Forex Trading Hours: Best Time to Trade Each Currency Pair in 2026

Unlike stock markets that close at the end of each business day, the forex market operates 24 hours a day, five days a week. This round-the-clock availability is one of forex trading’s biggest advantages, allowing traders worldwide to participate whenever it suits their schedule. However, not all trading hours are created equal. Understanding when to trade specific currency pairs can dramatically improve your trading results and profitability.

In this comprehensive guide, you’ll learn exactly when the forex market is most active, which currency pairs to trade during different sessions, and how to maximize your trading opportunities based on global market hours.

Understanding the 24-Hour Forex Market

The forex market never sleeps because it follows the sun around the globe. As trading closes in one major financial center, it opens in another. This creates a continuous cycle of currency trading that begins Sunday evening (EST) and continues until Friday afternoon.

The Four Major Trading Sessions

The 24-hour forex market is divided into four main trading sessions, each centered around a major financial hub:

Sydney Session (Asian-Pacific)

- Opens: 5:00 PM EST (Sunday)

- Closes: 2:00 AM EST

- Characteristics: Lower volatility, sets tone for Asia trading

Tokyo Session (Asian)

- Opens: 7:00 PM EST

- Closes: 4:00 AM EST

- Characteristics: Moderate volatility, strong JPY movement

London Session (European)

- Opens: 3:00 AM EST

- Closes: 12:00 PM EST

- Characteristics: Highest volume, strong EUR and GBP movement

New York Session (American)

- Opens: 8:00 AM EST

- Closes: 5:00 PM EST

- Characteristics: High volatility, strong USD movement

Why Trading Session Timing Matters

The trading session significantly impacts your potential success because:

- Liquidity varies dramatically – More active sessions mean tighter spreads and better execution

- Volatility changes throughout the day – Price movements are larger during certain hours

- Currency pairs have “home sessions” – Pairs move most when their home markets are open

- Economic news releases are scheduled – Major announcements occur during specific sessions

- Trading costs differ – Spreads widen during quiet periods and tighten during active hours

[LINK PLACEHOLDER: Internal link to “Understanding Forex Liquidity and Why It Matters”]

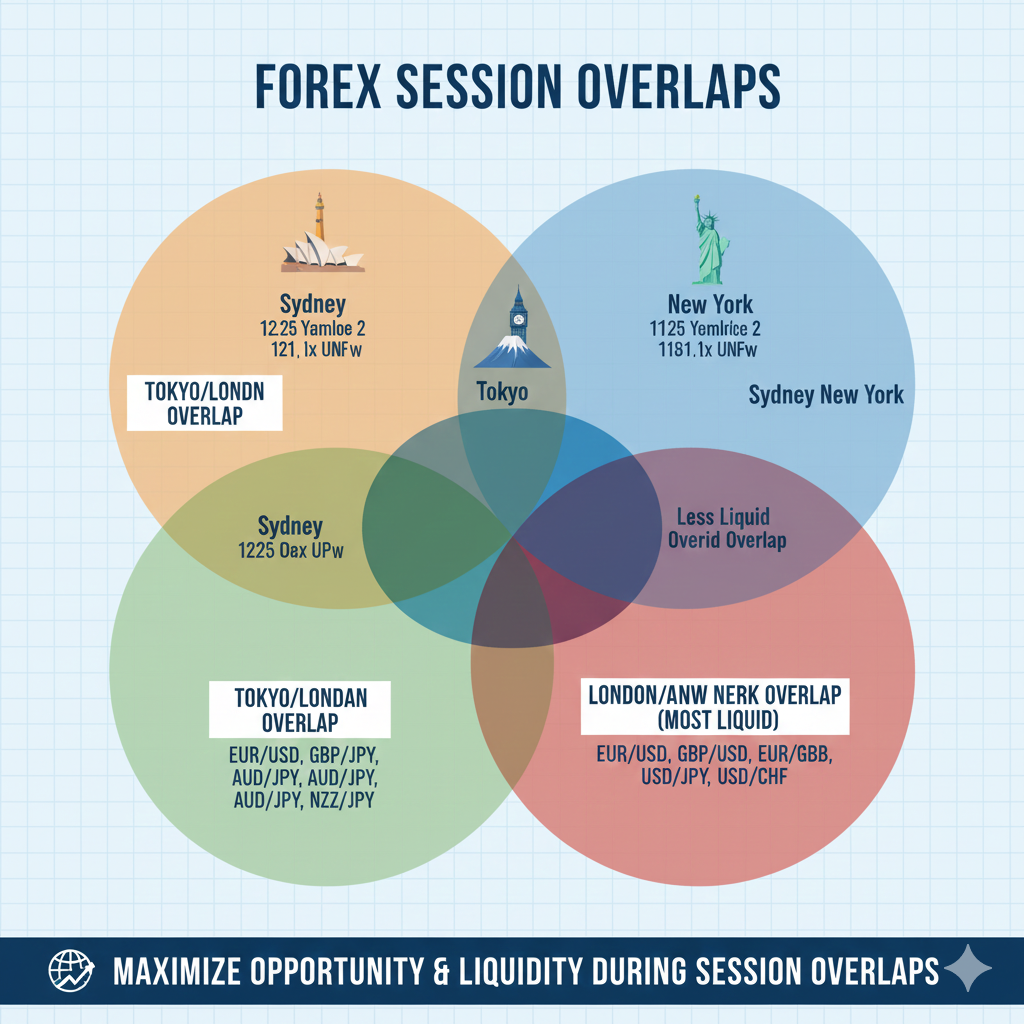

The Best Times to Trade Forex (Session Overlaps)

While the forex market is open 24 hours, the most profitable trading opportunities occur during session overlaps when two major markets are open simultaneously.

London/New York Overlap (8:00 AM – 12:00 PM EST)

This is widely considered the absolute best time to trade forex because:

- Highest trading volume of the entire day (over 50% of daily volume)

- Maximum liquidity means tightest spreads and best execution

- Greatest volatility creates the most trading opportunities

- Major economic releases from both Europe and the US

- All major currency pairs are active and moving strongly

Best pairs to trade during this overlap:

- EUR/USD (most active)

- GBP/USD (most volatile)

- USD/CHF

- EUR/GBP

If you can only trade during one period each day, this four-hour window from 8:00 AM to 12:00 PM EST offers the most consistent opportunities across all major pairs.

London/Tokyo Overlap (3:00 AM – 4:00 AM EST)

This brief one-hour overlap offers limited opportunities but can be worthwhile for:

- Asian currency pairs (AUD/JPY, EUR/JPY, GBP/JPY)

- Traders in Asian time zones looking for increased liquidity

- Quick scalping opportunities during the transition period

The movement is generally subdued compared to the London/New York overlap, but it’s still more active than trading during a single session alone.

Sydney/Tokyo Overlap (7:00 PM – 2:00 AM EST)

This overlap offers moderate opportunities, particularly for:

- AUD and NZD pairs (AUD/USD, NZD/USD, AUD/NZD)

- Traders in Asian and Australian time zones

- Position traders looking to catch early moves before major sessions

While not as active as the London/New York overlap, this period can be profitable if you focus on the right currency pairs.

Complete Trading Session Breakdown

Sydney Session (5:00 PM – 2:00 AM EST)

Characteristics:

- Lowest volume and liquidity of all sessions

- Generally calm market conditions

- Sets the tone for Asian trading day

- Occasional volatility from Australian economic data

Best Currency Pairs:

- AUD/USD (Australian dollar is most active)

- AUD/JPY

- AUD/NZD

- NZD/USD

Trading Strategy: This session is best for position traders and swing traders rather than day traders or scalpers. The lower volatility means fewer opportunities but also more predictable price action. Consider this session for placing pending orders or adjusting existing positions rather than active trading.

Economic Events to Watch:

- Reserve Bank of Australia (RBA) announcements

- Australian employment data

- Chinese economic releases (impact AUD)

- New Zealand economic data

Tokyo Session (7:00 PM – 4:00 AM EST)

Characteristics:

- Moderate liquidity and volatility

- Strong movement in JPY pairs

- Asian economic news can create significant moves

- Often establishes support/resistance levels for the London session

Best Currency Pairs:

- USD/JPY (most liquid during this session)

- EUR/JPY

- GBP/JPY

- AUD/JPY

- NZD/JPY

Trading Strategy: The Tokyo session offers decent opportunities, especially in the first few hours when volatility is highest. Japanese economic data releases can create sharp moves in JPY pairs. This session favors range-trading strategies more than trend-following approaches.

Economic Events to Watch:

- Bank of Japan (BoJ) policy decisions

- Japanese GDP and inflation data

- Trade balance reports

- Consumer confidence indicators

[LINK PLACEHOLDER: Internal link to “Trading Japanese Yen Pairs: Complete Strategy Guide”]

London Session (3:00 AM – 12:00 PM EST)

Characteristics:

- Highest trading volume (about 35% of daily forex volume)

- Strong volatility and liquidity

- EUR and GBP pairs extremely active

- Many European economic releases

- Often establishes daily highs and lows

Best Currency Pairs:

- EUR/USD (most traded pair in the world)

- GBP/USD (highly volatile)

- EUR/GBP

- EUR/JPY

- GBP/JPY

- USD/CHF

Trading Strategy: The London session is ideal for breakout traders and trend followers. Price movements are strong and sustained, with clear directional bias. The first two hours (3:00 AM – 5:00 AM EST) and the overlap with New York (8:00 AM – 12:00 PM EST) are particularly active.

Economic Events to Watch:

- European Central Bank (ECB) announcements

- UK employment and inflation data

- Eurozone GDP figures

- German economic indicators (manufacturing, sentiment)

- UK retail sales and GDP

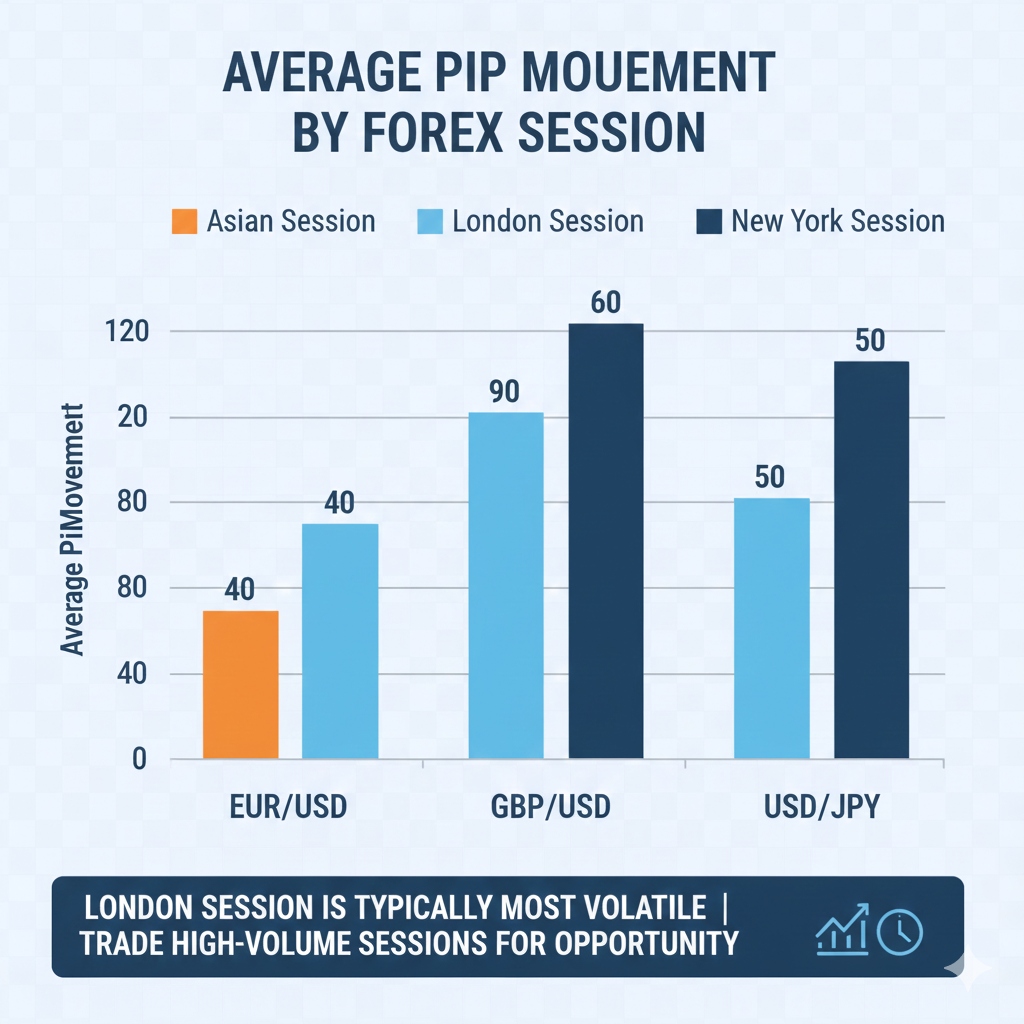

[IMAGE PLACEHOLDER: Bar chart showing average pip movement by session for major currency pairs – Alt text: “Average daily pip range by trading session for EUR/USD, GBP/USD, and USD/JPY”]

New York Session (8:00 AM – 5:00 PM EST)

Characteristics:

- Second-highest trading volume (about 20% of daily volume)

- Overlaps with London for peak liquidity (8:00 AM – 12:00 PM EST)

- All USD pairs very active

- Major US economic releases can trigger significant moves

- Volatility typically decreases after London close (12:00 PM EST)

Best Currency Pairs:

- EUR/USD (especially during overlap)

- GBP/USD (especially during overlap)

- USD/JPY

- USD/CAD (particularly active due to US-Canada economic ties)

- AUD/USD

- USD/CHF

Trading Strategy: The New York session offers two distinct periods. The morning (8:00 AM – 12:00 PM EST) during the London overlap is excellent for aggressive trading with tight spreads. The afternoon (12:00 PM – 5:00 PM EST) after London closes becomes quieter, better suited for position adjustments or swing trading setups.

Economic Events to Watch:

- Federal Reserve (Fed) interest rate decisions and speeches

- US Non-Farm Payrolls (NFP) – first Friday of each month

- US GDP and inflation (CPI) reports

- FOMC meeting minutes

- US retail sales and consumer confidence

[LINK PLACEHOLDER: Internal link to “How to Trade Non-Farm Payrolls (NFP) Report”]

Best Times to Trade Specific Currency Pairs

EUR/USD – The World’s Most Traded Pair

Absolute Best Time: 8:00 AM – 12:00 PM EST (London/New York overlap)

Why: This is when both European and US markets are active, creating maximum volume and liquidity. Average movement during this period: 40-60 pips.

Secondary Good Times:

- 3:00 AM – 8:00 AM EST (London session opening) – 30-40 pip average

- 1:00 PM – 4:00 PM EST (New York afternoon) – 20-30 pip average

Avoid: 5:00 PM – 2:00 AM EST (Sydney/Tokyo sessions) – Only 10-20 pip average

Typical Daily Range: 70-100 pips

GBP/USD – “The Cable”

Absolute Best Time: 8:00 AM – 12:00 PM EST (London/New York overlap)

Why: The British pound is extremely volatile, and this overlap period sees the most action. Average movement: 50-80 pips during this window.

Secondary Good Times:

- 3:00 AM – 8:00 AM EST (London opening) – 40-60 pip average

- Immediately after major UK economic releases

Avoid: 5:00 PM – 3:00 AM EST (Asian sessions) – Minimal movement

Typical Daily Range: 100-150 pips (one of the most volatile majors)

USD/JPY – Major Asian Influence

Absolute Best Time: 7:00 PM – 2:00 AM EST (Tokyo session and Sydney/Tokyo overlap)

Why: Japanese economic data and Bank of Japan operations occur during Tokyo hours. Average movement: 30-50 pips.

Secondary Good Times:

- 8:00 AM – 12:00 PM EST (London/New York overlap) – 25-40 pip average

- 3:00 AM – 5:00 AM EST (London opening) – 20-35 pip average

Typical Daily Range: 50-75 pips

AUD/USD – “The Aussie”

Absolute Best Time: 7:00 PM – 2:00 AM EST (Sydney/Tokyo overlap)

Why: Australian economic releases and Asian market activity drive movement. Average movement: 30-45 pips.

Secondary Good Times:

- 8:00 AM – 12:00 PM EST (London/New York overlap) – 25-35 pip average

- During US dollar-specific news releases

Typical Daily Range: 60-80 pips

USD/CAD – The “Loonie”

Absolute Best Time: 8:00 AM – 3:00 PM EST (New York session)

Why: Canadian and US economic ties mean both countries’ economic releases impact this pair. Oil price movements also play a major role.

Secondary Good Times:

- 3:00 AM – 12:00 PM EST (London and early New York)

- During oil inventory reports (10:30 AM EST Wednesdays)

Typical Daily Range: 60-90 pips

EUR/GBP – Pure European Pair

Absolute Best Time: 3:00 AM – 12:00 PM EST (London session)

Why: Both currencies are European, so European trading hours see the most activity. Average movement: 30-50 pips.

Secondary Good Times:

- During specific UK or Eurozone economic releases

- 8:00 AM – 11:00 AM EST (peak European activity)

Avoid: 5:00 PM – 3:00 AM EST (Asian sessions) – Extremely quiet

Typical Daily Range: 50-70 pips

[LINK PLACEHOLDER: Internal link to “Cross Currency Pairs: Advanced Trading Strategies”]

GBP/JPY – The Most Volatile Major

Absolute Best Time: 3:00 AM – 12:00 PM EST (London session)

Why: Combines British pound volatility with Asian session momentum. Average movement: 70-120 pips.

Secondary Good Times:

- 8:00 PM – 2:00 AM EST (Tokyo session)

- 8:00 AM – 11:00 AM EST (London/New York overlap)

Typical Daily Range: 120-180 pips (highest volatility of major pairs)

Day of the Week Considerations

Not only do trading hours matter, but the day of the week also significantly impacts forex trading conditions.

Monday

Characteristics:

- Slow start as traders assess weekend news

- Gaps common at market open (Sunday 5:00 PM EST)

- Liquidity builds throughout the day

- Generally lower volume than mid-week

Best Approach: Wait for the first few hours to assess direction. Avoid trading the opening gap unless you’re experienced with gap strategies.

Tuesday, Wednesday, Thursday

Characteristics:

- Peak trading activity and volume

- Most economic releases occur mid-week

- Best liquidity and tightest spreads

- Most reliable technical patterns

Best Approach: These are the prime trading days. Most traders focus their activity here when opportunities are most abundant.

Friday

Characteristics:

- High volatility in the morning

- Volume drops significantly after 12:00 PM EST

- Position squaring before the weekend

- Unpredictable afternoon moves

- Spreads widen as liquidity dries up

Best Approach: Trade actively in the morning during the London/New York overlap, but be cautious in the afternoon. Many traders close positions before the weekend to avoid gap risk.

[LINK PLACEHOLDER: Internal link to “Weekend Gap Trading Strategy for Forex”]

Times to Avoid Trading Forex

Knowing when NOT to trade is just as important as knowing the best times to trade.

Major Holidays

Trading volume plummets during major holidays in financial centers:

- Christmas and New Year (late December/early January)

- Easter (variable, March/April)

- Thanksgiving (US, late November)

- Good Friday (markets closed)

- National holidays in major economies (UK, EU, Japan, Australia)

During these periods, expect:

- Extremely low liquidity

- Widened spreads (sometimes 3-5x normal)

- Erratic price movements

- Increased slippage

- Higher risk of stop-hunting

Sunday Evening Opening (5:00 PM – 8:00 PM EST)

The market opens with:

- Very low liquidity

- Wide spreads

- Potential gaps from weekend news

- Unpredictable price action

Wait until Asian liquidity picks up around 7:00 PM EST or later.

Late Friday Afternoon (1:00 PM – 5:00 PM EST)

After London closes at noon EST on Fridays:

- Liquidity drops sharply

- Spreads widen considerably

- Price movements become erratic

- Risk of unpredictable spikes

Most professional traders are done for the week by 1:00 PM EST on Fridays.

Major News Releases (Immediate Moments)

During the first 1-5 minutes of major economic releases:

- Extreme volatility

- Massive slippage possible

- Spreads can widen to 10-20 pips

- Stop losses may not execute at desired levels

Either avoid trading entirely during major news or wait 10-15 minutes for conditions to normalize.

How to Optimize Your Trading Schedule

For Full-Time Traders

If you can trade any time you want:

- Focus on London/New York overlap (8:00 AM – 12:00 PM EST) for highest probability setups

- Trade London session opening (3:00 AM – 8:00 AM EST) for European pairs

- Avoid Asian sessions unless specifically trading JPY, AUD, or NZD pairs

- Take weekends completely off to maintain mental freshness

- Limit Friday afternoon exposure

For US-Based Part-Time Traders

If you work a standard 9-5 job:

Option 1: Early Morning Trading

- Wake up at 3:00 AM – 4:00 AM EST

- Trade London session opening for 2-3 hours

- Focus on EUR/USD, GBP/USD, EUR/GBP

- Get high-quality setups before work

Option 2: Lunch Break Trading

- Trade during lunch (12:00 PM – 1:00 PM EST)

- Catch end of London/New York overlap

- Quick scalping or day trading setups

- Limited time but good liquidity

Option 3: Evening Position Trading

- Review charts after work (6:00 PM – 8:00 PM EST)

- Place swing trade setups for the next day

- Set pending orders and alerts

- Focus on longer timeframes (4H, daily)

Option 4: Late Night Asian Session

- Trade Tokyo session (7:00 PM – 12:00 AM EST)

- Focus on USD/JPY, AUD/USD, NZD/USD

- Lower volatility, more controlled trading

[LINK PLACEHOLDER: Internal link to “Part-Time Forex Trading: Complete Guide for Working Professionals”]

For European Traders

European time zones are ideal for forex trading:

- Start early (8:00 AM – 12:00 PM London time) during peak London session

- Trade through the US session opening (1:00 PM – 5:00 PM London time)

- Enjoy overlap advantage – you’re awake for the most active trading period

- Focus on EUR, GBP, USD pairs which are most active during your waking hours

For Asian Traders

Asian time zones present challenges for trading major pairs:

- Focus on Asian session pairs (AUD, NZD, JPY)

- Trade the Tokyo session (your daytime hours)

- Consider swing trading on daily charts to catch London/New York moves while you sleep

- Use pending orders to capture breakouts during European/US sessions

- Check charts during Sydney/Tokyo overlap for best Asian session opportunities

For Australian/New Zealand Traders

Similar to Asian traders, with some advantages:

- Start your day with Sydney session (best for AUD/NZD pairs)

- Continue through Tokyo session for increased activity

- Use the evening (your time) to catch end of London session

- Swing trading and position trading work better than active day trading

- Focus on AUD and NZD pairs during your active hours

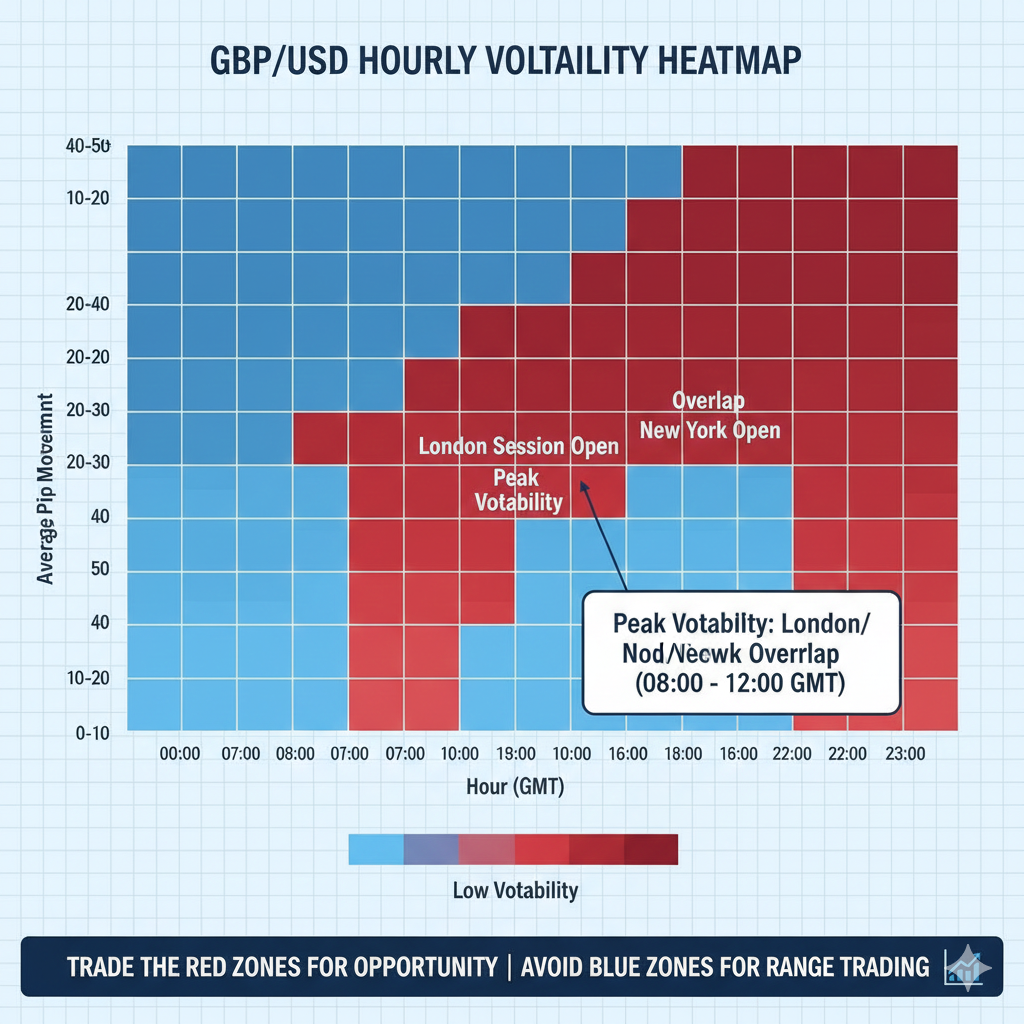

Volatility Patterns and Market Behavior

Understanding typical volatility patterns helps you choose optimal trading times.

Hourly Volatility Patterns (EST)

Quiet Period: 5:00 PM – 7:00 PM EST

- Market just opened, low participation

- 10-20 pip average hourly movement

Moderate Activity: 7:00 PM – 3:00 AM EST

- Asian session activity

- 15-30 pip average hourly movement

High Volatility: 3:00 AM – 12:00 PM EST

- London session and overlap

- 30-60+ pip average hourly movement

Declining Activity: 12:00 PM – 5:00 PM EST

- New York afternoon

- 20-40 pip average hourly movement

Monthly Volatility Patterns

First Week of Month:

- Highest volatility

- Major economic releases (NFP, PMI, etc.)

- Employment data from multiple countries

- Best trading opportunities

Mid-Month:

- Moderate volatility

- Inflation reports (CPI)

- Retail sales data

- Steady trading conditions

End of Month:

- Variable volatility

- Month-end flows and rebalancing

- GDP releases (quarterly)

- Position squaring can create unpredictable moves

[LINK PLACEHOLDER: Internal link to “Forex Economic Calendar: How to Trade the News”]

Trading Session Strategies

London Session Strategy

Best Approach: Breakout Trading

The London session often establishes daily highs and lows. Strategy:

- Identify Asian session range (5:00 PM – 3:00 AM EST)

- Wait for London open breakout (3:00 AM – 4:00 AM EST)

- Enter in direction of breakout with confirmation

- Set tight stop loss below/above Asian range

- Target 40-80 pip moves on EUR/USD or GBP/USD

New York Overlap Strategy

Best Approach: Trend Following

The overlap period shows strong directional moves. Strategy:

- Identify London session trend (3:00 AM – 8:00 AM EST)

- Wait for New York open (8:00 AM EST)

- Enter trades in the direction of established trend

- Use 15-minute or 30-minute charts for entries

- Ride the momentum until London close (12:00 PM EST)

Asian Session Strategy

Best Approach: Range Trading

The Tokyo session tends to consolidate. Strategy:

- Identify support and resistance levels

- Sell at resistance, buy at support

- Use tight stop losses (15-25 pips)

- Target smaller moves (20-40 pips)

- Focus on USD/JPY and AUD/USD

Tools and Resources for Tracking Forex Hours

Forex Market Hours Indicators

Many trading platforms offer indicators that show:

- Current active sessions

- Session overlaps

- High-liquidity periods

- Color-coded session boxes on charts

World Clock Tools

Essential for tracking multiple time zones:

- Forex Market Hours website

- Forex Session Indicator (MT4/MT5)

- World Clock apps for mobile devices

- Economic calendar with session filters

Economic Calendar Integration

Use calendars that show:

- Release times in your local timezone

- Impact level of each release

- Previous and forecasted figures

- Which session each release affects

Adjusting for Daylight Saving Time

Be aware that daylight saving time changes affect forex trading hours:

Important Notes:

- US observes DST (March – November)

- Europe observes DST (March – October) but different dates

- UK observes BST (March – October)

- Australia observes DST (October – April) – opposite seasons

- Japan does NOT observe daylight saving time

During DST transitions, session times can shift by one hour. Most professional traders use GMT (Greenwich Mean Time) or UTC to avoid confusion.

Frequently Asked Questions

What is the best time of day to trade forex?

The absolute best time is 8:00 AM – 12:00 PM EST during the London/New York session overlap. This four-hour window offers the highest liquidity, tightest spreads, and most trading opportunities across all major currency pairs.

Can I trade forex 24/7?

The forex market is open 24 hours a day from Sunday 5:00 PM EST to Friday 5:00 PM EST, but it’s closed on weekends. While you can trade any time during this period, trading quality varies dramatically by session.

Which forex session is most profitable?

The London session, particularly when it overlaps with the New York session (8:00 AM – 12:00 PM EST), is generally considered the most profitable. This period accounts for over 50% of daily forex trading volume and offers the best conditions for most trading strategies.

Is it better to trade forex at night?

For traders in the US and Europe, trading at night (Asian session) is generally not ideal for major pairs like EUR/USD and GBP/USD. However, if you’re trading Asian currency pairs (USD/JPY, AUD/USD), the Asian session offers good opportunities despite being “nighttime” for Western traders.

What time does forex open on Sunday?

The forex market opens at 5:00 PM EST on Sunday when the Sydney session begins. However, liquidity is very low initially, and most traders wait until the Tokyo session opens at 7:00 PM EST for better trading conditions.

Should I avoid trading during news releases?

It depends on your experience level and risk tolerance. Beginners should avoid the immediate moments (first 1-5 minutes) of major news releases due to extreme volatility and widened spreads. Experienced traders can profit from news trading but must understand the risks involved.

Conclusion: Time Your Trades for Maximum Success

Understanding forex trading hours and session characteristics is fundamental to your success as a trader. The 24-hour nature of the forex market provides incredible flexibility, but this advantage only benefits you when you trade during optimal times for your chosen currency pairs.

Key takeaways to remember:

- The London/New York overlap (8:00 AM – 12:00 PM EST) offers the best trading conditions for most pairs

- Trade currency pairs during their “home sessions” when their countries’ markets are most active

- Avoid low-liquidity periods like holidays, Sunday evenings, and Friday afternoons

- Match your trading strategy to session characteristics (breakouts for London, trends for overlaps, ranges for Asian)

- Consider your personal schedule and choose trading times that fit your lifestyle sustainably

Remember that successful forex trading isn’t just about being in the market—it’s about being in the market at the right time with the right currency pairs. By aligning your trading schedule with optimal market hours, you’ll immediately improve your entry and exit quality, reduce trading costs through tighter spreads, and increase your probability of success.

Start by tracking when you achieve your best trading results. You’ll likely find they coincide with the high-liquidity sessions discussed in this guide. Focus your efforts on these peak periods, and your trading performance will reflect the improvement.

Ready to optimize your trading schedule? Review your trading journal to identify which sessions produce your best results, then structure your trading plan around these high-probability time windows.