD strength, EUR/USD toward parity

Expert Forecasts: Wall Street Views

Major banks and institutions have published EUR/USD forecasts for 2026.

Investment Bank Forecasts (As of January 2026)

Goldman Sachs:

- Q4 2026 Target: 1.0600

- View: Neutral with slight EUR weakness

- Key factor: Fed patience, ECB forced to cut

JPMorgan:

- Q4 2026 Target: 1.0400

- View: Mild bearish

- Key factor: Eurozone growth concerns

Morgan Stanley:

- Q4 2026 Target: 1.0800

- View: Slightly bullish

- Key factor: Fed pivot expectations

Citigroup:

- Q4 2026 Target: 1.0200

- View: Bearish

- Key factor: Policy divergence favors USD

Deutsche Bank:

- Q4 2026 Target: 1.0700

- View: Neutral

- Key factor: Range-bound consolidation

BNP Paribas:

- Q4 2026 Target: 1.0900

- View: Modestly bullish

- Key factor: European recovery hopes

UBS:

- Q4 2026 Target: 1.0500

- View: Neutral with downside risks

- Key factor: ECB dovish tilt

Consensus:

- Median forecast: 1.0600

- Range: 1.0200 – 1.0900

- Lean: Slight EUR weakness or consolidation

- Outliers: Few see parity or 1.20+ as likely

Important Note: Bank forecasts have mixed accuracy. Use as one input among many, not gospel.

Trading Strategies for Different Scenarios

How should traders position for 2026?

For Bulls (Expecting 1.15-1.22)

Strategy:

- Buy dips to 1.04-1.05 support

- Hold through volatility

- Add on breaks above 1.0850

- Targets: 1.10, 1.12, 1.15, 1.18, 1.22

- Stop: Below 1.0300

Timeframe: Swing trading to position trading (weeks to months)

Risk Management:

- Risk 1-2% per position

- Scale in across multiple entries

- Use trailing stops as profit accumulates

For Bears (Expecting 1.00-1.03)

Strategy:

- Sell rallies to 1.09-1.10 resistance

- Short on breaks below 1.0350

- Targets: 1.02, 1.01, 1.00, 0.98

- Stop: Above 1.0900

Timeframe: Swing trading (days to weeks)

Risk Management:

- Tight stops (EUR can rally sharply)

- Take partial profits at each target

- Re-short on failed rallies

For Range Traders (Expecting 1.04-1.10)

Strategy:

- Buy support: 1.0400-1.0500

- Sell resistance: 1.0850-1.0950

- Quick profits: 30-50 pips

- Break above/below: Exit and reassess

Timeframe: Day trading to swing trading

Risk Management:

- Tight stops outside range (20-30 pips)

- Quick exits on range break

- High win rate but small profits

For Conservative Traders

Strategy:

- Wait for clear breakout above 1.0850 or below 1.0350

- Trade in direction of break

- Confirmation required before entry

Timeframe: Position trading (weeks to months)

Risk Management:

- Lower position sizes for patience

- Wider stops to avoid whipsaw

- Let major trends develop

[LINK PLACEHOLDER: Internal link to “50 EMA Trading Strategy: Simple Yet Powerful”]

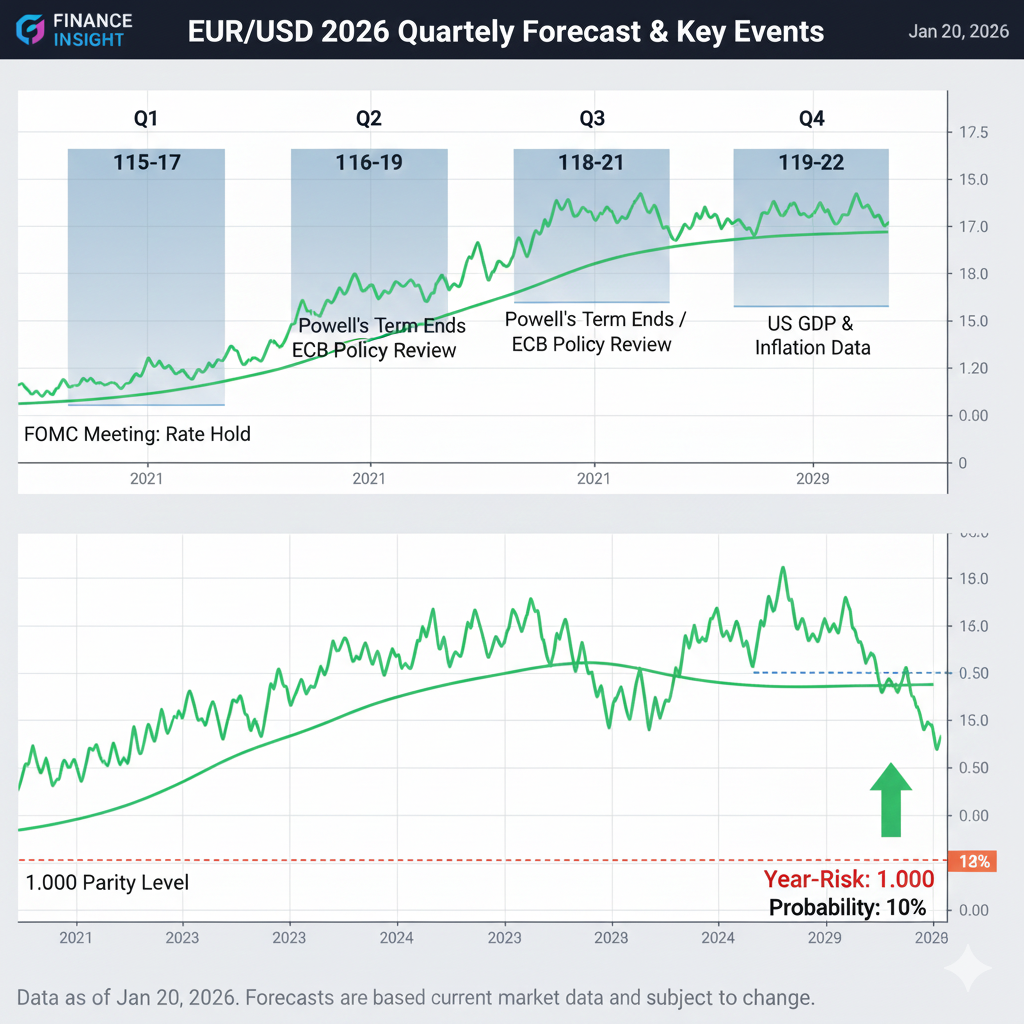

Quarterly Projections

Breaking down the year by quarter.

Q1 2026 (January – March)

Expected Range: 1.0350 – 1.0750 Key Events: ECB meeting (Jan 30), Fed meeting (Feb 19), US payrolls

Most Likely:

- Consolidation near current levels

- Test of 1.0350 support

- Range-bound between 1.04-1.07

Upside Scenario: Break to 1.0850 on positive European data Downside Scenario: Break below 1.0350 on growth fears

Q1 Forecast: 1.0550 (slight decline from current)

Q2 2026 (April – June)

Expected Range: 1.0200 – 1.0900 Key Events: ECB meeting (April 17, June 12), Fed meeting (May 7)

Most Likely:

- Volatility increases as policies diverge

- Either breakout or breakdown

- Range expands in either direction

Upside Scenario: Rally to 1.09-1.10 on Fed dovish signals Downside Scenario: Drop to 1.02-1.03 on ECB cuts

Q2 Forecast: 1.0450 (gradual weakening bias)

Q3 2026 (July – September)

Expected Range: 1.0000 – 1.1100 Key Events: ECB meeting (July 24, Sep 11), Fed meeting (July 30, Sep 17-18)

Most Likely:

- Trend establishes direction

- Either sustained move toward 1.10+ or 1.00-1.02

- Jackson Hole (August) provides policy clarity

Upside Scenario: Push toward 1.11-1.13 if EUR momentum builds Downside Scenario: Test or break parity if EUR weakness accelerates

Q3 Forecast: 1.0350 (continued EUR pressure)

Q4 2026 (October – December)

Expected Range: 0.9800 – 1.1200 Key Events: US elections, ECB meeting (Oct 23, Dec 12), Fed meeting (Nov 6-7, Dec 17-18)

Most Likely:

- Year-end positioning

- Either capitulation move or reversal

- Widest range of possibilities

Upside Scenario: Rally to 1.12-1.15 if policy pivot materializes Downside Scenario: Break below parity to 0.98-0.99 if recession hits

Q4 Forecast: 1.0400 (modest recovery attempt from Q3 lows)

Year-End 2026 Forecast: 1.0400-1.0600

Black Swan Risks

Low-probability, high-impact events that could invalidate all forecasts.

Potential Black Swans

1. Major European Bank Failure

- Credit Suisse-style crisis

- Contagion across European banking

- EUR crashes below 0.95

2. US Debt Crisis

- Treasury market dysfunction

- Credit rating downgrade

- Dollar collapse, EUR surge above 1.25

3. Major Geopolitical Shock

- NATO-Russia direct conflict

- China invades Taiwan

- Middle East conflagration

- Flight to USD, EUR below 0.90

4. Central Bank Policy Error

- Fed cuts too late, US recession deepens

- ECB holds too long, Eurozone collapses

- Either direction is possible, depending on the error

5. Pandemic 2.0

- New global health crisis

- Economic shutdowns return

- EUR/USD is highly volatile, direction uncertain

6. Energy Supply Shock

- Major pipeline sabotage

- Middle East oil disruption

- Europe’s energy crisis 2.0

- EUR collapses toward 0.95

Note: Black swans are by definition unpredictable. Maintain proper risk management to survive the unexpected.

Final Forecast: Base Case

Weighing all factors, here’s our most likely scenario.

Central Forecast

Q1 2026: 1.0550 (±100 pips) Q2 2026: 1.0450 (±150 pips) Q3 2026: 1.0350 (±150 pips) Q4 2026: 1.0500 (±200 pips)

Year-End 2026 Target: 1.0500

Trading Range: 1.0200 – 1.0900

Reasoning

Why Not Rally to 1.22:

- Fed unlikely to cut aggressively (45% probability of restrictive policy)

- Eurozone structural issues persist (weak manufacturing, demographic challenges)

- Growth divergence favors the US

- Dollar retains safe-haven status

- Technical resistance formidable (1.09-1.11)

Why Not Fall to Parity:

- ECB won’t panic into aggressive cuts (political/inflation constraints)

- Europe is avoiding an outright recession (weak but stable)

- Energy crisis unlikely to repeat

- EUR already reflects significant weakness

- Technical support is strong at 1.03-1.04

Why Range-Bound is Most Likely:

- Policy uncertainty keeps both sides guessing

- Economic data mixed for both regions

- No clear catalyst for a major break

- Fair value around the 1.04-1.06 range

- Markets need a decisive trigger for trend

Probability Distribution

- Bull Case (1.15-1.22): 20-25%

- Mild Bull (1.10-1.15): 15-20%

- Range-Bound (1.04-1.10): 35-40% ← Most likely

- Mild Bear (1.00-1.04): 20-25%

- Bear Case (Below 1.00): 5-10%

Confidence Level: Moderate (6/10)

Numerous variables create uncertainty, but range-bound with downside bias appears most probable given current trajectory.

How to Trade EUR/USD in 2026

Practical advice for different trader types.

For Day Traders

Best Approach:

- Trade range boundaries (buy 1.04-1.05, sell 1.09-1.10)

- Focus on London/NY session overlap (highest liquidity)

- Use 5-minute to 1-hour charts

- Targets: 20-50 pips

- Tight stops: 15-30 pips

Key Times:

- 8:00-12:00 EST (London/NY overlap)

- News releases (NFP, CPI, ECB/Fed meetings)

[LINK PLACEHOLDER: Internal link to “5-Minute Scalping Strategy for Forex Beginners”]

For Swing Traders

Best Approach:

- Buy dips to 1.04-1.05 support

- Sell rallies to 1.09-1.10 resistance

- Hold 3-10 days

- Targets: 50-150 pips

- Stops: 40-80 pips

Key Indicators:

- 50 EMA and 200 EMA for trend

- RSI for overbought/oversold

- Support/resistance levels

[LINK PLACEHOLDER: Internal link to “Fibonacci Retracement Strategy for Swing Trading”]

For Position Traders

Best Approach:

- Wait for clear breakout above 1.0850 or below 1.0350

- Hold weeks to months

- Targets: 200-500+ pips

- Stops: 100-200 pips

Key Analysis:

- Monthly/weekly charts

- Fundamental analysis primary

- Technical confirmation secondary

Risk Management (All Styles)

✅ Never risk more than 2% per trade ✅ Use stop losses on every position ✅ Scale position sizes for volatility ✅ Reduce exposure ahead of major news ✅ Don’t fight clear trends once established ✅ Take partial profits at targets ✅ Keep trading journal for review

Conclusion: Navigating EUR/USD in 2026

EUR/USD faces a year of uncertainty with multiple possible outcomes. While dramatic moves to 1.22 or parity are possible, the most likely scenario is continued consolidation between 1.02-1.10 with a gradual bias toward EUR weakness.

Key Takeaways:

🎯 Base Case: Range-bound 1.04-1.10, ending near 1.0500 🎯 Bull Case: 20-25% probability of rally to 1.15-1.22 🎯 Bear Case: 25-30% probability of decline to parity 🎯 Primary Driver: Central bank policy divergence 🎯 Secondary Factors: Economic growth, geopolitics, risk sentiment 🎯 Trading Approach: Range trading until clear breakout confirmed

Critical Levels to Watch:

Resistance: 1.0850 > 1.0950 > 1.1000 > 1.1150 Support: 1.0400 > 1.0350 > 1.0250 > 1.0000

Events That Could Change Everything:

- Fed pivot to dovish (EUR up)

- ECB forced into aggressive cuts (EUR down)

- European recession (EUR down)

- US recession (EUR up)

- Major geopolitical shock (likely USD up)

Our Recommendation:

- Don’t bet the farm either direction – Uncertainty is high

- Use range-trading strategies until a clear trend emerges

- Monitor key economic data for early trend signals

- Manage risk meticulously – Volatility will remain elevated

- Be prepared to adapt – 2026 could surprise in either direction

- Consider smaller position sizes given the uncertainty

- Review the forecast quarterly as new data emerges

Remember: All forecasts are educated guesses based on current information. Markets surprise us regularly. The difference between successful and unsuccessful traders isn’t predicting perfectly—it’s managing risk when predictions prove wrong.

Trade wisely. Stay flexible. Manage risk. The only certainty is uncertainty.