Exness Review 2026: Why 5 Million Traders Choose This Broker

Are you searching for a reliable forex broker that combines low costs, lightning-fast execution, and robust regulatory oversight? If so, you’re not alone. Over 5 million traders worldwide have already chosen Exness as their preferred trading partner.

But with countless brokers competing for your attention, what makes Exness stand out in 2026? In this comprehensive review, we’ll dive deep into everything you need to know about Exness—from trading conditions and fees to platform features and customer support—helping you decide if this broker deserves your hard-earned capital.

What is Exness? Quick Overview {#what-is-exness}

Founded in 2008, Exness has evolved from a modest startup to one of the world’s leading forex and CFD brokers. Headquartered in Limassol, Cyprus, the company serves retail and institutional traders across more than 180 countries.

Key Exness Statistics (2026)

- 5+ million active traders globally

- $4.5+ trillion in monthly trading volume

- Regulated in 8 jurisdictions including FCA, CySEC, and FSA

- 200+ tradable instruments across forex, metals, energies, indices, stocks, and cryptocurrencies

- 24/7 customer support in 13 languages

What truly sets Exness apart is its commitment to transparency, competitive pricing, and technological innovation. The broker has consistently pushed boundaries by offering some of the tightest spreads in the industry, unlimited leverage options, and instant withdrawal processing.

[INTERNAL LINK: For beginners wondering about forex basics, check out our guide: “Forex Trading for Beginners: Complete 2026 Guide”]

Is Exness Safe and Regulated? {#regulation-safety}

When entrusting a broker with your capital, safety should be your top priority. So, is Exness trustworthy?

Regulatory Licenses

Exness operates through multiple regulated entities, each supervised by respected financial authorities:

Primary Regulators:

- Financial Conduct Authority (FCA) – UK (License #730729)

- One of the world’s strictest financial regulators

- Requires segregated client funds

- Offers Financial Services Compensation Scheme (FSCS) protection up to £85,000

- Cyprus Securities and Exchange Commission (CySEC) – EU (License #178/12)

- EU-wide passporting rights

- Investor Compensation Fund (ICF) coverage up to €20,000

- MiFID II compliance

- Financial Services Authority (FSA) – Seychelles (License #SD025)

- Offshore regulation for international clients

- Less stringent than FCA/CySEC but still provides oversight

- Additional Licenses:

- Financial Sector Conduct Authority (FSCA) – South Africa

- Financial Services Commission (FSC) – British Virgin Islands

- Capital Markets Authority (CMA) – Kenya

Security Measures

Beyond regulation, Exness implements multiple security layers:

- Segregated accounts: Client funds kept separate from company operating capital

- Two-factor authentication (2FA): Extra login protection

- SSL encryption: Bank-grade data protection

- Negative balance protection: You can’t lose more than your deposit

- Regular audits: Independent third-party verification

Verdict: With tier-1 regulation from the FCA and CySEC, plus robust security protocols, Exness ranks among the safest brokers available in 2026.

[INTERNAL LINK: Learn more about broker safety in our article: “How to Choose a Safe Forex Broker: Red Flags to Avoid”]

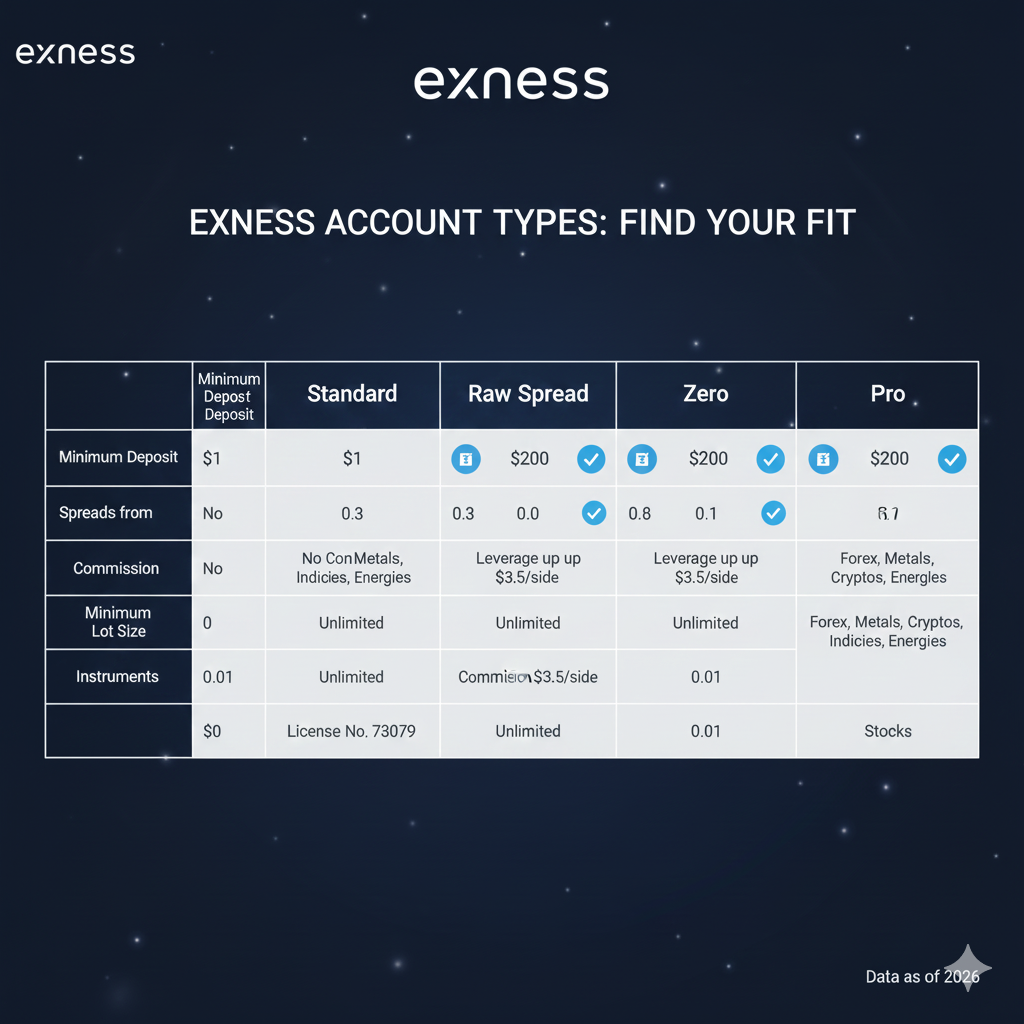

Exness Account Types Explained {#account-types}

Exness offers five distinct account types, each tailored to different trading styles and experience levels. Understanding these options is crucial for optimizing your trading costs and experience.

1. Standard Account

Best For: Beginners and casual traders

Key Features:

- Minimum deposit: $1 (varies by payment method)

- Spreads: From 0.3 pips

- Commission: None

- Leverage: Up to 1:Unlimited (conditions apply)

- Stop out level: 0%

The Standard account provides the most straightforward pricing with no commission charges. While spreads are slightly wider than pro accounts, the zero-commission structure makes it easy to calculate costs.

2. Standard Cent Account

Best For: Complete beginners testing strategies

Key Features:

- Identical to Standard account

- Trade in cent lots (0.01 lot = 1,000 cents)

- Perfect for micro-position sizing

- Risk management for new traders

3. Raw Spread Account

Best For: Experienced traders seeking transparency

Key Features:

- Minimum deposit: $200

- Spreads: From 0.0 pips (market spreads)

- Commission: From $3.50 per lot round turn

- Leverage: Up to 1:Unlimited

- Stop out level: 0%

This account offers raw market spreads with a clear commission structure. Ideal for scalpers and high-frequency traders who need the tightest possible spreads.

4. Zero Account

Best For: Traders prioritizing major currency pairs

Key Features:

- Minimum deposit: $200

- Spreads: 0.0 pips on 30 instruments during 95% of trading day

- Commission: From $0.20 per lot

- Leverage: Up to 1:Unlimited

- Instruments: Limited to 30 popular pairs/instruments

The Zero account guarantees zero spreads on select instruments for most of the trading day—perfect if you focus primarily on major forex pairs.

5. Pro Account

Best For: Professional traders and institutions

Key Features:

- Minimum deposit: $200

- Spreads: From 0.1 pips

- Commission: None

- Leverage: Up to 1:Unlimited

- Instant order execution

The Pro account combines tight spreads with zero commission, offering the best overall value for medium to high-volume traders.

Quick Recommendation:

- New traders: Start with Standard or Standard Cent

- Scalpers: Choose Raw Spread

- Major pair traders: Opt for Zero

- Volume traders: Select Pro

[INTERNAL LINK: Not sure which account suits you? Read: “Choosing the Right Trading Account Type: A Decision Guide”]

Trading Costs: Spreads, Commissions & Fees

Understanding the complete cost structure is essential for profitable trading. Let’s break down exactly what you’ll pay when trading with Exness.

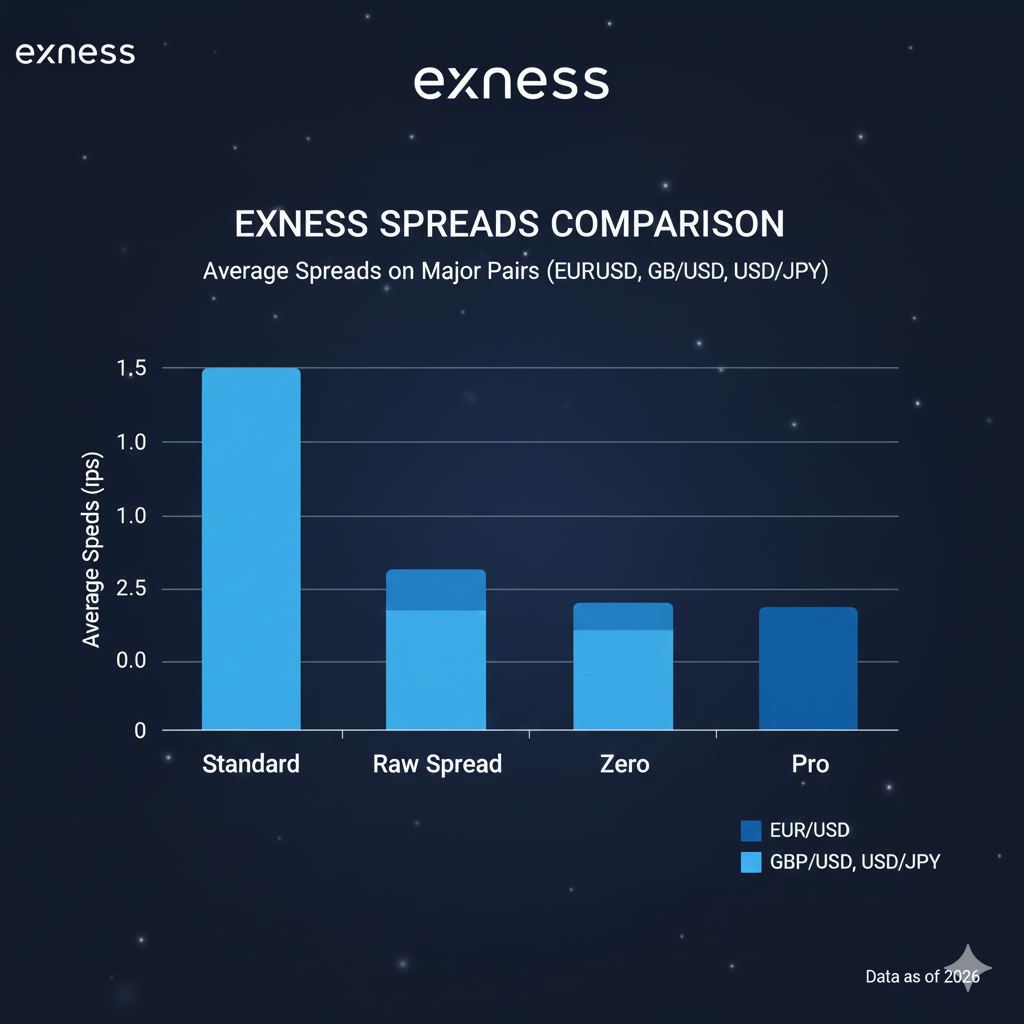

Spreads by Account Type

EUR/USD Spreads (typical):

- Standard: 1.0 pips

- Standard Cent: 1.0 pips

- Raw Spread: 0.0 pips + commission

- Zero: 0.0 pips (95% of time) + commission

- Pro: 0.4 pips

GBP/USD Spreads (typical):

- Standard: 1.5 pips

- Raw Spread: 0.1 pips + commission

- Zero: 0.0 pips + commission

- Pro: 0.6 pips

Commission Structure

- Standard & Pro: $0 commission

- Raw Spread: $3.50 per lot (round turn) = $7 total per lot

- Zero: From $0.20 per side = $0.40 total per lot (varies by instrument)

Non-Trading Fees

Deposit Fees: Free for all payment methods

Withdrawal Fees: Free for most methods (some payment processors may charge)

Inactivity Fee: $0 – Exness does NOT charge inactivity fees (major advantage)

Swap Fees (Overnight Interest):

- Vary by instrument and account type

- Swap-free (Islamic) accounts available for qualifying traders

- Calculated automatically in your platform

Real Cost Example

Let’s calculate the total cost for a 1-lot EUR/USD trade on different accounts:

Standard Account:

- Spread: 1.0 pips = $10

- Commission: $0

- Total cost: $10

Raw Spread Account:

- Spread: 0.0 pips = $0

- Commission: $7

- Total cost: $7

Pro Account:

- Spread: 0.4 pips = $4

- Commission: $0

- Total cost: $4

Winner: The Pro account offers the lowest overall costs for most traders.

[INTERNAL LINK: Learn to calculate trading costs: “Understanding Forex Trading Costs: Spreads, Commissions & Hidden Fees”]

Exness Trading Platforms Review {#trading-platforms}

Your trading platform is your window to the markets. Exness provides access to both industry-standard MetaTrader platforms and their proprietary solutions.

MetaTrader 4 (MT4)

[IMAGE PLACEMENT: Screenshot of MetaTrader 4 platform on Exness showing chart analysis and order placement] Alt Text: MetaTrader 4 platform interface on Exness with forex charts and technical indicators

The legendary MetaTrader 4 remains one of the most popular platforms globally, and for good reason:

Pros:

- User-friendly interface perfect for beginners

- 30+ built-in technical indicators

- Automated trading via Expert Advisors (EAs)

- One-click trading

- Available on Windows, Mac, iOS, Android, and web

- Massive community support and custom indicators

Cons:

- Older technology (released 2005)

- Limited order types compared to MT5

- No economic calendar integration

Best For: Beginners, EA traders, and those who value simplicity

MetaTrader 5 (MT5)

MetaTrader 5 is MT4’s more advanced successor, offering enhanced features:

Improvements Over MT4:

- 21 timeframes (vs 9 in MT4)

- 38 technical indicators (vs 30)

- Built-in economic calendar

- More order types (6 pending orders vs 4)

- Better strategy tester for backtesting

- Access to stocks and futures (beyond forex/CFDs)

- MQL5 programming language

Best For: Advanced traders, multi-asset traders, and serious algorithmic traders

Exness Terminal (Mobile)

[IMAGE PLACEMENT: Mobile screenshots showing Exness Terminal app on iOS and Android] Alt Text: Exness Terminal mobile trading app interface showing charts, orders, and account management

The Exness Terminal is the broker’s proprietary mobile app offering a streamlined trading experience:

Key Features:

- Instant deposits and withdrawals

- One-tap trading

- Push notifications for price alerts

- Biometric login (fingerprint/face ID)

- Real-time account monitoring

- Copy trading integration

Available: iOS and Android

Exness WebTerminal

For traders who prefer browser-based access:

- No download required

- Access from any device

- Lighter than desktop platforms

- Full trading functionality

- Real-time quotes and charts

Trading Tools & Features

Exness enhances your trading with:

- Virtual Private Server (VPS): Free VPS for traders meeting minimum activity requirements—essential for EA trading

- Copy Trading: Mirror successful traders’ strategies automatically

- Trading Calculator: Quickly calculate pip value, margin requirements, and profit/loss

- Economic Calendar: Stay informed about market-moving events

- Trading Signals: Built-in signal services (MT4/MT5)

Platform Verdict: The combination of MT4, MT5, and proprietary solutions gives traders flexibility. MT4 suits most traders, while MT5 serves advanced users, and the mobile apps provide exceptional on-the-go functionality.

[INTERNAL LINK: Master your platform: “MetaTrader 4 vs MetaTrader 5: Which Platform is Right for You?”]

Available Markets and Instruments {#markets-instruments}

Diversification is key to risk management. Exness provides access to a broad range of markets:

Forex (Currency Pairs)

- Major pairs: EUR/USD, GBP/USD, USD/JPY, etc.

- Minor pairs: EUR/GBP, AUD/NZD, GBP/CAD, etc.

- Exotic pairs: USD/TRY, USD/ZAR, EUR/SEK, etc.

- Total: 100+ currency pairs

Spreads: As low as 0.0 pips (Raw Spread and Zero accounts)

Metals

- Gold (XAU/USD)

- Silver (XAG/USD)

- Platinum

- Palladium

Leverage: Up to 1:Unlimited

Energies

- Crude Oil (Brent & WTI)

- Natural Gas

Popular among traders seeking commodity exposure.

Indices

Trade major global stock indices as CFDs:

- US: S&P 500, NASDAQ 100, Dow Jones

- Europe: FTSE 100, DAX 40, CAC 40

- Asia: Nikkei 225, Hang Seng

Total: 10+ indices

Cryptocurrencies

Trade leading cryptocurrencies 24/7:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Ripple (XRP/USD)

- Litecoin (LTC/USD)

- Total: 30+ crypto pairs

Note: Crypto trading involves high volatility and risk.

Stocks

Access CFDs on popular US stocks:

- Tech: Apple, Microsoft, Tesla, Amazon, Google

- Finance: JPMorgan, Bank of America

- Consumer: Nike, Coca-Cola

Total: 100+ individual stock CFDs

Summary

With 200+ instruments spanning multiple asset classes, Exness provides excellent diversification opportunities. Whether you’re a forex purist or multi-asset trader, you’ll find what you need.

[INTERNAL LINK: Explore different markets: “Best Markets for Day Trading in 2026: Forex, Stocks, or Crypto?”]

Deposit and Withdrawal Options

Fast, convenient funding is crucial. Exness excels in this area with instant processing and zero fees.

Deposit Methods

Available Methods:

- Credit/Debit Cards: Visa, Mastercard, Maestro

- E-Wallets: Skrill, Neteller, Perfect Money, WebMoney

- Bank Transfer: Wire transfer, local bank options

- Cryptocurrency: Bitcoin, Tether (USDT), Ethereum

- Mobile Payments: Region-specific options

Processing Time: Instant for most methods Minimum Deposit: $1 (varies by account type and payment method) Fees: Free (Exness covers all deposit fees)

Withdrawal Process

One of Exness’s standout features is instant withdrawals:

Processing Time:

- E-wallets: Instant

- Credit/Debit Cards: Instant (same card used for deposit)

- Bank Transfer: 3-5 business days

- Cryptocurrency: Within 24 hours

Minimum Withdrawal: Varies by method (as low as $1) Fees: Free (Exness covers most fees; some payment processors may charge)

Withdrawal Limit: No maximum limit

How to Deposit (Step-by-Step)

- Log into your Exness Personal Area

- Click “Deposit”

- Select your preferred payment method

- Enter amount

- Complete payment through secure gateway

- Funds appear instantly in your trading account

Important: Exness follows anti-money laundering (AML) regulations. Withdrawals must return to the original deposit source (up to deposited amount). Profits can be withdrawn via any method.

Funding Verdict: With instant deposits, instant withdrawals, and zero fees, Exness offers one of the best funding experiences in the industry.

[INTERNAL LINK: Protect your funds: “Forex Broker Deposit and Withdrawal Safety: What You Need to Know”]

Leverage and Margin Requirements

Leverage amplifies both profits and losses. Exness offers some of the highest leverage in the industry—but is it a blessing or curse?

Leverage Levels

Available Leverage:

- Standard & Pro Accounts: Up to 1:Unlimited

- Raw Spread & Zero: Up to 1:Unlimited

- Regulated entities: Up to 1:30 (FCA/CySEC clients due to ESMA restrictions)

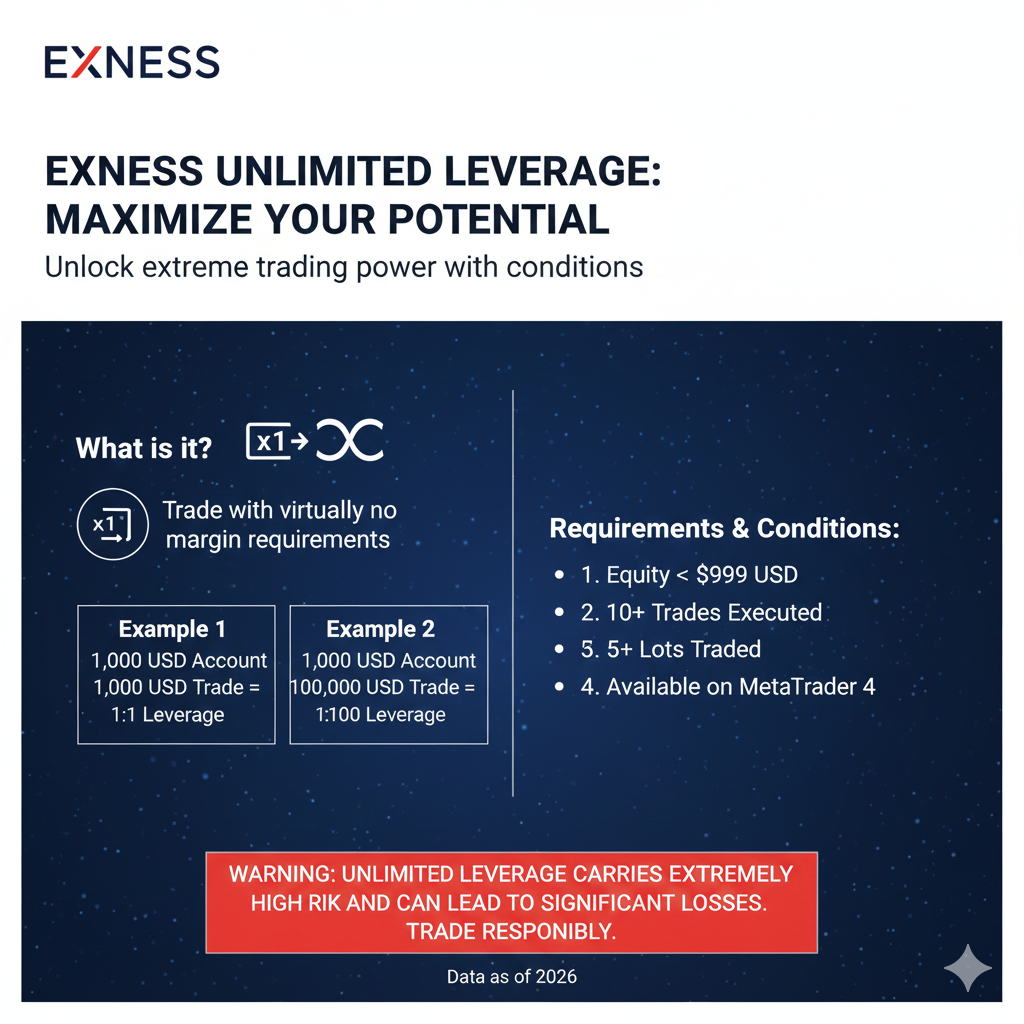

Unlimited Leverage: How It Works

Exness’s unlimited leverage feature is unique but comes with conditions:

Requirements for Unlimited Leverage:

- Complete at least 10 trades (any volume)

- Trade a total volume of at least 5 lots

- Account equity of $1,000 or less

Once conditions are met, margin requirements become minimal, allowing you to open larger positions with less capital.

Example:

- With 1:2000 leverage, a 1-lot EUR/USD position requires $50 margin

- With unlimited leverage, the same position requires less than $1 margin

The Leverage Debate

Advantages:

- Maximize capital efficiency

- Open larger positions with smaller accounts

- Flexibility for experienced traders

Disadvantages:

- Extreme risk: Small price movements can wipe out accounts

- Encourages over-leveraging

- Not suitable for beginners

Exness’s Safety Features:

- Stop out level: 0% (positions close when margin reaches zero)

- Negative balance protection: Can’t lose more than deposit

- Margin call: Warning at 60% margin level

Leverage Recommendations

- Beginners: Use 1:10 or 1:20 maximum

- Intermediate: 1:50 to 1:100

- Professionals: Higher leverage with strict risk management

- Never: Use unlimited leverage without comprehensive experience

Leverage Verdict: Exness’s high leverage options provide flexibility for experienced traders but require strict discipline and risk management.

[INTERNAL LINK: Use leverage safely: “Understanding Forex Leverage: Complete Risk Management Guide”]

Customer Support and Education

Quality support can make the difference between trading success and frustration.

Customer Support

[IMAGE PLACEMENT: Screenshot showing Exness live chat interface and support options] Alt Text: Exness 24/7 customer support live chat showing multilingual assistance

Contact Methods:

- Live Chat: 24/7 availability

- Email: support@exness.com

- Phone: Multiple regional numbers

- Social Media: Facebook, Twitter, Instagram

Languages: 13 languages including English, Spanish, Arabic, Chinese, Russian, Thai

Response Time:

- Live chat: Typically under 1 minute

- Email: Within 24 hours

- Phone: Immediate

Support Quality: Based on user reviews, Exness support is consistently rated as helpful, knowledgeable, and quick to resolve issues.

Educational Resources

Available Learning Materials:

- Exness Academy:

- Free video courses

- Trading strategies

- Platform tutorials

- Market analysis basics

- Webinars:

- Weekly live sessions

- Expert traders

- Q&A opportunities

- Market Analysis:

- Daily market news

- Economic calendar

- Technical analysis

- Trading ideas

- Glossary:

- Comprehensive trading term definitions

- Beginner-friendly explanations

- Demo Account:

- Risk-free practice

- Virtual $10,000 balance

- Full platform features

Education Verdict: While Exness provides solid educational resources, they’re not as comprehensive as some competitors. The materials cover basics well but lack advanced content.

[INTERNAL LINK: Boost your knowledge: “Top 10 Free Forex Trading Courses for Beginners in 2026”]

Pros and Cons of Trading with Exness

Let’s objectively weigh the advantages and disadvantages.

Advantages ✅

- Tight Spreads: Among the lowest in the industry (0.0 pips on some accounts)

- Zero Fees: No deposit, withdrawal, or inactivity fees

- Instant Withdrawals: Money in your account within minutes

- High Leverage: Up to unlimited leverage (for experienced traders)

- Strong Regulation: FCA and CySEC oversight provides safety

- Multiple Platforms: MT4, MT5, WebTerminal, mobile apps

- 200+ Instruments: Excellent market variety

- 24/7 Support: Always available when you need help

- Low Minimum Deposit: Start trading with just $1

- Stop Out at 0%: Maximizes position holding time

- Copy Trading: Follow successful traders automatically

- Free VPS: For qualifying accounts

- Swap-Free Accounts: Available for Islamic traders

Disadvantages ❌

- Limited Education: Less comprehensive than some competitors

- No Proprietary Platform: Relies on MetaTrader (though many prefer this)

- Unlimited Leverage Risk: Can lead to overleveraging

- Offshore Options: Some entities are regulated in less strict jurisdictions

- No Stock/Crypto Trading: Only CFDs available (not actual ownership)

- No Guaranteed Stop Losses: Available only on some regulated entities

- Limited Research Tools: Basic market analysis compared to full-service brokers

The Verdict

Exness excels in cost efficiency, execution speed, and withdrawal convenience. The broker is ideal for traders who prioritize tight spreads, fast execution, and flexible funding. However, if you need extensive educational resources or prefer full-service brokers with proprietary platforms, you might want to explore alternatives.

[INTERNAL LINK: Compare options: “Top 10 Forex Brokers in 2026: Comprehensive Comparison Guide”]

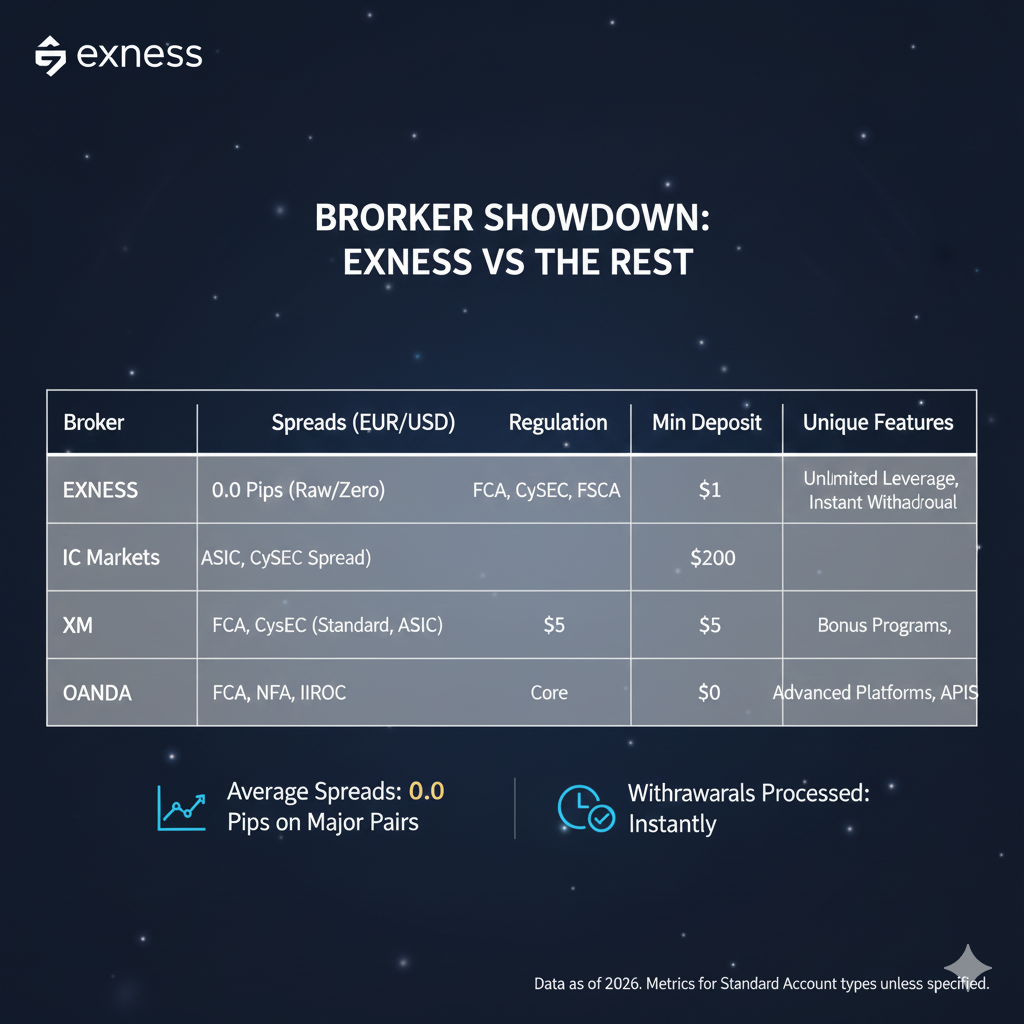

How Does Exness Compare to Competitors?

Exness vs IC Markets

| Feature | Exness | IC Markets |

|---|---|---|

| Min Deposit | $1 | $200 |

| EUR/USD Spread | From 0.0 pips | From 0.0 pips |

| Regulation | FCA, CySEC | ASIC, CySEC |

| Max Leverage | 1:Unlimited | 1:500 |

| Platforms | MT4, MT5 | MT4, MT5, cTrader |

| Withdrawal Speed | Instant | 1-2 days |

Winner: Tie. Exness wins on leverage and withdrawals; IC Markets wins on platform variety and Australian regulation.

Exness vs XM

| Feature | Exness | XM |

|---|---|---|

| Min Deposit | $1 | $5 |

| EUR/USD Spread | From 0.4 pips (Pro) | From 1.6 pips |

| Education | Basic | Extensive |

| Bonuses | None | Available |

| Regulation | FCA, CySEC | FCA, CySEC, ASIC |

Winner: Exness for costs and conditions; XM for education and bonuses.

Exness vs OANDA

| Feature | Exness | OANDA |

|---|---|---|

| Platforms | MT4, MT5 | Proprietary |

| EUR/USD Spread | From 0.4 pips | From 1.2 pips |

| US Clients | Not accepted | Accepted |

| Leverage | Up to unlimited | Up to 1:50 |

| Research | Basic | Comprehensive |

Winner: Exness for costs and leverage; OANDA for US access and research.

Overall Comparison Verdict: Exness stands out for low costs, instant withdrawals, and high leverage. For education and research, consider XM or OANDA. For platform variety, IC Markets is stronger.

Who Should Trade with Exness?

Perfect For:

- Cost-conscious traders seeking minimal spreads and zero fees

- Scalpers and day traders requiring fast execution

- High-frequency traders who value tight spreads

- Experienced traders comfortable with high leverage

- International traders in regions where Exness is available

- Mobile traders needing reliable mobile apps

- Those prioritizing withdrawal speed

Not Ideal For:

- Complete beginners needing extensive hand-holding

- US residents (Exness doesn’t accept US clients)

- Traders seeking proprietary research and analysis tools

- Those requiring comprehensive educational programs

- Investors wanting actual stock/crypto ownership (only CFDs available)

[INTERNAL LINK: Find your fit: “What Type of Forex Trader Are You? Quiz and Strategy Guide”]

Frequently Asked Questions

Is Exness a legitimate broker?

Yes, Exness is a fully legitimate and regulated broker. Established in 2008, it holds licenses from top-tier regulators, including the FCA (UK) and CySEC (Cyprus). With over 5 million active traders and $4.5+ trillion in monthly trading volume, Exness is one of the largest and most trusted brokers globally.

Can US traders use Exness?

No, Exness does not accept clients from the United States due to regulatory restrictions. US residents should consider OANDA, TD Ameritrade, or Interactive Brokers instead.

What is the minimum deposit for Exness?

The minimum deposit varies by account type and payment method but can be as low as $1. Standard and Standard Cent accounts typically require $1-$10, while Raw Spread, Zero, and Pro accounts require $200.

How long do withdrawals take?

Exness offers instant withdrawals for e-wallets and credit/debit cards. Bank transfers take 3-5 business days, while cryptocurrency withdrawals process within 24 hours. This is significantly faster than most competitors.

Does Exness charge withdrawal fees?

No, Exness does not charge withdrawal fees. However, some payment processors (like banks or e-wallet providers) may apply their own fees.

Is unlimited leverage safe?

Unlimited leverage is extremely risky and only suitable for highly experienced traders with strict risk management. While Exness offers this option, it’s not recommended for beginners. Most traders should use leverage of 1:50 or less.

What is the stop out level on Exness?

Exness has a 0% stop out level, meaning positions are closed when your margin level reaches 0%. This differs from many brokers who close positions at 20-50%, giving you more room to withstand temporary price movements.

Does Exness offer Islamic accounts?

Yes, Exness offers swap-free (Islamic) accounts that comply with Sharia law. These accounts do not charge overnight interest (swap fees) on positions held overnight.

Can I use Expert Advisors (EAs) on Exness?

Yes, Exness fully supports automated trading through Expert Advisors on both MT4 and MT5 platforms. They also offer free VPS hosting for qualifying accounts to ensure your EAs run 24/7.

How do I contact Exness customer support?

You can reach Exness support 24/7 via:

- Live chat (fastest, usually under 1 minute)

- Email: support@exness.com

- Phone: Regional numbers available

- Social media: Facebook, Twitter, Instagram

Support is available in 13 languages.

Does Exness offer a demo account?

Yes, Exness provides free demo accounts with virtual funds ($10,000 standard). Demo accounts include full platform functionality and real-time market prices, making them perfect for practice and strategy testing.

What trading platforms does Exness support?

Exness offers:

- MetaTrader 4 (desktop, web, mobile)

- MetaTrader 5 (desktop, web, mobile)

- Exness Terminal (mobile app)

- WebTerminal (browser-based)

[INTERNAL LINK: Still have questions? Check: “Forex Broker FAQ: 50+ Common Questions Answered”]

Final Verdict: Is Exness Worth It?

After this comprehensive analysis, here’s our final assessment:

Overall Rating: ⭐⭐⭐⭐☆ (4.5/5)

Breakdown:

- Regulation & Safety: ⭐⭐⭐⭐⭐ (5/5)

- Trading Costs: ⭐⭐⭐⭐⭐ (5/5)

- Platform Quality: ⭐⭐⭐⭐☆ (4/5)

- Market Range: ⭐⭐⭐⭐☆ (4/5)

- Funding Options: ⭐⭐⭐⭐⭐ (5/5)

- Customer Support: ⭐⭐⭐⭐⭐ (5/5)

- Education: ⭐⭐⭐☆☆ (3/5)

Who Wins with Exness?

Exness is an excellent choice for:

- Active traders who execute multiple trades daily

- Scalpers requiring ultra-tight spreads

- Cost-conscious traders seeking zero-fee operations

- Those prioritizing speed (execution and withdrawals)

- International traders in supported regions

- Experienced traders comfortable with high leverage

Who Should Look Elsewhere?

Consider alternatives if you:

- Are a complete beginner needing extensive education

- Reside in the United States

- Require comprehensive research tools and market analysis

- Prefer full-service brokers with proprietary platforms

- Want actual stock/crypto ownership (not CFDs)

The Bottom Line

With 5+ million traders already onboard, Exness has proven its value proposition: ultra-competitive costs, lightning-fast execution, instant withdrawals, and robust regulation. The broker excels in areas that matter most to active traders—cost efficiency and execution quality.

While the educational resources could be more comprehensive, and the platform selection is limited to MetaTrader (which many consider an advantage), these minor drawbacks are overshadowed by Exness’s strengths.

If cost-effective trading with tier-1 regulation is your priority, Exness deserves serious consideration in 2026.

Ready to Start Trading with Exness?

[IMAGE PLACEMENT: Call-to-action banner with “Get Started” button] Alt Text: Open Exness trading account CTA banner

Quick Start Guide:

- Visit Exness website and click “Open Account”

- Complete registration (2-3 minutes)

- Verify your identity (upload ID and proof of address)

- Fund your account (minimum $1)

- Download platform (MT4, MT5, or mobile app)

- Start trading

Pro Tip: Start with a demo account to familiarize yourself with the platform and test strategies risk-free before committing real capital.

Final Thoughts

The forex market is competitive, with dozens of brokers vying for your business. Exness has distinguished itself through relentless focus on transparency, cost efficiency, and technological innovation.

Is it perfect? No broker is. But for traders who value tight spreads, instant withdrawals, strong regulation, and flexibility, Exness ranks among the best options available in 2026.

The 5 million traders who’ve chosen Exness aren’t wrong—there’s genuine substance behind the numbers.

Your trading success depends on choosing the right broker. Consider your priorities, test the platform with a demo account, and make an informed decision.