Best broker for crypto trading – eToro

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

Visit Site |

eToro eToro

|

|

Yes |

Yes |

Yes |

|

eToro is a long-time pioneer of cryptocurrency trading and one of the first global forex brokers that offered bitcoin trading in the early years before it became an established asset class.

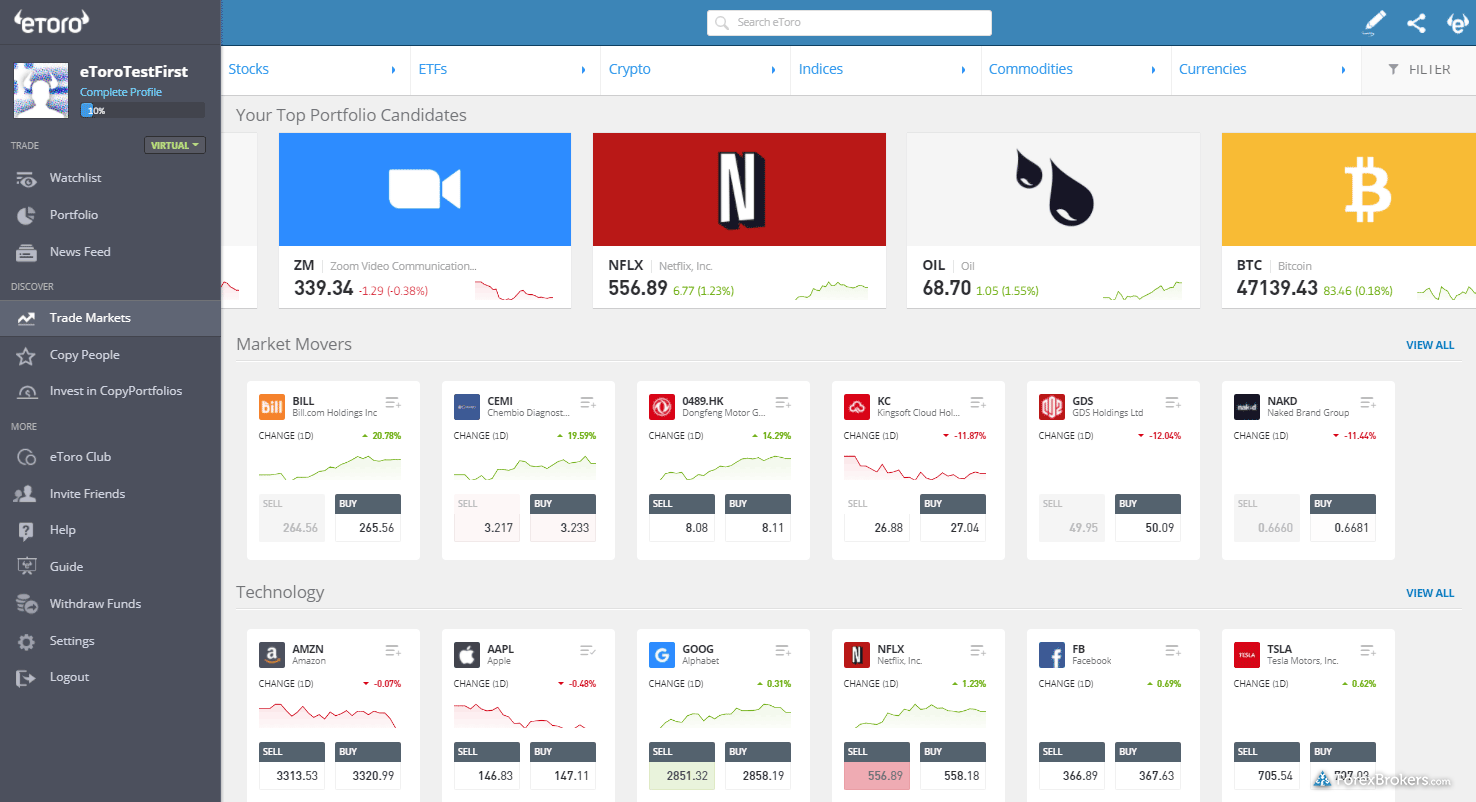

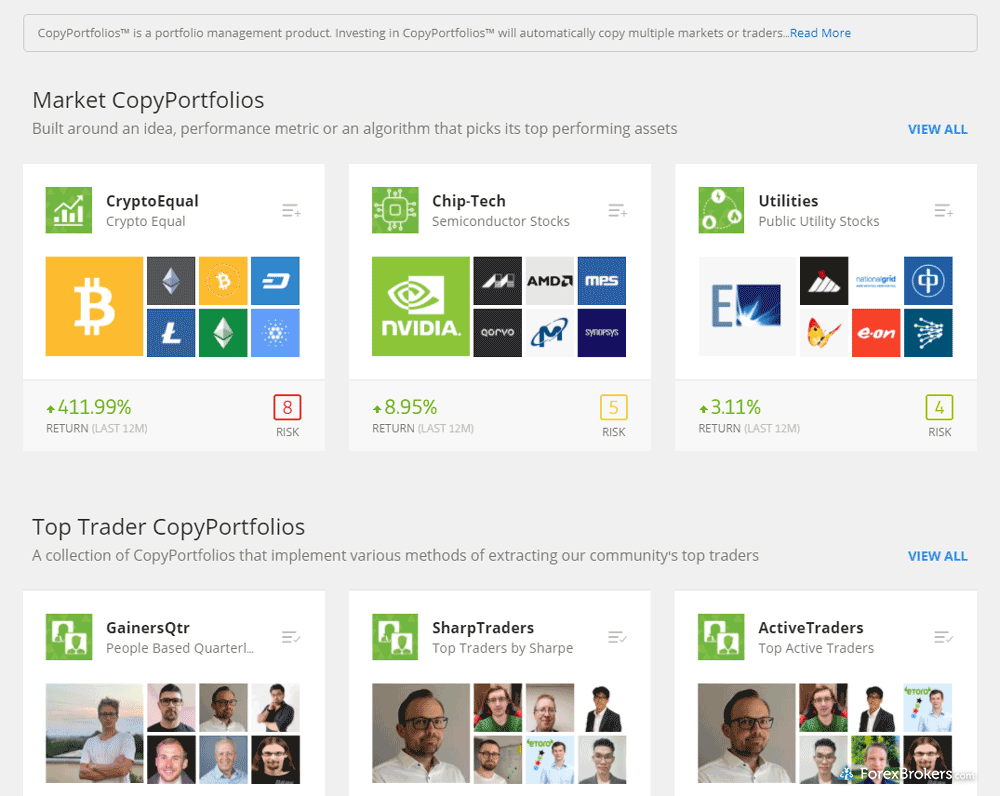

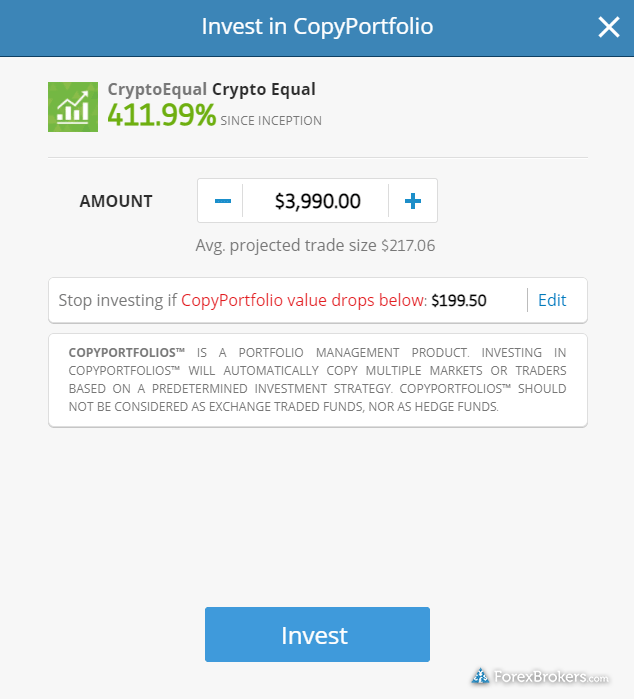

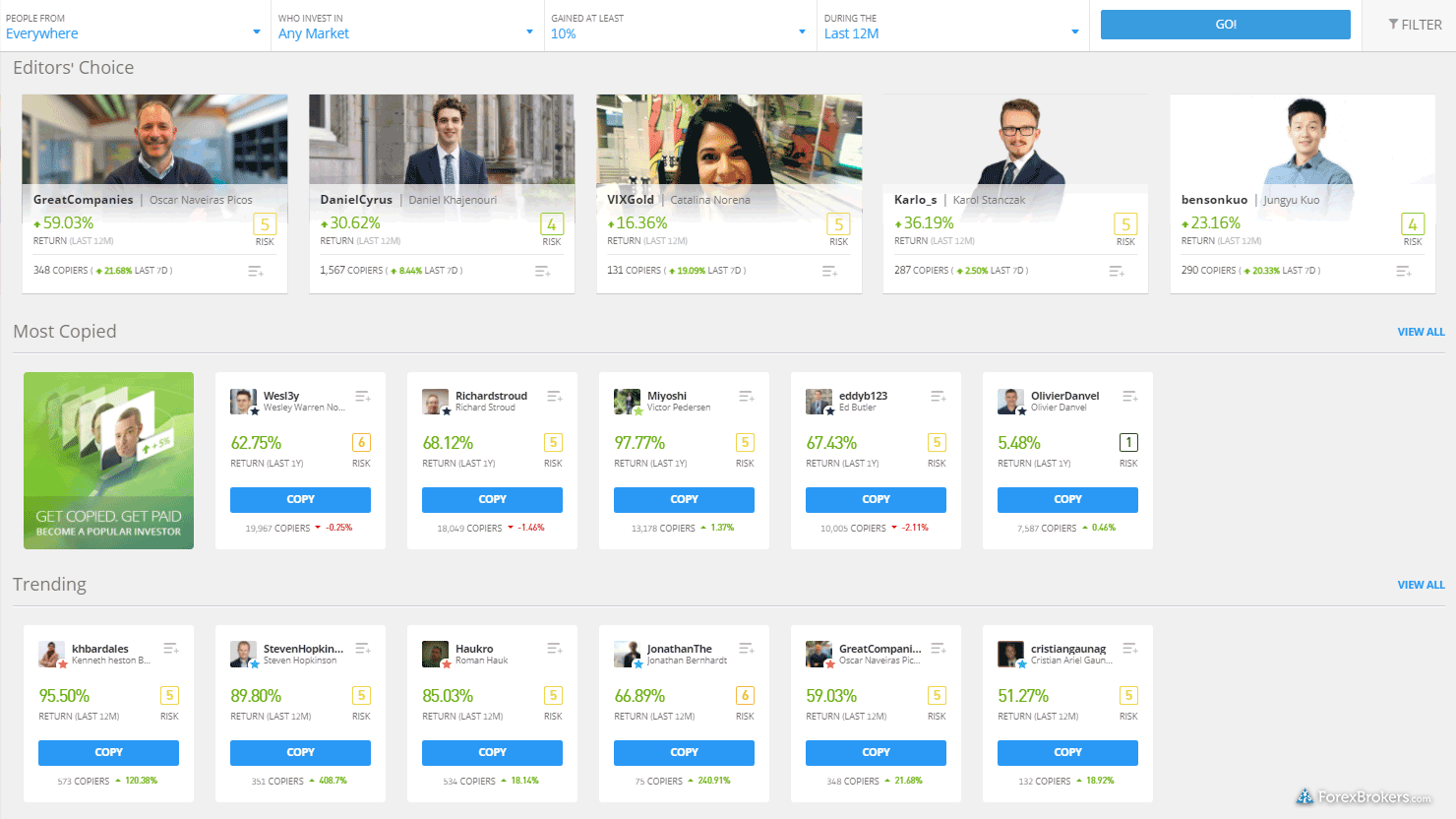

Innovations: eToro has developed many new innovations as part of its crypto offering, including the ability to easily switch between crypto CFDs and underlying (physical) crypto assets straight from within the trade ticket window when creating an order.

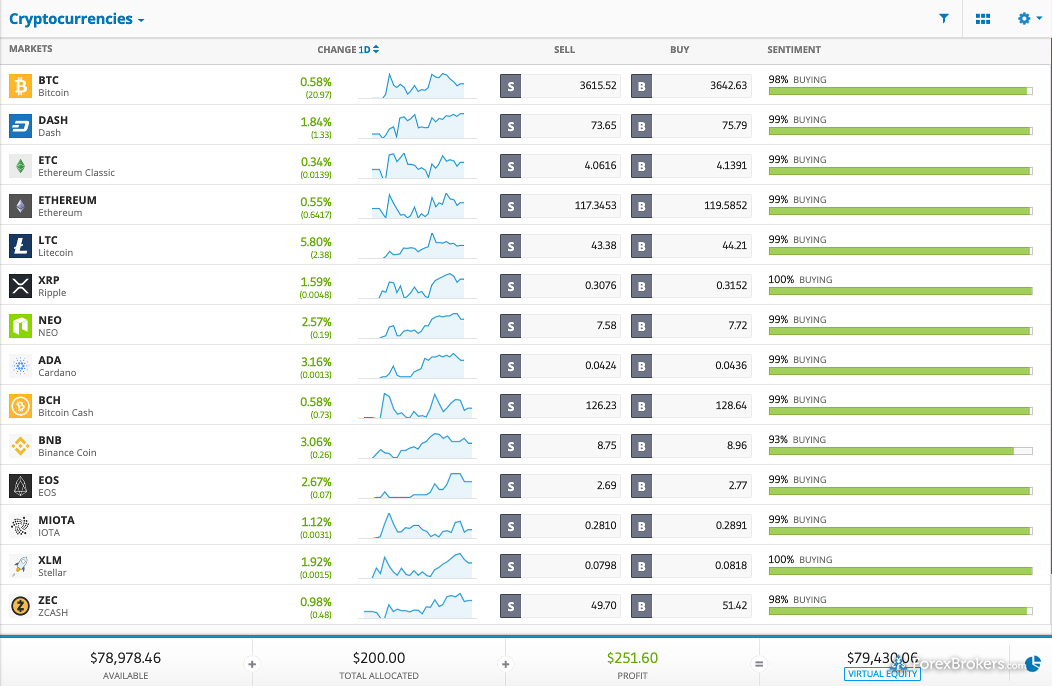

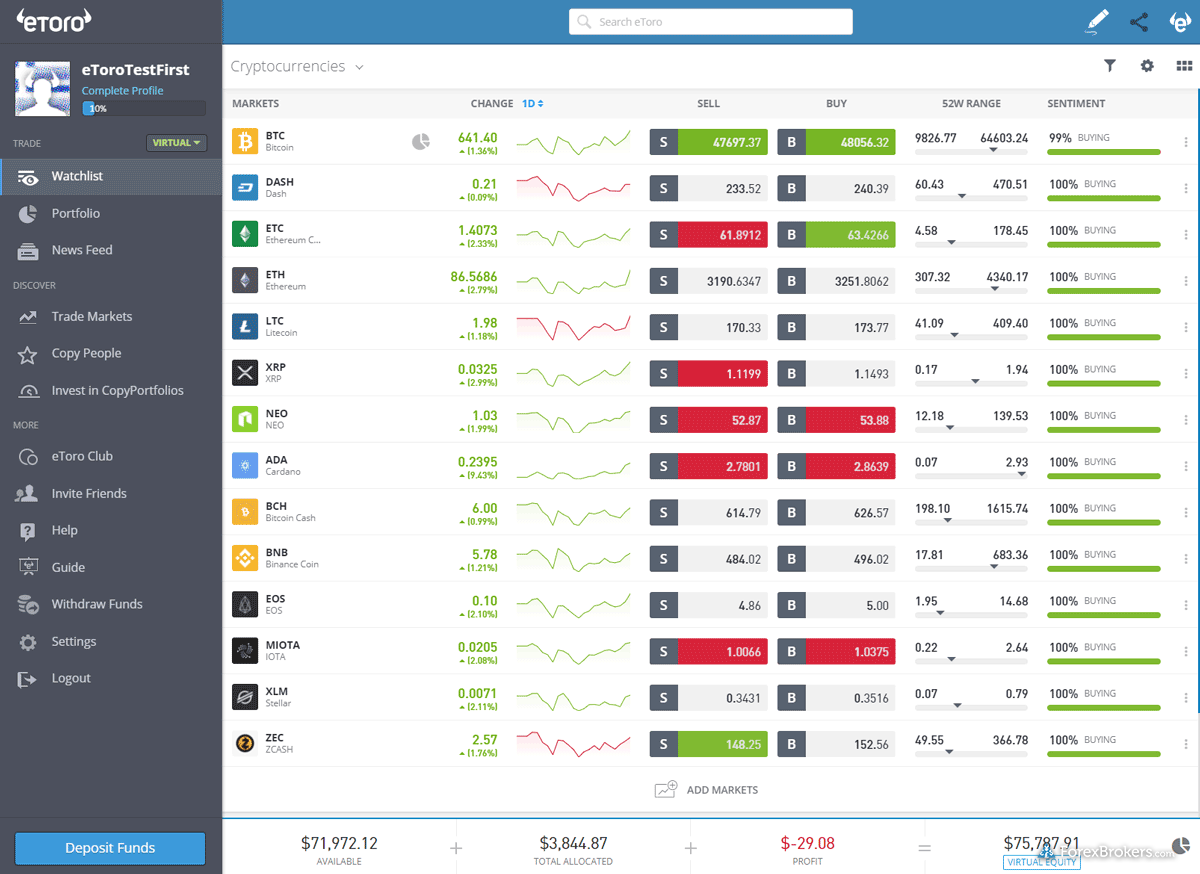

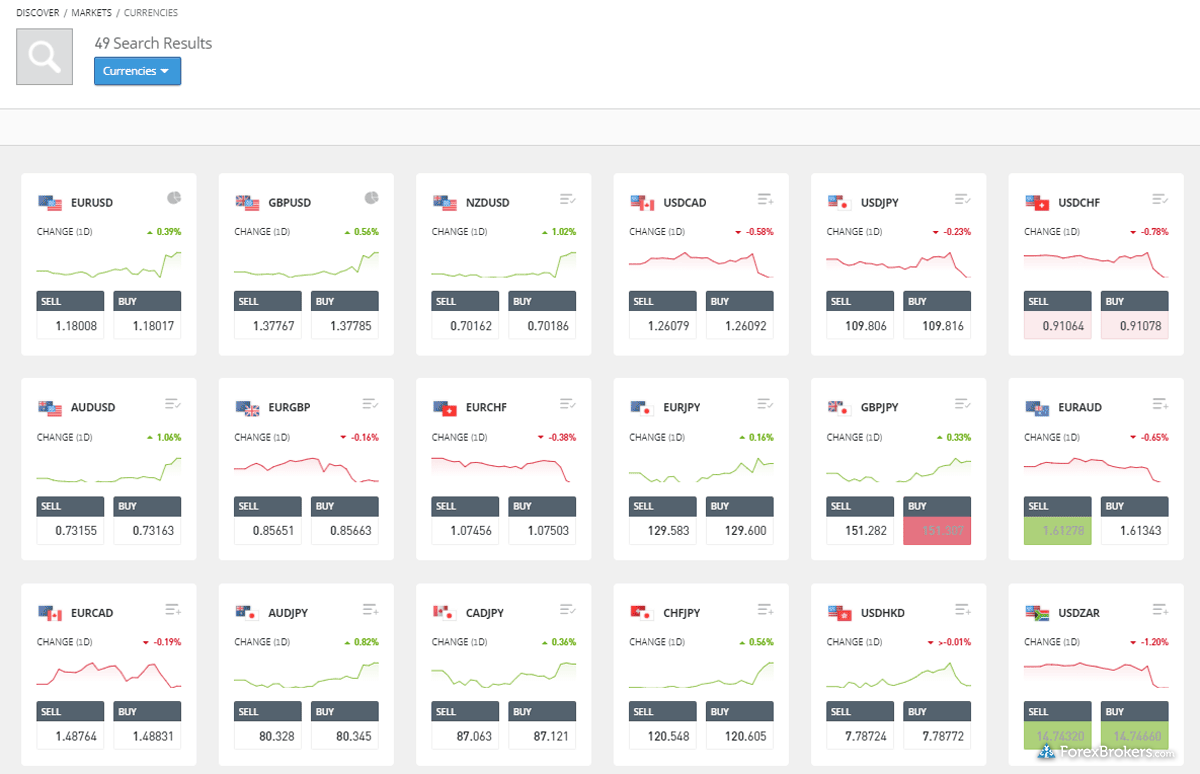

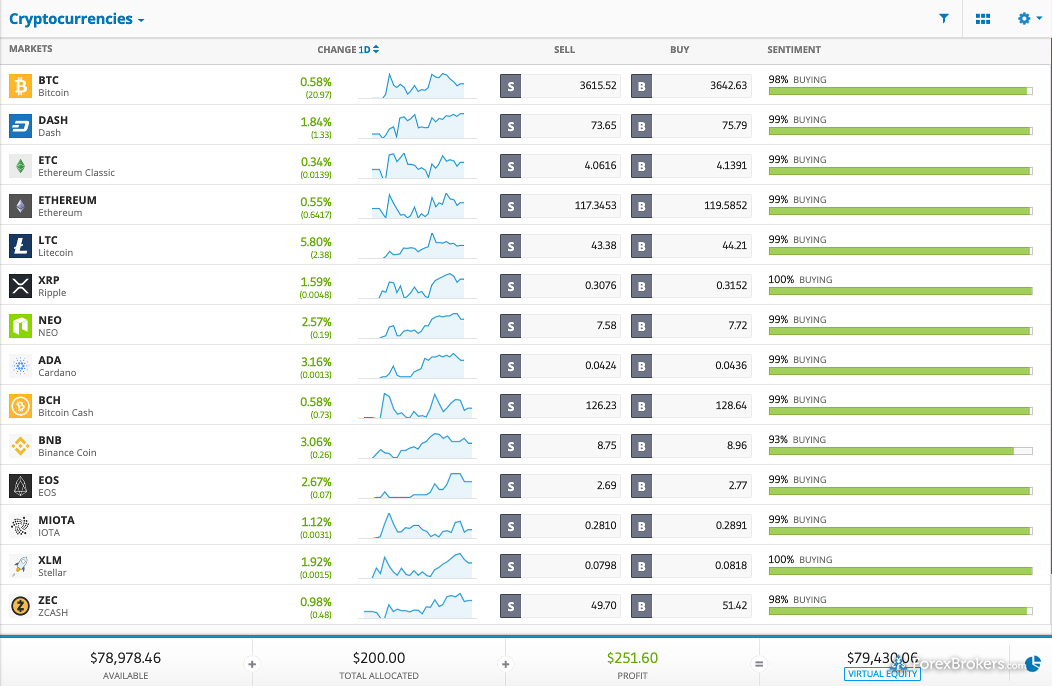

Selection of cryptocurrencies: eToro offers a wide range of 111 cryptocurrencies, including popular crypto tokens. Traders can compare daily movers, cryptos by market cap, crypto portfolios to copy, as well as crypto-focused investors. Directional signals from COINFI are also directly integrated within the platform, along with client sentiment.

Trading costs: It’s worth noting that eToro is not a discount broker – it charges about 1% for buying or selling underlying crypto assets, in addition to prevailing spreads. There may be brokers out there that offer lower fees, but you won’t get the same research or trading tools that you’ll find at eToro. There is also a 2% fee (minimum $1) or maximum fee of $100 for transferring crypto out into the eToro Money crypto wallet.

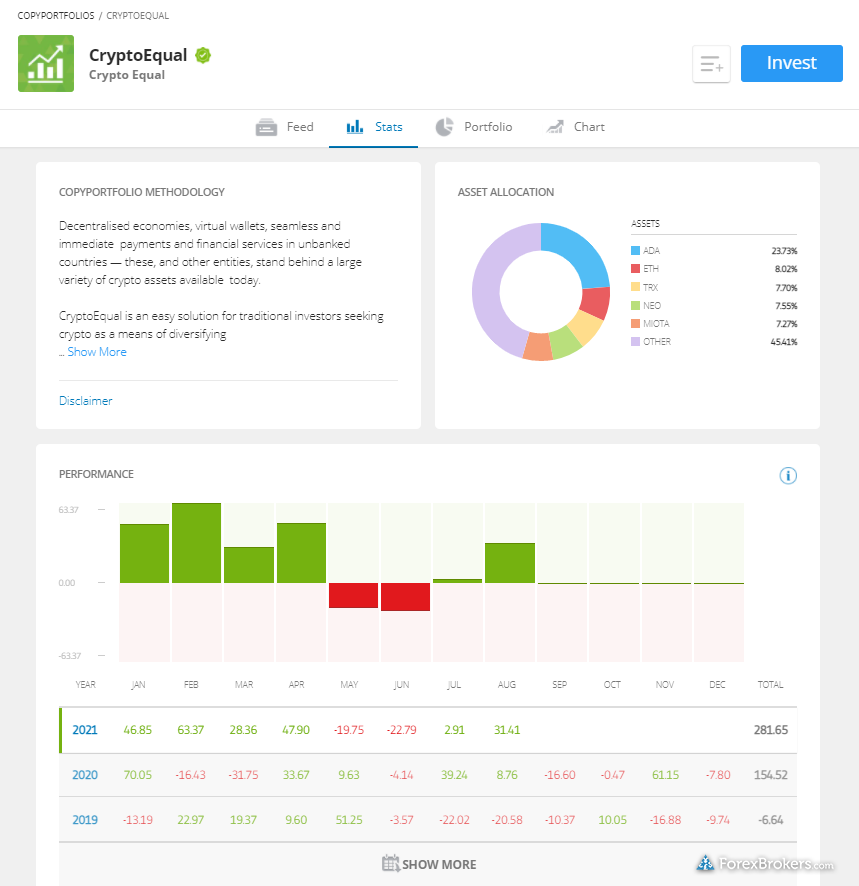

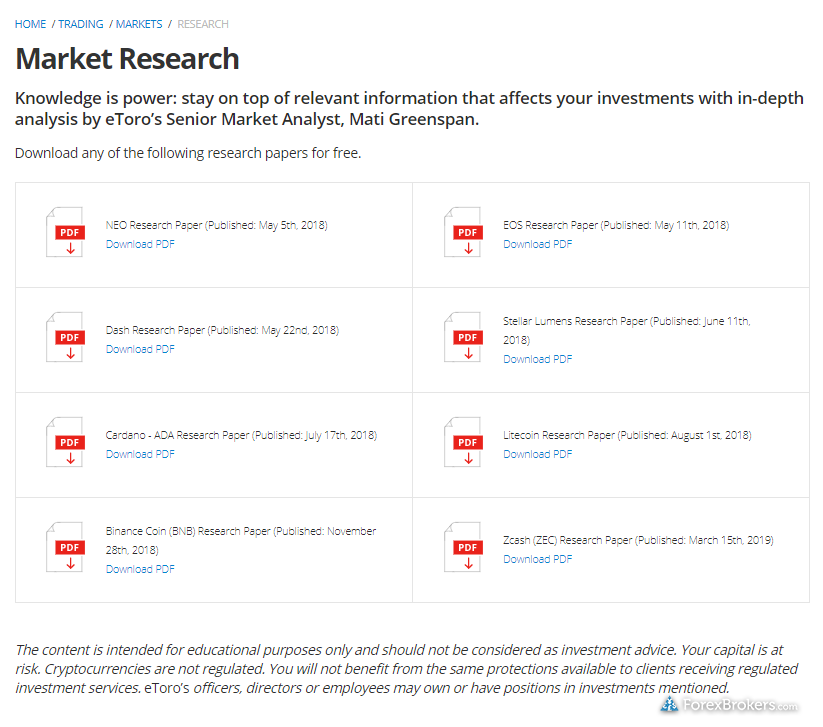

Integrated copy trading and research: Additional standout features that make eToro my top choice for bitcoin and crypto trading across forex brokers include the integrated news and research articles within the “Latest News” section for each crypto asset, as well as the ability to copy trade crypto investors and crypto portfolios.

NFTs: In addition to cryptocurrencies, eToro has an app called Delta, dedicated to Non-Fungible Tokens (NFTs). This app lets you connect a Web3 wallet and explore NFTs across compatible blockchain networks. As an owner and creator of NFTs, I’m glad to see features like this coming to established brokerages such as eToro, helping to solidify its position as a market leader for cryptocurrency.

Trusted Swiss crypto custodian – Swissquote

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

Visit Site |

Swissquote Swissquote

|

|

Yes |

Yes |

No |

|

Swissquote is another early pioneer in the world of crypto trading and was one of the first global banks to offer the underlying bitcoin asset. It was also one of the first to launching exchange-traded products (ETPs) dedicated to crypto. It’s worth noting that traders don’t choose Swissquote for its low fees, but rather for the security of holding their crypto with a Swiss Bank.

Variety of crypto assets: Swissquote offers nearly 40 crypto assets, with underlying assets available via its in-house crypto exchange SQX, which includes digital asset custody via its Swissquote Wallet. The only downside here is that these are separate from its forex and CFD trading account. Multi-asset traders looking to trade crypto will have to open a separate crypto account and then switch between them from within the broker’s web platform.

Range of crypto instruments: Swissquote also offers bitcoin and ethereum futures contracts via the CME and EUREX. Other exchange-traded crypto products at Swissquote include crypto tracker certificates, mini futures via Swiss DOTS, crypto ETFs, and crypto ETPs.

Crypto Staking: Swissquote is one of the few forex broker banks that offers crypto staking, which allows you to lock your crypto assets for a period of time in return for interest that can be payable in native tokens. Staking is currently available across Ethereum (ETH), Solana (SOL), Polkadot (DOT) and Tezos (XTZ). Staking fees come to 20%, which is steep, but setting up manual staking would require self-custodial crypto wallets and quite a bit of technical expertise.

Extensive selection of crypto CFDs – Capital.com

| Company |

Overall Rating |

Bitcoin |

Bitcoin (Deposit/Withdraw) |

Cryptocurrency (Derivative) |

Visit Site |

Capital.com Capital.com

|

|

Yes |

No |

Yes |

|

Capital.com provides one of the largest selection of cryptocurrency CFDs, making it a top choice in 2024 for your bitcoin trading needs.

Crypto CFDs exclusively: Capital.com doesn’t offer underlying (physical) crypto assets for long-term holding. That said, if you want to trade crypto CFDs over the short term, including bitcoin, Capital.com provides both the ability to go long and short on crypto CFDs. These products are offered alongside its forex and CFD business, helping to round out Capital.com’s offering as a multi-asset broker (On a related note: Share trading was recently discontinued at Capital.com).

Wide selection of crypto CFDs: Capital.com offers a whopping 136 cryptocurrency CFD pairs, making it a great choice for trading bitcoin and beyond. Whether you want to focus on popular crypto assets, or more exotic tokens, you’ll likely find them at Capital.com

Low trading costs for crypto: Capital.com offers excellent pricing for crypto CFD trading, with spreads of roughly $100 when you trade bitcoin versus the USD (BTC/USD), which is a fairly low sample spread. (Note: This is not an average or minimum spread). Considering that one bitcoin at the time of writing is worth over $57,000, this equates to less than 0.0017% of the trade value. In addition, you can buy as little as 0.0005 BTC or roughly $285 worth of bitcoin at a time.

FAQs

What is bitcoin?

Bitcoin is a form of public internet money or electronic cash, known as cryptocurrency. It was launched in January 2009 after its design was published in a white paper. Bitcoin's supply is limited, and every bitcoin comes into existence through mining, where anyone from the public can verify transactions to help secure the network.

Bitcoin behaves very much like a commodity, due to its limited supply and because of the intense mining process. Bitcoin mining is akin to mining for gold, at least in the sense that it requires great effort and cost. However, bitcoin is far more efficient than gold in many ways, thanks to its use of blockchain technology, which means that all transactions are public and anyone can join the network.

Furthermore, bitcoin is highly resistant to any form of censorship, and forged transactions are impossible, thanks to the cryptographic primitives used in the bitcoin blockchain (and in bitcoin wallets).

How do you buy bitcoin?

There are three primary ways to buy and sell cryptocurrencies like bitcoin:

- Buy bitcoin (the underlying asset) - The most common way to buy bitcoin is to buy physical bitcoin from an online bitcoin exchange such as

eToro. Your bitcoin is then held and secured in a digital wallet provided by the broker (or you can withdraw it to the wallet of your choice).

- Buy a bitcoin CFD (contract for difference) - Another popular way to trade bitcoin is through CFDs. With a CFD, you do not own the underlying bitcoin. Instead, you are betting on the direction that bitcoin's price will go — either up or down. With CFDs, you can short bitcoin if you expect the price to go down. However, holding longer term can be expensive due to the cost of carrying CFDs overnight – you can learn more about how CFDs work by checking out our full-length guide to CFDs.

- Buy an exchange-traded product (ETP) - Exchange-traded products are a class of securities that can be anything from a structured product or fund to a derivative contract or trust. Bitcoin ETPs include exchange traded funds (ETFs), exchange traded notes (ETNs) and other securities such as the Greyscale Trust (GBTC) that aim to track the price of bitcoin.

currency_exchangeMore about Bitcoin ETFs

Curious about spot Bitcoin ETFs following their approval by the SEC? Check out my guide to the Best Bitcoin ETF Brokers to learn more about this exchange-traded product.

How much does it cost to trade bitcoin?

Fees for buying bitcoin can become quite high across many of the websites and unregulated exchanges that are out there, which is why we suggest only using a regulated broker. While the fees themselves may vary when buying bitcoin, the costs will consist of any per-trade commission, along with the difference between the bid/ask price — also known as the spread.

The fees to trade bitcoin generally start at anywhere from 0.002% to as much as 2% (and sometimes even more) of the trade value, depending on where you trade and the trade size.

Brokers that charge a commission will usually have lower spreads, while commission-free brokers will have higher spreads to make up for the difference. For example, if you buy $25,000 worth of a bitcoin CFD that has a spread of $50, that would be the commission equivalent of 0.002% of the trade value.

In other words, whether they come via spread or commission, bitcoin involves trading costs. Sometimes the fees also vary depending on whether you place a market order (to fill at the current or next available price) or if you use a limit order (to fill at a specific price or better), the latter of which can sometimes be cheaper at exchanges such as Coinbase.

What does a bitcoin broker do?

Bitcoin brokers enable you to buy or sell cryptocurrency. Without a broker, you cannot safely trade cryptocurrencies like bitcoin. To avoid scams, using a trusted broker is crucial when you are trading bitcoin.

reportWatch out for crypto scams

Crypto traders are now targeted by sophisticated scams and cryptocurrency thieves. Learn about how to protect yourself by reading our guide to avoiding crypto scams.

What is the best forex broker to trade bitcoin?

Traders who wish to purchase the underlying physical bitcoin will find that eToro is a great option, followed by

Swissquote Bank and

Interactive Brokers. For bitcoin CFD trading, which includes the ability to go long or short on bitcoin, we recommend forex brokers such as

Eightcap,

Capital.com,

Saxo and

AvaTrade due to their range of crypto assets (as long as you are located outside of the U.K.). We’ve conducted extensive research to determine the best brokers for trading CFDs – you can check out our CFD guide to see our top picks for the Best CFD Brokers and Trading Platforms.

Crypto CFDs cannot be traded in the U.K. by U.K. residents due to regulatory restrictions (unless you are designated a Professional Client). Click here to learn more.

Which forex broker offers the most cryptocurrencies to trade?

Our research found that

eToro offers the most cryptocurrency pairs to trade. With eToro, investors can buy and sell bitcoin (as the underlying asset), trade crypto CFDs, and even copy trade other investors. After eToro, other crypto brokers that offer dozens of cryptocurrency CFDs to choose from include

XTB and

HYCM

.

What is a crypto exchange?

A crypto exchange is a brokerage that holds your funds as a custodian and grants you the ability to buy or sell crypto assets from within its trading platform(s). Crypto exchanges may match your orders with orders of other customers on their order book, or they may act as a market-maker by filling the opposite side of your market-order trade. Or, they might do both. Non-custodial exchanges use smart contracts, meaning their order book is entirely math-driven, but it’s worth noting that slippage can be extreme for larger transactions and volume can be limited.

reportWatch out for crypto scams

Regardless of the type of crypto exchange you are looking for, it’s crucial that you choose a well-regulated exchange to reduce your chances of falling victim to a crypto scam.

What’s the difference between a crypto exchange and a crypto broker?

The term “crypto broker” is virtually synonymous with the term “crypto exchange” – all crypto exchanges provide crypto broker services, in that they’ll let you buy and sell currency via their online trading platform. That said, a crypto broker can, in some cases, refer to a dedicated individual – such as an institutional trader – working on a trading desk. While the individual on the trading desk is helping to “broker” each trade, it’s important to note that they will almost always utilize underlying crypto exchanges to execute their trades.

What is the best crypto exchange for U.S. citizens?

Coinbase is my top pick for the best crypto exchange for U.S. citizens. I’ve been investing in crypto markets since 2017 and I’ve opened dozens of crypto brokerage accounts. In that time, Coinbase has emerged as my exchange of choice. Founded in 2012, Coinbase is one of the largest regulated cryptocurrency companies in the world. It is well-regulated and highly trusted as a custodian and brokerage for crypto investors. Since I first started using Coinbase in 2017, it has significantly expanded its number of tradeable crypto assets and expanded the range of tools and features on its platforms.

Coinbase caters equally well to retail, professional, and institutional clients. Whether you want to day trade crypto using the Coinbase Pro platform, or buy and hold crypto as a passive, long-term investor under their retail offering, Coinbase delivers an excellent user experience and reasonable fees.

Worth noting: With over 108 million customers (as of their latest transparency report for 2022) and just over 3,400 staff, getting fast customer service at Coinbase can be a challenge. You might have to fill out forms, check FAQs, and exercise some patience.

Trust factor: Coinbase is publicly traded (NASDAQ: COIN), registered with FinCEN, and licensed by 45 U.S. States as a Money Service Business (MSB). Coinbase’s LMX Labs LLC entity is regulated by the Commodity Futures Trading Commission (CFTC) as a designated contract market.

What are the safest crypto exchanges?

I’ve opened dozens of accounts with crypto exchanges and placed thousands of crypto trades over the last seven years. I’ve even written a guide on the most common forms of crypto scams. Here are my top picks for the safest, most reliable crypto exchanges:

1. Coinbase

With over 100 million clients across 100 countries and $128 billion in assets, Coinbase is a highly regulated market leader in cryptocurrency services. It is also publicly traded (NASDAQ: COIN) and regulated by the Commodity Futures Trading Commission (CFTC) in the U.S.

2. Gemini

Regulated in the U.K., Italy, Ireland, Greece, and 38 U.S. states, Gemini is a fiduciary and qualified custodian that operates in 71 countries. Gemini is also regulated as a Trust in New York and has over $5 billion in assets under custody.

3. Bitstamp

Headquartered in Luxembourg, Bitstamp is highly regulated and holds over 50 licenses. With over 5 million customers, Bitstamp has over 5 million customers and processes over 100 million transactions each year. 30% of the company’s staff are compliance-focused, and Bitstamp has been audited by a “Big Four” accounting firm each year since 2016.

Which crypto broker has the lowest fees?

While Coinbase and Binance both offer entry-level pricing, Binance is cheaper with just 0.1% for the maker fee (when you place a limit order) or taker fee (when you place a market order), compared to Coinbase which charges 0.5% for both maker and taker fees on its base level (lowest) pricing tier. Binance and Coinbase are the largest cryptocurrency exchanges globally.

In terms of fees for active traders, Coinbase only outranks Binance when you compare the highest tiers offered by each broker. For example, for traders that surpass $1 billion dollars in volume — or 150,000 BTC — Coinbase is cheaper, offering a 0% maker fee and 0.04% taker fee. The 0% maker fee kicks in when you surpass $300 million on Coinbase, whereas on Binance you are charged a maker fee no matter how much volume you trade.

How much is one bitcoin worth?

Powered by blockchain technology, the price of one bitcoin reached a new all-time high of almost $70,000 in November 2021. The price gains were mostly attributed to new institutional investors entering the market and buying bitcoin.

I first wrote about cryptocurrencies in 2013 when bitcoin was still a novelty. Yet, as I'm writing this, the combined market cap of cryptocurrencies is over $2 trillion, with bitcoin accounting for nearly half. According to data from Coinmarketcap, the price of bitcoin can fluctuate widely across various trading venues, although in recent years the cryptocurrency markets have become more efficient — despite the high volatility.

Is buying bitcoin risky?

Despite the potential for large gains, buying bitcoin remains risky. The main risk is significant volatility (price swings). If you buy bitcoin and then the price plummets, you can sustain substantial losses. Adding any leverage (trading with borrowed money) will only further increase your risk when buying bitcoin.

Also, bitcoin remains a complex financial product. Many investors have lost money simply by losing their private keys, whether through exchange hacks or because they did not secure them properly in self-hosted wallets. Using a regulated, reputable broker is essential for safely trading bitcoin.

keyCommon crypto scams

Learn more about how to protect your private crypto keys – and how to spot crypto scams – by checking out my guide to common crypto scams.

How do I know if a crypto broker or crypto exchange is regulated?

To avoid scams, you should only use regulated bitcoin brokers. To verify a broker's regulatory status, start by determining the broker's legal name and country, and then find the appropriate regulator website to look them up. For example, a broker in the U.K. must be authorized and regulated by the Financial Conduct Authority (FCA). Here at ForexBrokers.com, we track, rate, and rank brokers across 100+

international regulators.

How do you sell bitcoin short?

To speculate that bitcoin's price will fall, you must open a forex brokerage account with a broker that offers bitcoin CFDs, or contracts for difference. Using a CFD, you can open a sell order (bet the price will go down) and then place your trade. To make a profit, the price of bitcoin must fall. If bitcoin rises in price, you will lose money.

If CFDs are not available, using a futures or options contract can be an alternative way to bet against bitcoin. However, bitcoin futures and options are very complex instruments, not widely available, and should only be traded by professionals.

Should I buy physical bitcoin or use CFDs to trade bitcoin?

If you are a long-term cryptocurrency investor, buying the underlying physical bitcoin is the safest and lowest-cost way to invest in bitcoin. For more active, short-term trading, Contracts for Difference (CFDs) might be your best option. Just remember: CFDs are not ideal for holding long-term positions (months or years), as the financing charges will add up over time.

Is trading cryptocurrency legal?

In some jurisdictions, cryptocurrency is banned or illegal to purchase, trade, or own. Meanwhile, in other countries, it is perfectly legal. For example, in the United States (U.S.) and the United Kingdom (U.K.), it is legal to buy cryptocurrency from regulated brokers. However, CFDs are illegal to trade in both countries. The U.K. ban on bitcoin CFDs went into effect on Jan. 6, 2021.

United States residents: If you live in the U.S. we recommend reading our best U.S. brokers for bitcoin trading guide on our sister site, StockBrokers.com

How do you safely store bitcoin?

If you do not want to keep your bitcoin with your online broker, you'll need to store it safely. To secure your bitcoin, you must choose a hot (online) or cold self-hosted (offline) wallet. Note: safeguarding cryptocurrencies in your own self-custody wallet comes with its own risks and responsibilities. Just like having cash in your pocket, it must be secured properly.

Personally, for a hot wallet (online, internet-connected), I use Blockchain.com, which provides a mobile and web-based version. For cold storage, I use Ledger, a hardware device that allows you to keep the bitcoin private key offline. When you keep your private key offline, you'll need to create a written backup recovery phrase — a critical step to safeguard your bitcoin in the event that you lose your hardware device.

Now that you've seen our picks for the top forex brokers for bitcoin and cryptocurrencies, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

Interactive Brokers

Interactive Brokers

Eightcap

Eightcap

XTB

XTB

Saxo

Saxo

IG

IG

CMC Markets

CMC Markets

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

AvaTrade

AvaTrade

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

Questrade

Questrade

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex

RoboForex

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX