FBS Broker Review 2026: Best for Beginners or Just Marketing Hype?

FBS is one of the most heavily marketed forex brokers globally, with flashy advertisements promising massive bonuses, $1 accounts, and beginner-friendly trading. But behind the aggressive marketing campaigns and celebrity endorsements, what’s the actual trading experience like? Is FBS genuinely a good choice for beginners, or is it all marketing hype designed to attract deposits?

In this brutally honest, unbiased review, we’ll cut through the marketing noise and examine the real FBS experience—spreads, execution quality, regulation, hidden fees, bonuses (and their catches), and whether this broker truly serves beginners or exploits them. We’ll compare FBS to industry leaders and give you the unvarnished truth about what you’re actually getting.

Spoiler alert: FBS has some genuine advantages for certain traders, but it’s far from the perfect beginner broker its marketing suggests. Let’s dive into the details.

Disclaimer: This is an independent, educational review based on publicly available information as of 2026. We have no affiliate relationship with FBS. This analysis aims to provide honest insights to help you make informed decisions.

FBS Overview: Quick Facts

Founded: 2009 (15+ years in business) Headquarters: Belize (offshore) Primary Regulation: IFSC (Belize), CySEC (Cyprus), ASIC (Australia) Trading Platforms: MetaTrader 4, MetaTrader 5, FBS Trader (proprietary mobile app) Minimum Deposit: $1 (Cent Account) to $1,000 (ECN Account) Account Types: Cent, Micro, Standard, Zero Spread, ECN Maximum Leverage: Up to 1:3000 (yes, three thousand!) Instruments: 250+ including forex, metals, energies, stocks, indices, cryptocurrencies Execution Model: Mixed (Market Maker for most accounts, ECN for ECN account only) Average Spreads: 1.3-2.0 pips on major pairs (Standard account) Notable Features: Cashback program, massive bonuses, ultra-high leverage, $1 minimum deposit

Best For: Absolute beginners wanting to test with minimal capital, bonus hunters, traders in developing markets Not Ideal For: Scalpers, professional traders, those wanting tight spreads, traders prioritizing regulation

The FBS Marketing Machine: Separating Fact from Fiction

Before diving into the technical review, let’s address the elephant in the room: FBS’s marketing.

What FBS Marketing Claims:

✅ “Trade with just $1!” ✅ “Get up to $140 bonus without deposit!” ✅ “100% deposit bonus!” ✅ “Best broker for beginners!” ✅ “Win luxury prizes and gadgets!” ✅ “Trade like a pro from day one!”

The Reality Behind the Marketing:

Claim 1: “Trade with just $1!”

- True: You can open a Cent account with $1

- Reality: With $1, you can trade 0.01 micro lots. A 10-pip move = $0.01 profit. It’s more educational than practical.

- Verdict: Technically true, but misleading about what $1 can actually do

Claim 2: “Get up to $140 bonus without deposit!”

- True: They do offer no-deposit bonuses

- Reality: Withdrawn profits capped at $100-$200, requires verification, can’t withdraw bonus itself, expires after 30 days

- Verdict: True but with significant restrictions not emphasized in ads

Claim 3: “100% deposit bonus!”

- True: Offered on certain accounts

- Reality: Can’t withdraw bonus, only profits. Must trade high volumes to withdraw profits. Bonus disappears when you withdraw funds.

- Verdict: True but “free money” isn’t actually free

Claim 4: “Best broker for beginners!”

- Subjective: No objective criteria for this claim

- Reality: High spreads, offshore regulation, complex bonus terms = questionable for beginners

- Verdict: Marketing opinion, not fact

The Bottom Line on Marketing:

FBS uses aggressive, attention-grabbing marketing that’s technically accurate but presents information in the most favorable light while downplaying limitations. This review will give you the full picture.

Regulation and Safety: Major Concerns

This is where FBS faces significant challenges compared to top-tier brokers.

Regulatory Framework

IFSC (Belize) – Primary Regulation

- License Number: IFSC/60/230/TS/19

- Offshore jurisdiction

- Minimal regulatory oversight

- Low capital requirements

- No investor compensation scheme

- Limited investor protection

CySEC (Cyprus) – EU Entity

- License Number: 331/17

- EU regulation (better than IFSC)

- €20,000 investor compensation

- Serves European clients only

- MiFID II compliant

- More restrictive leverage (1:30 max)

ASIC (Australia) – Australian Entity

- Serves Australian residents

- Tier-1 regulation

- Strict oversight

- Leverage capped at 1:30

- Negative balance protection

FSC (Mauritius)

- Additional offshore license

- Minimal oversight

The Regulatory Red Flags

🚩 Primary entity is offshore (Belize)

- Most international clients trade through Belize entity

- IFSC is known for lax oversight

- Many reputable brokers avoid Belize incorporation

🚩 Segregation of funds unclear

- FBS states funds are segregated but provides limited transparency

- No third-party audits publicly available

🚩 No compensation scheme for most clients

- Only EU (CySEC) and Australian (ASIC) clients have compensation

- Belize entity has no investor protection

🚩 Mixed reviews on withdrawal issues

- Some traders report withdrawal delays

- Bonus terms complicate withdrawals

- Some complaints about account closures

What This Means for You

If you’re in EU/Australia: You’ll be under CySEC/ASIC regulation (much better) If you’re international: You’re likely trading through Belize entity (weak protection) Bottom line: FBS’s primary regulation is significantly weaker than IC Markets (ASIC), Pepperstone (ASIC/FCA), or other Tier-1 regulated brokers

Verdict: ★★☆☆☆ (2/5)

Regulation is FBS’s weakest point. While they do have CySEC and ASIC licenses for specific regions, most international clients fall under weak offshore regulation. This is a significant concern for fund safety.

[LINK PLACEHOLDER: Internal link to “How to Verify Forex Broker Regulation and Safety”]

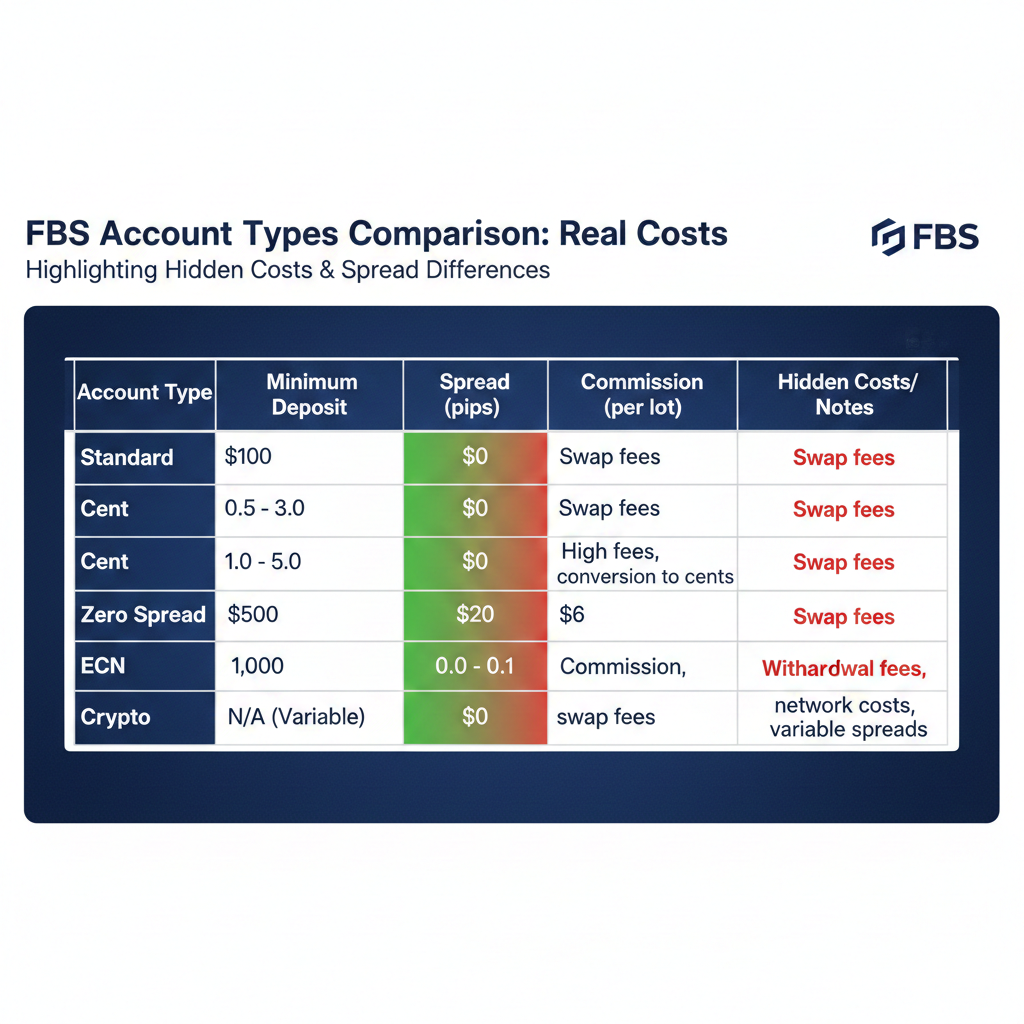

Account Types: Confusing Variety

FBS offers five account types, each with different conditions. This variety seems appealing but creates confusion.

Cent Account (The $1 Account)

Minimum Deposit: $1 Leverage: Up to 1:1000 Spreads: From 1 pip (actually 1.3-2.0 pips typical) Commission: None Execution: Market Maker Best For: Absolute beginners testing with minimal risk

The Reality:

- Trading in cents (1/100th of a dollar)

- 1 lot = $1,000, not $100,000

- With $1, you’re trading 0.01 micro lots = $0.01 per pip

- Good for learning platform, terrible for making money

- More of a marketing gimmick than serious trading account

Pros:

- Literally can start with $1

- Zero financial risk for learning

- Good psychology training

Cons:

- Profits are negligible

- Not realistic trading

- Might create unrealistic expectations

Micro Account

Minimum Deposit: $5 Leverage: Up to 1:3000 (yes, three thousand!) Spreads: From 3 pips (floating) Commission: None Execution: Market Maker

The Reality:

- Standard lot sizes (100,000 units)

- 1:3000 leverage is dangerously high

- Wider spreads than other accounts

- Market maker execution

Pros:

- Very low minimum deposit

- High leverage for aggressive traders

Cons:

- Dangerous leverage levels

- Wide spreads (3+ pips)

- Easy to blow account with high leverage

Standard Account (Most Popular)

Minimum Deposit: $100 Leverage: Up to 1:3000 Spreads: From 0.5 pips (claimed), actually 1.3-2.0 pips typical Commission: None Execution: Market Maker

Typical Costs:

| Pair | Claimed | Actual Average | Competitor Average |

|---|---|---|---|

| EUR/USD | 0.5 pips | 1.5 pips | 0.8-1.0 pips |

| GBP/USD | 0.9 pips | 2.0 pips | 1.0-1.5 pips |

| USD/JPY | 0.7 pips | 1.6 pips | 0.8-1.2 pips |

The Reality:

- Most common account type

- Spreads wider than advertised

- Market maker execution (broker may trade against you)

- High leverage = high risk

Zero Spread Account

Minimum Deposit: $500 Leverage: Up to 1:3000 Spreads: 0 pips (claimed) Commission: $20 per lot (round trip) Execution: Market Maker

The Reality:

- Not truly “zero spread” – you pay via commission

- Total cost: 0 spread + $20 commission ≈ 2 pips equivalent

- More expensive than advertised

- Commission is high compared to competitors (IC Markets: $7)

Cost Comparison:

- FBS Zero Spread: 0 pips + $20 commission = ~2.0 pip equivalent

- IC Markets Raw: 0.1 pip + $7 commission = ~0.8 pip equivalent

- FBS is 2.5× more expensive!

ECN Account

Minimum Deposit: $1,000 Leverage: Up to 1:500 Spreads: From 0.1 pips (floating) Commission: $6 per lot (round trip) Execution: True ECN

The Reality:

- This is FBS’s only true ECN account

- Actually competitive spreads and commission

- Requires $1,000 minimum (highest of all accounts)

- Most FBS marketing doesn’t mention this account

Verdict on ECN Account: If you’re serious about FBS, this is the only account worth considering. But at $1,000 minimum with $6 commission and ~0.1 pip spreads, IC Markets or Pepperstone offer similar or better conditions with stronger regulation.

Account Types Verdict: ★★☆☆☆ (2/5)

The variety looks impressive but creates confusion. Most accounts have wide spreads and market maker execution. Only the ECN account is competitive, but it’s rarely emphasized in marketing. The other accounts serve FBS’s profit margins more than trader interests.

Spreads and Execution: Below Industry Standards

Spread Reality Check

FBS advertising emphasizes “tight spreads from 0.5 pips,” but the reality is different for most accounts.

Standard Account (Most Users):

- EUR/USD: 1.3-1.8 pips (average 1.5 pips)

- GBP/USD: 1.7-2.3 pips (average 2.0 pips)

- USD/JPY: 1.4-1.9 pips (average 1.6 pips)

- AUD/USD: 1.5-2.1 pips (average 1.8 pips)

How This Compares:

| Broker | EUR/USD Average | GBP/USD Average |

|---|---|---|

| IC Markets | 0.8 pips* | 0.9 pips* |

| Pepperstone | 0.9 pips* | 1.1 pips* |

| FBS Standard | 1.5 pips | 2.0 pips |

| Industry Avg | 1.0 pips | 1.3 pips |

*Including commission converted to pips

FBS spreads are 50-100% wider than top-tier brokers.

Execution Quality

Execution Model: Market Maker (except ECN account)

- FBS is the counterparty to your trades

- Potential conflict of interest

- Orders not sent to actual forex market

- Slippage and requotes more common

Average Execution Speed: 0.5-2 seconds

- Significantly slower than ECN brokers (<40ms)

- Requotes occur during volatile markets

- Slippage common on news releases

Execution Statistics:

- Based on trader reports (FBS doesn’t publish official stats)

- Requotes: Common during high volatility

- Slippage: Frequently reported, often negative

- Order rejection: Some traders report issues with large orders

Scalping Policy

Official policy: Scalping allowed Reality: Some traders report:

- Increased slippage on scalping strategies

- Requotes on quick trades

- Account warnings for “excessive” scalping

- Platform slowdowns during active scalping

Bottom line: While technically allowed, FBS’s market maker model and wide spreads make scalping unprofitable anyway.

Verdict: ★★☆☆☆ (2/5)

Spreads are significantly wider than industry leaders, execution is market maker model (potential conflict), and speed is slow compared to ECN brokers. The ECN account is better but still doesn’t match top-tier brokers.

[LINK PLACEHOLDER: Internal link to “5-Minute Scalping Strategy for Forex Beginners”]

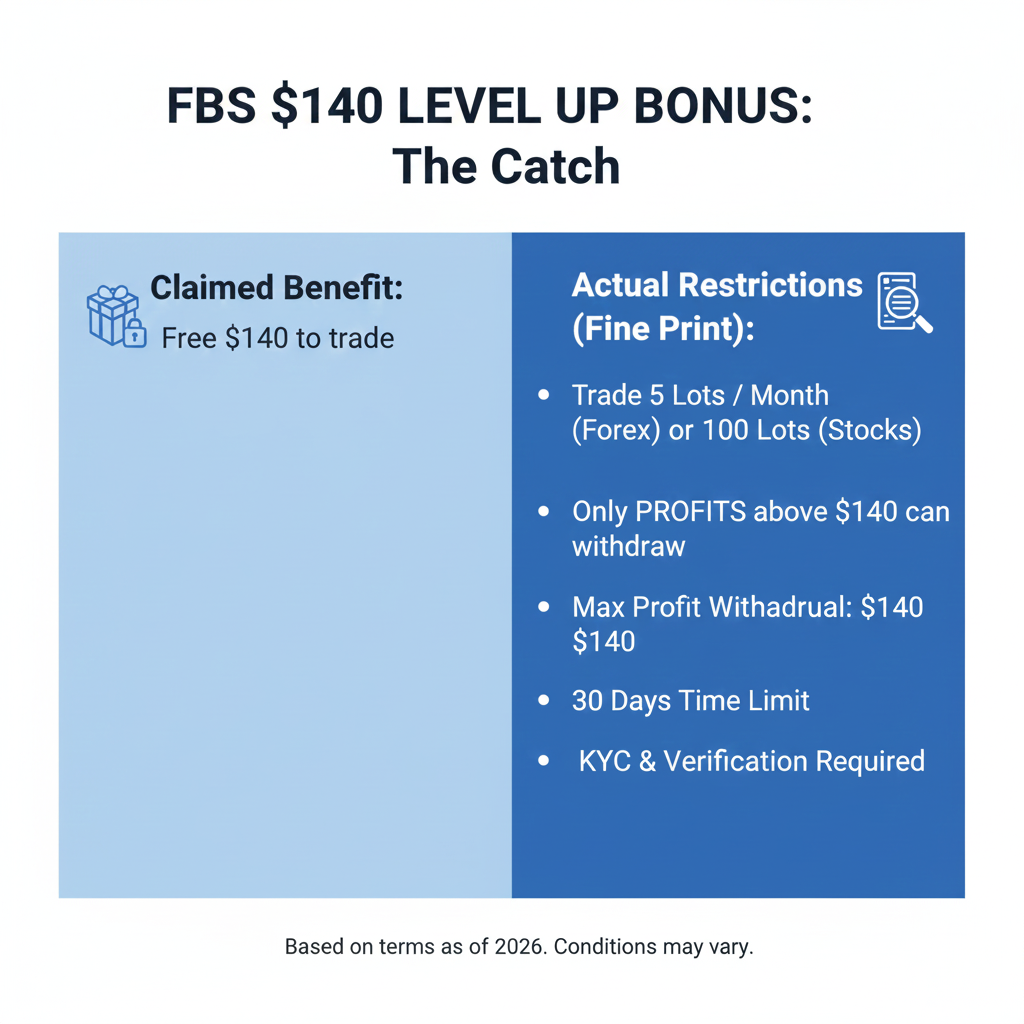

The Bonus System: Free Money or Trap?

FBS’s bonus system is central to its marketing. Let’s examine what you’re actually getting.

Types of Bonuses

1. No-Deposit Bonus ($140 claimed)

- Register and verify account

- Get $50-$140 bonus (varies by region)

- Can trade with bonus money

The Catches:

- Can’t withdraw the bonus itself

- Profit withdrawal limited to $100-$200

- Expires after 30 days

- Must complete verification (some rejected)

- Must maintain minimum activity

Reality: It’s a trial promotion, not free money. Good for testing, but profit caps limit usefulness.

2. 100% Deposit Bonus

- Deposit $100, get $100 bonus = $200 total

- Sounds amazing, right?

The Catches:

- Can’t withdraw bonus, only profits

- Bonus disappears when you withdraw principal

- Must trade high volume to withdraw profits (typically 1 lot per $3-$5 bonus)

- Bonus may prevent withdrawal for weeks/months

- Can’t transfer funds between accounts with bonus

Example:

- You deposit $100, get $100 bonus ($200 total)

- Make $50 profit ($250 total)

- Want to withdraw your $150 ($100 deposit + $50 profit)

- Must trade 20-30 lots first (might take weeks)

- If you withdraw before completing volume, lose bonus

- Bonus keeps your money “locked” longer

3. Cashback Program

- Receive $2-$15 per lot traded

- Paid monthly

- Varies by account type and trading volume

The Catches:

- Only paid on completed months

- Can be revoked for “abnormal trading patterns”

- Lower on most accounts, highest on ECN (the account they market least)

Are Bonuses Worth It?

For complete beginners: The no-deposit bonus is genuinely useful for risk-free testing. Take it.

For deposit bonuses: Generally NOT worth it for these reasons:

- Locks your capital with withdrawal restrictions

- Forces you to overtrade to meet volume requirements

- Clouds judgment (you focus on bonus requirements, not good trades)

- Complicates accounting and tax reporting

- Creates psychological attachment to losing trades

Professional Opinion: Legitimate traders don’t need bonuses. Legitimate brokers don’t need to lure clients with bonuses. Top-tier brokers (IC Markets, Pepperstone) offer minimal/no bonuses because their execution quality speaks for itself.

Verdict: ★★☆☆☆ (2/5)

Bonuses look attractive but come with restrictive terms that often trap traders. The no-deposit bonus is useful for testing, but deposit bonuses create more problems than benefits. This is a marketing tactic more than a genuine value proposition.

Trading Platforms: Standard But Limited

MetaTrader 4

Available: Yes Customization: Standard MT4 features Expert Advisors: Allowed Connection: Generally stable

Performance:

- Standard MT4 performance

- Occasional disconnections reported

- Slower execution than ECN brokers

MetaTrader 5

Available: Yes Features: Standard MT5 features Timeframes: All 21 timeframes Assets: Multi-asset support

FBS Trader (Proprietary Mobile App)

Platforms: iOS and Android Features:

- Simplified interface for beginners

- One-tap trading

- Limited charting tools

- News and analysis integrated

- Account management

Pros:

- User-friendly for beginners

- Clean interface

Cons:

- Limited functionality vs MT4/MT5

- Can’t use EAs

- Basic charting only

Verdict: ★★★☆☆ (3/5)

Platforms are standard MT4/MT5 with no special advantages. FBS Trader app is user-friendly but limited. Nothing impressive, nothing terrible. Average offering.

Leverage: Dangerously High

FBS advertises up to 1:3000 leverage as an advantage. This is actually a massive red flag.

Leverage by Account

- Cent Account: Up to 1:1000

- Micro Account: Up to 1:3000

- Standard Account: Up to 1:3000

- Zero Spread: Up to 1:3000

- ECN Account: Up to 1:500

Why 1:3000 is Dangerous

With 1:3000 leverage:

- A 0.03% adverse move = 100% account loss

- That’s 3 pips on EUR/USD

- Your account can be wiped out in SECONDS

- A single news spike could destroy your capital

Example:

- $100 account with 1:3000 leverage

- You can control $300,000 worth of currency

- EUR/USD moves against you 3 pips

- You lose $300 (your entire $100 + owe $200 more!)

Industry Standard:

- Professional brokers: 1:30 to 1:100

- US regulations: Maximum 1:50

- EU regulations: Maximum 1:30

- IC Markets maximum: 1:500 (and they recommend using less)

Negative Balance Protection

ASIC and CySEC entities: Yes, negative balance protection IFSC (Belize) entity: Not clearly stated

This means international clients might owe money if leverage causes losses beyond account balance.

Verdict: ★☆☆☆☆ (1/5)

Offering 1:3000 leverage is irresponsible and dangerous, especially for beginners (FBS’s target market). This is predatory, not beneficial. It’s designed to generate larger trades (more profit for broker) while exposing traders to devastating losses.

[LINK PLACEHOLDER: Internal link to “What is Leverage in Forex? How It Works (With Real Examples)”]

Fees and Hidden Costs

Commission Structure

- Cent, Micro, Standard accounts: $0 commission (cost in spread)

- Zero Spread account: $20 per lot round trip (expensive)

- ECN account: $6 per lot round trip (reasonable)

Deposit Fees

- Bank wire: May have bank fees ($10-$50)

- Credit/debit card: FREE

- E-wallets (Skrill, Neteller, Perfect Money): FREE

- Crypto: Network fees apply

Withdrawal Fees

This is where hidden costs appear:

- First withdrawal per month: FREE

- Additional withdrawals:

- Bank wire: $1-$50 depending on amount

- E-wallets: 1% fee (minimum $1)

- Crypto: Network fees

The Hidden Cost: If you trade actively and withdraw frequently, fees accumulate. Many traders report surprise fees not clearly disclosed during withdrawal.

Conversion Fees

- If your account currency differs from deposit currency: 0.5-1% conversion fee

- Not clearly disclosed in marketing

- Adds hidden cost to deposits/withdrawals

Inactivity Fee

- Fee: $5 per month after 3 months of inactivity

- Worse than most brokers: Many charge after 6-12 months

- Starts quickly, easy to forget

Swap Rates (Overnight Fees)

Generally higher than competitors:

- EUR/USD Long: -$7 per lot per night (vs -$5.50 at IC Markets)

- GBP/USD Long: -$6 per lot per night (vs -$4.20 at IC Markets)

Islamic Accounts: Available (swap-free) but with additional restrictions

Verdict: ★★☆☆☆ (2/5)

Multiple withdrawal fees, conversion fees not clearly disclosed, higher swap rates than competitors, and inactivity fee kicks in quickly. While first withdrawal is free, frequent traders face accumulating costs.

Customer Service: Mixed Reviews

Support Channels

Live Chat:

- Available 24/7 (better than some brokers)

- Multi-language support (15+ languages)

- Response time: 1-5 minutes typically

Email:

- support@fbs.com

- Response: 12-48 hours (inconsistent)

Phone:

- International numbers available

- Some users report difficulty reaching support

Social Media:

- Active on Facebook, Instagram, Twitter

- Community forums

Support Quality

Positive Reports:

- Friendly support staff

- Multi-language capability

- Generally responsive on live chat

Negative Reports:

- Scripted responses (feels like talking to bots)

- Difficulty resolving withdrawal issues

- Account verification delays

- Bonus term disputes

- Platform technical issues not resolved quickly

Common Complaints:

- “They helped me deposit but not withdraw”

- “Support went silent when I had withdrawal issue”

- “Verification rejected without clear reason”

- “Bonus terms weren’t explained until I tried to withdraw”

Educational Resources

Available:

- Trading tutorials and videos

- Webinars (irregular schedule)

- Market analysis and news

- FBS Copytr ade (copy trading platform)

- Economic calendar

Quality:

- Basic educational content

- Focused on encouraging deposits

- Less comprehensive than IC Markets or Pepperstone

- More marketing than education

Verdict: ★★★☆☆ (3/5)

24/7 support is good, but quality is inconsistent. Many reports of issues with withdrawals and bonus disputes. Educational resources are basic. Average customer service at best.

Deposit and Withdrawal Experience

Minimum Deposit

- Cent Account: $1

- Micro Account: $5

- Standard Account: $100

- Zero Spread: $500

- ECN Account: $1,000

Deposit Process

Processing Time:

- E-wallets: Instant

- Credit/debit cards: Instant

- Bank wire: 1-3 business days

- Crypto: 30-60 minutes

Generally smooth: Most traders report easy deposits

Withdrawal Process

This is where problems emerge:

Processing Time:

- FBS claims: 1-2 business days

- Reality: 2-5 business days (sometimes longer)

- Some traders report: 1-2 weeks for first withdrawal

Verification Requirements:

- ID verification required (reasonable)

- Proof of address (reasonable)

- Proof of deposit method (reasonable)

- Sometimes: Additional documents requested (source of funds, employment, etc.)

Common Withdrawal Issues:

- Verification delays – Documents rejected multiple times

- Bonus complications – Can’t withdraw until volume met

- Profit caps – Limited withdrawals from bonus accounts

- Unexpected fees – Charges not clearly disclosed

- Processing delays – Requests sit for days without update

Trustpilot Reviews (Sample):

- Many 5-star reviews (possibly incentivized by bonus)

- Many 1-star reviews citing withdrawal problems

- Pattern: Easy to deposit, hard to withdraw

Withdrawal Verdict

First small withdrawal: Usually works Larger withdrawals: More scrutiny, more delays Bonus-related withdrawals: Expect complications

Verdict: ★★☆☆☆ (2/5)

Deposits are smooth (as expected), but withdrawals have too many reported issues. While legitimate brokers prioritize client fund access, FBS appears to create friction during withdrawals, particularly when bonuses are involved.

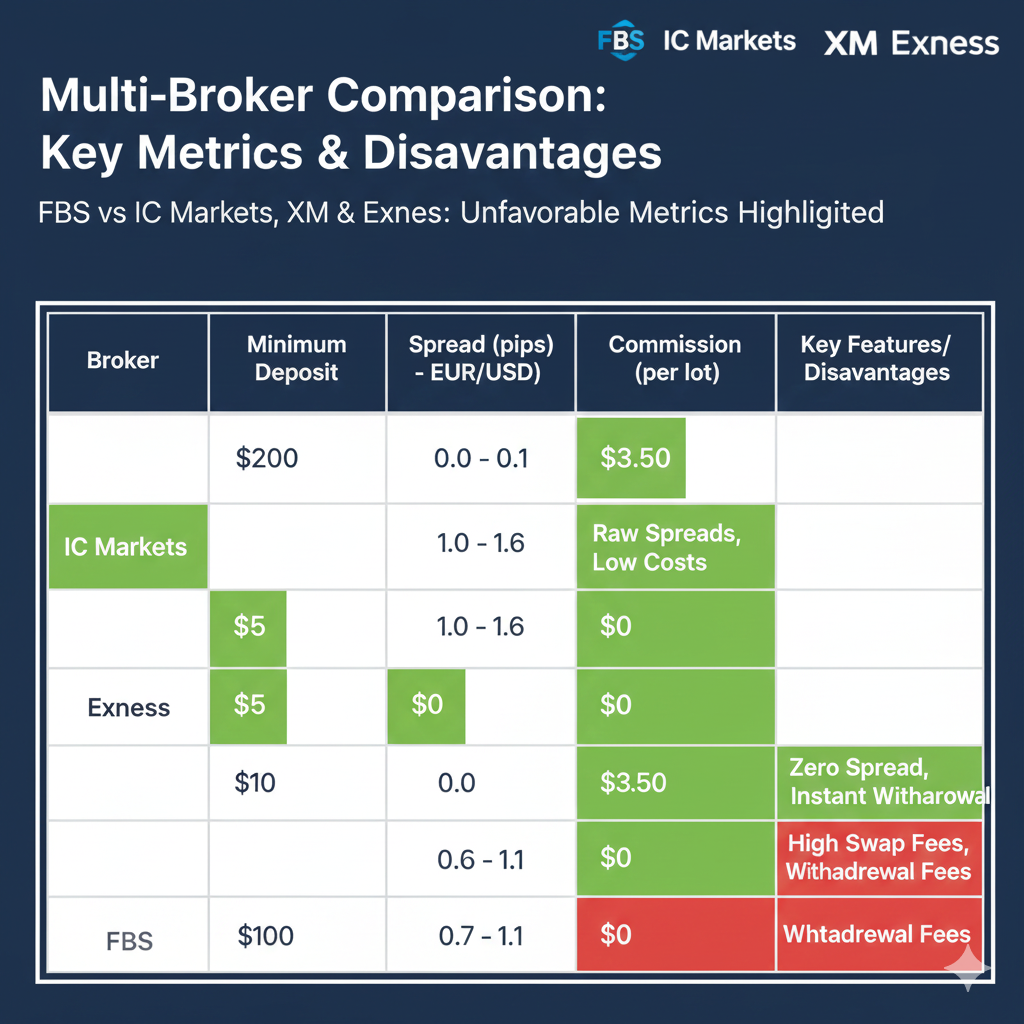

FBS vs Competitors: How It Stacks Up

FBS vs IC Markets

| Feature | FBS | IC Markets |

|---|---|---|

| Regulation | IFSC (weak) | ASIC (strong) |

| Spreads EUR/USD | 1.5 pips | 0.8 pips* |

| Execution | Market Maker | True ECN |

| Commission | $0-$20 | $7 |

| Leverage | Up to 1:3000 | Up to 1:500 |

| Min Deposit | $1-$1000 | $200 |

| Platforms | MT4, MT5 | MT4, MT5, cTrader |

| Bonuses | Extensive | Minimal |

| Best For | Beginners testing | Serious traders |

Winner: IC Markets by wide margin for serious trading

FBS vs XM

| Feature | FBS | XM |

|---|---|---|

| Regulation | IFSC/CySEC | CySEC/ASIC |

| Spreads | 1.5 pips | 1.6 pips |

| Bonuses | 100% deposit | $30 no-deposit |

| Leverage | 1:3000 | 1:888 |

| Education | Basic | Comprehensive |

| Reputation | Mixed | Better |

Winner: XM (slightly) – better reputation, better education, similar conditions

FBS vs Exness

| Feature | FBS | Exness |

|---|---|---|

| Regulation | IFSC/CySEC | FCA/CySEC |

| Spreads | 1.5 pips | 1.0 pips |

| Execution | Market Maker | Hybrid |

| Leverage | 1:3000 | Unlimited |

| Withdrawal | Issues reported | Generally smooth |

| Reputation | Mixed | Better |

Winner: Exness – better spreads, better regulation, better reputation

Overall Verdict: FBS ranks below industry leaders in almost every category except marketing budget and bonus offerings.

Pros and Cons: The Complete Picture

Advantages (Why Some Choose FBS)

✅ Ultra-low minimum deposit – Genuinely can start with $1-$5 ✅ No-deposit bonus – Risk-free way to test platform ✅ High leverage available – For aggressive traders (though dangerous) ✅ Multiple account types – Options for different experience levels ✅ 24/7 customer support – Around-the-clock assistance ✅ FBS Trader app – Simplified mobile trading for beginners ✅ Multi-language support – 15+ languages ✅ Cashback program – Some rebates on trading volume ✅ Copy trading available – FBS Copytrade feature ✅ Islamic accounts – Swap-free for Muslim traders ✅ Good for testing – Minimal risk to try forex trading ✅ Active in developing markets – Supports local payment methods

Disadvantages (Major Concerns)

❌ Weak primary regulation – IFSC (Belize) is offshore with minimal oversight ❌ Wide spreads – 50-100% wider than top-tier brokers ❌ Market maker execution – Potential conflict of interest (except ECN) ❌ Withdrawal issues reported – Many complaints about delays and rejections ❌ Bonus terms restrictive – “Free money” comes with strings attached ❌ Dangerously high leverage – 1:3000 can wipe accounts instantly ❌ Hidden fees – Withdrawal fees, conversion fees not clearly disclosed ❌ Slow execution – 0.5-2 seconds vs <40ms at ECN brokers ❌ Mixed reputation – Many negative reviews regarding withdrawals ❌ Misleading marketing – Claims don’t match reality ❌ Frequent requotes – During volatile markets ❌ High inactivity fee – Starts after just 3 months ❌ Not ideal for scalping – Wide spreads and market maker model ❌ Complicated account structure – Five account types create confusion ❌ Poor transparency – Vague about execution model, fund segregation

Who Should (and Shouldn’t) Use FBS

Potentially Suitable For:

✅ Absolute beginners – Who want to test with $1-$5 (but use Cent account only) ✅ Traders in developing markets – Where local payment methods are important ✅ Bonus hunters – Who understand and accept bonus restrictions ✅ Risk-free testers – Using no-deposit bonus to try forex ✅ Very casual traders – Not concerned with tight spreads or best execution ✅ Copy trading beginners – Wanting to try social trading

NOT Suitable For:

❌ Serious traders – Better options available with tighter spreads ❌ Scalpers – Wide spreads make scalping unprofitable ❌ Professional traders – Execution quality insufficient ❌ Large account traders – Weak regulation is risk to larger capital ❌ Those prioritizing safety – Offshore regulation concerning ❌ Active traders – Withdrawal fees accumulate ❌ Anyone with >$1,000 – Better brokers available at this capital level ❌ Traders valuing transparency – Too many hidden costs and unclear terms ❌ US residents – Not available

The Honest Verdict: Marketing Over Substance

Overall Rating: ★★☆☆☆ (2.3/5)

Breakdown:

- Regulation & Safety: ★★☆☆☆ (2/5) – Weak primary regulation

- Spreads & Execution: ★★☆☆☆ (2/5) – Below industry standard

- Platforms: ★★★☆☆ (3/5) – Standard MT4/MT5, nothing special

- Fees & Costs: ★★☆☆☆ (2/5) – Hidden costs, withdrawal fees

- Leverage: ★☆☆☆☆ (1/5) – Dangerously irresponsible

- Customer Service: ★★★☆☆ (3/5) – Available but inconsistent quality

- Bonuses: ★★☆☆☆ (2/5) – Attractive but restrictive

- Transparency: ★★☆☆☆ (2/5) – Poor disclosure of costs and risks

- Overall Value: ★★☆☆☆ (2/5) – Marketing exceeds actual value

The Bottom Line

Is FBS the best broker for beginners? No. Despite aggressive marketing claiming this, FBS is not ideal for beginners due to:

- Wide spreads that make profitability harder

- Weak regulation that doesn’t protect beginners adequately

- Dangerously high leverage marketed as an advantage

- Complex bonus terms that confuse newcomers

- Market maker execution with potential conflicts

Is FBS just marketing hype? Mostly, yes. The core offering—wide spreads, offshore regulation, market maker execution—is below industry standards. The extensive marketing, bonuses, and low minimums create the illusion of value, but the fundamentals don’t support the hype.

Does FBS have legitimate uses? Limited. The $1 Cent account and no-deposit bonus are genuinely useful for absolute beginners to test forex trading with zero risk. Beyond that initial testing phase, better brokers exist at every capital level.

Our Honest Recommendation

For Complete Beginners:

- Use FBS’s no-deposit bonus to test forex trading risk-free

- Open a Cent account with $5-$10 for learning

- Then move to a better broker (IC Markets, Pepperstone, XM) when ready for serious trading

For Anyone with $200+:

- Skip FBS entirely

- Open account with IC Markets, Pepperstone, or other top-tier broker

- You’ll save money on spreads and have better security

For Bonus Hunters:

- Take the no-deposit bonus if you want

- Understand and accept deposit bonus restrictions

- Don’t let bonuses drive your trading decisions

Bottom Line: FBS serves a narrow niche—absolute beginners testing with minimal capital. For anyone past the learning phase or with serious capital ($200+), significantly better alternatives exist. The marketing is impressive, but the substance doesn’t match the hype.

Rating: 2.3/5 – Below Average, Use Cautiously for Testing Only

How to Open an FBS Account (If You Decide To)

Step-by-Step Process

Step 1: Visit FBS Website

- Go to www.fbs.com

- Click “Open Account”

Step 2: Choose Account Type

- For testing: Cent Account ($1 minimum)

- For learning: Micro Account ($5 minimum)

- For standard trading: Standard Account ($100 minimum)

- If serious (not recommended): ECN Account ($1,000 minimum)

Step 3: Registration

- Email address

- Create password

- Select country

- Phone number

- Choose account currency

Step 4: Verification

- Upload government ID (passport or driver’s license)

- Upload proof of address (utility bill, bank statement <3 months)

- Sometimes: Additional documents requested

Step 5: Choose Bonus (Optional)

- Consider a no-deposit bonus for testing

- Avoid deposit bonuses unless you understand and accept restrictions

Step 6: Deposit Funds

- Choose a deposit method

- Minimum: $1 (Cent), $5 (Micro), $100 (Standard)

- Follow payment instructions

Step 7: Download Platform

- Download MT4, MT5, or FBS Trader app

- Log in with the provided credentials

- Start trading (carefully!)

Total Time: 15-30 minutes for registration, 1-3 days for verification

Important: Before You Trade

- Read bonus terms completely if accepting any bonus

- Start with Cent account to test with minimal risk

- Use low leverage (1:10 or 1:20 maximum, not 1:3000!)

- Test withdrawal process with small amount first

- Have exit plan – know when you’ll move to better broker

Frequently Asked Questions

Is FBS a legitimate broker or a scam?

FBS is a legitimate broker that has been operating since 2009. However, “legitimate” doesn’t mean “good.” FBS has regulatory licenses (though primarily offshore), processes withdrawals (though with reported delays), and provides trading services. It’s not an outright scam, but it’s a below-average broker with aggressive marketing, wide spreads, and weak regulation. Many traders experience frustration with withdrawals and bonus terms.

Can I really start trading with just $1 on FBS?

Yes, the Cent account genuinely allows a $1 minimum deposit. However, with $1, you can only trade 0.01 micro lots, meaning a 10-pip move equals $0.01 profit. It’s useful for learning the platform mechanics but not for making meaningful money. Think of it as a paid demo account that costs $1 instead of being free.

Are FBS bonuses worth taking?

The no-deposit bonus is worth taking for risk-free testing. The 100% deposit bonus is generally NOT worth it because: (1) You can’t withdraw the bonus itself, (2) Withdrawal of profits is restricted until you trade high volumes, (3) The bonus disappears if you withdraw your principal, (4) It creates psychological pressure to overtrade. Professional traders avoid deposit bonuses and choose brokers based on trading conditions, not promotions.

What are the catches with FBS’s bonuses?

Major catches include: (1) Can’t withdraw bonus money, only profits, (2) Must trade high volume (often 1 lot per $3-5 bonus) before withdrawing profits, (3) Bonus disappears when you withdraw principal, (4) Volume requirements can take weeks/months to meet, (5) Profits from no-deposit bonus are capped at $100-200, (6) Bonuses expire after set periods, (7) Terms are complex and not always clearly communicated upfront.

Is 1:3000 leverage safe for beginners?

Absolutely not. 1:3000 leverage is extremely dangerous, especially for beginners. With this leverage, a mere 3-pip adverse move can wipe out your entire account. It’s designed to generate larger trading volumes (benefiting the broker) while exposing traders to catastrophic losses. Professionals recommend using no more than 1:30 leverage, even if higher is available. FBS marketing high leverage as an advantage is irresponsible and predatory.

How long do FBS withdrawals take?

FBS claims 1-2 business days for withdrawal processing. In reality, traders report: (1) First withdrawal: 3-7 days, (2) Subsequent withdrawals: 2-5 days, (3) Withdrawals with bonuses: Can take 1-2 weeks or longer, (4) Verification issues: Add additional days/weeks, (5) Some traders report withdrawals taking over a month during disputes. Compare this to IC Markets or Pepperstone, where most withdrawals process within 24 hours.

Should I choose FBS or IC Markets?

For almost all traders, IC Markets is the better choice. IC Markets offers: Stronger regulation (ASIC), tighter spreads (0.8 pips vs 1.5 pips), true ECN execution, faster order processing (<40ms vs 0.5-2s), transparent pricing, and better reputation. FBS only makes sense if: (1) You have literally $1-5 and want to test, (2) You’re in a region where IC Markets isn’t available, (3) You want to claim the no-deposit bonus for testing. For serious trading with $200+, IC Markets is superior in every meaningful way.

Alternatives to Consider

If FBS doesn’t meet your needs (and for most traders, it won’t), consider these alternatives:

For Serious Traders (Best Overall)

IC Markets

- Regulation: ASIC, CySEC (Tier-1)

- Spreads: From 0.0 pips + $7 commission

- Execution: True ECN, <40ms

- Best for: Scalpers, day traders, professionals

- [LINK: Read full IC Markets review]

Pepperstone

- Regulation: ASIC, FCA (Tier-1)

- Spreads: From 0.1 pips + commission

- Execution: True ECN

- Best for: Active traders, scalpers

For Beginners (Better Than FBS)

XM

- Regulation: CySEC, ASIC

- Spreads: 1.6 pips (similar to FBS but better regulated)

- Bonuses: $30 no-deposit (simpler terms than FBS)

- Education: Extensive

- Best for: Beginners who want learning resources

eToro

- Regulation: FCA, ASIC, CySEC

- Spreads: 1.0-3.0 pips (variable)

- Social trading: Copy successful traders

- Best for: Beginners wanting copy trading

For Low Capital Traders

Exness

- Regulation: FCA, CySEC

- Spreads: From 1.0 pips

- Minimum: $10

- Best for: Better than FBS at similar capital levels

OctaFX

- Regulation: CySEC

- Spreads: From 0.6 pips

- Minimum: $25

- Best for: Low capital with better conditions than FBS

All of these alternatives offer better trading conditions, stronger regulation, or more comprehensive education than FBS.

Final Thoughts: Look Beyond the Marketing

FBS has invested heavily in marketing—celebrity endorsements, flashy ads, massive bonuses, and aggressive social media presence. This creates the impression of a premium broker. However, when you examine the fundamentals—regulation, spreads, execution quality, transparency—FBS consistently ranks below industry leaders.

The core issues:

- Weak primary regulation (IFSC Belize)

- Wide spreads (50-100% above industry average)

- Market maker execution (conflict of interest)

- Withdrawal issues (too many reports to ignore)

- Misleading marketing (claims don’t match reality)

- Dangerous leverage (1:3000 is predatory)

- Restrictive bonus terms (trap, not benefit)

The limited uses:

- No-deposit bonus (genuinely useful for testing)

- Cent account (good for learning with $1-10)

- Developing market access (local payment methods)

Our recommendation pyramid:

Tier 1 (Best): IC Markets, Pepperstone, Interactive Brokers Tier 2 (Good): XM, OANDA, Forex.com, IG Tier 3 (Acceptable): Exness, OctaFX, HotForex Tier 4 (Caution): FBS, others with weak regulation

FBS sits in the lowest tier of internationally available brokers. Use it only for initial testing with minimal capital ($1-10), then graduate to a Tier 1 or Tier 2 broker for serious trading.

The answer to our title question: “Best for Beginners or Marketing Hype?”

Verdict: Primarily marketing hype with limited legitimate use cases for absolute beginners testing with $1-10. Not recommended for serious trading at any capital level.