USD Weakness in 2026: How Fed Rate Cuts Are Reshaping EUR/USD and JPY Trading

Meta Title: USD Weakness 2026: Fed Rate Cuts Impact on EUR/USD & USD/JPY Trading Meta Description: Comprehensive analysis of USD weakness in 2026. Discover how Fed rate cuts are reshaping EUR/USD and USD/JPY trading strategies. Expert forecasts and actionable insights. Focus Keyword: USD weakness 2026 Secondary Keywords: Fed rate cuts 2026, EUR/USD forecast, USD/JPY analysis, dollar weakness, forex trading 2026

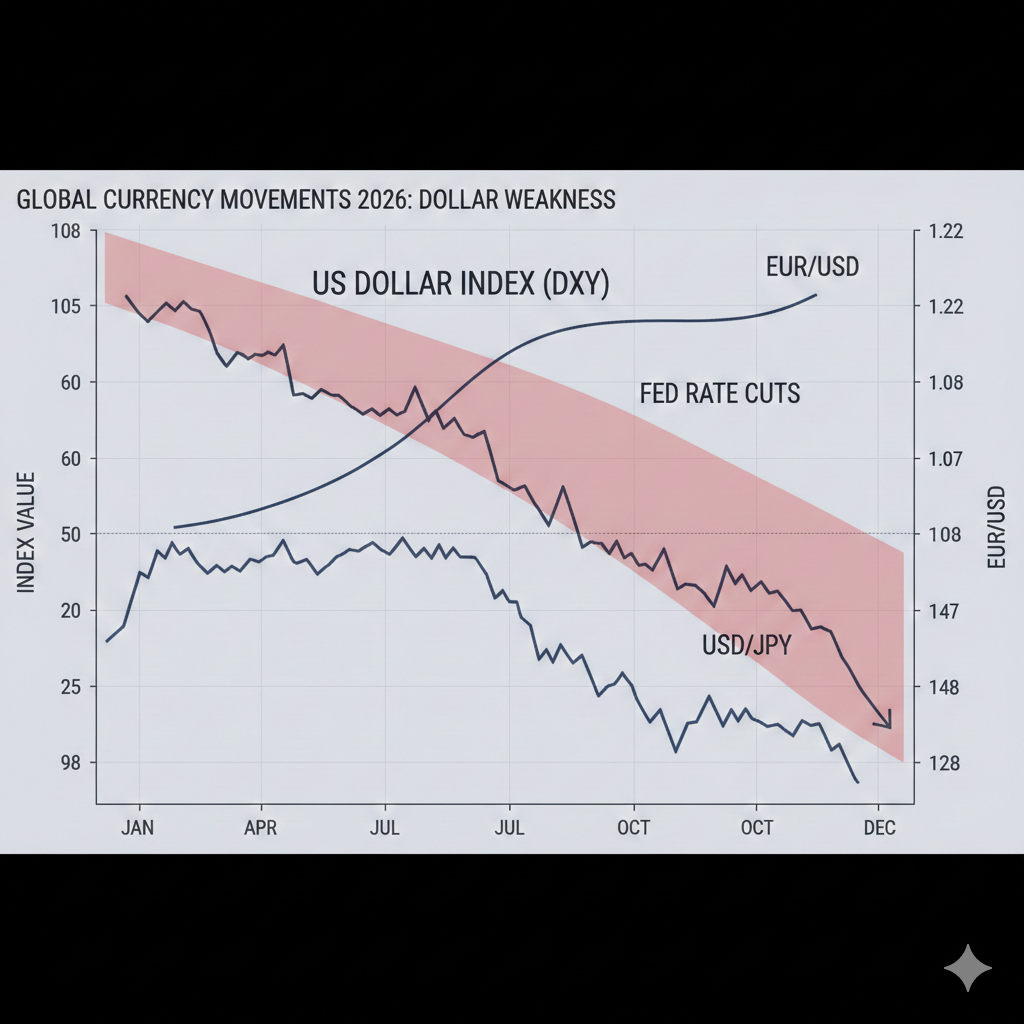

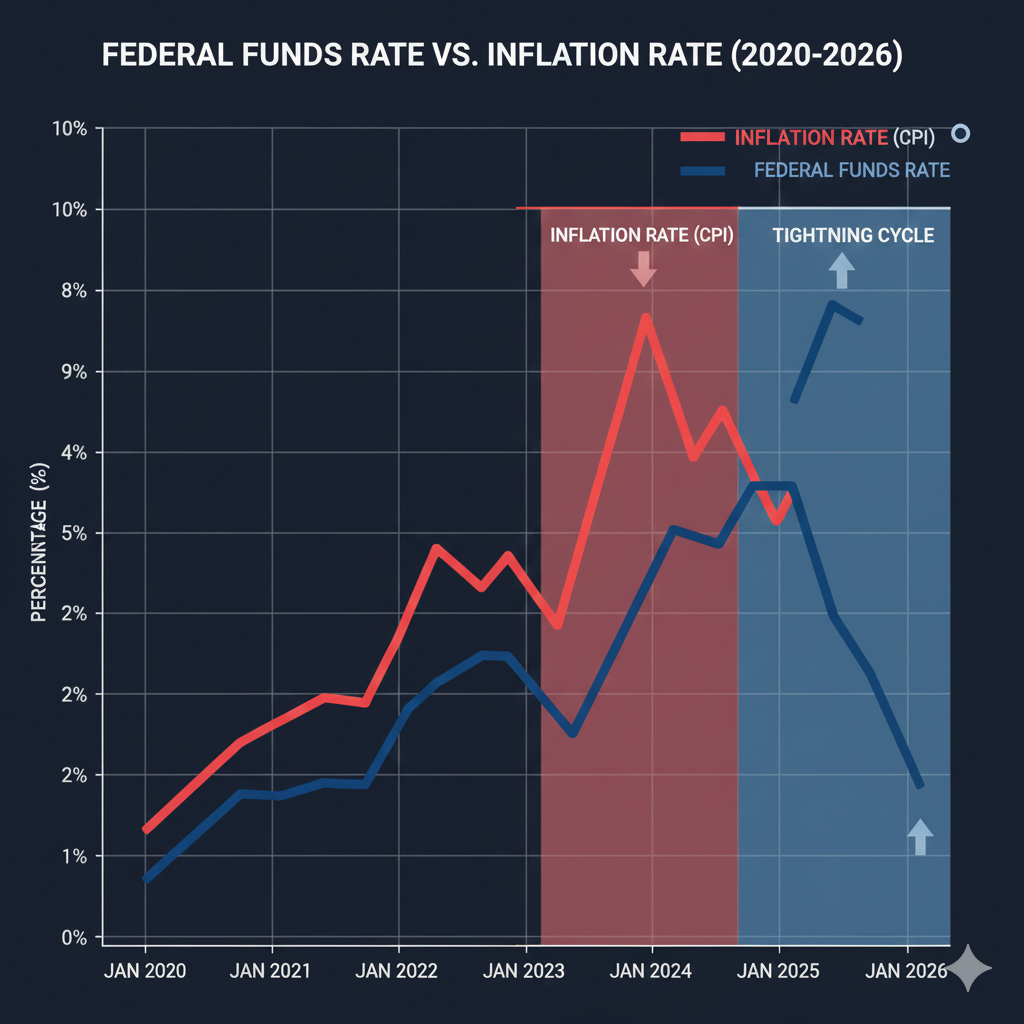

The U.S. dollar’s dominance is facing its most significant challenge in years. After aggressive Federal Reserve rate hikes in 2022-2023, the greenback entered 2026 under mounting pressure as the Fed pivots to rate cuts.

EUR/USD has surged beyond 1.10, while USD/JPY has retreated from its 2024 highs, creating new trading dynamics.

This comprehensive analysis covers:

- Why the Fed is cutting rates and what comes next

- How EUR/USD and USD/JPY are responding to dollar weakness

- Actionable trading strategies for the current environment

- Expert forecasts for the remainder of 2026

The Current State of USD Weakness

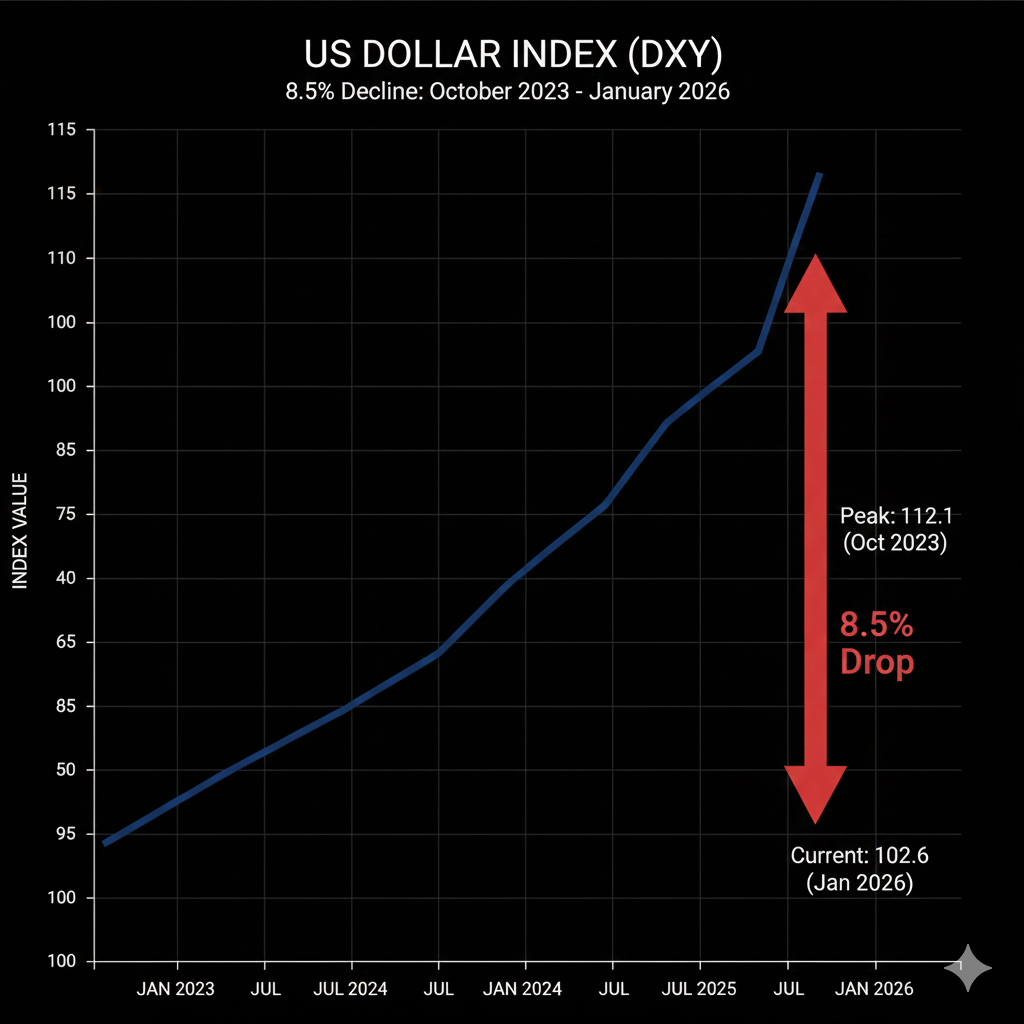

As of January 2026, the U.S. Dollar Index (DXY) has declined approximately 8.5% from its October 2023 peak of 107.35, now trading around 97.5—its lowest level since early 2023.

Key Currency Pair Movements

EUR/USD:

- Current Level: 1.1080 (as of January 6, 2026)

- YTD Change: +6.2%

- 12-Month Change: +9.8%

- Key Level Broken: Convincingly above 1.10 psychological resistance

USD/JPY:

- Current Level: 148.25 (as of January 6, 2026)

- YTD Change: -3.1%

- From 2024 Peak: Down from 162 (October 2024) = -8.5% decline

- Key Level: Below 150 support zone

GBP/USD:

- Current Level: 1.2850

- YTD Change: +4.8%

USD/CHF:

- Current Level: 0.8320

- YTD Change: -5.2%

What Changed?

The dollar’s reversal can be traced to three pivotal moments:

- September 2024: Fed begins rate cut cycle with 50 bps cut

- December 2024: Fed signals continued easing despite inflation concerns

- January 2026: Softer-than-expected jobs data confirms dovish path

This combination has fundamentally altered interest rate differentials, the primary driver of currency values.

[INTERNAL LINK: “Understanding Interest Rate Differentials in Forex Trading”]

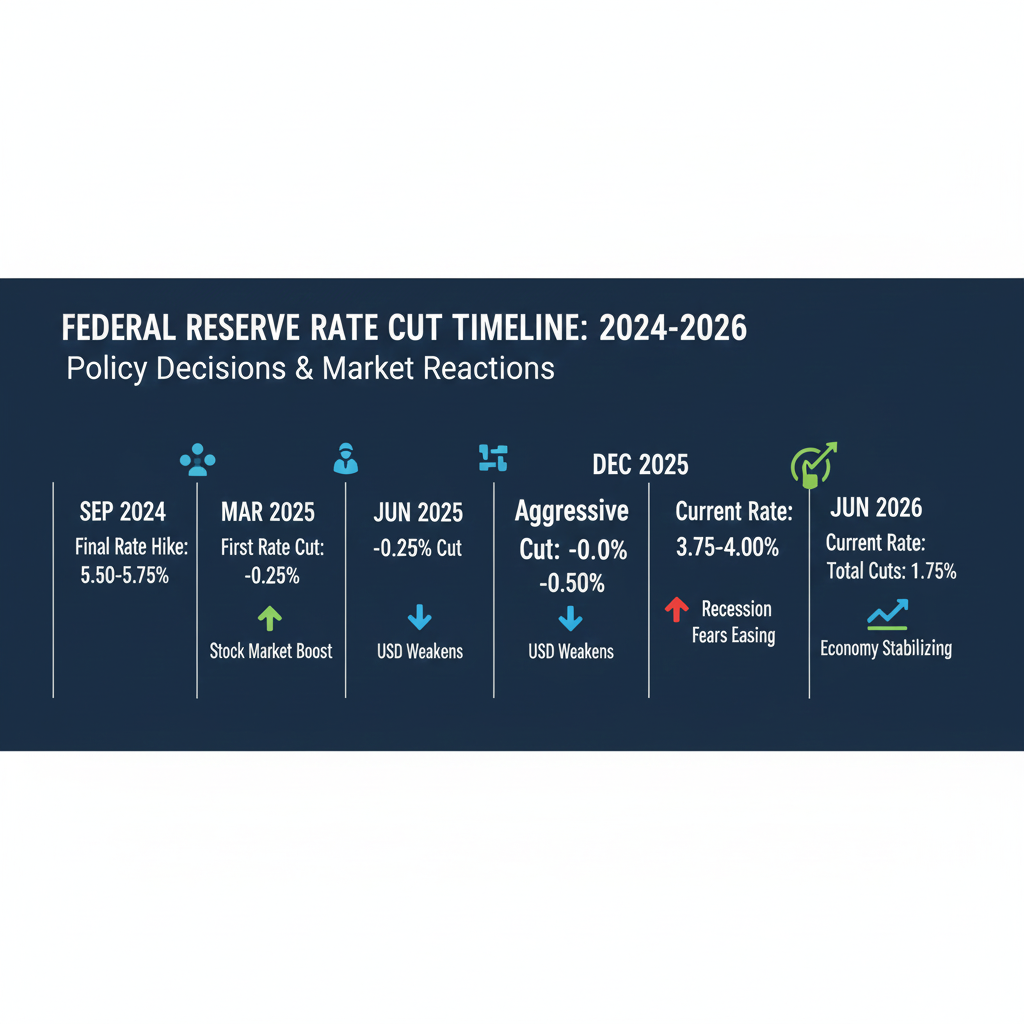

Fed Rate Cuts 2026: The Complete Timeline

Understanding the Federal Reserve’s monetary policy trajectory is essential for trading USD pairs.

The Rate Cut Cycle: 2024-2026

2024:

- September 18: -50 bps (5.50% → 5.00%) – “Recalibration” begins

- November 7: -25 bps (5.00% → 4.75%)

- December 18: -25 bps (4.75% → 4.50%)

2025:

- January 31: HOLD at 4.50%

- March 20: -25 bps (4.50% → 4.25%)

- May 1: -25 bps (4.25% → 4.00%)

- June 12: -25 bps (4.00% → 3.75%)

- July 31: HOLD at 3.75%

- September 18: -25 bps (3.75% → 3.50%)

- November 7: -25 bps (3.50% → 3.25%)

- December 18: -25 bps (3.25% → 3.00%)

2026 (Current):

- February 5 (Expected): Likely HOLD at 3.00%

- March 19 (Expected): Potentially -25 bps to 2.75%

Total Easing: 250 basis points (2.50%) from peak

Fed’s Stated Rationale

- Inflation Progress: Core PCE down to 2.4% (from 5.6% peak)

- Labor Market Rebalancing: Unemployment rose from 3.4% to 4.2%

- Growth Concerns: GDP growth slowing (3.1% → 2.0% forecast)

- Financial Conditions: Preventing economic over-cooling

What’s Next: Fed Forward Guidance

Market Pricing (Fed Funds Futures):

- February 2026: 95% chance of hold

- March 2026: 60% chance of hold, 40% chance of -25 bps

- June 2026: 75% chance of reaching 2.75%

- December 2026: 50% chance of reaching 2.50%

Translation for Forex Traders: More cuts are likely, but the pace has slowed. This supports continued (but potentially moderating) dollar weakness.

[INTERNAL LINK: “How to Trade Fed Interest Rate Decisions: Complete Strategy Guide”]

Why the Dollar is Weakening: 5 Key Drivers

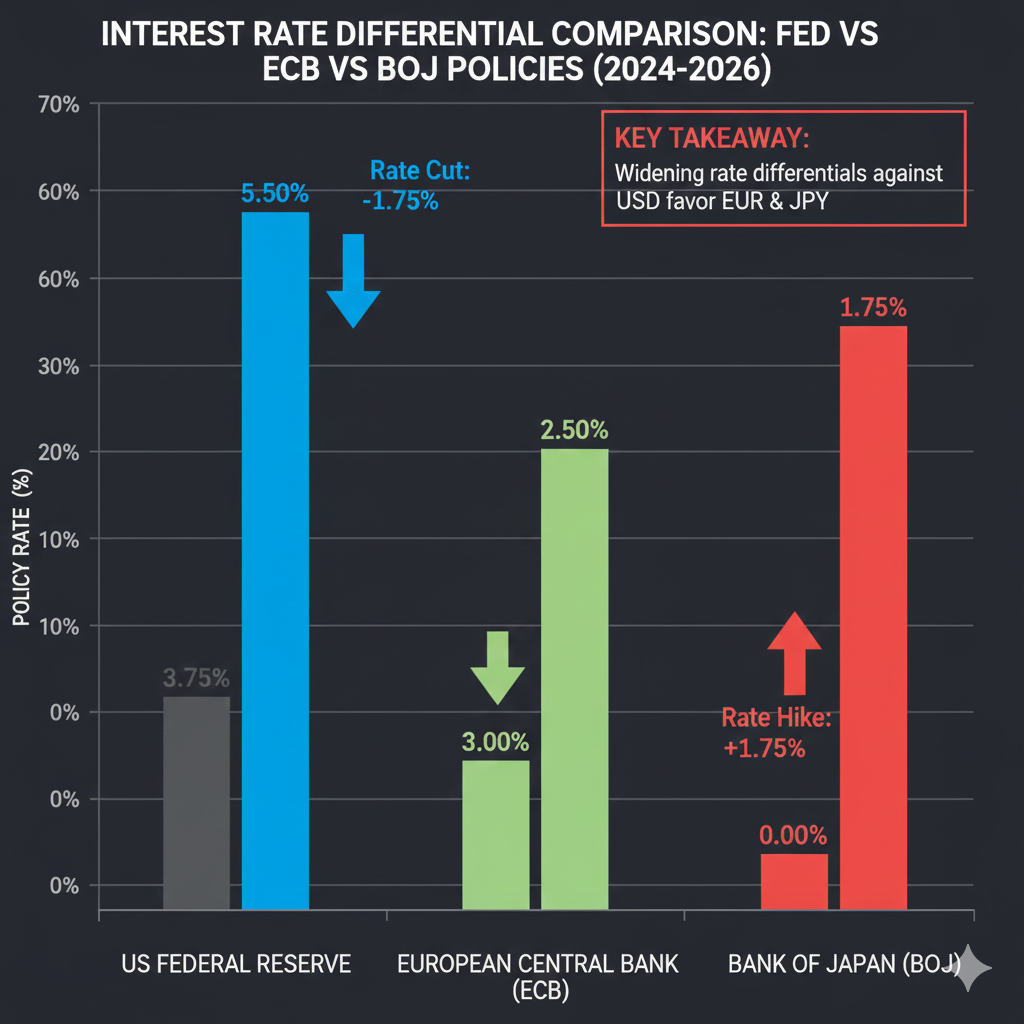

1. Interest Rate Differential Compression

The Fundamental Mechanism: Currency values are heavily influenced by interest rate differentials.

Current Differential Changes:

US vs Eurozone:

- 2023: US 5.50%, EU 4.00% = +150 bps US advantage

- 2026: US 3.00%, EU 3.25% = -25 bps US disadvantage ✅

US vs Japan:

- 2023: US 5.50%, Japan -0.10% = +560 bps US advantage

- 2026: US 3.00%, Japan 0.50% = +250 bps US advantage (shrinking)

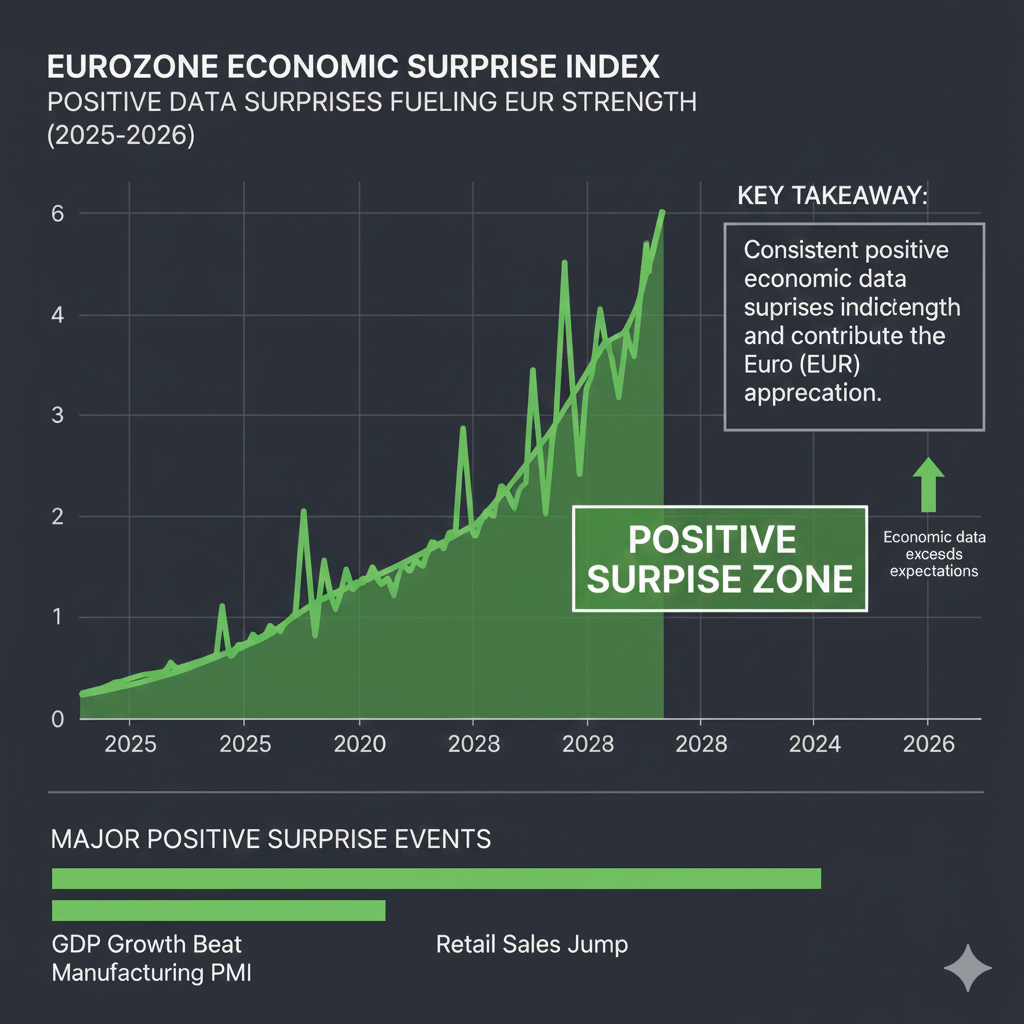

2. Relative Economic Performance Shifts

US Economic Momentum Slowing:

- GDP Growth: 2.0% forecast (down from 3.1%)

- Consumer Confidence: Declining

- Business Investment: Moderating

Eurozone Economic Stabilization:

- GDP Growth: 1.2% (up from near-zero)

- Germany: Exiting technical recession with €200B infrastructure plan

- Manufacturing PMI: Returning to expansion

Japan Economic Renaissance:

- Wage Growth: Strongest in 30+ years (5.1% in 2024)

- Corporate Profits: Near record highs

- Tourism: Booming recovery

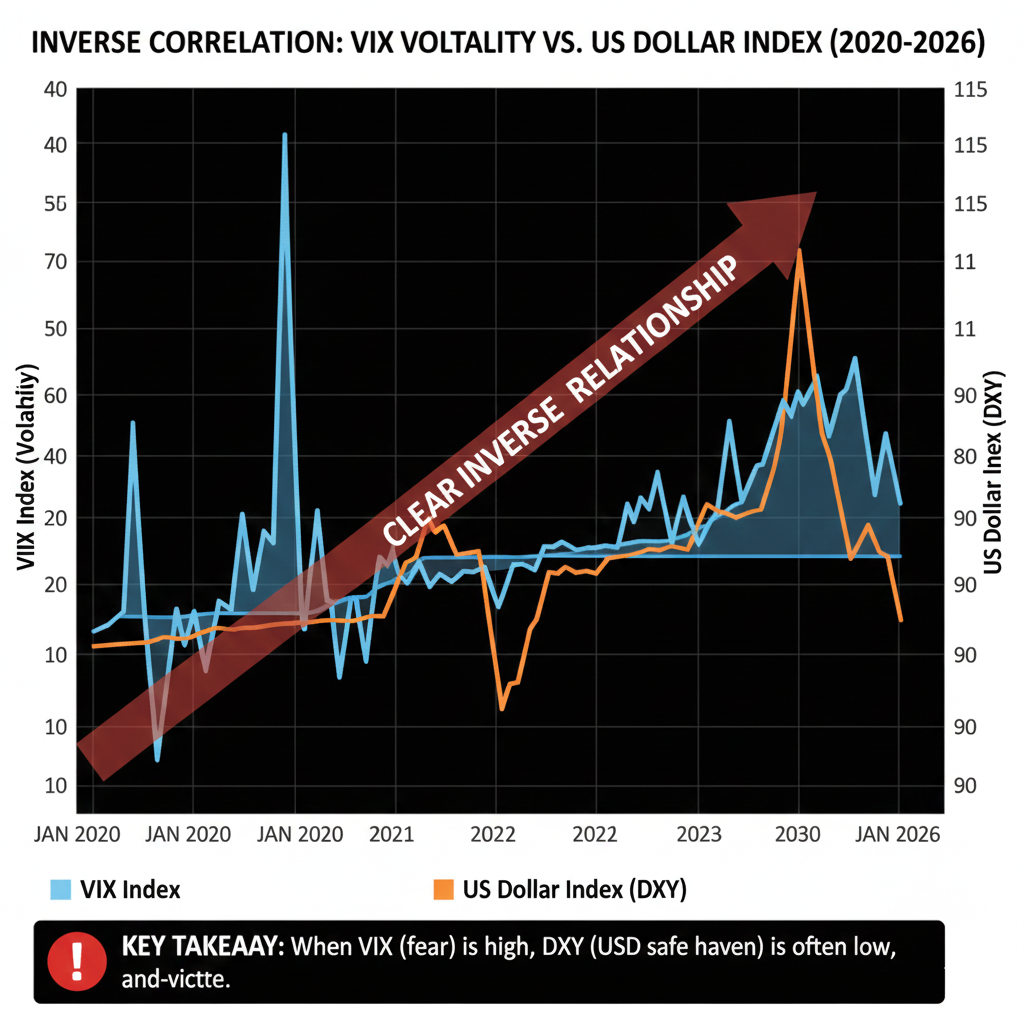

3. Safe Haven Demand Reduction

Risk-On Indicators:

- Equity Markets: S&P 500 near all-time highs

- VIX (Fear Index): Below 15

- Credit Spreads: Tight

- Emerging Markets: Attracting capital inflows

4. Capital Flow Reallocation

Capital Flowing OUT of US and INTO:

Europe:

- German infrastructure spending

- ECB maintaining higher rates longer

- European equities cheaper on valuation

Japan:

- Tokyo Stock Exchange at 34-year highs

- Corporate governance reforms

- Warren Buffett-led value investing trend

Emerging Markets:

- Attractive valuations

- Commodity exposure

5. Technical and Positioning Factors

Speculative Positioning (CFTC COT data):

- Late 2023: Net long USD positions at 5-year highs

- January 2026: Net long USD positions at 2-year lows

Technical Breakdown:

- 103.00 support broken (September 2024)

- 100.00 psychological level broken (November 2024)

- 98.50 support broken (December 2025)

[INTERNAL LINK: “Understanding COT Report for Forex Trading”]

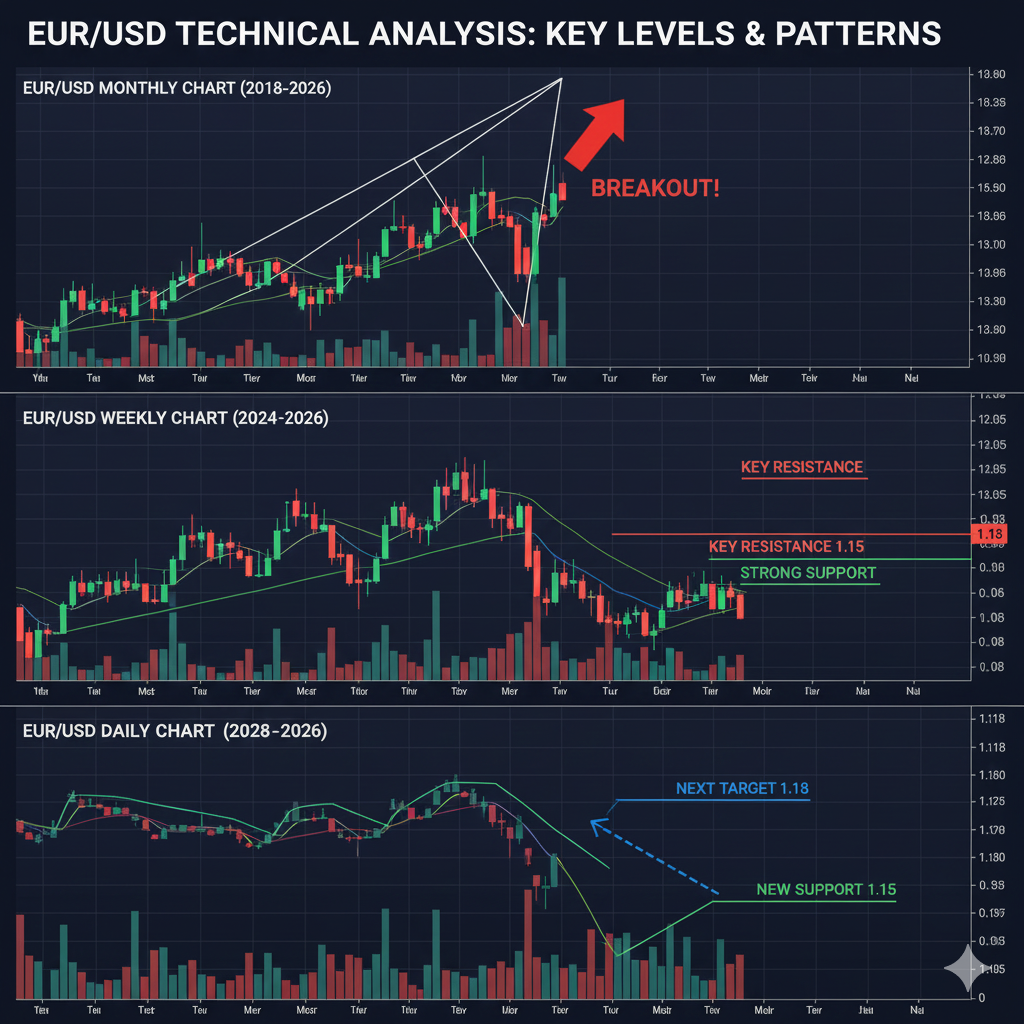

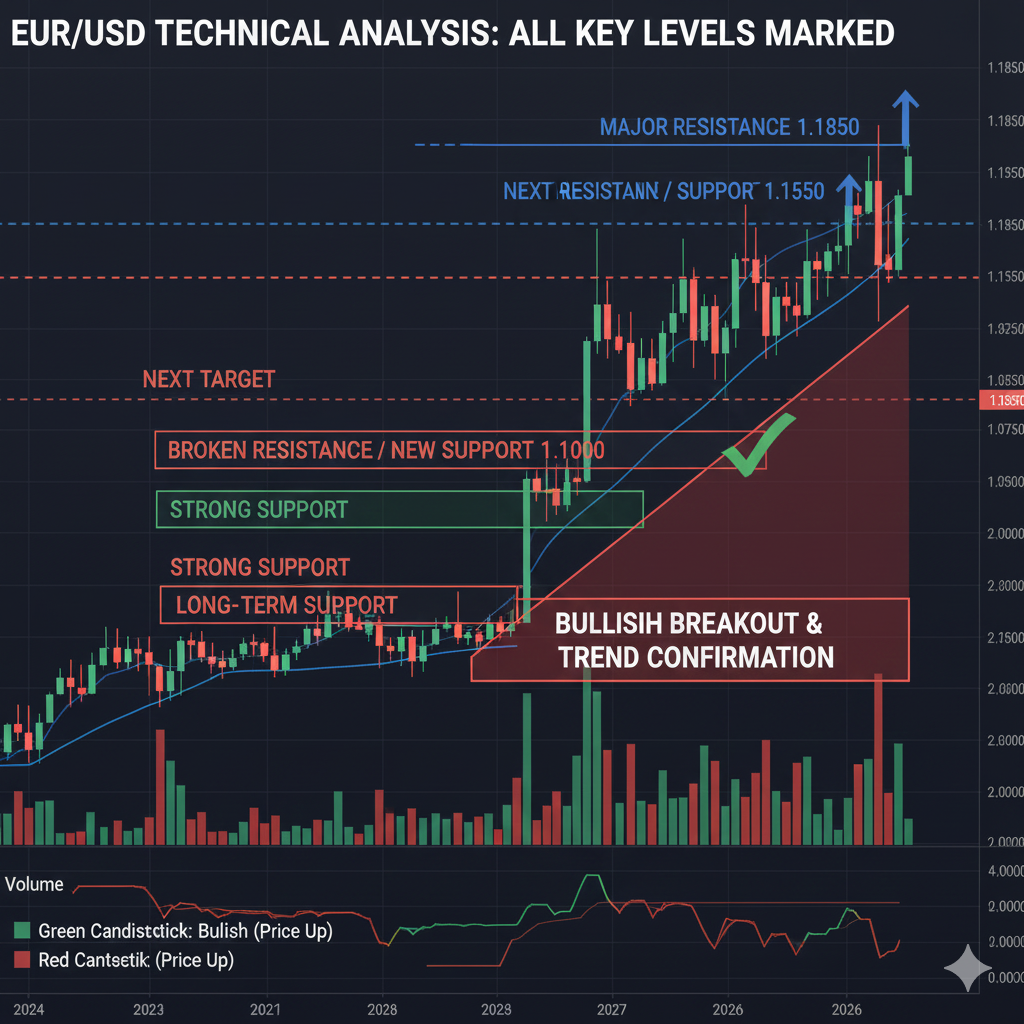

EUR/USD Analysis: Breaking Above 1.10 {#eurusd-analysis}

EUR/USD is the world’s most traded currency pair, and its 2026 performance has been dramatic.

Current Price Action

Key Statistics:

- Current Level: 1.1080

- January High: 1.1145

- Average Daily Range: 85 pips (elevated volatility)

The 1.10 Breakout Story

The Breakout (December 2025):

- Catalyst: Fed’s dovish December meeting

- Above-average volume confirming breakout

- Successful backtest of 1.10 as support (January 3)

- Rally to 1.1145

Technical Confirmation: ✅ Break and close above 1.10 ✅ Successful retest (bull flag pattern) ✅ Rising moving averages (“Golden Cross”) ✅ RSI in bullish territory (55-65) ✅ Higher highs and higher lows

Fundamental Drivers for EUR Strength

1. ECB Policy Divergence:

- ECB rate: 3.25% vs Fed: 3.00%

- Europe now offers HIGHER rates than US

- ECB messaging: “Restrictive rates still appropriate”

2. Eurozone Economic Surprises:

- Germany’s €200B infrastructure plan

- Manufacturing PMI returned to expansion (51.2)

- Energy crisis resolved (gas prices down 85%)

3. Capital Flows into European Assets:

- European Equities outperforming (+8% vs S&P +3%)

- German Bunds attractive

- FDI increasing

Technical Outlook for EUR/USD

Support Levels:

- 1.1000-1.1020: Former resistance = new support

- 1.0900-1.0920: 50-day MA

- 1.0800: Major support zone

- 1.0700: 200-day MA

Resistance Levels:

- 1.1145: January high

- 1.1200: Psychological round number

- 1.1275-1.1300: 2023 highs

- 1.1450: 2022 high

Indicators:

- RSI: 58 (bullish, not overbought)

- MACD: Bullish crossover confirmed

- ADX: 28 (moderate trend strength)

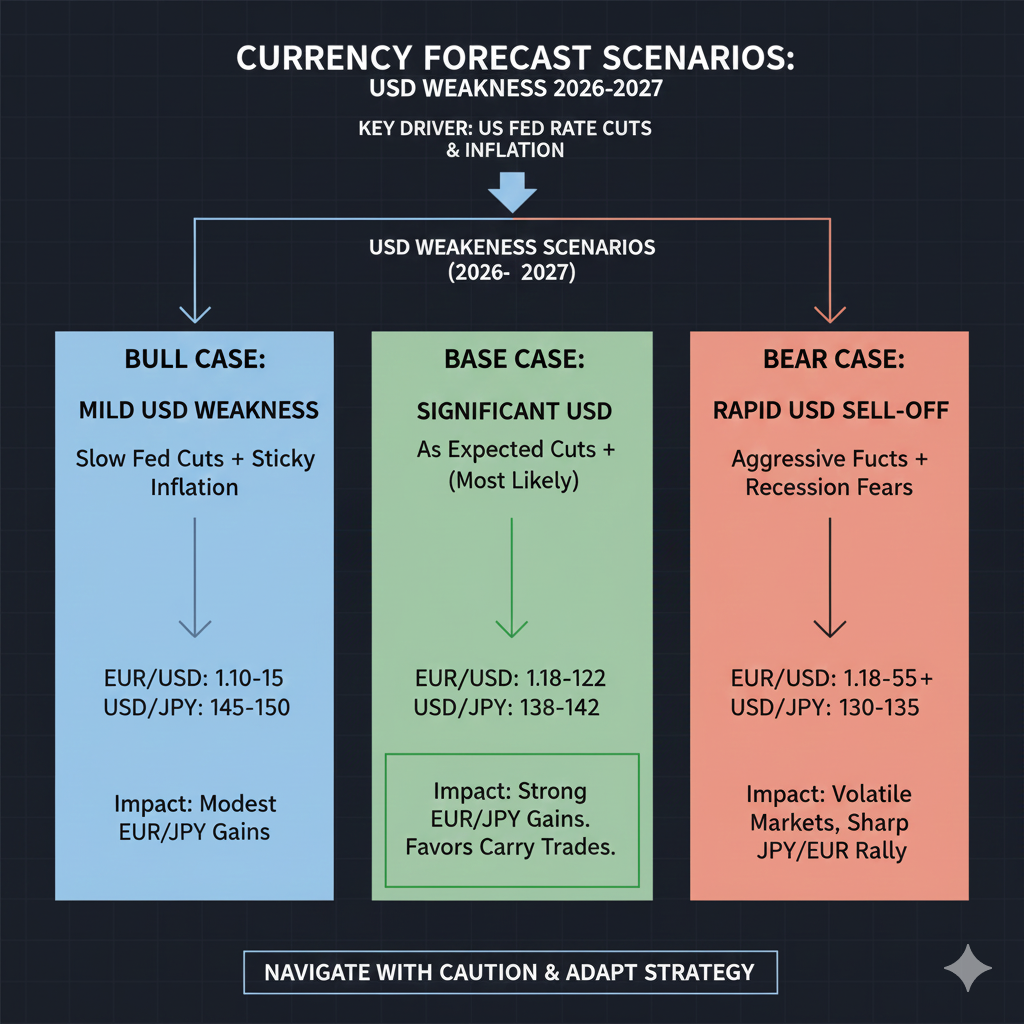

Scenario Analysis: EUR/USD

Bull Case (60% Probability):

- Target: 1.15-1.17 by Q3 2026

- Fed continues cutting, ECB holds longer

Base Case (30% Probability):

- Target: Range-bound 1.09-1.13

- Both central banks converging

Bear Case (10% Probability):

- Target: Retreat to 1.05-1.07

- Fed pauses/reverses on inflation

[INTERNAL LINK: “EUR/USD Trading Strategy: Complete Guide for 2026”]

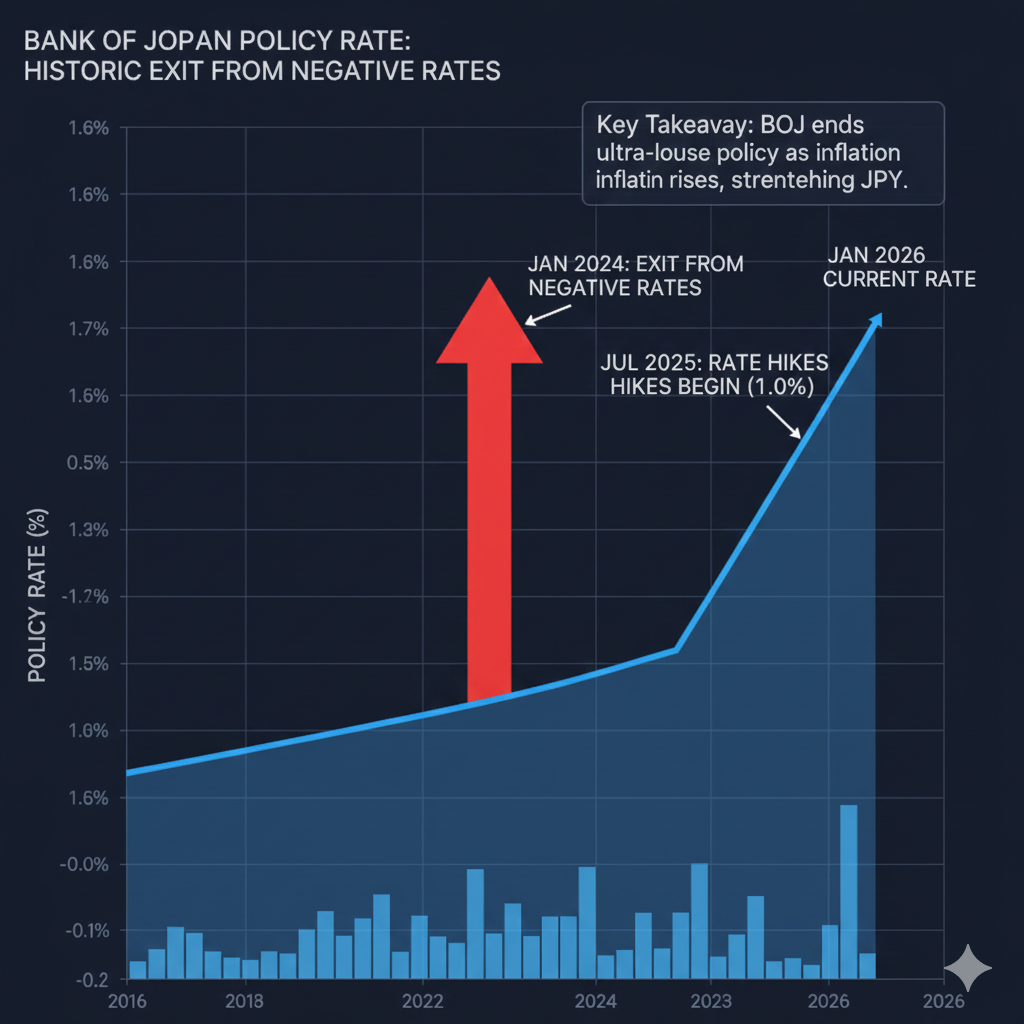

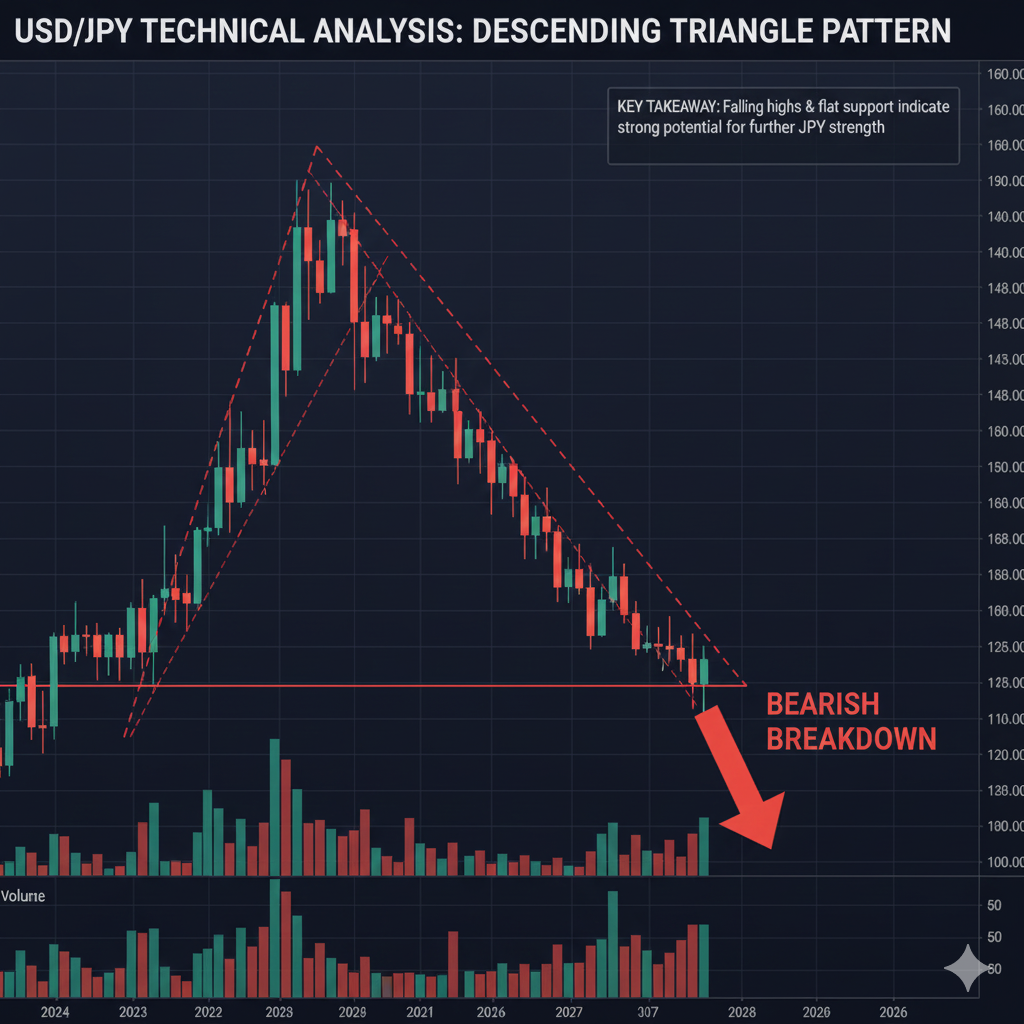

USD/JPY Dynamics: The Carry Trade Unwind

USD/JPY tells a more complex story—it’s about the historic shift in Japanese monetary policy.

Current Price Action

Key Statistics:

- Current Level: 148.25

- 2024 Peak: 162.00 (October 2024)

- Peak-to-Current: -8.5% decline

- Critical Level: 150.00 broken

The 162 to 148 Journey

Phase 1: The Peak (July-October 2024)

- Maximum Fed-BOJ differential (5.50% vs -0.10% = 560 bps)

- Carry trade mania

- BOJ refusing to hike despite inflation

Phase 2: The BOJ Awakening (Nov 2024-Apr 2025)

BOJ Policy Actions:

- December 2024: Ended negative rates (-0.10% → 0.00%)

- March 2025: First rate hike in 17 years (0.00% → 0.25%)

- July 2025: Second hike (0.25% → 0.50%)

Phase 3: The Carry Trade Unwind (May 2025-Present)

Differential Collapse:

- October 2024: +560 bps in favor of USD

- January 2026: +250 bps in favor of USD

- Change: 310 bps compression in 15 months

Carry Trade Impact:

- Estimated $500B+ in carry trades unwinding

- Forced selling of dollars, buying of yen

- Stop losses triggered → cascading effect

The August 2025 “Flash Crash”:

- USD/JPY dropped from 153 to 145 intraday

- Billions in losses for carry trade funds

- 150 level never regained

Japan’s Economic Renaissance

Why BOJ Can Finally Hike:

- Wage Growth Breakthrough: 5.1% average increases (highest in 33 years)

- Inflation Above Target: Core CPI 2.5% (above 2% target)

- Corporate Profits: Tokyo Stock Exchange at 34-year highs

- Tourism Boom: Services inflation robust

- Governance Reforms: Foreign investment surging

Technical Outlook for USD/JPY

Support Levels:

- 147.50-148.00: Current consolidation

- 145.00: August flash crash low (CRITICAL)

- 142.00-143.00: Next major support

- 140.00: Intervention risk zone

Resistance Levels:

- 150.00: Broken support = resistance

- 152.50: Previous consolidation

- 155.00: Breakdown point

- 158.00-160.00: Strong resistance

Pattern Analysis:

- Descending Triangle: Bearish

- Head and Shoulders: Topping pattern

- Downtrend Intact

Scenario Analysis: USD/JPY

Bear Case (55% Probability):

- Target: 140-142 by Q3 2026

- Fed cuts to 2.75%, BOJ hikes to 1.00%

Base Case (35% Probability):

- Target: 145-152 range

- Differential stabilizes

Bull Case (10% Probability):

- Target: Recovery to 155-158

- Fed reverses course

Ministry of Finance Intervention Risk

Important: Below 145, intervention risk increases significantly. MOF might intervene to weaken yen (support exporters). This provides a “soft floor” for USD/JPY.

[INTERNAL LINK: “USD/JPY Trading Guide: Understanding Japanese Intervention”]

Trading Strategies for USD Weakness

Strategy 1: EUR/USD Breakout Trading

Setup:

- Price pulls back to 1.1000-1.1020 support

- Bullish reversal pattern forms

- RSI above 50

Position:

- Entry: 1.1020

- Stop Loss: 1.0950 (70 pips)

- Take Profit 1: 1.1145 (125 pips)

- Take Profit 2: 1.1200 (180 pips)

Risk/Reward: 1:1.8 to 1:2.5

Strategy 2: USD/JPY Short Strategy

Setup:

- Price rallies to 149.50-150.00 resistance

- Bearish reversal pattern

- Rejection at 150.00

Position:

- Entry: 149.80

- Stop Loss: 151.00 (120 pips)

- Take Profit 1: 147.50 (230 pips)

- Take Profit 2: 145.00 (480 pips)

Risk/Reward: 1:2 to 1:4

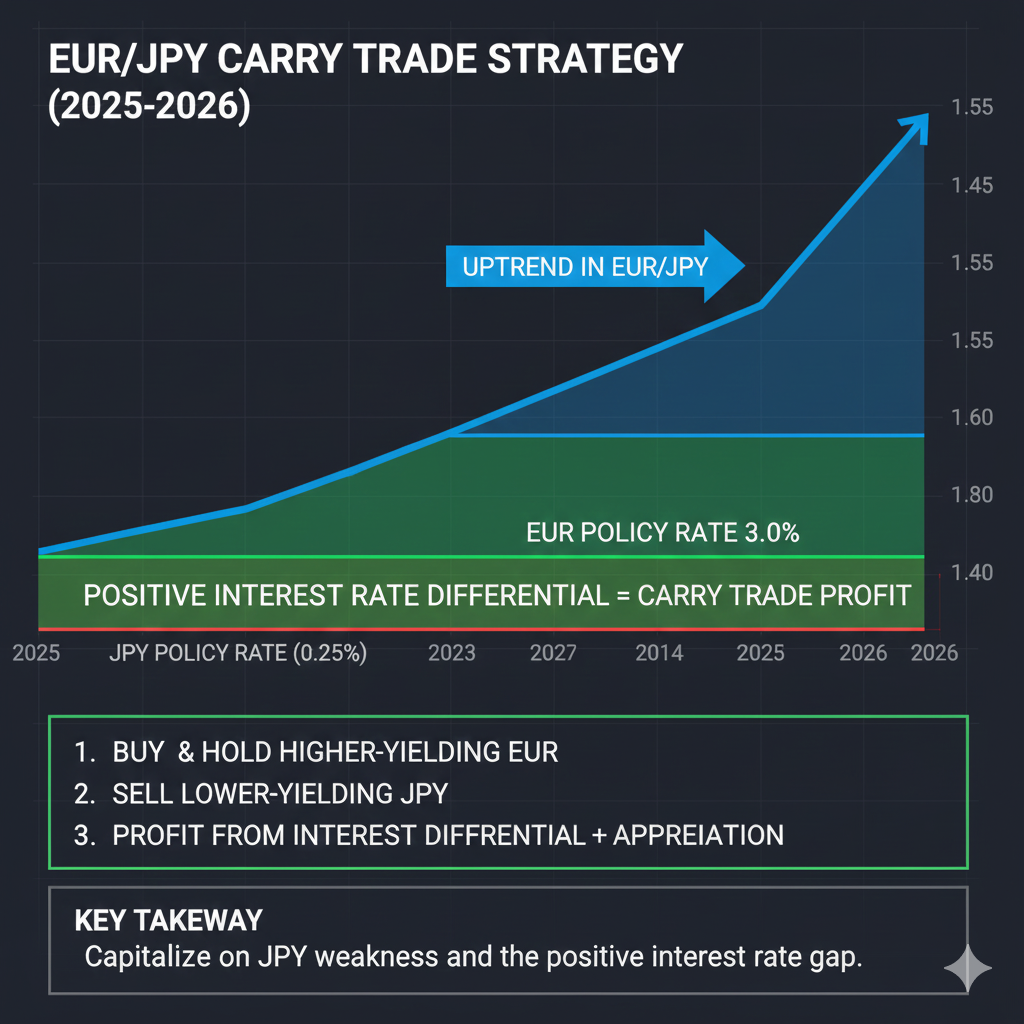

Strategy 3: EUR/JPY Long (Carry Trade)

Setup:

- Strong uptrend

- Interest differential positive (+275 bps)

- Earn interest holding long overnight

Position:

- Entry: 163.20

- Stop Loss: 161.50 (170 pips)

- Take Profit: 168.00 (480 pips)

Risk/Reward: 1:2.8 Bonus: Positive swap ~5.5% annualized

Strategy 4: Dollar Index (DXY) Short

Direct play on dollar weakness via DXY futures or CFD

Position:

- Entry: 98.20 (on rally)

- Stop Loss: 99.50 (130 pips)

- Take Profit: 95.00 (320 pips)

Advantage: Single position captures USD weakness against basket of currencies

[INTERNAL LINK: “Forex Risk Management: Position Sizing Guide”]

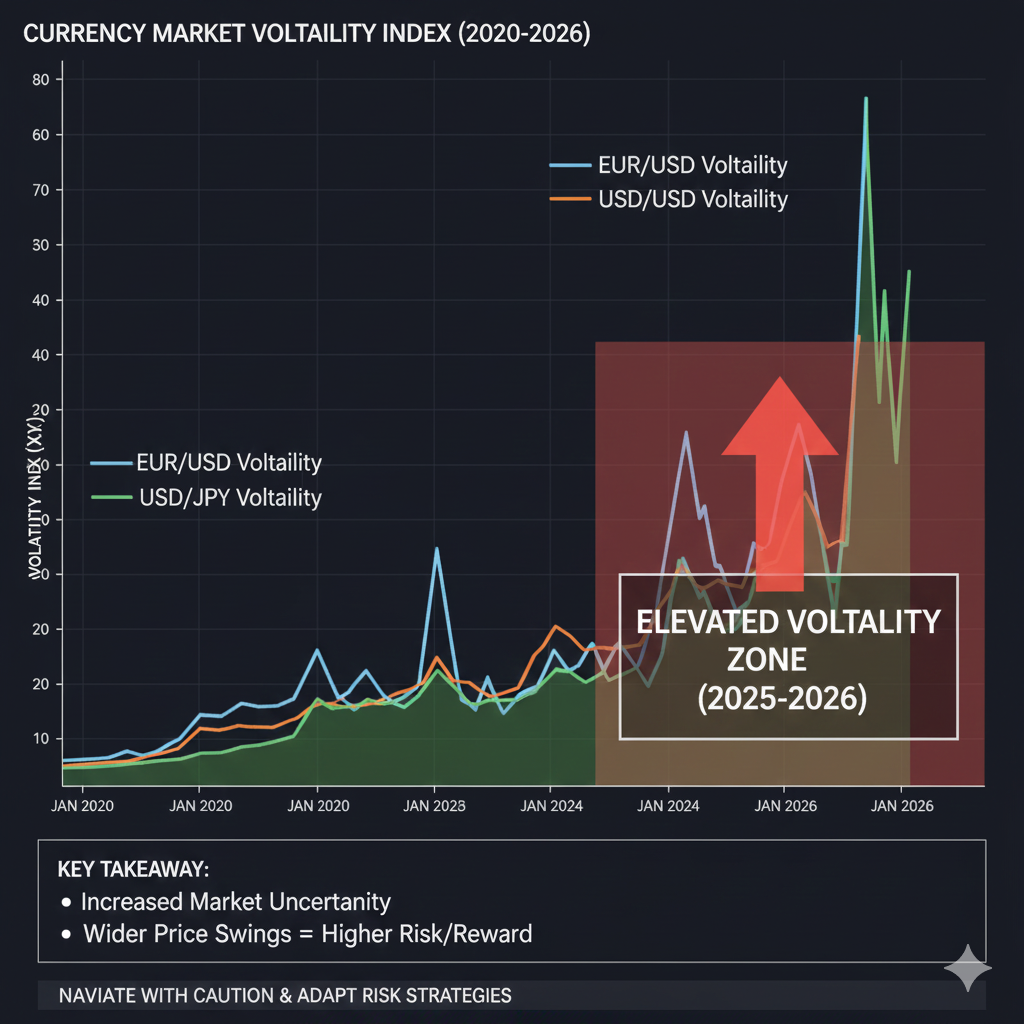

Risk Management in Volatile Markets

Understanding Currency Volatility

Average Daily Ranges (ADR) – January 2026:

- EUR/USD: 85 pips (elevated from 60-70 average)

- USD/JPY: 120 pips (significantly elevated from 80-90)

- GBP/USD: 95 pips

- EUR/JPY: 140 pips

Position Sizing Formulas

Method: Fixed Percentage Risk

Formula: Position Size = (Account Risk $) / (Stop Loss pips × Pip Value)

Example:

- Account: $10,000

- Risk: 1% = $100

- EUR/USD stop: 70 pips

- Pip value: $10/pip/lot

Position Size = $100 / (70 × $10) = 1.4 mini lots

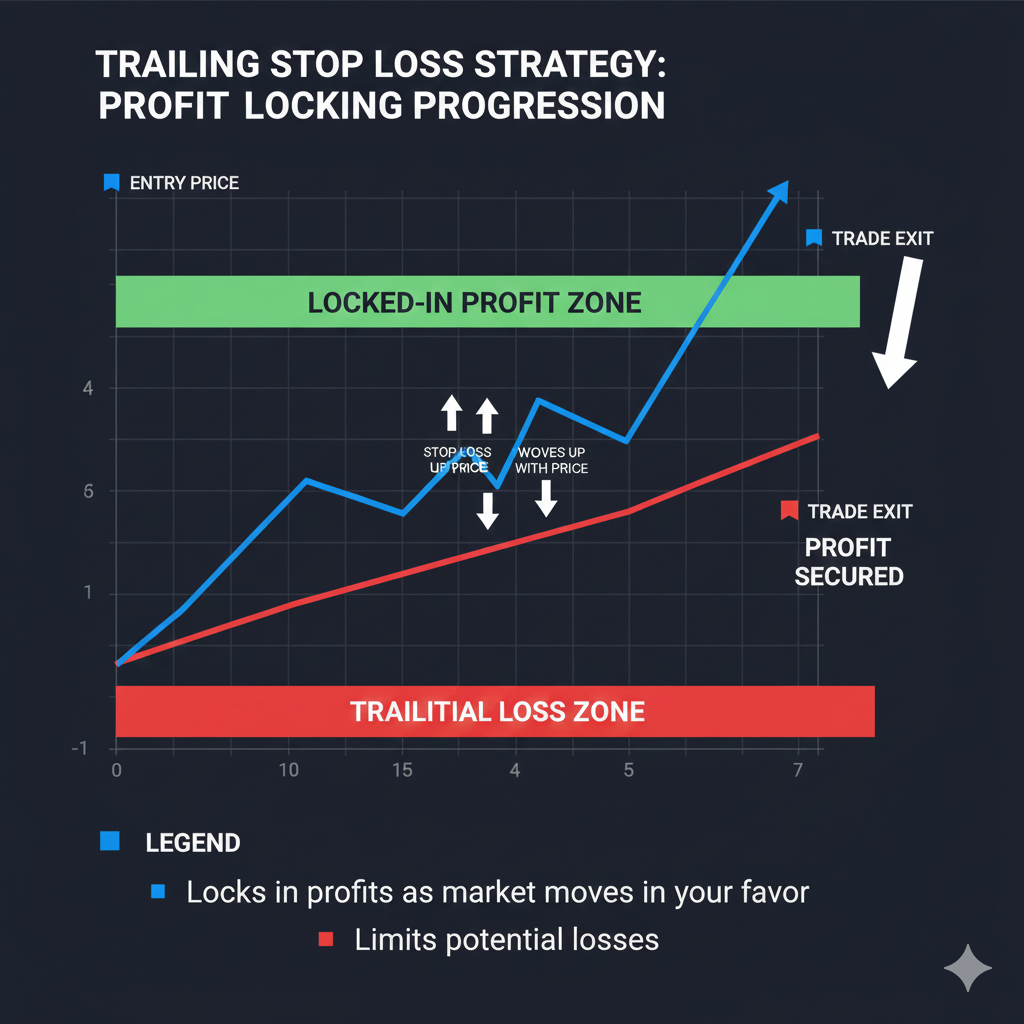

Stop Loss Strategies

Technical Stop Loss:

- Below/above key technical levels

- EUR/USD: Below 1.0950 support

ATR Stop:

- EUR/USD ATR: 85 pips

- Stop: 85 × 1.5 = 127 pips

NEVER: ❌ Trade without stop loss ❌ Move stop further away ❌ “Hope” position recovers ❌ Average down on losses

Take Profit Strategies

Partial Profit Taking:

- Close 50% at 1:1 risk/reward

- Move stop to breakeven

- Let remaining 50% run to 1:3+

Example:

- Entry: EUR/USD 1.1020

- Stop: 1.0950 (70 pips risk)

- Take 50% at 1.1090 (70 pips = 1:1)

- Move stop to breakeven

- Target remaining at 1.1160+ (140+ pips = 1:2)

Correlation Risk Management

Positive Correlations (Move together):

- EUR/USD and GBP/USD: +0.85

- AUD/USD and NZD/USD: +0.90

Risk: Long EUR/USD + Long GBP/USD = 2x USD short exposure (concentrated, not diversified)

Solution: Trade correlated pairs separately or reduce position sizes

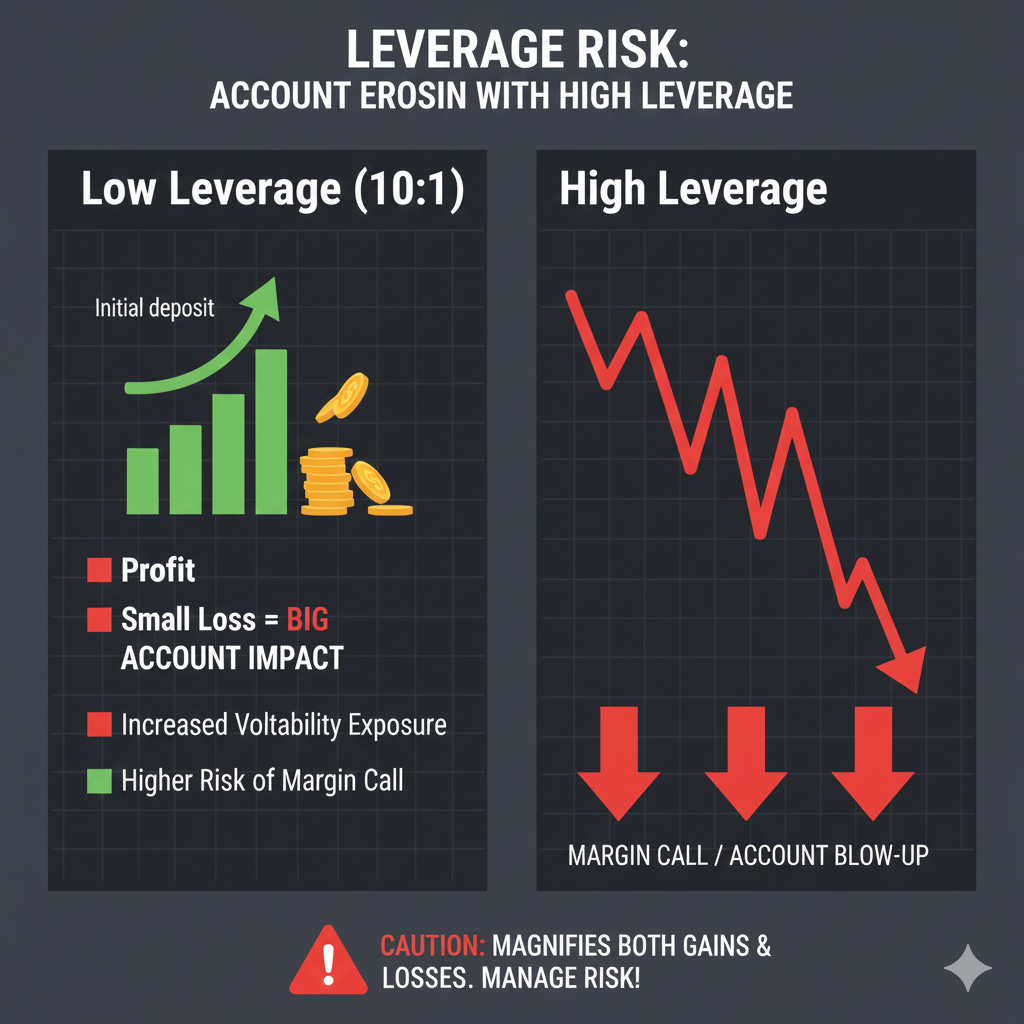

Leverage Management

Safe Usage:

- Use only 5-10% of available leverage

- $1,000 account with 1:100 leverage = $100,000 capacity

- Actually use only $5,000-$10,000 (0.05-0.10 lots)

Avoid: ❌ Using full leverage ❌ Weekend risk without protection ❌ Over-allocating to forex (max 50% of capital)

[INTERNAL LINK: “Forex Leverage Explained: Safe Usage Guide”]

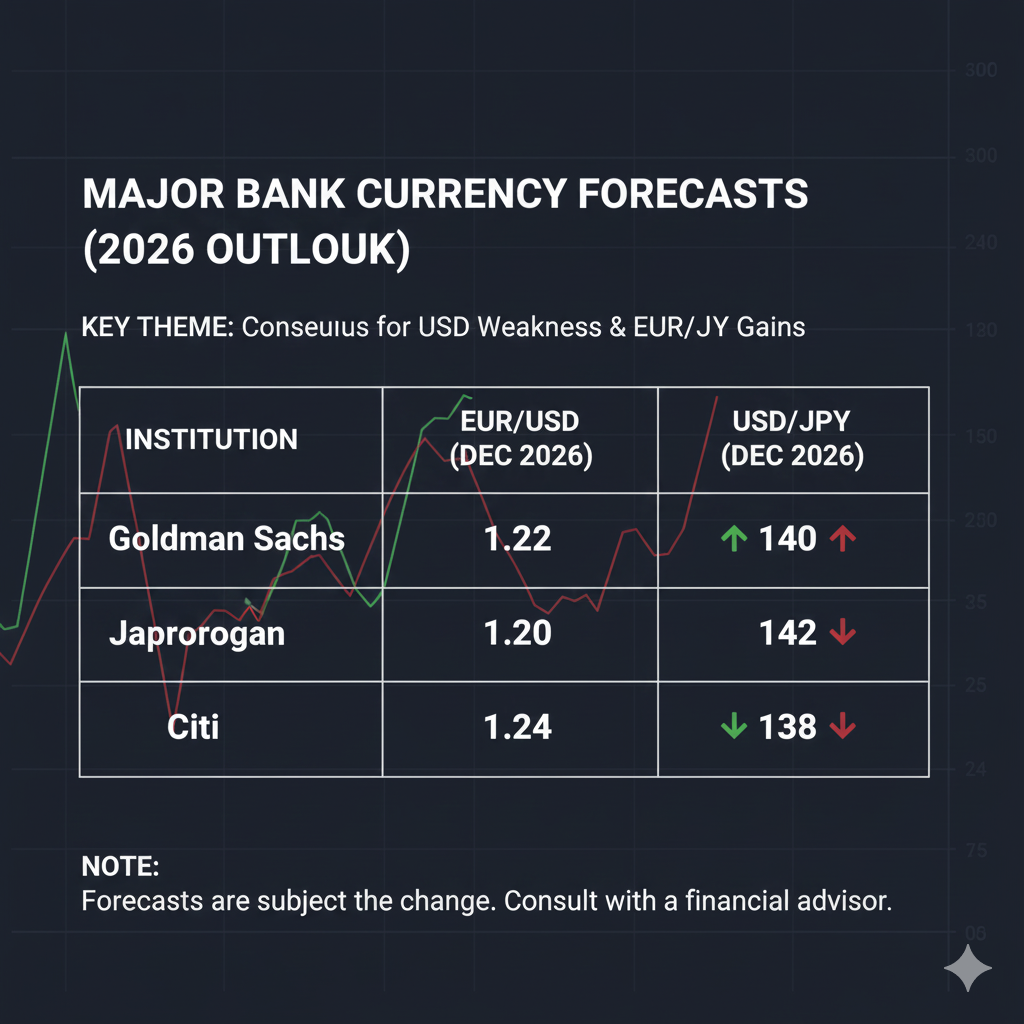

Expert Forecasts: Where Are We Heading?

EUR/USD Forecasts

Bullish (Dollar Weakness Continues):

Goldman Sachs:

- Q2 2026: 1.13

- Q4 2026: 1.15

- Rationale: Fed continues cutting, ECB holds

Morgan Stanley:

- Q2 2026: 1.12

- Q4 2026: 1.14

BNP Paribas:

- Q2 2026: 1.14

- Q4 2026: 1.17 (most bullish)

Neutral/Moderate:

JPMorgan:

- Q2 2026: 1.11

- Q4 2026: 1.12

Bearish (Dollar Rebound):

Bank of America:

- Q2 2026: 1.09

- Q4 2026: 1.07

- Rationale: Fed pause on inflation

Consensus (Median):

- Q2 2026: 1.11-1.12

- Q4 2026: 1.12-1.14

- Bias: Moderately bullish EUR/USD

USD/JPY Forecasts

Bearish (Yen Strength):

Nomura:

- Q2 2026: 143

- Q4 2026: 138

Mizuho:

- Q2 2026: 142

- Q4 2026: 140

Goldman Sachs:

- Q2 2026: 145

- Q4 2026: 142

Neutral:

JPMorgan:

- Q2 2026: 148

- Q4 2026: 147

Bullish (Dollar Rebound):

Bank of America:

- Q2 2026: 150

- Q4 2026: 153

Consensus (Median):

- Q2 2026: 145-147

- Q4 2026: 142-145

- Bias: Bearish USD/JPY (yen strength)

[INTERNAL LINK: “Currency Forecasting: How Accurate Are Expert Predictions?”]

Technical Analysis: Key Levels to Watch

EUR/USD Technical Levels

Support:

- 1.1000-1.1020 (Former resistance = support)

- 1.0900 (50-day MA)

- 1.0850 (Ascending trendline)

- 1.0750-1.0780 (200-day MA)

Resistance:

- 1.1145 (January high)

- 1.1200 (Psychological)

- 1.1275 (2023 high)

- 1.1350-1.1375 (Fibonacci 61.8%)

Key Moving Averages:

- 20-day: 1.1050

- 50-day: 1.0905 (Golden Cross present)

- 200-day: 1.0770

Indicators:

- RSI: 58 (bullish, room to run)

- MACD: Bullish crossover

- ADX: 28 (moderate trend strength)

USD/JPY Technical Levels

Support:

- 147.50-148.00 (Current)

- 145.00 (CRITICAL – flash crash low)

- 142.50

- 140.00 (Intervention risk)

Resistance:

- 150.00 (Psychological)

- 152.00-152.50

- 155.00

- 158.00 (200-day MA)

Key Moving Averages:

- 20-day: 149.20

- 50-day: 151.50 (Death Cross present)

- 200-day: 158.00

Indicators:

- RSI: 42 (bearish, approaching oversold)

- MACD: Bearish crossover

- ADX: 32 (strong trend)

Pattern: Descending triangle (bearish continuation)

[INTERNAL LINK: “Multi-Timeframe Forex Analysis: Complete Technical Guide”]

Common Trading Mistakes to Avoid

Mistake 1: Fighting the Trend

Error: “USD has fallen too much, it must bounce!”

Reality: Trends last longer than expected. 2002-2008 dollar weakness lasted 6 years.

Solution: Trade WITH the trend. Buy EUR/USD dips, sell USD/JPY rallies.

Mistake 2: Overleveraging

Error: Using maximum leverage (50:1+)

Reality: Normal volatility can blow up highly leveraged accounts.

Solution: Use maximum 5-10:1 effective leverage. Never risk more than 1-2% per trade.

Mistake 3: No Stop Loss

Error: “I’ll wait for it to come back…”

Reality: Can lead to massive losses and account blowup.

Solution: ALWAYS use stop losses. Set before entering. Never move further away.

Mistake 4: Trading News Impulsively

Error: Jumping in immediately after NFP spike.

Reality: Initial moves often reverse. Spreads widen. Slippage significant.

Solution: Wait 10-15 minutes for volatility to settle. Enter on retracement.

Mistake 5: Ignoring Correlations

Error: Long EUR/USD + Long GBP/USD + Long AUD/USD = “diversified”

Reality: All three are short USD (correlation +0.70 to +0.85). You’re 3x concentrated.

Solution: Check correlations. Reduce sizes if trading correlated pairs.

Mistake 6: Revenge Trading

Error: Lost trade → immediately enter another to “get back” losses with doubled size.

Reality: Emotional trading leads to bigger losses.

Solution: Take break after losses. Maintain consistent sizing. Accept losses as part of trading.

[INTERNAL LINK: “10 Forex Trading Mistakes Beginners Make”]

Frequently Asked Questions

Why is the US dollar weakening in 2026?

The primary driver is the Federal Reserve’s aggressive rate-cutting cycle. Since September 2024, the Fed has cut rates by 250 basis points (from 5.50% to 3.00%), reducing interest rate differentials that previously favored the dollar. Additionally, the US economy is slowing while Europe and Japan stabilize, reducing the dollar’s safe-haven appeal.

Will USD weakness continue throughout 2026?

Most analysts expect continued dollar weakness through mid-2026, with EUR/USD potentially reaching 1.12-1.15 and USD/JPY falling to 142-145. However, if the Fed pauses rate cuts due to inflation concerns, or if global risk-off events occur, the dollar could strengthen temporarily.

How can I profit from USD weakness?

The most direct strategies include: (1) Long EUR/USD on pullbacks to support, (2) Short USD/JPY on rallies to resistance, (3) Long EUR/JPY as a carry trade, or (4) Short the Dollar Index (DXY) directly. Always use proper risk management with stop losses and position sizing.

Is now a good time to buy EUR/USD?

EUR/USD has already rallied 9.8% in 12 months and broken above 1.10. While the trend remains bullish, buying at current levels (1.1080) carries risk. Better entry opportunities may arise on pullbacks to 1.1000-1.1020 support. Wait for confirmation of support holding before entering.

What could reverse USD weakness?

Key catalysts for dollar recovery include: (1) Fed pausing or reversing rate cuts due to inflation resurgence, (2) Major geopolitical crisis triggering safe-haven flows, (3) US economic growth significantly outperforming Europe/Japan, or (4) Financial market crash causing risk-off dollar buying.

Should I avoid USD pairs entirely?

No. USD weakness creates trading opportunities on both sides. You can trade USD weakness (long EUR/USD, short USD/JPY) or wait for counter-trend bounces (short EUR/USD rallies, long USD/JPY dips). The key is understanding the primary trend and trading accordingly with proper risk management.

How does BOJ policy affect USD/JPY?

The Bank of Japan’s historic shift from negative rates to hiking (currently at 0.50%) has compressed the USD-JPY interest rate differential from +560 bps to +250 bps. This makes yen carry trades less attractive and has triggered unwinding of an estimated $500B+ in carry positions, driving USD/JPY lower.

What are the key technical levels for EUR/USD?

Support: 1.1000-1.1020 (critical), 1.0900 (50-day MA), 1.0800 Resistance: 1.1145 (January high), 1.1200 (psychological), 1.1275 (2023 high) Break above 1.1145 opens path to 1.1200+. Break below 1.1000 questions bullish trend.

What are the key technical levels for USD/JPY?

Support: 148.00 (current), 145.00 (critical flash crash low), 140.00 (intervention zone) Resistance: 150.00 (psychological), 152.50, 155.00 Break below 145 likely accelerates decline to 140. Bounce above 150 questions bearish trend.

How much should I risk per trade?

Never risk more than 1-2% of your account per trade. For a $10,000 account, that’s $100-$200 maximum risk per position. Use position sizing calculators to determine appropriate lot sizes based on your stop loss distance and account size.

What’s the best platform for trading USD pairs?

Popular choices include MetaTrader 4/5 (most brokers), cTrader (superior for active trading), and TradingView (best charting). Choose based on your broker’s offerings and your trading style. All provide access to EUR/USD and USD/JPY with competitive spreads.

Should beginners trade USD pairs during this volatility?

USD pairs are experiencing elevated volatility, which increases both opportunity and risk. Beginners should: (1) Start with demo accounts, (2) Use smaller position sizes, (3) Focus on longer timeframes (4-hour, daily), (4) Master risk management before increasing exposure, and (5) Avoid trading major news events until experienced.

Conclusion: Navigating the New USD Reality

The dollar weakness cycle of 2026 represents a fundamental shift in currency markets. After years of dollar dominance driven by aggressive Fed tightening, the reversal to rate cuts—combined with BOJ normalization and ECB resilience—has created a new trading paradigm.

Key Takeaways

1. The Trend is Real:

- DXY down 8.5% from peak

- EUR/USD above 1.10 (9.8% rally)

- USD/JPY down from 162 to 148 (8.5% decline)

- Interest rate differentials have compressed dramatically

2. Duration Likely Extends:

- Historical dollar weakness cycles last 2-5 years

- Current cycle began mid-2024 (potentially 2-3 more years)

- Fed has more cutting to do (consensus: 2.75% by mid-2026)

- BOJ has more hiking to do (consensus: 1.00% by year-end)

3. Trading Opportunities Abundant:

- Long EUR/USD on dips to support

- Short USD/JPY on rallies to resistance

- EUR/JPY carry trade offers trend + yield

- Dollar Index shorts capture broad-based weakness

4. Risk Management Critical:

- Volatility elevated (widen stops accordingly)

- Never risk more than 1-2% per trade

- Use stop losses ALWAYS

- Beware correlation risk in USD pairs

5. Stay Flexible:

- Trends can reverse on single events (crisis, inflation shock)

- Fed could pause if inflation resurges

- BOJ could disappoint hawks

- Trade what you see, not what you hope

Your Action Plan

For Bulls (Dollar Weakness Continues):

- Buy EUR/USD pullbacks to 1.1000-1.1020

- Short USD/JPY rallies to 150.00

- Long EUR/JPY for carry + trend

- Risk 1% per trade, target 1:2+ reward

- Trail stops once profitable

For Bears (Waiting for Reversal):

- Wait for clear trend break signals

- EUR/USD: Break below 1.0950

- USD/JPY: Break above 152.50

- Don’t fight trend prematurely

- Smaller positions if counter-trending

For All Traders:

- Follow Fed, ECB, BOJ communications closely

- Mark key economic data on calendar (NFP, CPI, central bank meetings)

- Use demo accounts to test strategies

- Journal all trades for continuous improvement

- Never stop learning and adapting

Final Thoughts

Currency markets are among the most liquid and dynamic in the world. The USD weakness theme of 2026 offers significant opportunities—but only for those who combine sound analysis, disciplined execution, and rigorous risk management.

Whether you’re positioning for continued dollar decline or waiting for the inevitable reversal, success requires:

- Understanding the fundamental drivers

- Respecting technical levels

- Managing risk religiously

- Staying adaptable to changing conditions

The dollar’s journey from 107.35 to 97.50 is just one chapter in an ongoing story. Where we go from here depends on Fed policy, BOJ courage, Eurozone resilience, and global risk appetite.

Trade wisely. Manage risk. Stay disciplined.