FAQs

Is MetaTrader 4 a broker?

No. MetaTrader 4 (MT4) is a third-party trading platform that connects to a broker for forex trading. MetaTrader 4 is the most popular third-party platform for trading forex.

You'll need to open a live trading account with a supporting broker if you want to place real trades within the MT4 platform. If you select a broker's server name from the dropdown menu when logging in (this applies to the version of the software downloaded directly from the developer), you can open an account with the broker of your choice and access live rates within MT4.

A forex broker simply needs a proper license from the developer in order to offer MT4 to you as a customer. However, some forex brokers that offer MT4 may lack proper regulation in the countries in which they operate, thus it is important to only choose trustworthy MT4 brokers. See how we evaluate brokers' trustworthiness.

alt_routeMetaTrader Alternatives:

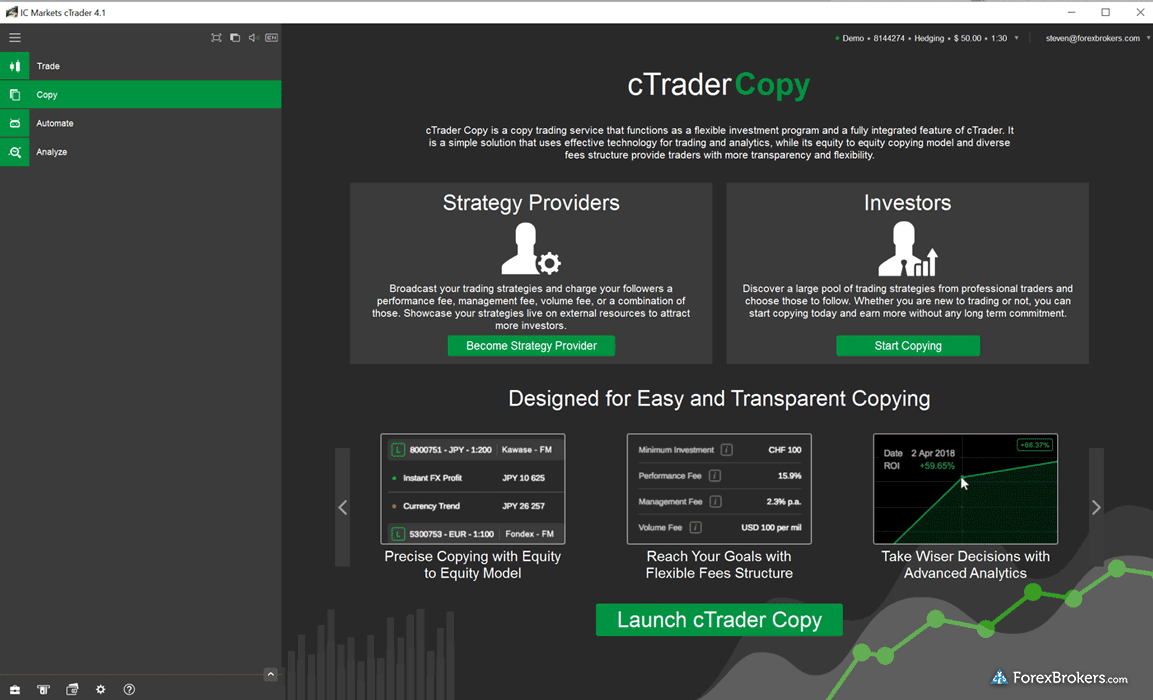

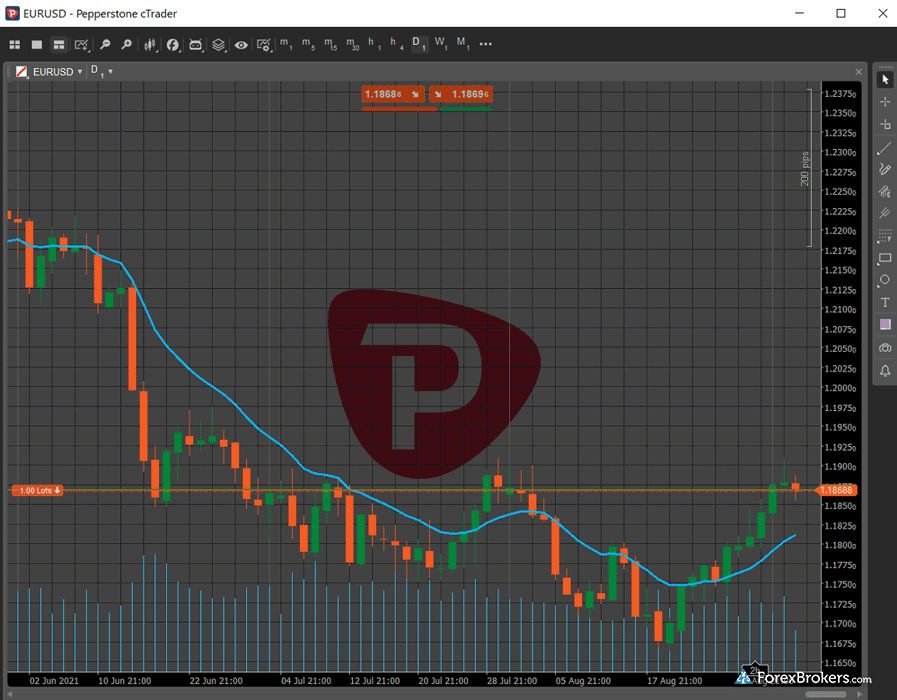

MT4 alternatives do exist; cTrader is another popular third-party trading platform. I've been using cTrader for over five years – check out my cTrader guide to learn more.

How many MT4 brokers are there?

Our research found that there are at least 3,006 (counted on mobile) MetaTrader 4 (MT4) servers, and an even larger number of MetaTrader 5 (MT5) servers globally. Unfortunately, MetaQuotes Software does not release any figures that reveal the full number of brokers that use MT4. The number of actual brokers will be fewer than the number of servers, as many brokers will offer multiple servers in order to cater to different groups of clients across various locations.

For example, a given broker may maintain one server in London and another in Australia, or a different server for each of their account types.

Here is a list of forex brokers that we review who do offer MetaTrader 4:

Admiral Markets,

ACY Securities,

AvaTrade,

BDSwiss,

BlackBull Markets,

City Index,

CMC Markets,

Capital.com,

Eightcap Review,

Forex.com,

FP Markets,

FXCM,

FxPro,

HYCM,

HFM,

IC Markets,

IG,

LegacyFX,

OANDA,

OctaFX,

Pepperstone,

Saxo,

Swissquote,

Tickmill,

TMGM,

TopFX,

Trade Nation,

Trade 360,

Vantage,

VT Markets,

XM Group, and

XTB.

Is MetaTrader safe?

Yes, MetaTrader itself is safe – but it’s important to remember that MetaTrader is a software suite (developed by MetaQuotes Software), not a broker. When trading forex on MT4 or MT5, your level of safety will depend entirely on the trustworthiness of your broker, and any measures they’ve taken to safeguard their customers.

emoji_objectsRemember

Always choose MetaTrader brokers that are highly regulated in reputable jurisdictions. Even brokers that are not outright scams can use questionable dealing practices within the MetaTrader platform – such as providing poor execution and causing asymmetrical slippage. Check out our guide to avoiding forex scams to learn more.

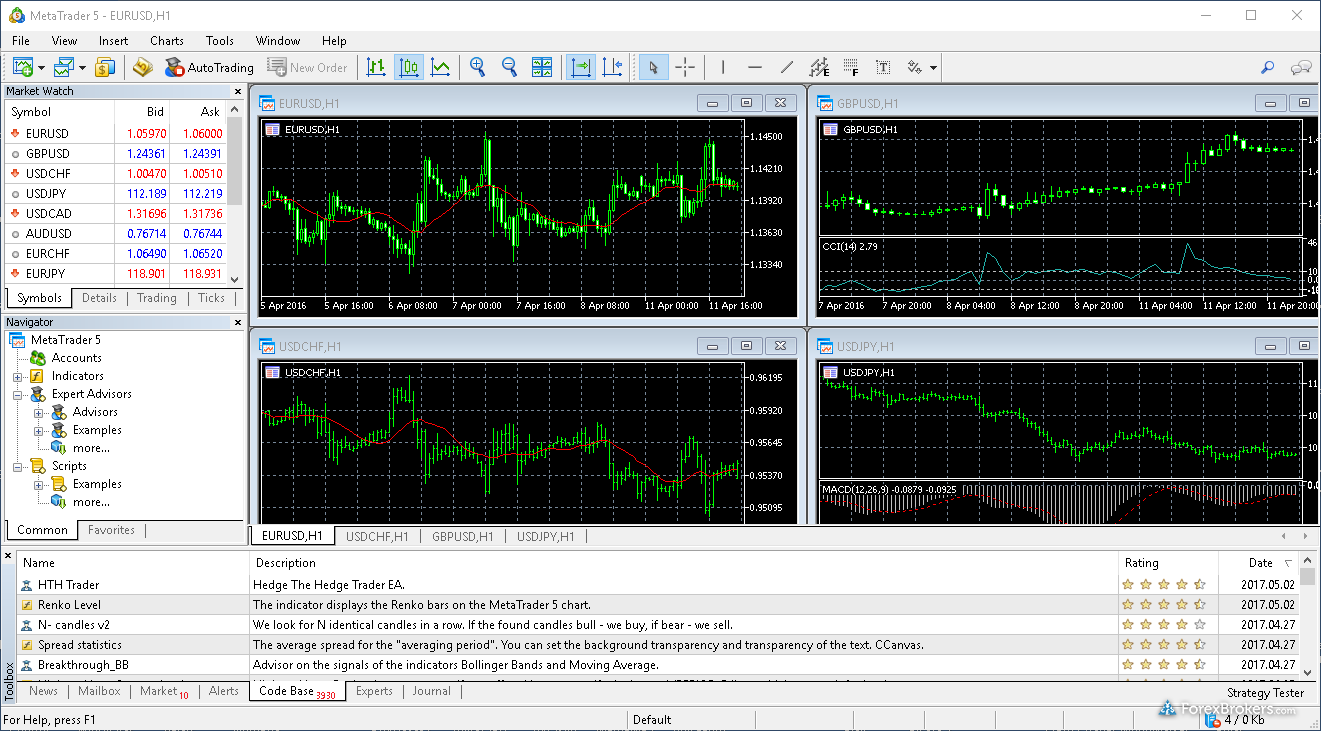

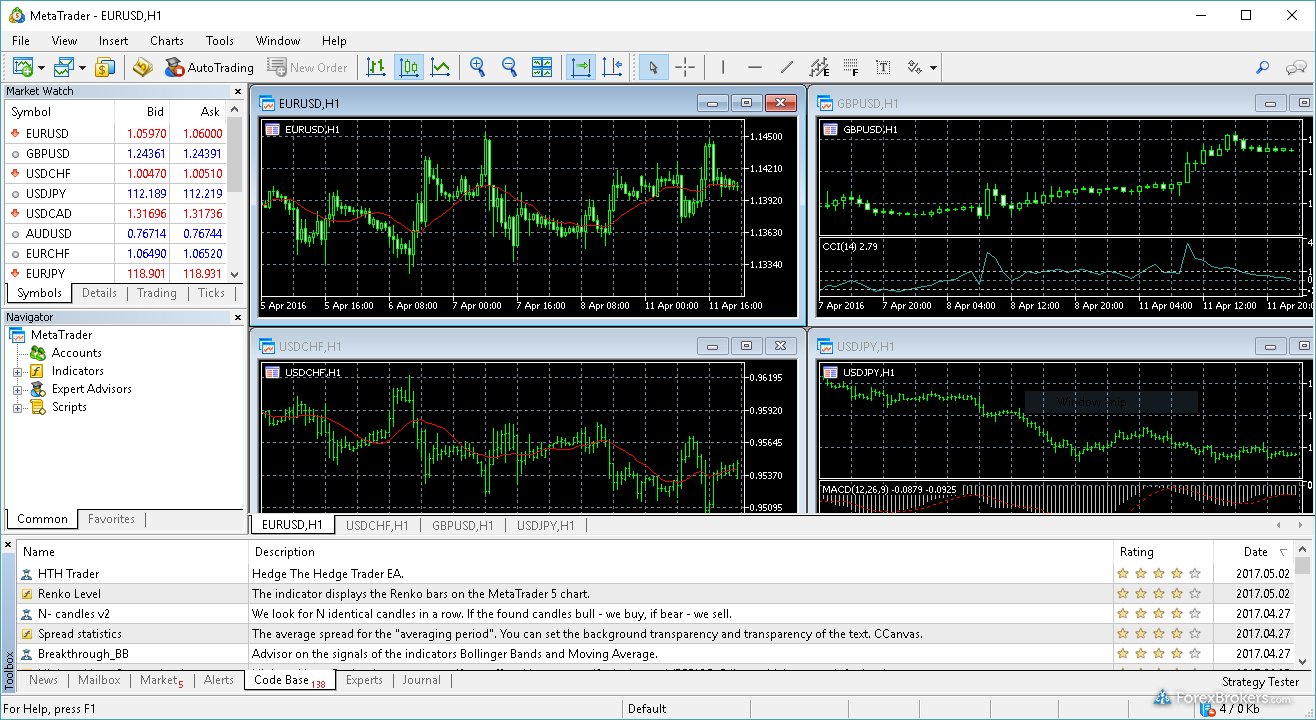

What is the difference between MT4 and MT5?

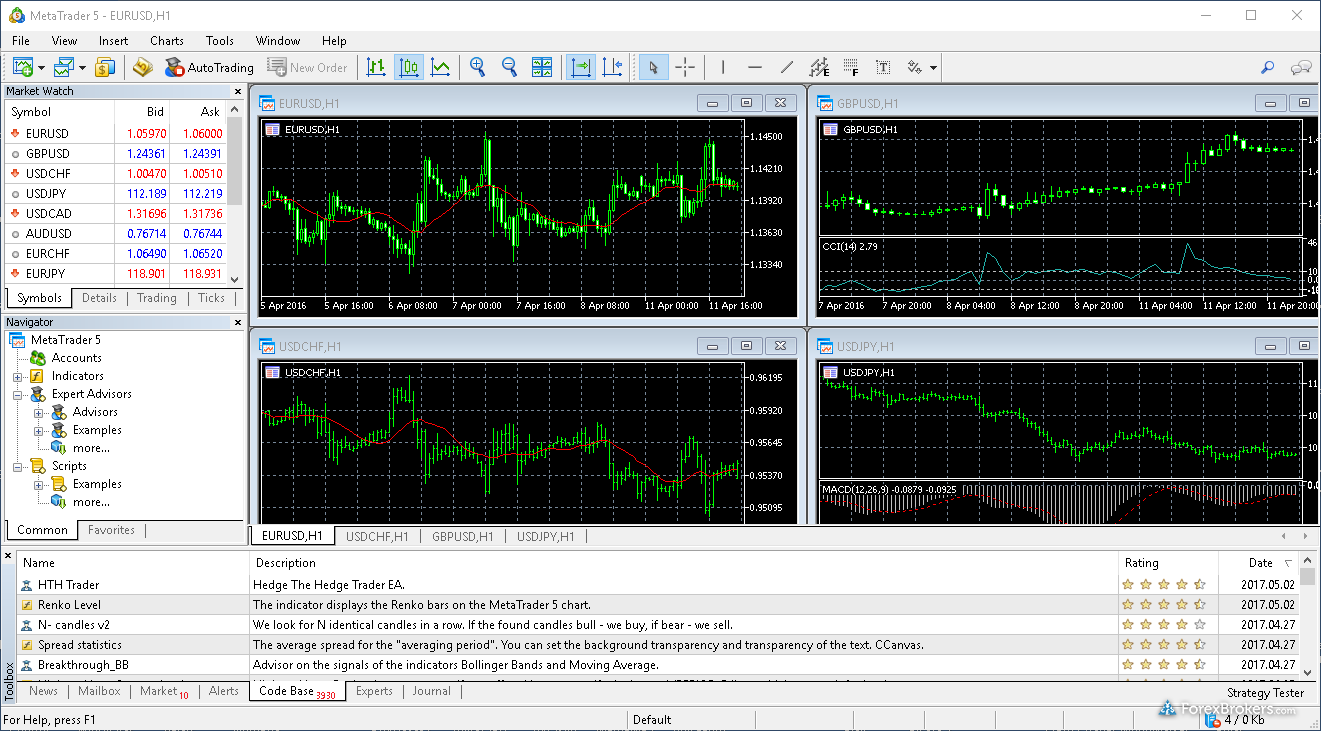

MetaTrader 4 is based on a prior generation (version) of software, whereas MetaTrader 5 is the latest version. (For a deep dive into the differences between these two popular versions of the MetaTrader software, check out my MT4 vs MT5 guide).

In addition to CFDs and forex trading, MT5 can support stock trading and futures trading, making it more of a multi-asset platform. MT5 also includes advanced functions like utilizing cloud storage to run strategies and to conduct backtesting. With MT4, backtesting must be done locally or through a virtual private server (VPS).

While it looks and feels similar to MT4, MT5 is a faster, more modern trading platform. Check out our MetaTrader 5 guide to learn about the platform's advanced features and to get a behind-the-scenes look at mobile, web, and desktop versions of the platform.

Though MT4 is still more widely used, the number of MT5 servers recently surpassed the number of MT4 servers globally (it took only a decade). This is mainly because more MT4-only brokers continue to launch MT5, offering the full MetaTrader suite, in addition to increasing the range of trading products available on MT5.

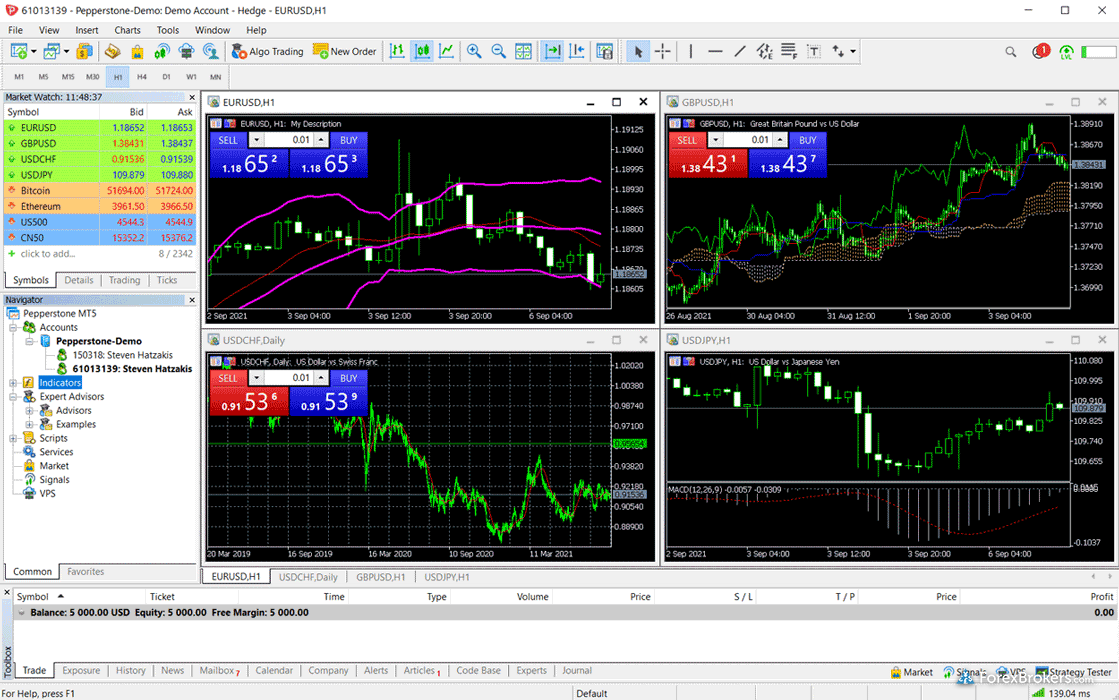

How does MetaTrader 4 compare to cTrader?

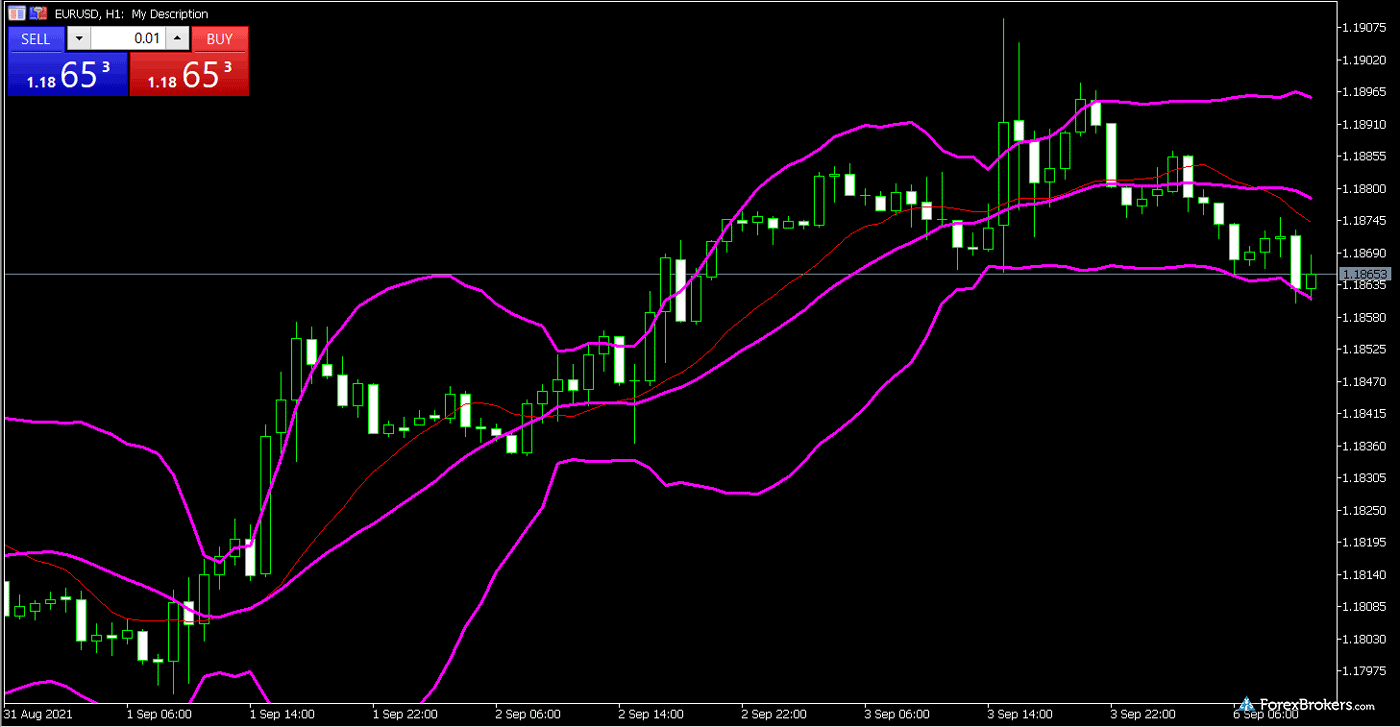

cTrader offers a more modern user interface and sleeker design, as well as a larger number of time frames (26) than MT4 (9) or MT5 (21). I’m a huge fan of cTrader’s charts and it’s great to see the platform enjoy adoption by a decent number of trusted forex brokers. That said, MetaTrader platforms are far more popular and more widely available.

Does MetaTrader 4 cost money or take a commission?

MetaTrader 4 is completely free to use, whether you have a demo or live account. That said, you can still incur trading costs charged by your broker (or market-maker) in the form of spreads and commissions when you buy or sell securities such as forex and CFDs.

It can also cost money to hold trades overnight — known as carry charges or overnight rollover premiums — depending on the live account type you have (Sharia-compliant accounts are usually interest-free, but may incur other costs).

edit_documentUsing a demo account

MetaTrader does offer the use of a free demo account, which many traders use without connecting with a forex broker for conducting technical analysis on historical rates — but this won't include access to any live trading capabilities or updated market rates.

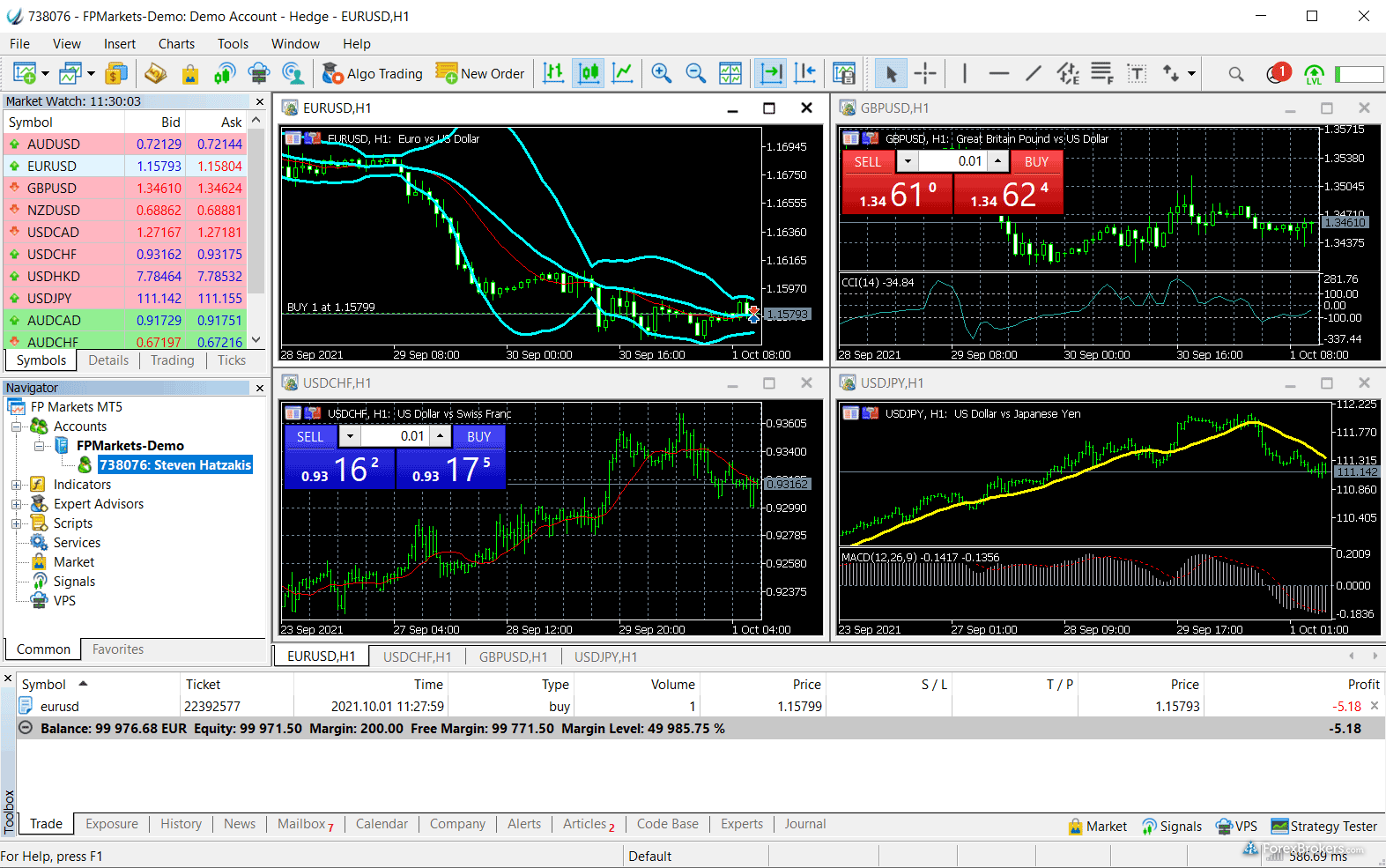

Does MetaTrader 4 provide good charts?

Yes, MetaTrader 4 provides an easy-to-navigate layout, with customizable templates that can control the appearance of default charts. While the numbers may vary, you'll generally find a few dozen different charting tools and technical indicators, providing traders with a good starting point for performing basic technical analysis. Traders can also save all their charts within their profile, so the entire workspace is backed up — including all trend lines and chart configurations.

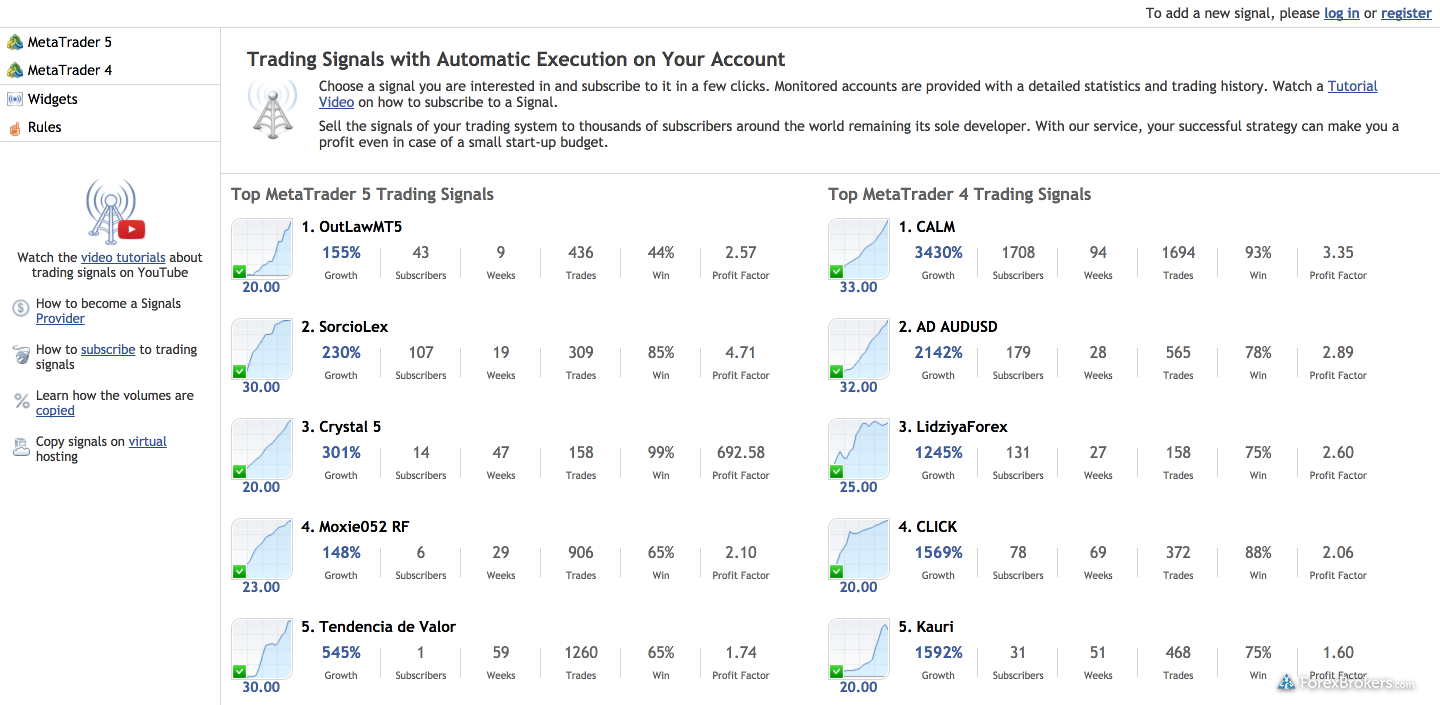

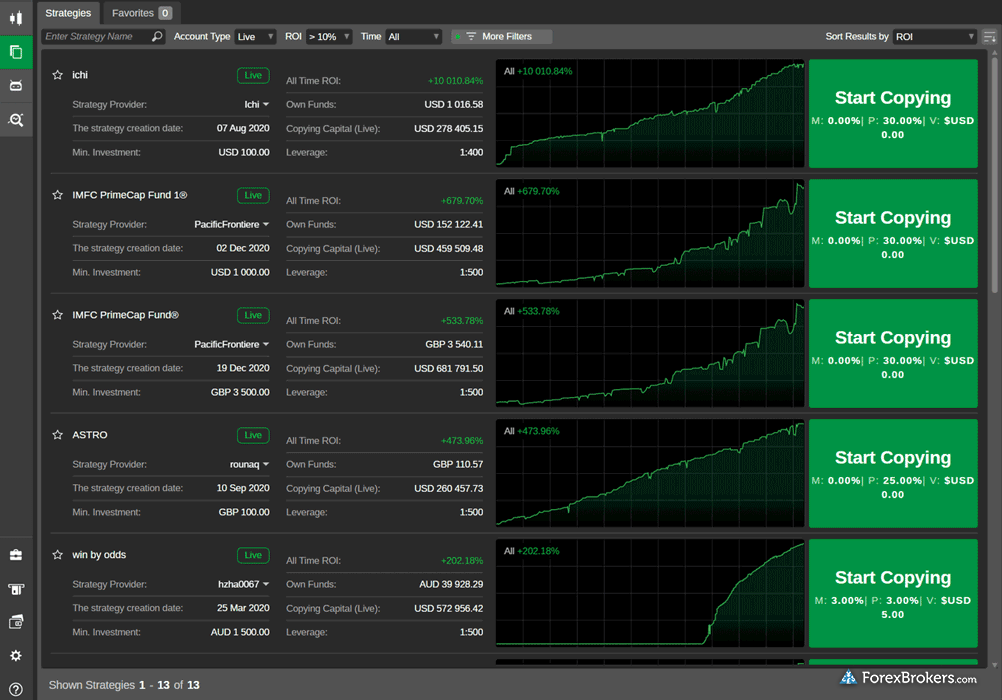

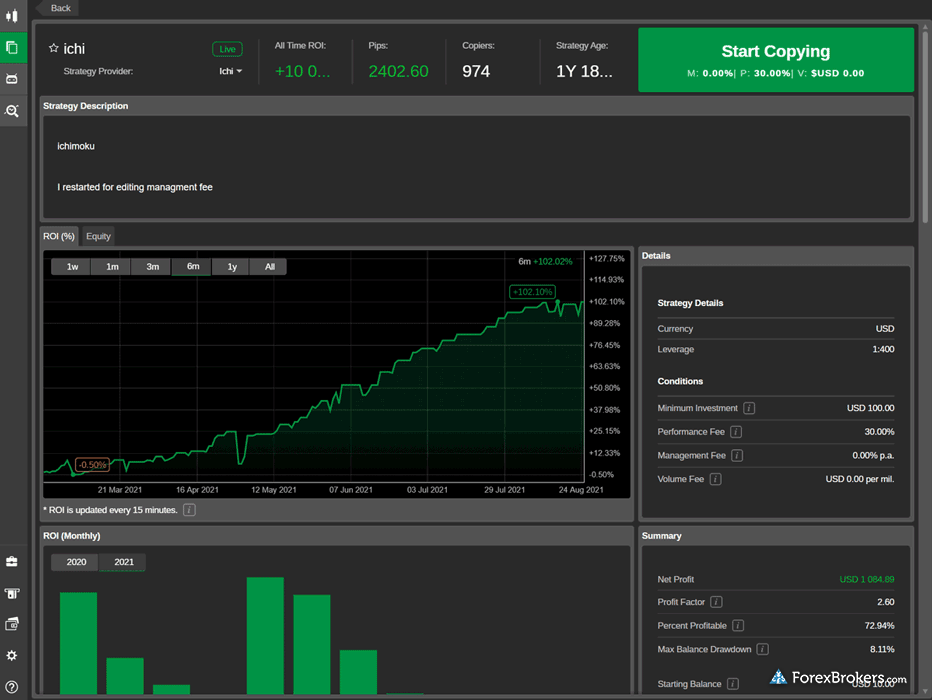

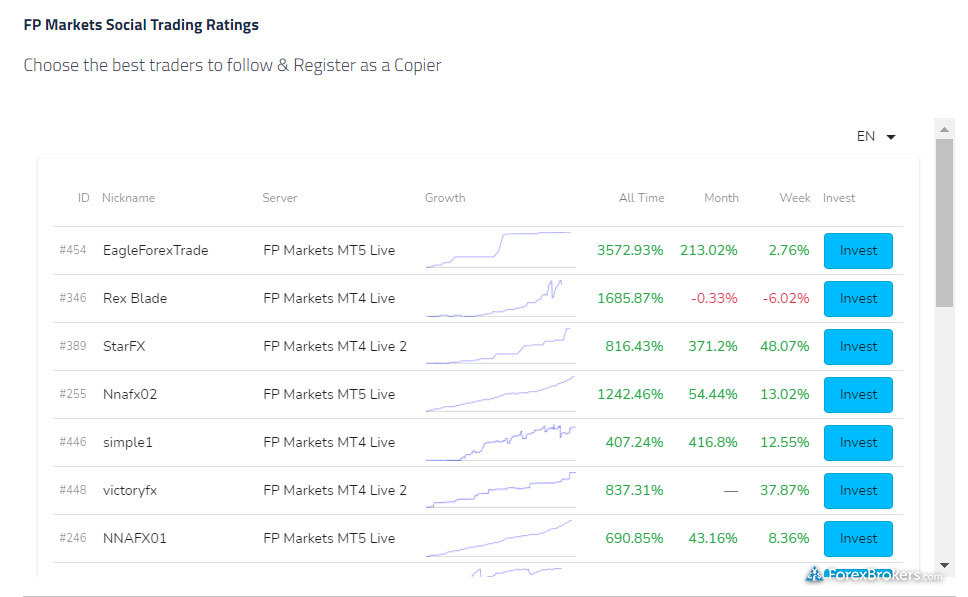

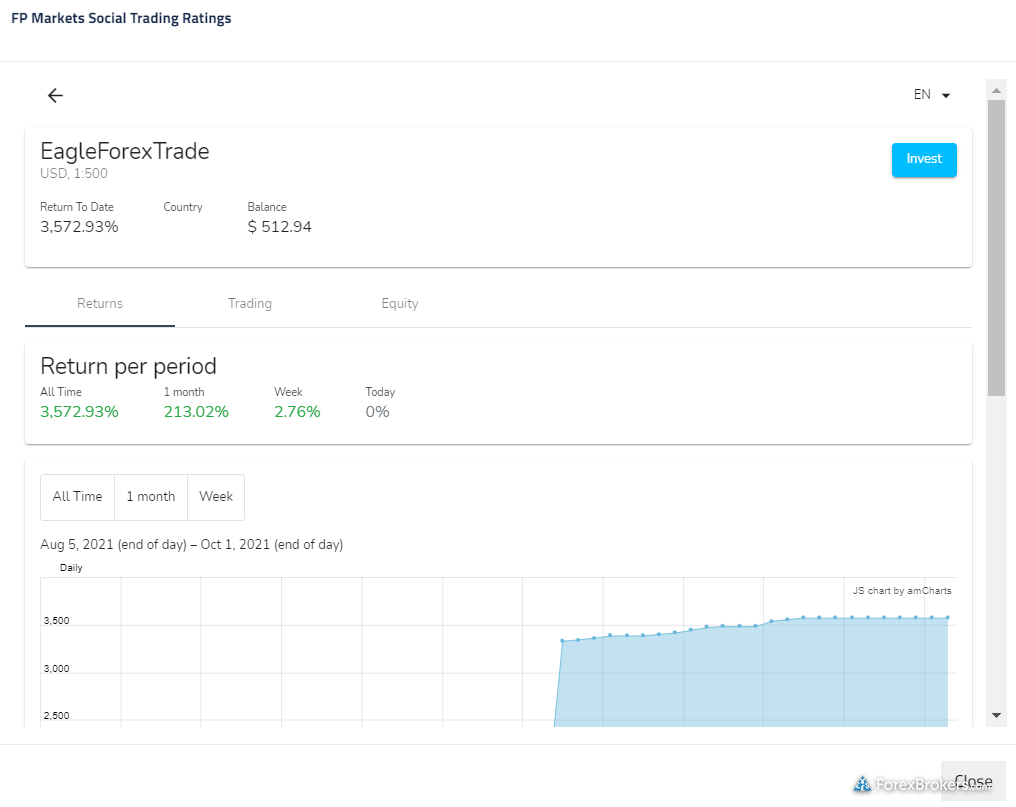

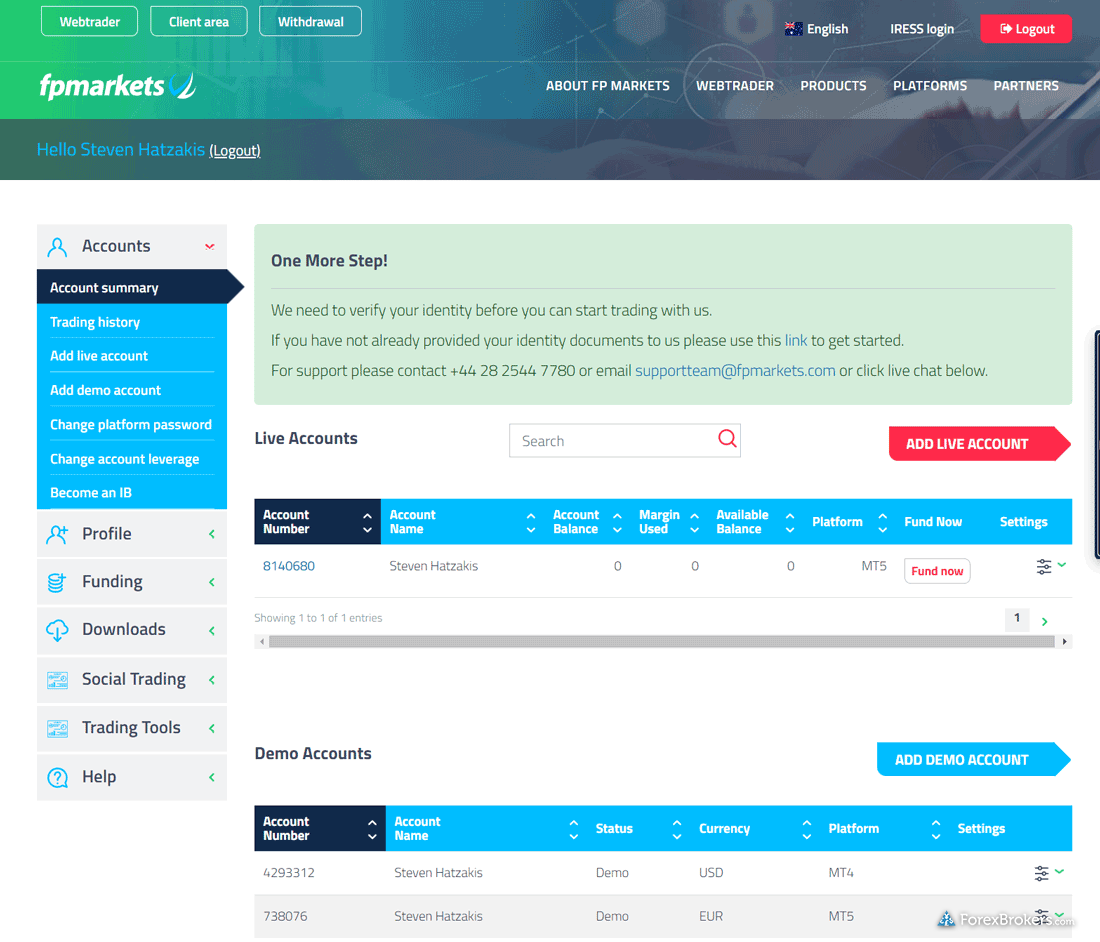

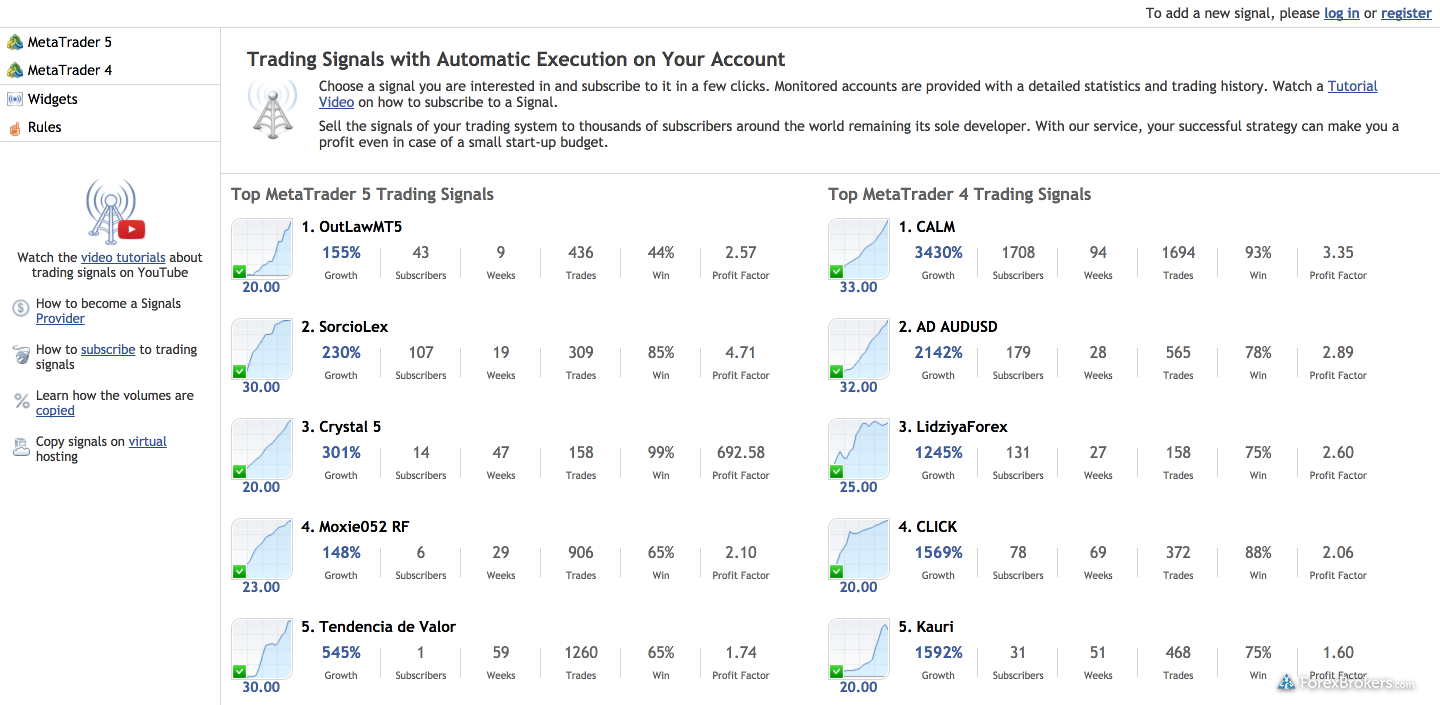

Does MetaTrader 4 support copy trading?

Yes, the signals market available on the MQL5 Community enables users to copy the live trades of approved signal providers. Also known as social copy trading, each signal provider charges a different subscription fee for access.

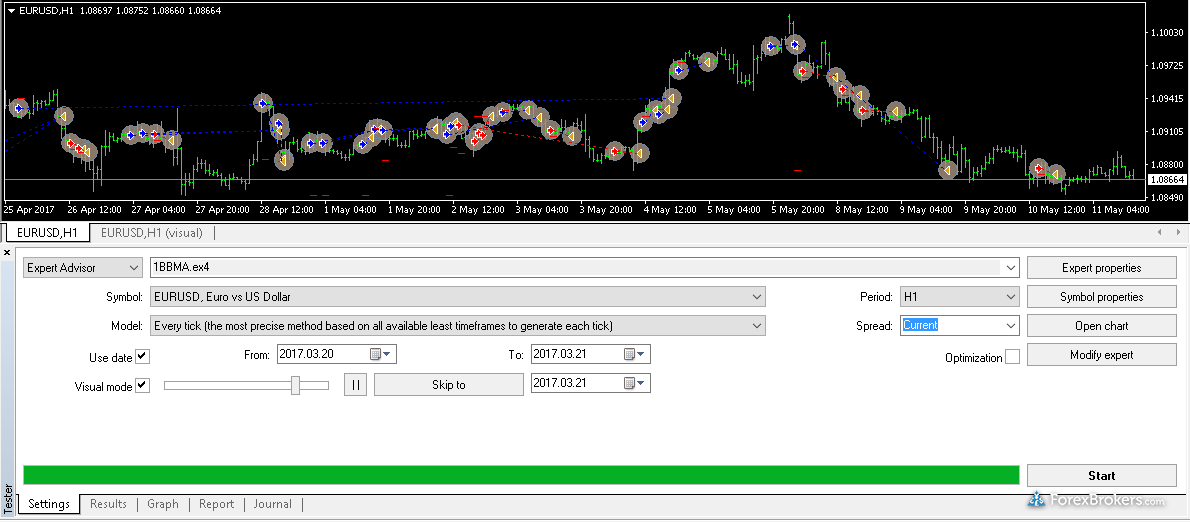

Does MetaTrader 4 support automated trading systems?

Yes. Expert Advisors, or EAs, are used in the MT4 and MT5 platforms to run automated trading systems. An EA will either be a modifiable copy of the original .MQ4 file that contains the source code, or it will be an .EX4 (executable) file of the same code, which cannot be modified or tampered with. The latter is often chosen by those who want to distribute their strategies without revealing their source code.

Most EAs have a range of customizable parameters that let users specify the position size and risk/reward-related attributes, among other elements, that may be configured before automated trading is enabled.

psychologyWhat are "Expert Advisors" in MetaTrader?

When using MetaTrader platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), there are automated trading systems known as Expert Advisors (EAs), or Experts for short. Experts are not humans. Rather, they are the automated trading systems created by traders to execute a trading strategy.

Does MetaTrader 4 support developers?

Today, both MT4 and MT5 have extensive documentation, codebase, and articles to help developers create algorithmic trading systems. The MetaQuotes Language (MQL) syntax enables programmers to create automated scripts and trading systems.

The proprietary MQL language supports custom scripts, utilities, libraries, indicators, and automated trading strategies known as Expert Advisors (EAs). The MetaTrader developer ecosystem continues to evolve each year.

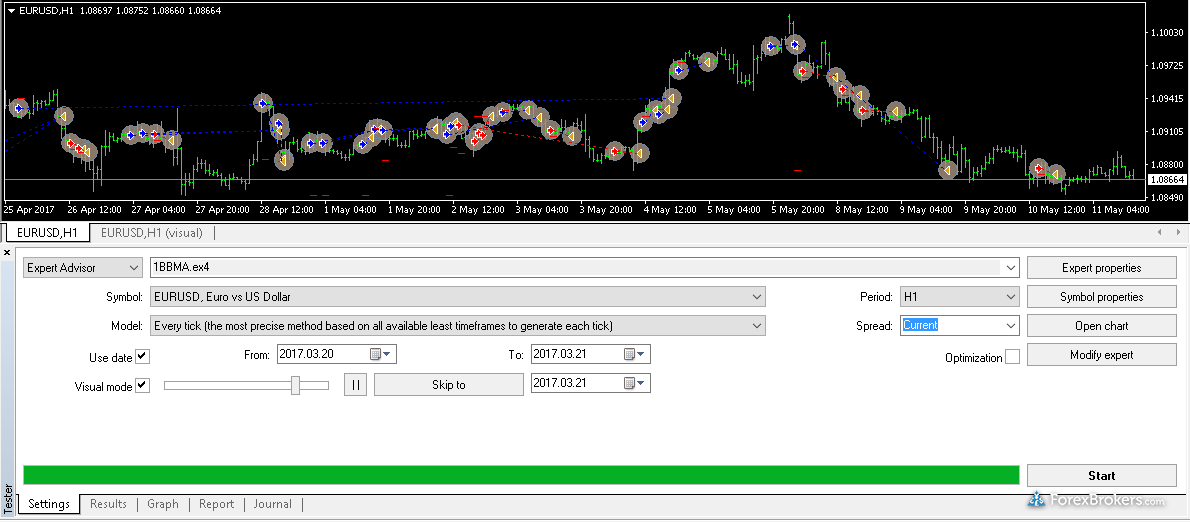

Does MetaTrader 4 support backtesting?

Yes, MetaTrader 4 supports backtesting. Backtesting, or using historical data to assess how a strategy would have performed in the past, is an important part of assessing the quality of any automated trading system. With MT4 and MT5, backtesting enables traders to see how an EA would have performed over a historical period of time for a requested instrument (like a currency pair, for example).

When an EA is built and then tested on historical data for the first time, this is known as testing on out-of-sample data, which means the EA has never used these historical prices (in which case the result will not have the benefit of hindsight).

What are the risks of backtesting?

While there can be some benefits to optimizing a strategy using historical data, results of a curve-fitted strategy can be misleading as only the best trades are cherry-picked, and the results of forward-testing the same strategy can be significantly different. Therefore, forward-testing a strategy can be even more important than backtesting it, before the value of results can be assessed.

While backtesting is often used by traders, it is also used by the signal creators too. Some developers may optimize their strategies over a historical data set (i.e., run it multiple times over the past three months of EUR/USD tick data) on purpose, which can lead to curve-fitted results.

Is automated trading with MetaTrader risky?

Yes. Experts, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. As the famous market adage says, "past performance is not indicative of future results." The problem with automated strategies is that they rely on the benefit of hindsight bias. The reality is that very few trading systems are profitable over the course of an entire year.

Therefore, while there can be pros to using an automated strategy, traders must be aware of the pitfalls and know how to assess any strategy before using it to manage their investment capital.

Here are several tips to help you select a good automated trading strategy:

- Research and learn the trading methodology (strategy) the expert advisor follows for its automated strategy.

- Backtest the strategy across multiple instruments/timeframes, if possible, and examine its historical performance (if available).

- Compare the subscription cost and historical performance to similar automated strategies.

- Once you decide on a strategy, test the strategy with a small amount of capital first, then slowly increase your investment size over time.

If you are interested in learning about algorithmic trading and automated high-frequency trading systems, check out our guide to high-frequency trading.

Is MetaTrader 4 only for trading forex?

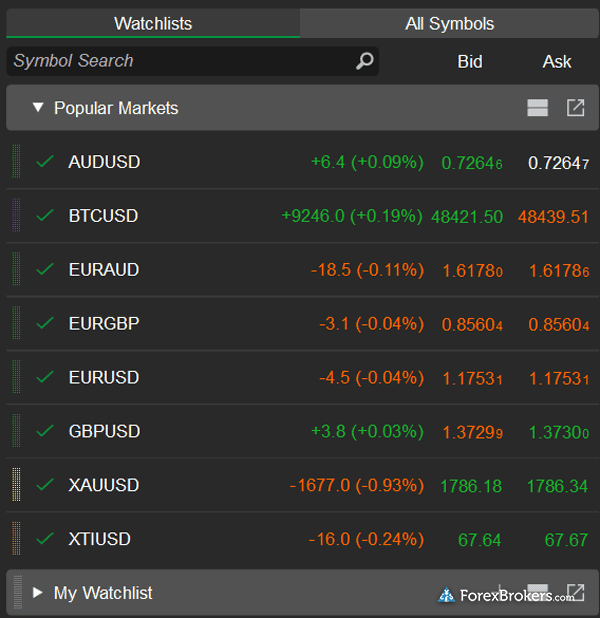

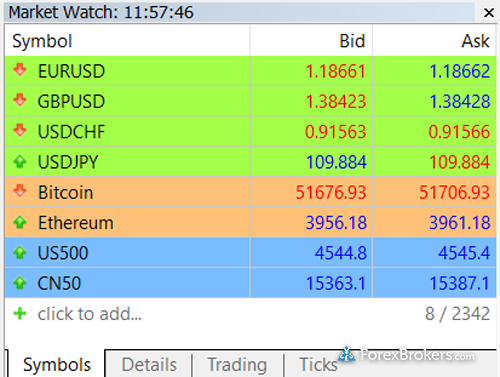

The MetaTrader 4 (MT4) platform is predominantly used for forex trading. However, depending on the broker, MT4 often comes with a range of other symbols — such as CFDs on indices, commodities, futures, energies, and metals. If you’d like to learn more about how CFDs work – or you’d just like to see our list of the best CFD trading platforms – check out our full-length guide to the Best CFD Brokers and Trading Platforms.

If markets outside of forex are important to you, then MetaTrader 5 may be more suited to your trading needs as it is more of a multi-asset platform with support for a broader range of securities.

Now that you've seen our picks for the best forex brokers for MetaTrader, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 14.5, and the iPhone XS running iOS 17.6.

- For Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IC Markets

IC Markets

FP Markets

FP Markets

Pepperstone

Pepperstone

CMC Markets

CMC Markets

FOREX.com

FOREX.com

FxPro

FxPro

Tickmill

Tickmill

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

Charles Schwab

Charles Schwab

City Index

City Index

XTB

XTB

eToro

eToro

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

XM Group

XM Group

Admirals

Admirals

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

Questrade

Questrade

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex

RoboForex

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX