How Much Money Do You Need to Start Forex Trading in 2026? The Complete Guide

One of the most common questions aspiring forex traders ask is: “How much money do I need to start trading forex?” The answer isn’t as straightforward as you might hope because it depends on your trading goals, risk tolerance, broker requirements, and trading strategy. In this comprehensive guide, we’ll break down everything you need to know about forex trading capital requirements in 2026.

The Short Answer: You Can Start with as Little as $10-$100

Here’s the truth that might surprise you: technically, you can start forex trading with as little as $10 to $100 with many modern brokers. However, starting with the bare minimum isn’t necessarily the best approach for long-term success. The real question isn’t “What’s the minimum?” but rather “What’s the optimal amount to start with?”

Let’s explore the different capital requirements, what they mean for your trading, and what financial experts recommend for sustainable forex trading.

Minimum Deposit Requirements by Broker Type

Micro Account Brokers ($10-$100)

Many online brokers now offer micro accounts with minimal deposit requirements. These accounts are designed for absolute beginners who want to experience real trading with minimal financial commitment.

Popular micro account options:

- Minimum deposit: $10-$100

- Lot sizes: Micro lots (1,000 units) or nano lots (100 units)

- Pip value: $0.01-$0.10 per pip

- Best for: Complete beginners learning the basics

Standard Account Brokers ($100-$500)

Traditional forex brokers typically require slightly higher minimum deposits for standard accounts. These accounts offer more features and better trading conditions.

Standard account features:

- Minimum deposit: $100-$500

- Lot sizes: Mini lots (10,000 units) and above

- Pip value: $1+ per pip

- Best for: Traders with some experience and basic understanding

Professional/Premium Accounts ($1,000-$10,000+)

Some brokers offer premium accounts with higher deposit requirements but provide enhanced benefits like lower spreads, dedicated account managers, and advanced tools.

Premium account benefits:

- Minimum deposit: $1,000-$10,000+

- Lot sizes: Standard lots (100,000 units)

- Pip value: $10+ per pip

- Best for: Experienced traders and serious investors

[LINK PLACEHOLDER: Internal link to “Best Forex Brokers for Beginners in 2026”]

What Professional Traders Recommend as Starting Capital

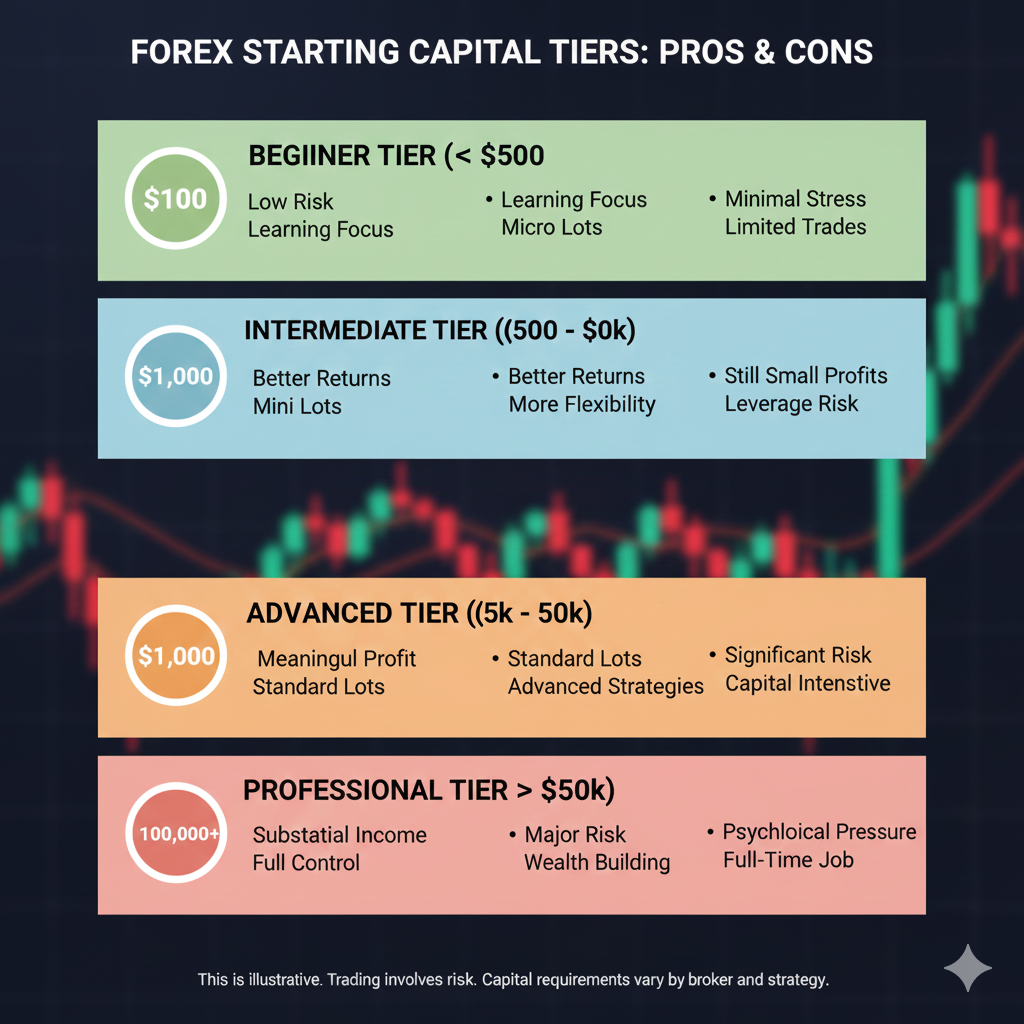

While you can technically start with $100, professional traders and financial educators typically recommend different amounts based on your goals and experience level.

For Learning and Practice: $100-$500

If your primary goal is to learn forex trading without significant financial risk, starting with $100-$500 is reasonable. This amount allows you to:

- Experience real market conditions and emotions

- Practice risk management with actual money

- Learn from mistakes without devastating losses

- Test different trading strategies with real execution

- Understand how spreads, slippage, and commissions affect profitability

At this level, you should treat your account as “tuition” for your forex education. The goal isn’t to make substantial profits but to gain invaluable experience that will serve you when trading larger amounts.

For Part-Time Trading: $1,000-$3,000

If you’re looking to generate supplemental income through forex trading while maintaining your day job, most experts recommend starting with $1,000-$3,000. This amount provides:

- Sufficient capital to implement proper risk management

- Ability to withstand normal market volatility

- Realistic profit potential that makes the effort worthwhile

- Psychological comfort that prevents emotional trading decisions

- Room for multiple simultaneous positions if your strategy requires it

With $2,000 and proper risk management (risking 1-2% per trade), you can risk $20-$40 per trade, which translates to meaningful position sizes on most currency pairs.

For Full-Time Trading: $10,000-$50,000+

If your goal is to eventually trade forex full-time and potentially replace your regular income, you’ll need substantially more capital. Most professional traders recommend:

- Minimum: $10,000-$25,000 for developing countries or low cost of living areas

- Recommended: $25,000-$50,000 for developed countries

- Comfortable: $50,000-$100,000+ for sustainable full-time income

These amounts allow you to:

- Generate meaningful income while risking only 1-2% per trade

- Cover living expenses from trading profits

- Maintain proper risk management without overleveraging

- Psychologically handle the ups and downs of trading

- Build your account steadily over time

[LINK PLACEHOLDER: Internal link to “How to Transition from Part-Time to Full-Time Forex Trading”]

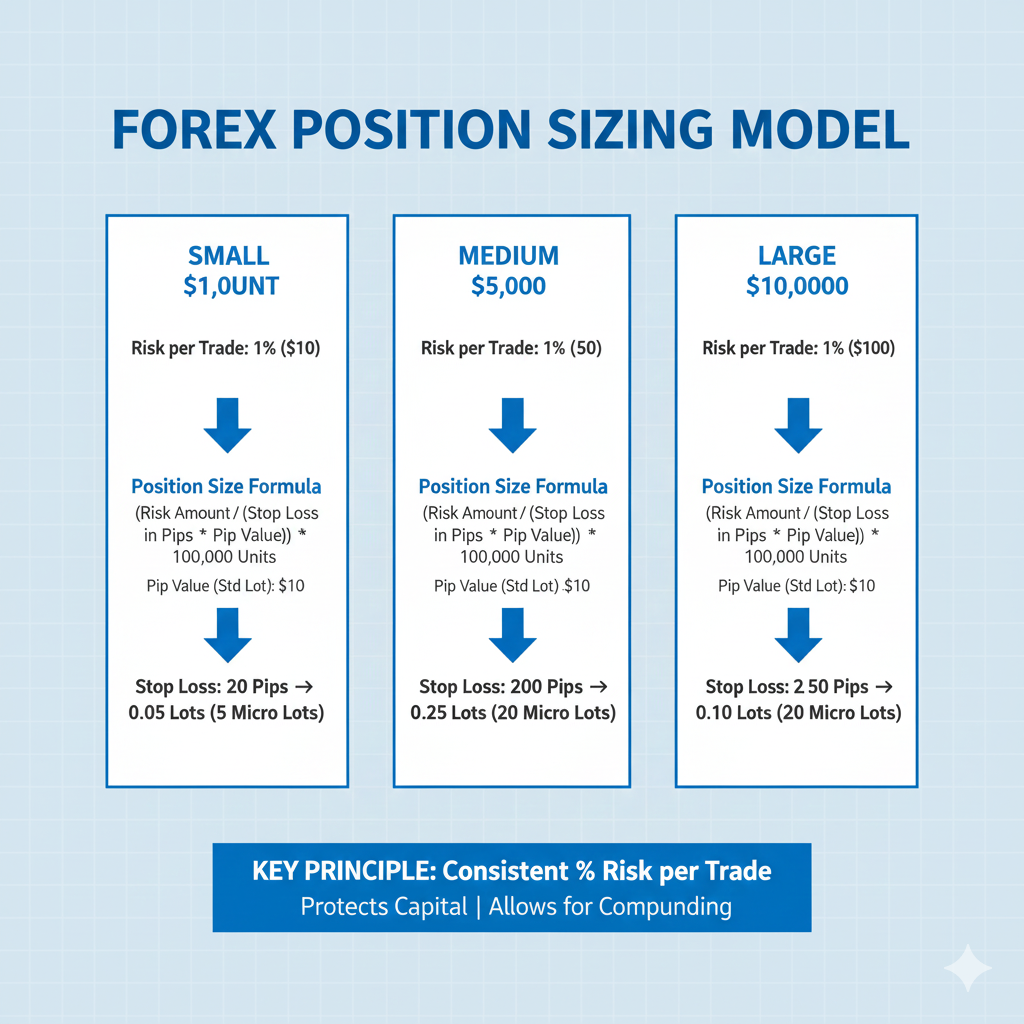

Understanding the 1-2% Risk Management Rule

One of the most important concepts in determining how much money you need is the risk management rule. Professional traders typically risk only 1-2% of their account balance on any single trade.

Why This Matters for Starting Capital

Let’s look at practical examples:

$100 Account:

- 1% risk per trade = $1

- If your stop loss is 20 pips, you can only trade 5 cents per pip (500 units)

- This severely limits your trading options and makes growth very slow

$1,000 Account:

- 1% risk per trade = $10

- If your stop loss is 20 pips, you can trade 50 cents per pip (5,000 units)

- More realistic position sizing with meaningful profit potential

$5,000 Account:

- 1% risk per trade = $50

- If your stop loss is 20 pips, you can trade $2.50 per pip (25,000 units)

- Comfortable position sizes with good profit potential while maintaining safety

$10,000 Account:

- 1% risk per trade = $100

- If your stop loss is 20 pips, you can trade $5 per pip (50,000 units)

- Professional-level position sizing with substantial profit potential

The larger your starting capital, the easier it becomes to implement proper risk management while still making worthwhile profits.

The Hidden Costs of Forex Trading

When determining how much money you need to start forex trading, don’t forget to factor in additional costs beyond your trading capital.

Spreads and Commissions

Every trade you make costs money in spreads (the difference between bid and ask prices) or direct commissions. These costs can add up quickly, especially if you’re a day trader or scalper making multiple trades daily.

- Average spread cost per standard lot: $10-$30

- Commission-based accounts: $3-$7 per standard lot (round trip)

- Monthly costs for active traders: $200-$1,000+

Educational Resources

While there’s plenty of free forex education available, quality courses, books, and mentorship programs require investment:

- Online courses: $50-$500

- Trading books: $15-$50 each

- Professional mentorship: $500-$5,000+

- Trading software/indicators: $50-$200/month

Technology and Tools

Professional trading requires reliable technology:

- Computer or laptop: $500-$2,000

- Multiple monitors (optional): $200-$800

- Reliable internet connection: $50-$100/month

- VPS (Virtual Private Server) for automated trading: $20-$100/month

- Premium charting software: $30-$100/month

[LINK PLACEHOLDER: Internal link to “Essential Forex Trading Tools and Software for 2026”]

Psychological Buffer

Perhaps most importantly, you need financial peace of mind. Never trade with money you can’t afford to lose. Your trading capital should be:

- Separate from emergency funds

- Not needed for bills or living expenses

- Money you’re comfortable risking

- Above and beyond your savings goals

Can You Really Start Forex Trading with $100?

Yes, you can start with $100, but let’s be realistic about what that means and the challenges you’ll face.

The Advantages

Starting small has some genuine benefits:

- Minimal financial risk while learning

- Real market experience without demo account limitations

- Low barrier to entry for trying forex trading

- Opportunity to prove your strategy works before scaling up

- Psychological practice with real money on the line

The Disadvantages

However, trading with $100 comes with significant limitations:

- Very limited position sizes make profits negligible

- One or two losses can wipe out a significant portion of your account

- Difficult to implement proper risk management

- Spread costs eat up a larger percentage of potential profits

- Hard to diversify across multiple positions

- Psychological pressure from account size volatility

- Limited broker options (some require higher minimums)

Making $100 Work: Best Practices

If you’re starting with $100, follow these guidelines to maximize your chances of success:

- Trade only the most liquid major pairs (EUR/USD, GBP/USD, USD/JPY) for tighter spreads

- Use micro or nano lots exclusively to maintain proper position sizing

- Limit trading frequency to reduce cumulative spread costs

- Focus on swing trading or position trading rather than day trading or scalping

- Set realistic expectations – aim for consistent percentage gains, not dollar amounts

- Plan to add capital as you prove your strategy works

- Keep detailed records to track your progress and learn from mistakes

How to Grow a Small Forex Account

If you’re starting with a small amount, your strategy should focus on steady, sustainable growth rather than trying to “get rich quick.”

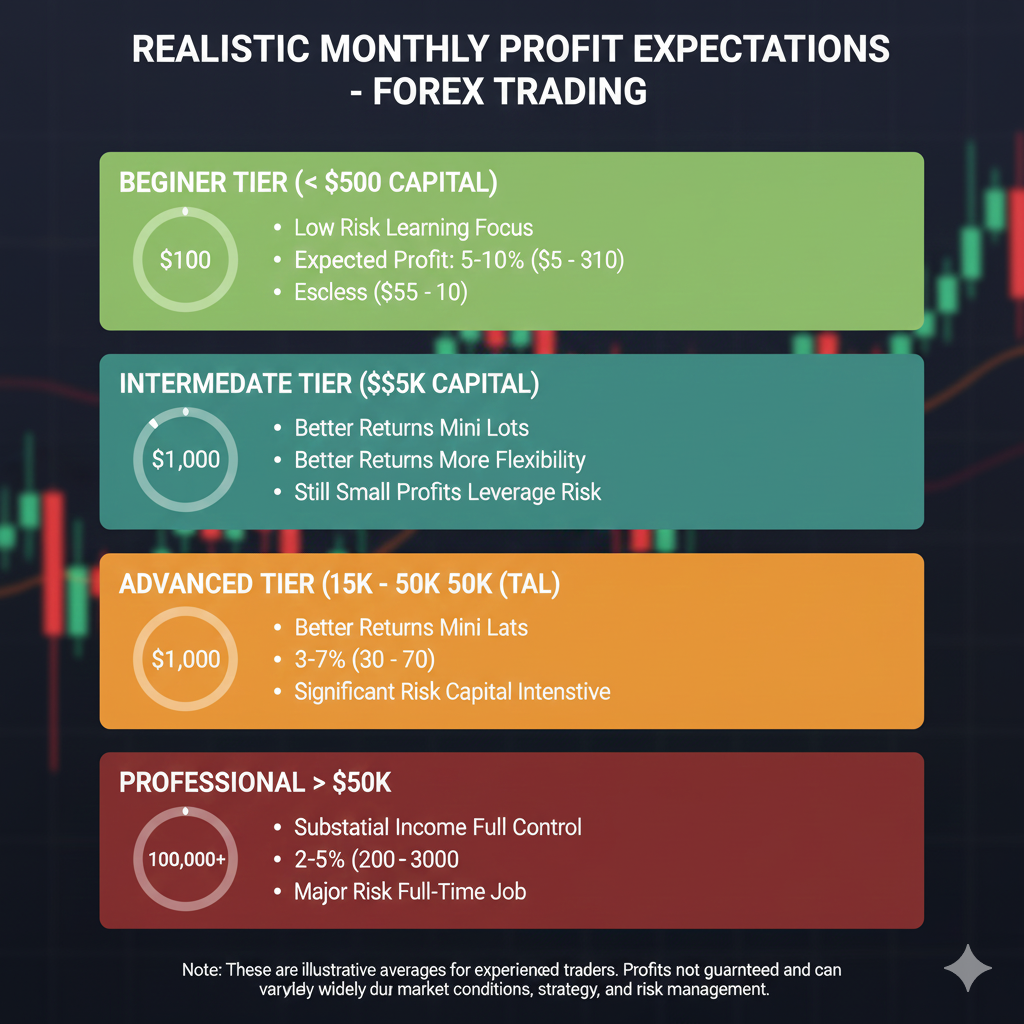

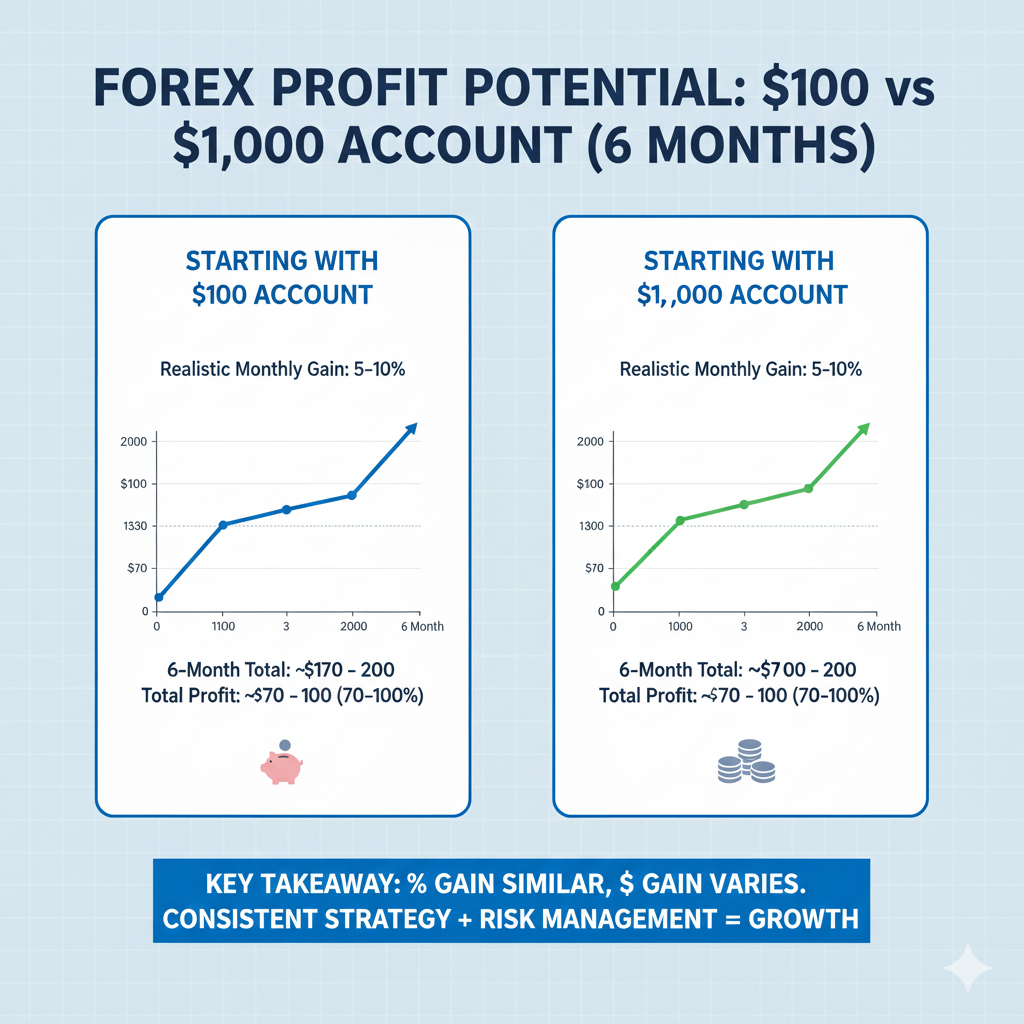

Realistic Growth Expectations

Professional traders typically aim for 5-20% monthly returns, with 10% being a solid target. Here’s what that looks like:

Starting with $500 at 10% monthly growth:

- Month 1: $550

- Month 3: $665

- Month 6: $885

- Month 12: $1,565

- Month 24: $4,895

Starting with $1,000 at 10% monthly growth:

- Month 1: $1,100

- Month 3: $1,331

- Month 6: $1,771

- Month 12: $3,138

- Month 24: $9,849

These projections assume consistent monthly returns, which is challenging but achievable with discipline and a proven strategy.

[LINK PLACEHOLDER: Internal link to “Realistic Profit Expectations for Forex Traders”]

Compounding vs. Withdrawing

With a small account, you should strongly consider reinvesting all profits (compounding) rather than withdrawing, at least initially. Compounding allows your account to grow exponentially over time.

However, once your account reaches $3,000-$5,000, you might start taking partial withdrawals to:

- Celebrate and reward your success

- Recover your initial investment

- Reduce psychological pressure

- Prove to yourself that the profits are “real.”

When to Add More Capital

Consider adding more capital to your forex account when:

- You’ve been consistently profitable for at least 3-6 months

- Your risk management is disciplined and automatic

- You’ve refined a trading strategy that works for you

- Your win rate and risk-reward ratios are favorable

- You’re comfortable with the emotional aspects of trading

- You have additional funds that meet the “money you can afford to lose” criteria

Different Trading Styles and Capital Requirements

Your trading style significantly impacts how much money you need to start effectively.

Scalping ($1,000-$5,000 minimum recommended)

Scalpers make dozens of trades daily, targeting just 5-20 pips per trade. This style requires:

- Larger capital to make small pip targets worthwhile

- Ability to absorb frequent spread costs

- Sufficient margin for multiple simultaneous positions

- Psychological comfort with rapid-fire trading

Starting with less than $1,000 makes scalping impractical because spread costs will eat up too much of your profits.

Day Trading ($500-$2,000 minimum recommended)

Day traders open and close positions within the same trading day, typically holding for a few hours. Requirements include:

- Moderate capital for 20-80 pip targets

- Flexibility for 2-10 trades per day

- Buffer for multiple positions if needed

- Adequate margin for volatility throughout the day

Day trading with less than $500 is possible but challenging due to position size limitations.

[LINK PLACEHOLDER: Internal link to “Day Trading Forex: Complete Strategy Guide for 2026”]

Swing Trading ($300-$1,000 minimum recommended)

Swing traders hold positions for several days to weeks, targeting larger moves of 50-300 pips. This style:

- Requires less active monitoring

- Needs wider stop losses (more capital at risk per trade)

- Allows smaller accounts to be more effective

- Reduces spread costs through fewer trades

Swing trading is often the best approach for traders with smaller accounts because you can achieve meaningful profits without requiring substantial capital.

Position Trading ($1,000-$5,000 minimum recommended)

Position traders hold for weeks to months, targeting major trends. Requirements:

- Larger capital due to very wide stop losses

- Ability to withstand significant drawdowns

- Patience to hold through temporary reversals

- Sufficient margin for long-term exposure

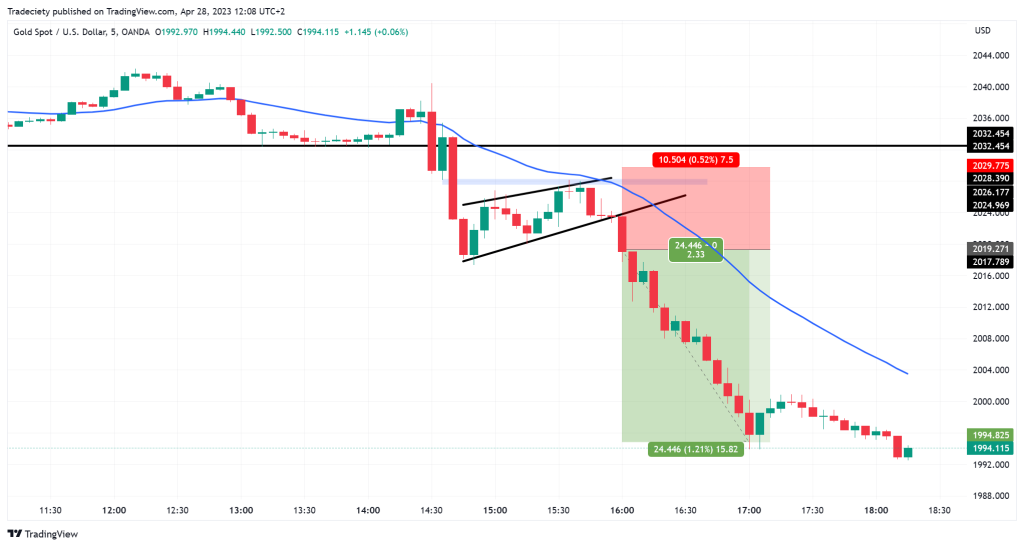

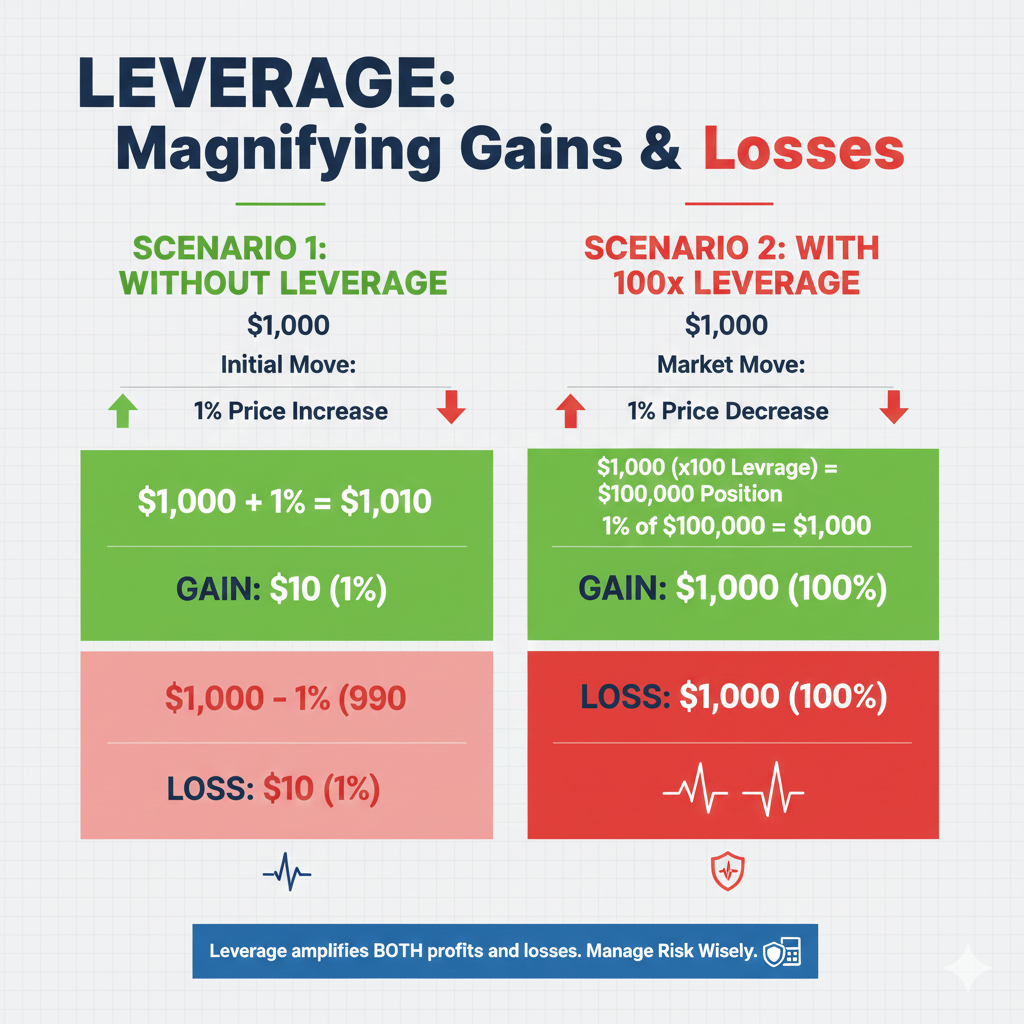

The Leverage Factor: Friend or Foe?

Leverage is one of forex trading’s most misunderstood concepts, and it dramatically affects how much money you need to start.

What is Leverage?

Leverage allows you to control a large position with a small amount of capital. For example, with 100:1 leverage, you can control $10,000 worth of currency with just $100 in your account.

Common leverage ratios:

- US brokers: Maximum 50:1 on major pairs

- European brokers: Maximum 30:1 on major pairs (ESMA regulations)

- Other international brokers: Up to 500:1 or even 1000:1

How Leverage Affects Starting Capital

Higher leverage means you need less capital to open positions:

Trading 1 mini lot (10,000 units) of EUR/USD:

- Without leverage: $10,000 required

- With 10:1 leverage: $1,000 required

- With 50:1 leverage: $200 required

- With 100:1 leverage: $100 required

The Leverage Trap

While high leverage allows you to start with less money, it’s also extremely dangerous:

- Magnifies losses just as much as profits

- Can wipe out accounts in minutes during volatile moves

- Encourages overleveraging and poor risk management

- Creates psychological pressure and emotional trading

Professional recommendation: Even if your broker offers 500:1 leverage, use no more than 10:1 to 20:1 effective leverage. This means if you have $1,000, trade as if you only have 50:1 leverage ($50 margin per $1,000 controlled), not the full 500:1 available.

Starting Capital Recommendations by Experience Level

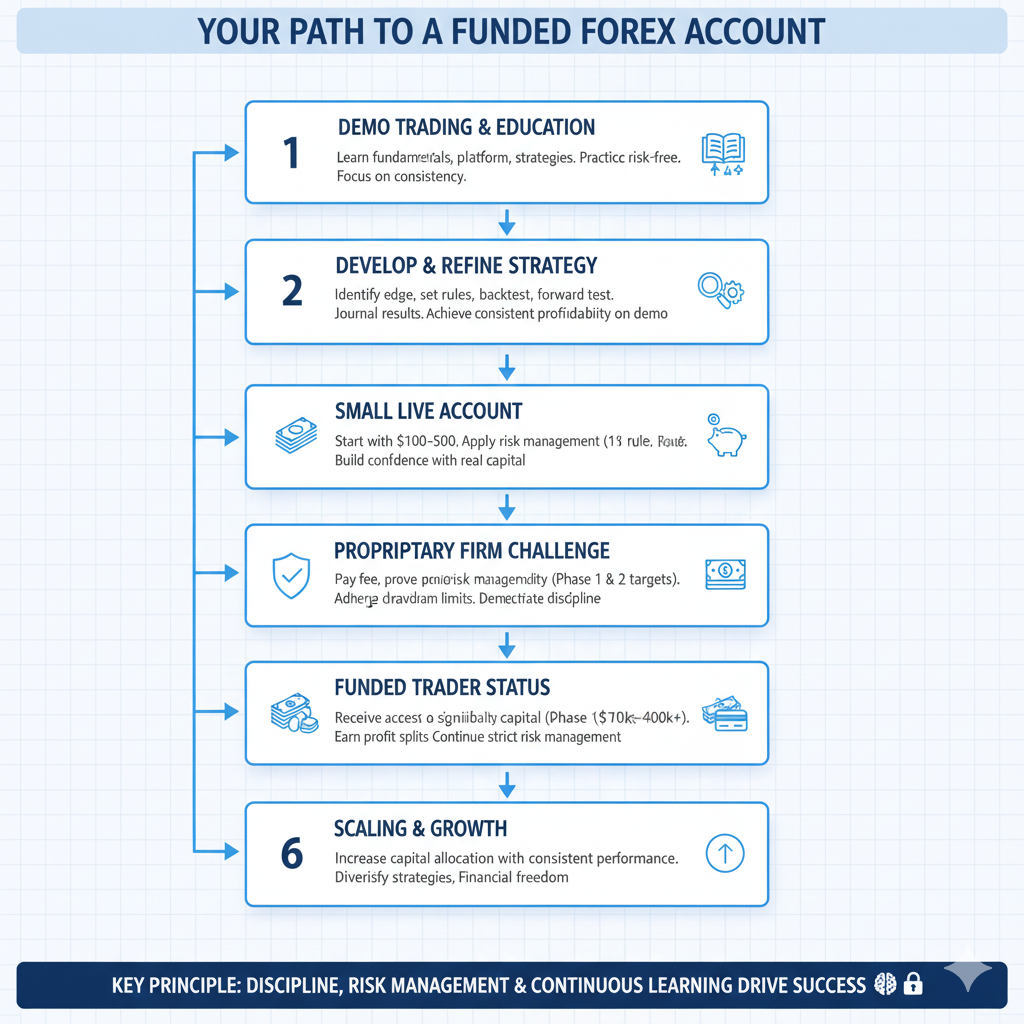

Complete Beginners: Start with Demo, Then $100-$500

If you’ve never traded forex before:

- Start with a demo account for 1-3 months to learn the platform and basic concepts

- Transition to a micro account with $100-$500 for real market experience

- Focus on education rather than profits during this phase

- Expect to lose money as you learn – consider it tuition

- Practice risk management religiously from day one

At this stage, your primary goal is learning, not earning.

Intermediate Traders: $1,000-$5,000

Once you’ve gained experience and have some winning months under your belt:

- Your risk management should be automatic and disciplined

- You understand which strategies work for your personality

- You’ve developed emotional control and trading psychology

- Your win rate and risk-reward ratios are documented and favorable

At this level, $1,000-$5,000 allows you to trade more comfortably while still learning and refining your approach.

Advanced Traders: $10,000+

Experienced traders who’ve proven consistent profitability over 6-12 months can consider:

- Scaling up to $10,000-$25,000 for more substantial income

- Potentially trading part-time or full-time

- Diversifying across multiple currency pairs and strategies

- Treating trading as a serious business with proper capitalization

[LINK PLACEHOLDER: Internal link to “How to Know When You’re Ready to Trade Larger Positions”]

Alternative Ways to Start Forex Trading with Less Money

If you don’t have much capital but want to start forex trading, consider these options:

Prop Trading Firms

Proprietary trading firms provide capital to traders who pass evaluation challenges:

- You pay $100-$500 for an evaluation account

- Pass the evaluation (specific profit targets and rules)

- Receive a funded account of $10,000-$200,000

- Keep 70-90% of profits you generate

- Risk only your evaluation fee, not large personal capital

Popular prop firms: FTMO, The5%ers, TopstepFX, Funded Trading Plus

Forex Contests and Competitions

Many brokers run regular trading contests where you can:

- Enter for free or low cost ($10-$50)

- Trade with virtual funds or small real accounts

- Win substantial prizes ($5,000-$100,000+)

- Gain experience in competitive environments

Building Your Capital Through Saving

If you can’t afford your target starting amount, create a savings plan:

- Set aside a specific amount monthly ($50-$200)

- Use this time to trade on demo and learn

- Study trading books and courses

- Develop and backtest your strategies

- Start with a properly capitalized account when ready

This approach is far superior to starting undercapitalized and repeatedly blowing up small accounts.

Tax Considerations for Forex Trading Capital

Before starting forex trading, understand the tax implications in your jurisdiction:

United States

- Forex profits are typically taxed under Section 1256 contracts (60/40 rule)

- 60% taxed at long-term capital gains rates (20% max)

- 40% taxed at short-term capital gains rates (ordinary income)

- Alternative: Section 988 treatment (all ordinary income/loss)

European Union

- Tax treatment varies significantly by country

- Some countries tax as capital gains (15-30%)

- Others tax as business income (up to 45%+)

- CFD trading may have different rules than spot forex

Other Jurisdictions

Always consult with a local tax professional about:

- Whether forex profits are taxable

- Required record-keeping

- Quarterly estimated tax payments

- Deductible expenses (education, software, data fees)

Factor in taxes when determining how much you need to start—if you’re aiming for specific income targets, you’ll need to account for tax obligations.

[LINK PLACEHOLDER: Internal link to “Forex Trading Taxes: Complete Guide for 2026”]

Common Mistakes When Starting Forex Trading

Mistake 1: Starting with Too Little Capital

Beginning with $10-$50 sets you up for frustration because:

- Position sizes are too small to be meaningful

- Spread costs consume a huge percentage of capital

- One or two losses can be catastrophic

- Psychological pressure is immense

Mistake 2: Overleveraging to Compensate for Small Capital

Trying to “make up for” a small account by using maximum leverage is the fastest way to blow up your account. A 50-pip adverse move with 500:1 leverage can wipe out your entire balance.

Mistake 3: Not Having a Financial Buffer

Trading with money you need for bills creates unbearable psychological pressure. You’ll make emotional decisions, overtrade, and likely lose everything. Only trade with money you can genuinely afford to lose.

Mistake 4: Unrealistic Profit Expectations

Expecting to turn $100 into $10,000 in a month leads to excessive risk-taking, overleveraging, and inevitable account destruction. Set realistic goals like 5-10% monthly growth.

Mistake 5: Ignoring Additional Costs

Focusing only on the trading account deposit while ignoring spreads, commissions, education costs, and technology needs leads to undercapitalization and frustration.

Your Forex Trading Capital Action Plan

Step 1: Define Your Goals

Are you trading to:

- Learn and practice (start with $100-$500)

- Generate supplemental income (start with $1,000-$3,000)

- Eventually trade full-time (save for $10,000-$25,000)

- Simply explore as a hobby (start with $100-$500)

Step 2: Assess Your Financial Situation

- Calculate your disposable income

- Ensure you have 3-6 months emergency fund

- Only allocate money you can afford to lose

- Factor in additional costs beyond account deposit

Step 3: Choose Your Trading Style

- Research different trading styles

- Choose one that fits your schedule and personality

- Determine appropriate starting capital for that style

- Adjust timeline if you need to save more

Step 4: Start with Demo Trading

- Practice for at least 1-3 months on demo

- Develop and test your strategy

- Learn risk management principles

- Track your hypothetical performance

Step 5: Begin with Real Money

- Start with your determined capital amount

- Implement strict risk management (1-2% per trade)

- Keep detailed trading journals

- Focus on consistency, not dramatic gains

- Regularly review and adjust your approach

[IMAGE PLACEHOLDER: Checklist graphic showing steps to start forex trading properly – Alt text: “Complete checklist for starting forex trading with proper capitalization 2026”]

Frequently Asked Questions

Can I start forex trading with $50?

Yes, some brokers allow accounts as small as $10-$50, but trading with this amount is extremely challenging. You’ll have very limited position sizing options, and a single loss can represent 10-20% of your account. While it’s possible, $50 should be viewed as practice money rather than serious trading capital.

How much can I make with $1,000 in forex?

With proper risk management (1-2% risk per trade) and realistic expectations, you might aim for 5-10% monthly returns, which would be $50-$100 per month from a $1,000 account. However, returns vary significantly based on your skill, strategy, and market conditions. Many traders lose money, especially initially.

Is $5,000 enough to day trade forex?

Yes, $5,000 is a reasonable amount for day trading forex, especially if you focus on major pairs and maintain disciplined risk management. With 1% risk per trade, you’d risk $50 per trade, allowing for meaningful position sizes. However, pattern day trader rules don’t apply to forex as they do to stocks, so technically you could day trade with any amount.

Do I need $25,000 to trade forex like stocks?

No, the $25,000 pattern day trader rule that applies to US stock trading does NOT apply to forex trading. You can day trade forex with any amount your broker allows as a minimum deposit. This is one of forex’s major advantages over stock day trading.

What leverage should I use as a beginner?

Beginners should use conservative leverage of 10:1 to 20:1, regardless of what their broker offers. Even if 500:1 leverage is available, higher leverage dramatically increases risk and can wipe out accounts quickly. As you gain experience, you’ll learn to manage leverage appropriately for your strategy.

How long does it take to grow a small forex account?

With consistent 10% monthly growth (which is excellent), a $500 account would grow to about $1,565 after 12 months and nearly $5,000 after 24 months. However, consistent monthly profits are challenging to achieve, and many traders experience losing months alongside winning ones. Growth takes patience and discipline.

Conclusion: How Much Should YOU Start With?

After examining all the factors, here’s the bottom line for 2026:

Absolute minimum: $100-$500 if you’re learning and can afford to lose it Recommended for learning: $500-$1,000 for meaningful practice with real money Comfortable part-time trading: $1,000-$5,000 for supplemental income goals Serious trading: $10,000-$25,000+ for potential full-time income

Remember that successful forex trading isn’t determined by how much money you start with, but rather by your discipline, risk management, emotional control, and willingness to continually learn and improve. A trader with $500 and excellent risk management will outperform a trader with $10,000 and reckless habits.

Start with an amount appropriate for your goals, experience level, and financial situation. Treat your initial capital as an investment in your education, not as the vehicle to instant riches. With time, patience, and discipline, you can grow your account and potentially achieve your financial goals through forex trading.

Ready to get started? Begin with a demo account to practice risk-free, then open a live account with capital you’re comfortable risking. Your forex trading journey starts with a single step—make sure it’s a well-planned one.