What is a Pip in Forex Trading? A Complete Beginner’s Guide (2026)

If you’re new to forex trading, you’ve probably encountered the term “pip” and wondered what it means. Understanding pips is absolutely fundamental to forex trading because they determine your profits, losses, and risk management strategies. In this comprehensive guide, we’ll break down everything you need to know about pips in simple, easy-to-understand terms.

What is a Pip in Forex Trading?

A pip (percentage in point or price interest point) is the smallest price movement that a currency pair can make based on market convention. Think of it as the basic unit of measurement for price changes in the forex market—similar to how cents measure changes in dollar prices.

For most currency pairs, a pip is equal to 0.0001 or one hundredth of one percent (1/100th of 1%). For example, if EUR/USD moves from 1.1050 to 1.1051, that’s a one-pip movement.

The Exception: Japanese Yen Pairs

Currency pairs involving the Japanese yen are the main exception to the standard pip measurement. For JPY pairs, a pip equals 0.01 rather than 0.0001. So if USD/JPY moves from 150.25 to 150.26, that’s a one pip change.

This exception exists because the Japanese yen has historically had a much lower value compared to other major currencies, making smaller decimal places impractical for everyday trading.

Why Are Pips Important in Forex Trading?

Understanding pips is crucial for several reasons:

1. Measuring Profit and Loss

Pips provide a standardized way to measure how much you’ve gained or lost on a trade. Instead of dealing with complex decimal numbers, traders can simply say, “I made 50 pips on that EUR/USD trade.” This universal language makes it easy for traders worldwide to communicate about their trading performance.

2. Risk Management and Position Sizing

Professional traders use pips to calculate their risk per trade. By knowing the pip value of your position size, you can determine exactly how much money you’re risking. For example, if you decide to risk 20 pips on a trade with a specific position size, you’ll know your maximum potential loss in your account currency before entering the trade.

[LINK PLACEHOLDER: Internal link to “Risk Management Strategies for Forex Traders”]

3. Setting Stop Loss and Take Profit Levels

Traders set their stop loss and take profit orders based on pip values. You might hear traders say “I’m setting my stop loss 30 pips below entry” or “My take profit target is 100 pips.” This pip-based approach allows for consistent risk-reward ratios across different currency pairs.

4. Strategy Development and Backtesting

When developing and testing trading strategies, pips provide consistent metrics for measuring performance. A strategy might aim for an average of 50 pips per winning trade while risking only 25 pips, creating a favorable 2:1 reward-to-risk ratio.

How to Calculate Pip Value

The pip value represents how much money you gain or lose when the market moves one pip. This value varies depending on three factors: your position size, the currency pair you’re trading, and your account currency.

The Standard Formula

The basic formula for calculating pip value is:

Pip Value = (One Pip / Exchange Rate) × Position Size

Let’s break this down with practical examples.

Example 1: EUR/USD

Suppose you’re trading 1 standard lot (100,000 units) of EUR/USD at 1.1050:

- One pip for EUR/USD = 0.0001

- Position size = 100,000 units

- Pip value = (0.0001 / 1) × 100,000 = $10 per pip

This means for every pip the EUR/USD moves in your favor, you gain $10. If it moves against you by one pip, you lose $10.

Example 2: USD/JPY

For a standard lot (100,000 units) of USD/JPY at 150.25:

- One pip for USD/JPY = 0.01

- Position size = 100,000 units

- Pip value in JPY = 0.01 × 100,000 = 1,000 JPY

- Convert to USD: 1,000 / 150.25 = approximately $6.66 per pip

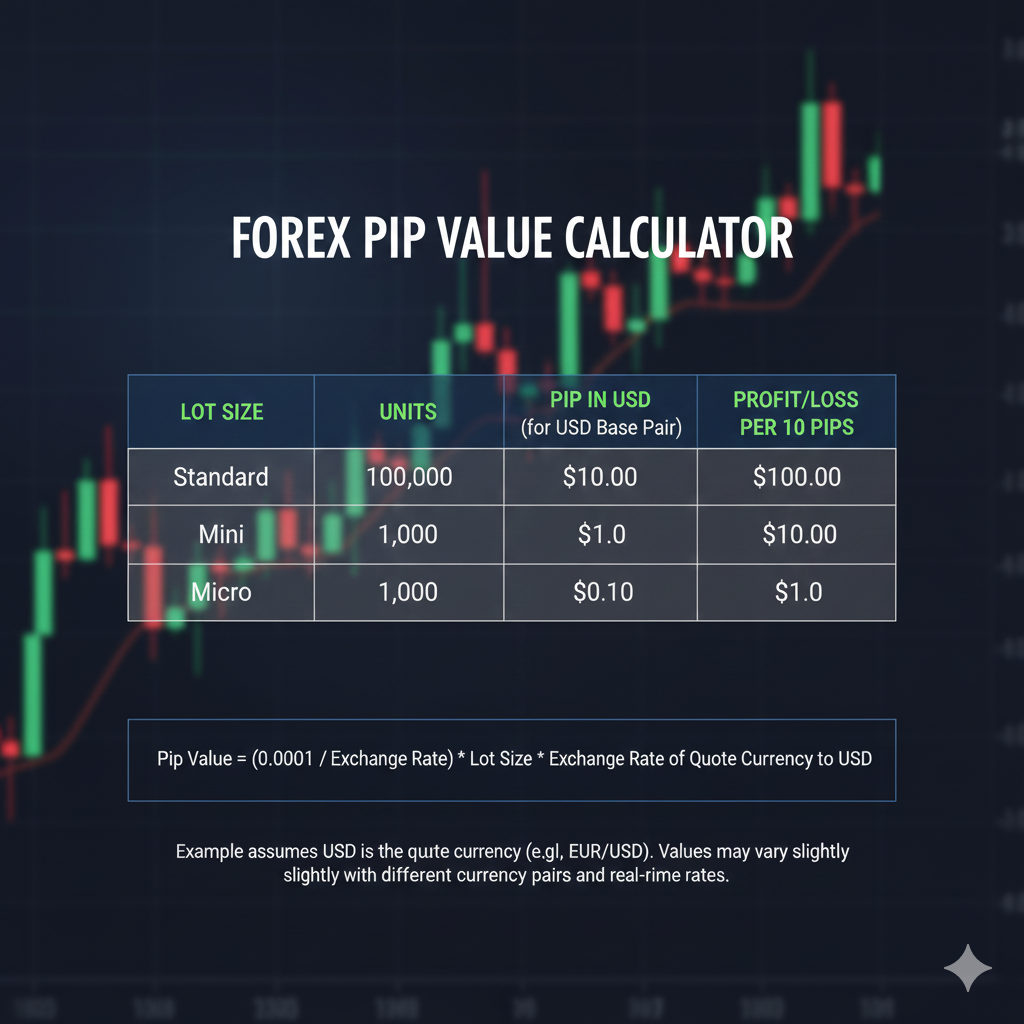

Understanding Different Lot Sizes and Pip Values

Forex trading offers different position sizes, and the pip value changes accordingly:

Standard Lot (100,000 units)

- Most EUR/USD trades: $10 per pip

- Suitable for well-funded accounts and experienced traders

Mini Lot (10,000 units)

- Most EUR/USD trades: $1 per pip

- Good for intermediate traders building experience

Micro Lot (1,000 units)

- Most EUR/USD trades: $0.10 per pip

- Perfect for beginners or testing strategies with minimal risk

Nano Lot (100 units)

- Most EUR/USD trades: $0.01 per pip

- Ideal for absolute beginners learning the ropes

[LINK PLACEHOLDER: Internal link to “Choosing the Right Lot Size for Your Trading Account”]

What is a Pipette (Fractional Pip)?

Modern forex brokers often quote prices with an additional decimal place beyond the standard pip. This fractional pip is called a pipette and equals one-tenth of a pip.

For example, instead of seeing EUR/USD quoted as 1.1050, you might see 1.10505. That final “5” represents 5 pipettes. Pipettes allow for more precise pricing and tighter spreads, which benefits traders by reducing trading costs.

[IMAGE PLACEHOLDER: Screenshot of forex trading platform showing pipette pricing – Alt text: “Forex broker platform displaying five decimal places including pipettes”]

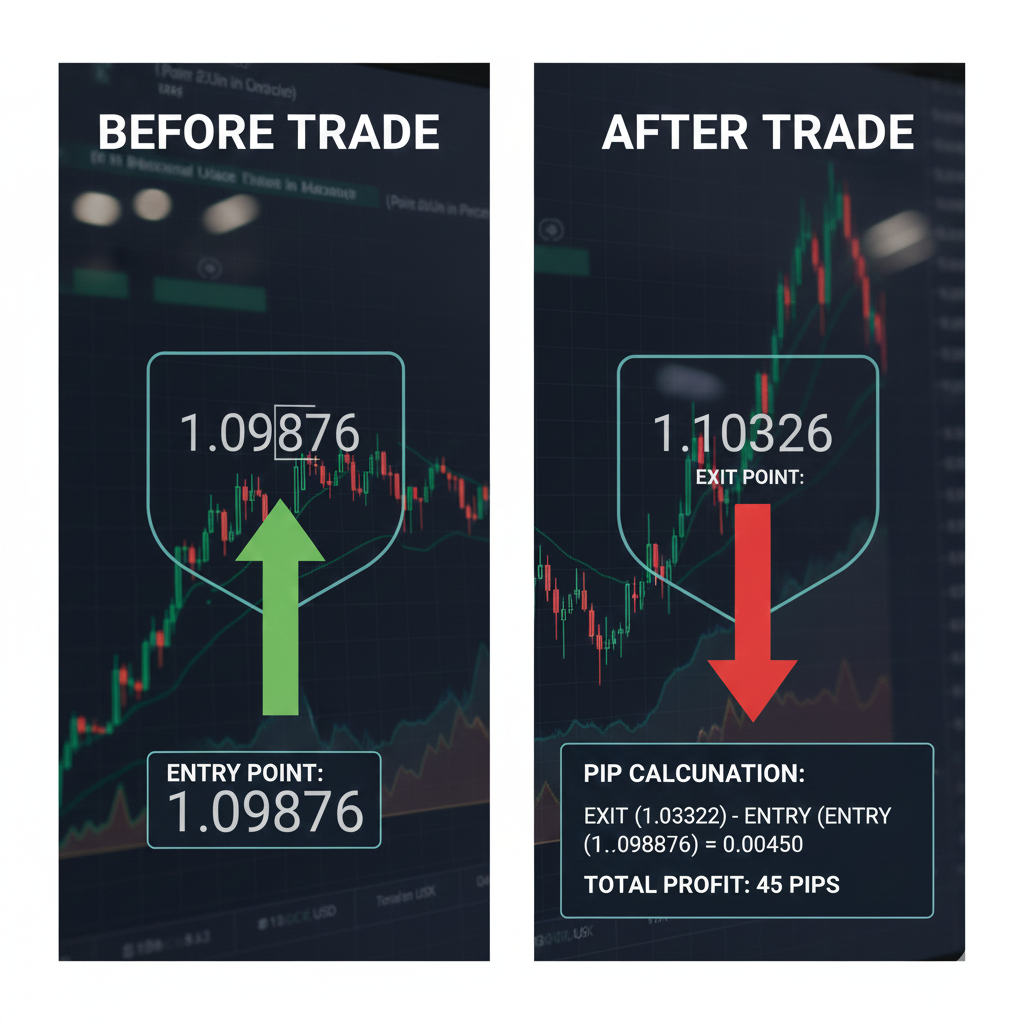

How to Calculate Your Profit in Pips

Calculating your profit or loss in pips is straightforward. Simply subtract your entry price from your exit price (or vice versa for short positions) and count the pip movement.

Long Position Example

- Entry: EUR/USD at 1.1050

- Exit: EUR/USD at 1.1080

- Pip profit: 1.1080 – 1.1050 = 0.0030 = 30 pips

If you traded 1 standard lot, your dollar profit would be 30 pips × $10 = $300

Short Position Example

- Entry: GBP/USD at 1.2650 (selling/shorting)

- Exit: GBP/USD at 1.2620 (buying back)

- Pip profit: 1.2650 – 1.2620 = 0.0030 = 30 pips

Again, with 1 standard lot, that’s 30 pips × $10 = $300 profit

Common Pip-Related Terms Every Trader Should Know

Spread (in Pips)

The spread is the difference between the bid price and ask price, measured in pips. If EUR/USD has a bid price of 1.1050 and an ask price of 1.1052, the spread is 2 pips. Tighter spreads mean lower trading costs.

[LINK PLACEHOLDER: Internal link to “Understanding Forex Spreads and How They Affect Your Trading”]

Slippage

Slippage occurs when your trade is executed at a different price than expected, resulting in you gaining or losing additional pips. This typically happens during high volatility or when trading illiquid pairs.

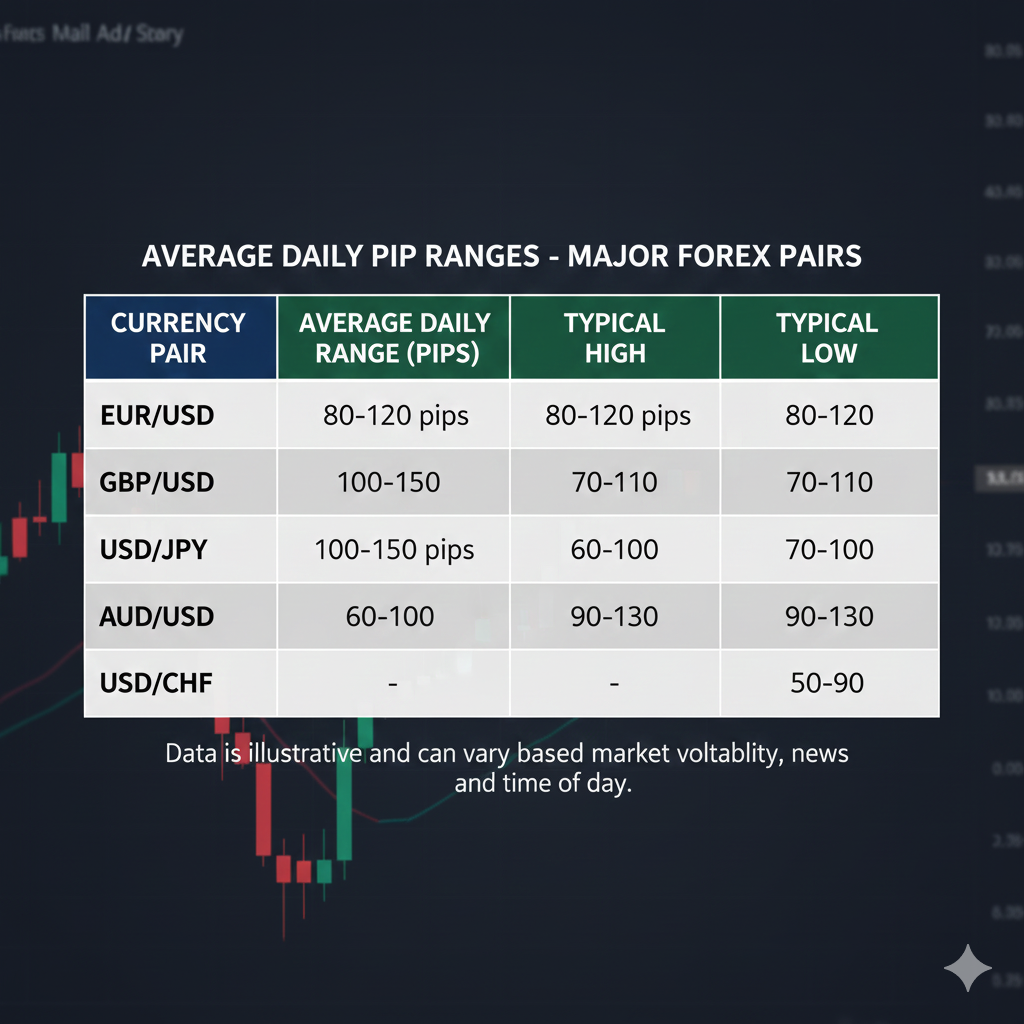

Pip Range

The pip range refers to how many pips a currency pair moves during a specific time period. Some pairs are more volatile and move hundreds of pips daily, while others are more stable.

Best Practices for Trading with Pips

1. Always Calculate Your Pip Value Before Trading

Never enter a trade without knowing exactly how much each pip is worth in your account currency. This knowledge is essential for proper risk management and prevents unpleasant surprises.

2. Use Risk-Reward Ratios Based on Pips

Professional traders typically aim for risk-reward ratios of at least 1:2. This means if you’re risking 30 pips on a trade, you should target at least 60 pips in profit. This approach ensures that even with a 50% win rate, you’ll be profitable over time.

3. Track Your Average Win and Loss in Pips

Keep a trading journal that records your wins and losses in pips. This data helps you analyze your trading performance objectively and identify which strategies work best for you.

[LINK PLACEHOLDER: Internal link to “How to Keep a Forex Trading Journal”]

4. Consider the Average Daily Range

Different currency pairs have different average daily ranges measured in pips. EUR/USD might move 70-100 pips on an average day, while GBP/JPY could move 150-200 pips. Understanding these ranges helps you set realistic profit targets and appropriate stop losses.

Pip Value Calculators and Tools

While understanding the mathematics behind pip calculations is important, most traders use tools to speed up the process:

Online Pip Calculators

Many forex websites offer free pip calculators where you simply input your position size, currency pair, and account currency to instantly get the pip value. These tools eliminate calculation errors and save time.

Trading Platform Built-in Calculators

Most modern trading platforms like MetaTrader 4, MetaTrader 5, and cTrader include built-in calculators that automatically display pip values when you adjust your position size. This real-time information helps you make informed decisions quickly.

Mobile Apps

Several smartphone apps are available that calculate pip values on the go, useful for traders who need to make quick calculations away from their desktop.

Common Mistakes Beginners Make with Pips

Mistake 1: Ignoring Pip Value Differences

Not all currency pairs have the same pip value. Trading a standard lot of EUR/USD has a different pip value than trading a standard lot of GBP/JPY. Always verify the pip value for each specific trade.

Mistake 2: Confusing Pipettes with Pips

When brokers display five decimal places, beginners sometimes count pipettes as pips, leading to miscalculations. Remember that it takes 10 pipettes to equal 1 pip.

Mistake 3: Overleveraging Based on Pip Targets

Just because a trade has a large pip target doesn’t mean you should increase your position size dramatically. Always base your position sizing on percentage risk of your account, not pip expectations.

Mistake 4: Setting Arbitrary Stop Losses

Don’t just randomly set your stop loss at “50 pips below entry.” Your stop loss should be based on technical analysis, support and resistance levels, or volatility measures like the Average True Range (ATR), not arbitrary pip distances.

[LINK PLACEHOLDER: Internal link to “How to Set Effective Stop Loss Orders in Forex Trading”]

How Pips Relate to Your Trading Strategy

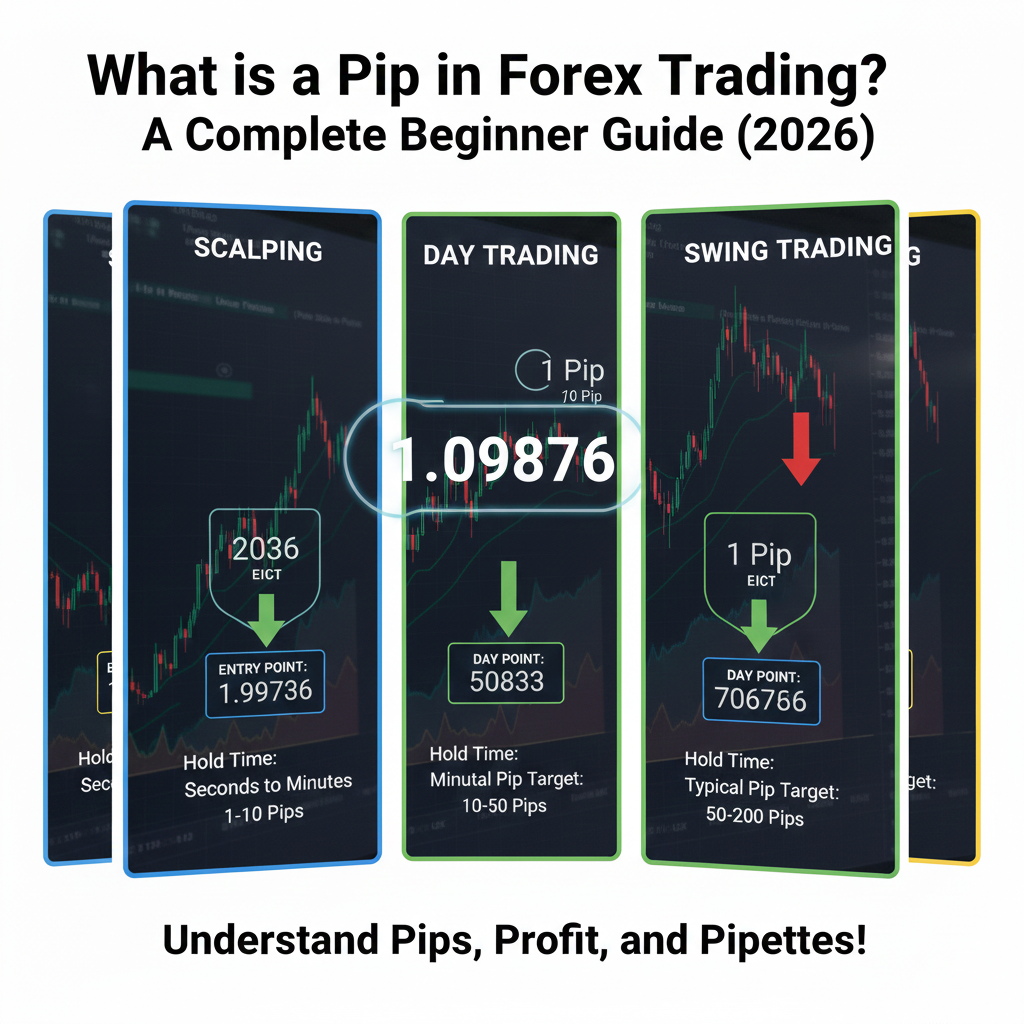

Scalping Strategies (5-20 pips per trade)

Scalpers aim for small, quick profits and typically target just 5-20 pips per trade. They execute numerous trades throughout the day, with very tight stop losses of 5-10 pips.

Day Trading Strategies (20-80 pips per trade)

Day traders hold positions for several hours and typically aim for 20-80 pips per trade. They use moderate stop losses of 15-40 pips depending on the currency pair’s volatility.

Swing Trading Strategies (50-300 pips per trade)

Swing traders hold positions for several days or weeks, targeting larger moves of 50-300 pips. They use wider stop losses of 40-100+ pips to avoid being stopped out by normal market noise.

Position Trading Strategies (200-1000+ pips per trade)

Position traders hold for weeks to months, targeting major trends that can yield hundreds or thousands of pips. They use very wide stop losses of 100-300+ pips.

Advanced Pip Concepts

Pipettes and High-Frequency Trading

The introduction of pipettes has enabled high-frequency trading strategies that capitalize on tiny price movements. While retail traders typically don’t engage in true high-frequency trading, understanding pipettes helps you see the full picture of price action.

Cross Currency Pairs and Pip Calculation

When trading cross currency pairs (pairs that don’t include USD), pip value calculations become slightly more complex because you need to convert through the USD or another intermediary currency. Most trading platforms handle this automatically, but understanding the principle helps you verify calculations.

Pip Value and Account Growth

As your trading account grows, the dollar value of each pip increases if you maintain consistent risk percentages. A 1% risk on a $10,000 account risking 20 pips means $5 per pip, but the same 1% risk on a $50,000 account would be $25 per pip.

Frequently Asked Questions About Pips

How many pips should I aim for per day?

There’s no universal answer—it depends entirely on your trading strategy. Scalpers might aim for 10-20 pips per trade with multiple trades daily, while swing traders might target 100+ pips per trade but only take a few trades per week. Focus on consistent execution of your strategy rather than arbitrary pip targets.

Is 50 pips a day realistic?

While 50 pips per day sounds achievable, consistently making 50 pips every single trading day is extremely difficult even for professional traders. Market conditions vary greatly, and some days offer few quality setups. It’s more realistic to think in terms of weekly or monthly pip averages rather than daily quotas.

What is a good pip-to-loss ratio?

Most successful traders aim for risk-reward ratios of at least 1:1.5 or ideally 1:2 or higher. This means if you risk 30 pips, you should target at least 45-60 pips in profit. However, your win rate must be considered alongside your ratio—higher ratios often come with lower win rates.

Do professional traders think in pips?

Yes, professional traders universally use pips as their standard measurement. It provides a consistent way to measure performance across different currency pairs, position sizes, and account currencies. However, they ultimately care about percentage returns on their capital.

How many pips is considered a good trade?

A “good trade” isn’t defined by pip quantity alone but by whether it follows your trading plan with proper risk management. A 20-pip winner with a 10-pip risk (2:1 ratio) executed according to your strategy is better than a random 100-pip winner that violated your rules.

Conclusion: Mastering Pips for Trading Success

Understanding pips is foundational to your forex trading education. These tiny price measurements are the building blocks of every profit, loss, risk calculation, and trading decision you’ll make. By mastering pip calculations, pip values, and how pips relate to your overall trading strategy, you’re equipping yourself with essential knowledge that separates successful traders from beginners who struggle.

Remember these key takeaways:

- A pip is the smallest standard price movement in forex (0.0001 for most pairs, 0.01 for JPY pairs)

- Pip value depends on your position size, currency pair, and account currency

- Always calculate your pip value before entering any trade

- Use pips to set appropriate stop losses, take profits, and risk-reward ratios

- Track your performance in both pips and percentage returns

As you continue your forex trading journey, the concept of pips will become second nature. You’ll automatically calculate pip values, set pip-based targets, and think in terms of risk-reward ratios measured in pips. This fundamental understanding forms the bedrock upon which you’ll build your trading success.

[LINK PLACEHOLDER: Internal link to “Next Steps: Essential Forex Trading Terms Every Beginner Must Know”]

Ready to put your pip knowledge into practice? Open a demo trading account and start practicing pip calculations with virtual money. There’s no substitute for hands-on experience, and demo accounts let you learn without risking real capital.