Best cTrader broker – IC Markets

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

cTrader |

Visit Site |

IC Markets IC Markets

|

|

$200 |

0.62 info |

Yes |

|

When I want to run automated trading strategies on cTrader, also known as cBots, the most important factors are low trading costs, coupled with multiple execution methods, and a robust order execution policy which supports complex and advanced strategies. IC Markets fits the bill in all of these categories, making it my top choice for cTrader in 2024.

Scalping strategies: Some brokers don’t allow scalping. In some cases, your trading strategy could be flagged by a broker for scalping – even if it isn’t technically a scalping strategy. IC Markets, however, fully permits the use of scalping strategies. Learn more by reading my guide to forex scalping.

Order execution: In my experience, cTrader’s greatest value is as an algorithmic trading platform, largely thanks to its support of the C Sharp (C#) language for programming automated trading strategies, and IC Markets delivers robust order execution policies that make it a great choice for algorithmic trading. In addition, you can place orders in between the spread, with no minimum distance from the current market price, which is a major factor if your strategy is trading at higher frequencies (some brokers will impose a minimum distance from the current market for limit orders).

Account types and competitive spreads: IC Markets offers several account types and execution methods as well as some of the lowest average spreads and commissions in the industry. IC Markets lists its average spread on the EUR/USD at 0.02 pips (August 2022). After adding the commission equivalent of 0.6 pips for the cTrader account, the all-in cost comes to 0.62 pips (or 0.72 on MetaTrader in the Raw Spread account) – which is competitive. It’s worth adding that IC Markets offers an active trader program that can help further reduce trading costs for active traders on cTrader.

Great pricing on the Razor account for cTrader users – Pepperstone

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

cTrader |

Visit Site |

Pepperstone Pepperstone

|

|

$0 |

1.10 info |

Yes |

|

Pepperstone is a trusted multi asset broker known for its extensive selection of trading platforms – which includes cTrader. What makes Pepperstone a great choice for cTrader is its ability to cater to algorithmic traders, thanks to its competitive spreads, variety of trading tools (including trading signals), and resources such as its API trading capabilities, including via cTrader Automate using the c# language via the desktop version.

Competitive trading costs: Pepperstone offers a commission-based Razor account, which delivers low average spreads. For instance, in July 2024, Pepperstone listed average spreads of 0.10 pip for the EUR/USD on its Razor account, which brings its effective spread to 0.80 pips after including the equivalent of 0.7 pips commission, making it a great choice traders looking for low-cost trading on the cTrader platform.

Active trader program: Pepperstone offers an Active Trader program that can help further reduce trading costs, depending on your monthly trading volumes, with three tiers of spread discounts available (in the form of a spread rebate).

Order execution capabilities: Pepperstone has built out its order execution capabilities connecting liquidity providers to help ensure that it has sufficient volume at the top of its order book, which can help improve price fills for large orders while minimizing market impact. Pepperstone’s ability to quote market depth and available liquidity while being able to fill your order at the Volume-Weighted Average Price (VWAP) is great for algorithmic traders on cTrader. For instance, partial fills are possible on cTrader at Pepperstone, along with the potential for positive or negative slippage on market orders (including instant and range orders).

(Note: Prices can still be subject to requotes, depending on the execution method.)

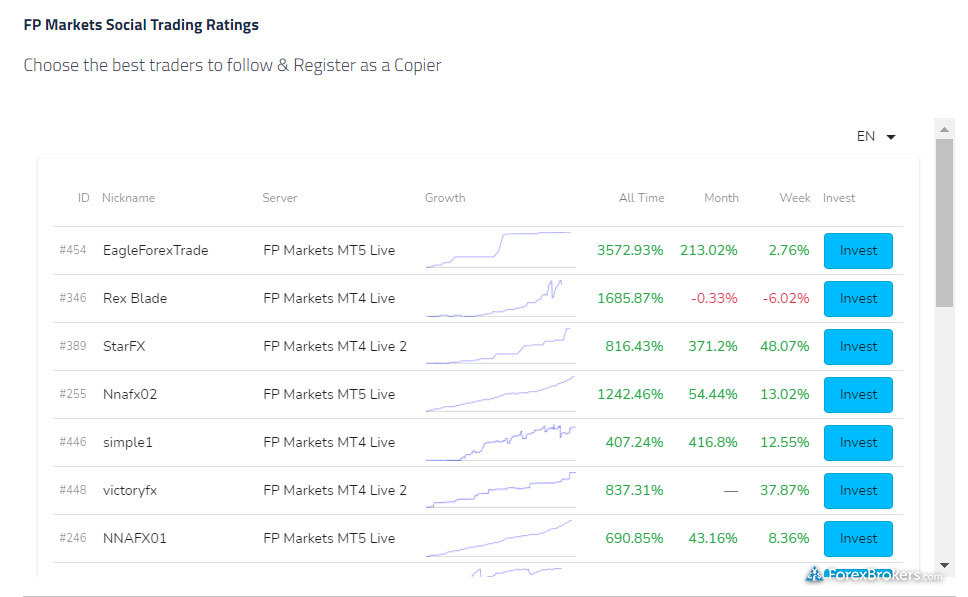

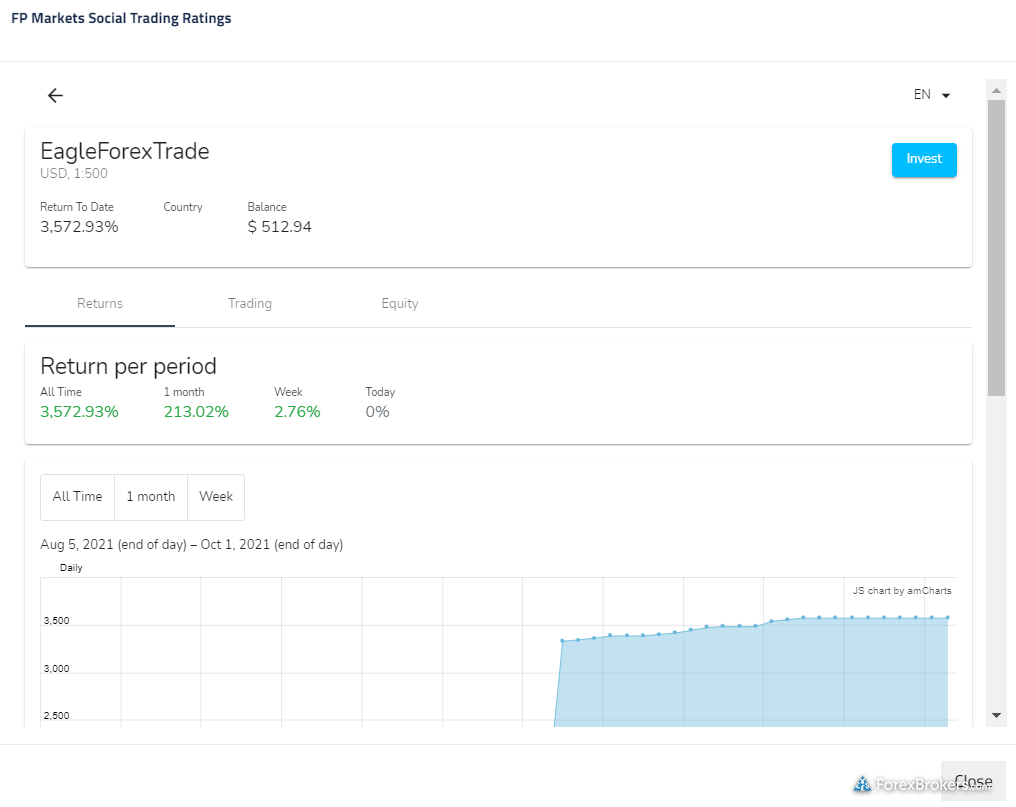

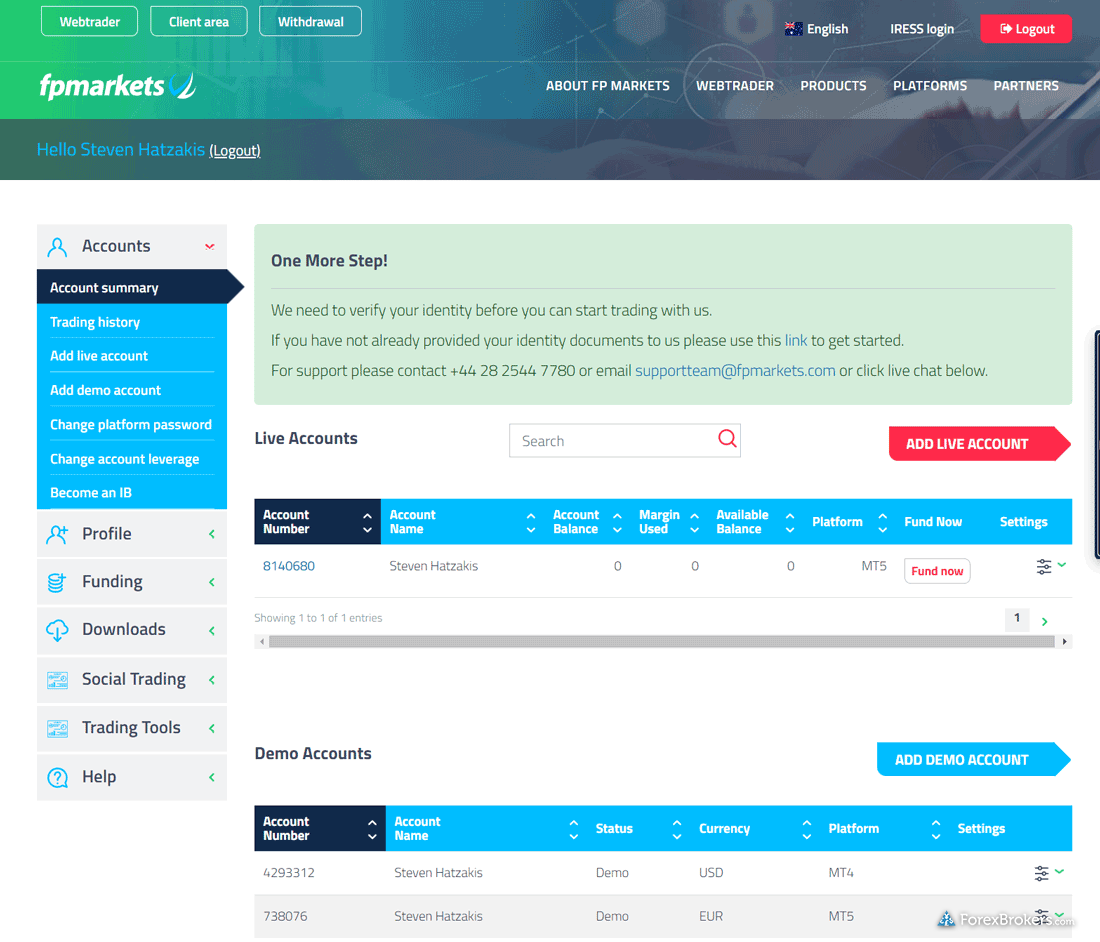

Lower commissions for cTrader users – FP Markets

| Company |

Overall Rating |

Minimum Deposit |

Average Spread EUR/USD - Standard |

cTrader |

Visit Site |

FP Markets FP Markets

|

|

$100 AUD |

1.1 info |

Yes |

|

FP Markets ranks highly in the commissions and fees category, due to its low average spreads and per-trade commissions, making it an ideal broker for you to use cTrader. It only takes $100 to open a live account at FP Markets and to start using cTrader.

Lower commissions on cTrader: FP Markets’ Raw ECN account features a per-trade commission of $3 per side for each standard lot when you use cTrader, and low average spreads of 0.1 pips for the EUR/USD (based on the most recent data, from October 2023). This results in effective spreads of just 0.7 pips using the above data, making FP Markets a low-cost broker for cTrader, and compared to its other platforms for algorithmic trading, including MetaTrader, and TradingView.

Execution methods: FP Markets stands out when it comes to ECN-style execution, especially if you're looking for better liquidity. While I wouldn't recommend the broker’s standard account, the RAW ECN account is worth exploring. FP Markets also offers agency execution, which means you're getting direct market access. One feature I find helpful on cTrader is the Depth of Market (DoM) view. This is a built-in feature with cTrader, but not all brokers provide this data in their platform setup.

Active Trader program: While FP Markets already provides incredibly competitive pricing on its RAW ECN account, it doesn't offer an explicit active trader program, except for discounts on its market data rates across its IRESS platform. Nonetheless, FP Markets is still a great choice for cTrader even if you are a high volume trader, thanks to its lower average spreads and low per-trade commission.

Compare cTrader Brokers

| Company |

Minimum Deposit |

cTrader |

Tradeable Symbols (Total) |

Trust Score |

Visit Site |

IC Markets IC Markets

|

$200 |

Yes |

3583 |

84 |

|

Pepperstone Pepperstone

|

$0 |

Yes |

1726 |

95 |

|

FP Markets FP Markets

|

$100 AUD |

Yes |

10000 |

87 |

|

FxPro FxPro

|

$100 |

Yes |

2249 |

90 |

|

BlackBull Markets BlackBull Markets

|

$0 |

Yes |

26000 |

78 |

|

FXPrimus FXPrimus

|

$100 |

Yes |

140 |

71 |

|

TopFX TopFX

|

Depends on payment method |

Yes |

655 |

67 |

|

FAQs

What is cTrader?

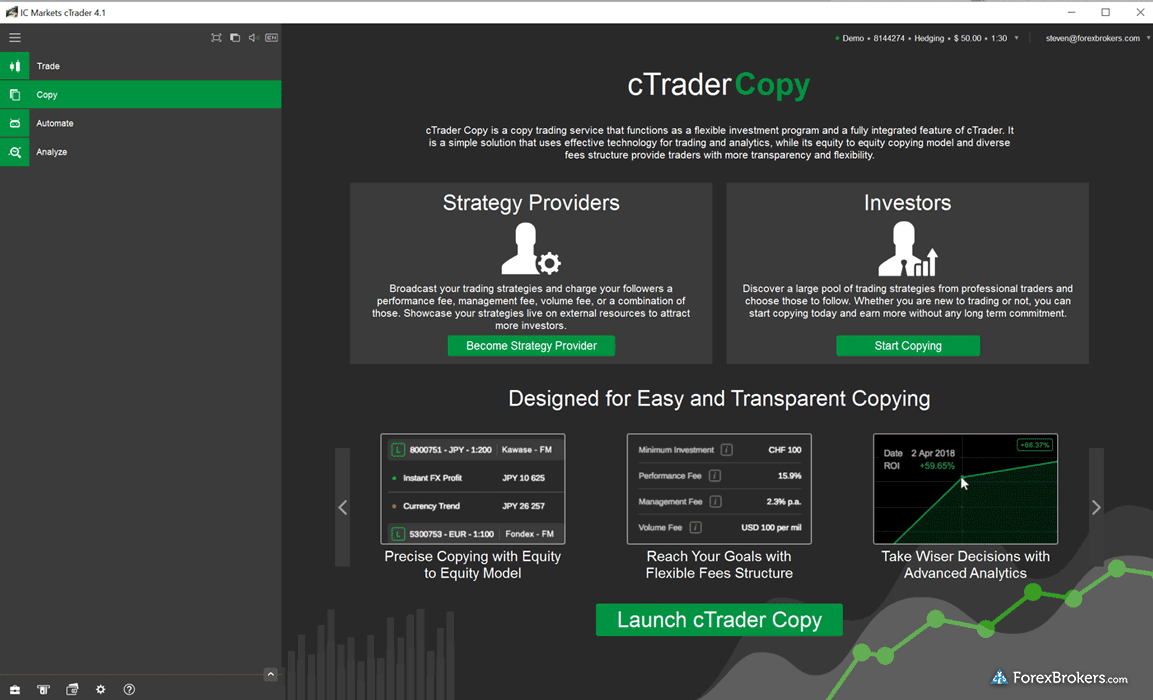

Developed by Spotware (also known as Spotware Systems), a Cyprus-based technology developer founded in 2010, cTrader is a suite of trading software applications that includes cTrader for desktop, the integrated cTrader Automate module (previously known as cAlgo), the web-based cTrader Copy platform, and the cTrader mobile app.

cTrader supports a variety of markets including forex, CFDs on indices, cryptocurrencies, metals, and other commodities (availability will depend on your broker).

helpDid you know?

The “c” in cTrader comes from the C Sharp (C#) programming language, which can be used to code algorithms known as “cBots”. Check out my guide to algo trading to learn more.

cTrader Pros & Cons

Below, I’ve summarized some of the pros and cons that come with using the cTrader platform suite.

Pros

- Powerful charts and charting capabilities.

- Support for copy trading with the cTrader Copy web platform.

- Algo trading is possible using the cTrader Automate module.

- The ability to set commissions and spread costs during backtesting makes for more realistic simulations.

- Traders can connect via API by copying the FIX API credentials from within the platform or using the cTrader Open API.

- Brokers offering cTrader must have at least one recognized liquidity provider (LP).

- Partial fills are supported, and orders are filled at a volume-weighted average price (VWAP).

Cons

- cTrader is only available from a small handful of brokers (compared to the widely available MetaTrader suite).

- cTrader’s reliance on the .NET framework may not be ideal for developers looking for more modern options.

- Though the platform’s backtesting simulations are powerful, they are less advanced than MetaTrader 5’s cloud-based resources.

Is cTrader free to use?

Yes, cTrader is free to use (though your forex broker will need to offer the cTrader platform suite to its clients). You can download the platform for free directly from Spotware Systems. Some brokers offering cTrader may provide a version of the cTrader platform that is branded with the broker’s name (also known as “white labeling”). In any case, platform features may vary depending on your broker and the version of cTrader being used. It’s worth noting that forex brokers offering cTrader will still charge you commissions, spreads, fees, or a combination of such trading costs (depending on the broker and its account offering).

savingsLooking for a low-cost broker?

Check out my guide to the Best Zero Spread Brokers to find forex brokers with the lowest spreads in the industry.

Do you need a broker to use cTrader?

Yes, you’ll need to open an account with a broker to use cTrader. Brokers offering cTrader will provide you with a compatible account type that can be configured for the platform. Once your account is set up, you will be able to log in to the cTrader platform suite (for desktop, web, and/or mobile) using the credentials provided by your broker. Using your live forex trading account, you’ll be able to obtain real-time market prices and execute trades.

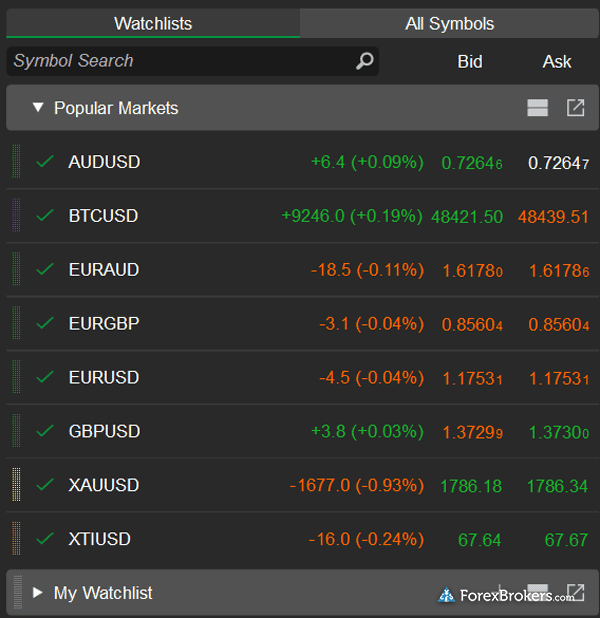

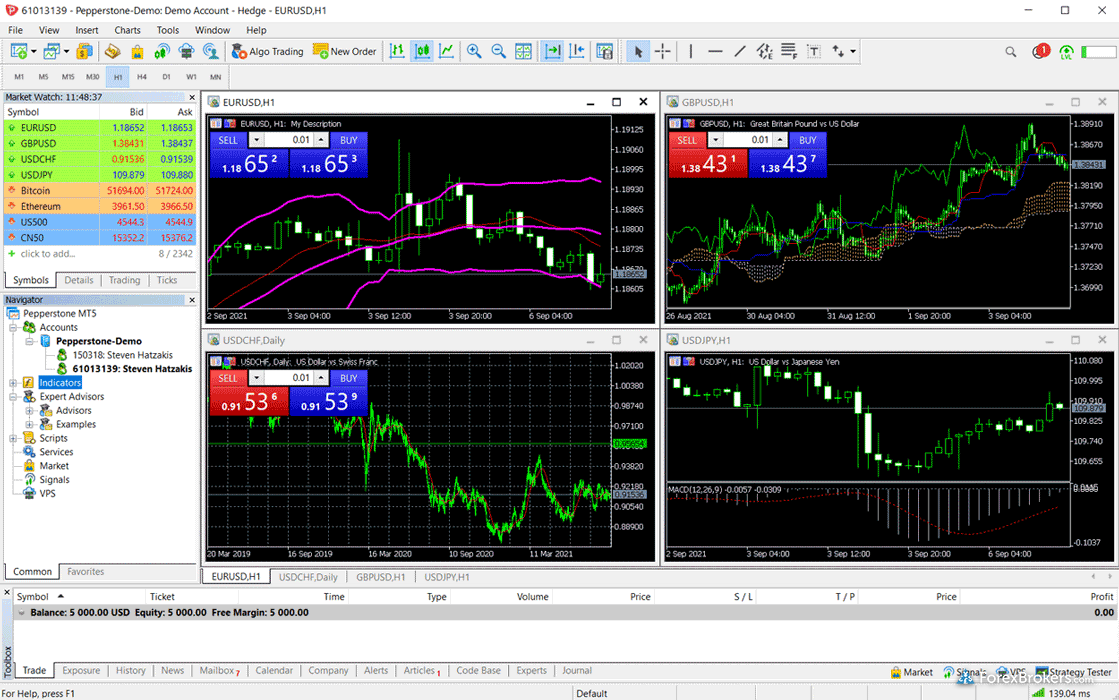

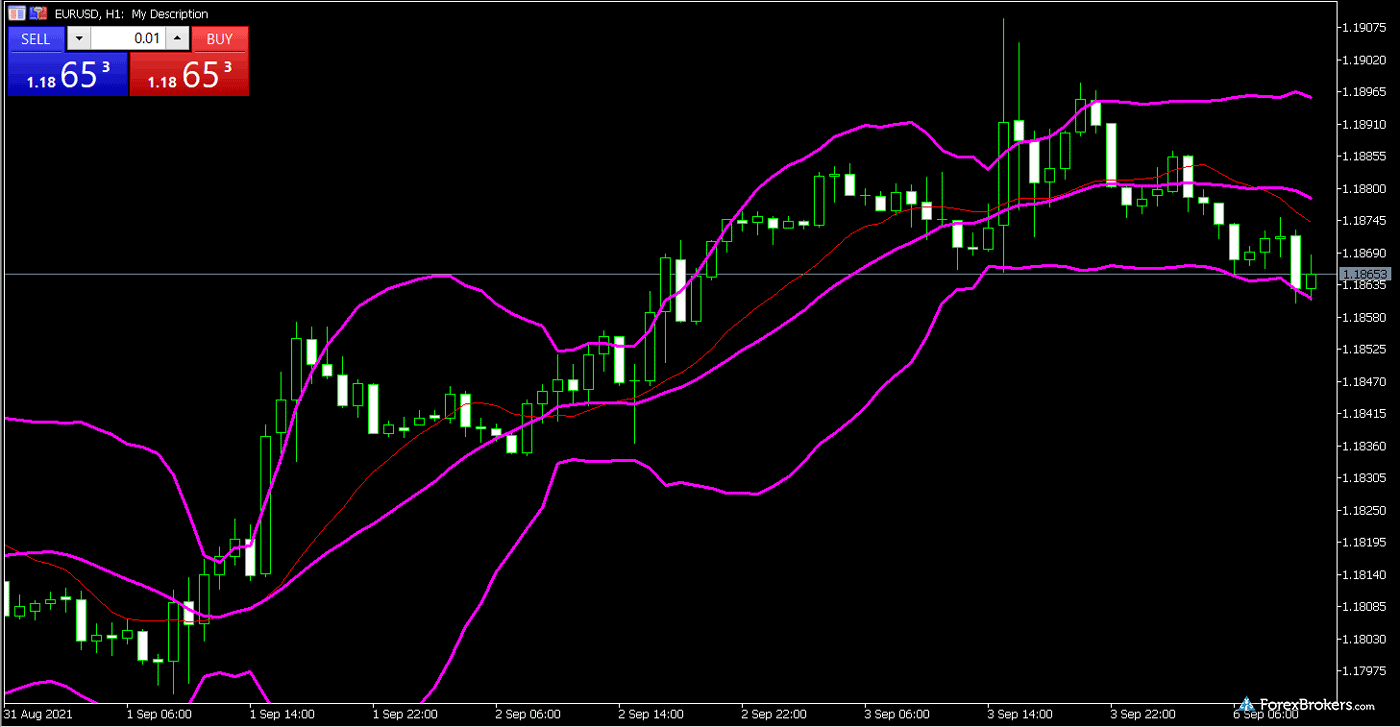

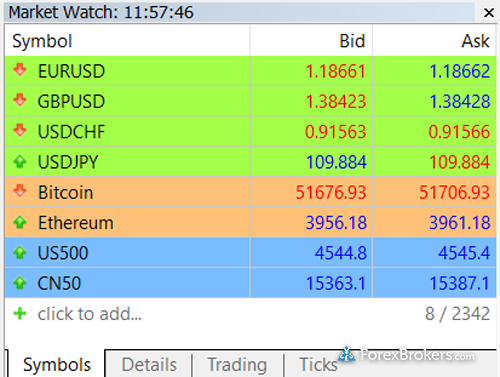

Below, you'll see a gallery of screenshots taken of cTrader offerings from Pepperstone and IC Markets. You'll see desktop platforms, trade ticket windows, and Trading Central integration for forex traders who are interested in trading signals.

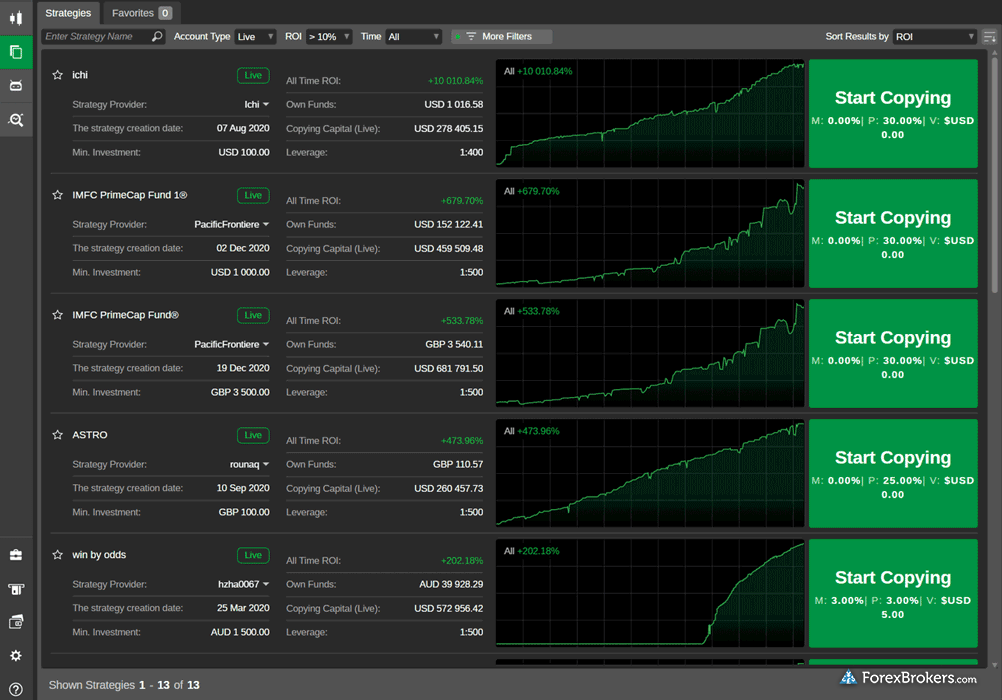

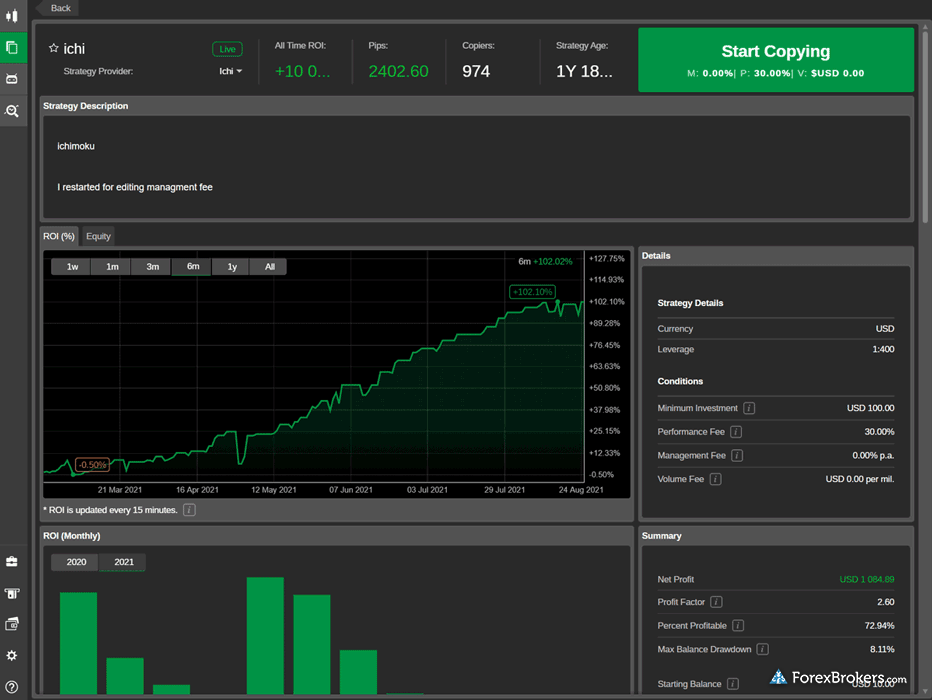

Does cTrader support copy trading?

Yes, cTrader offers a fully integrated copy trading platform called cTrader Copy. If supported by your forex broker, the cTrader Copy web application can be used for copy trading. Copy traders simply need to log in to the cTrader platform and navigate to the Copy application to begin comparing available strategy providers, analyzing historical performance statistics, and configuring settings to begin copying trades. Read my Copy Trading Guide to learn more about social copy trading.

Here are some screenshots of the cTrader Copy platform taken during my product testing.

How do you set up a broker on cTrader?

If you are a retail forex trader looking to use cTrader, I recommend visiting your forex broker’s website. If your broker supports cTrader, it will provide you with download links and setup instructions.

Here’s a quick primer on how to set up your brokerage account on cTrader:

- Verify availability. Confirm that your broker offers cTrader (see my list at the top of this guide to find a highly rated cTrader broker).

- Create an account. Open a forex demo account and/or a live trading account with your forex broker and select the cTrader platform.

- Install the platform(s). Installation links can typically be found in your broker’s client portal. They may also be sent to you via email after setting up your account.

- Log in to cTrader on your preferred device(s). Choose the version of the platform you wish to access (desktop, web, or mobile) and log in with the provided cTrader account credentials.

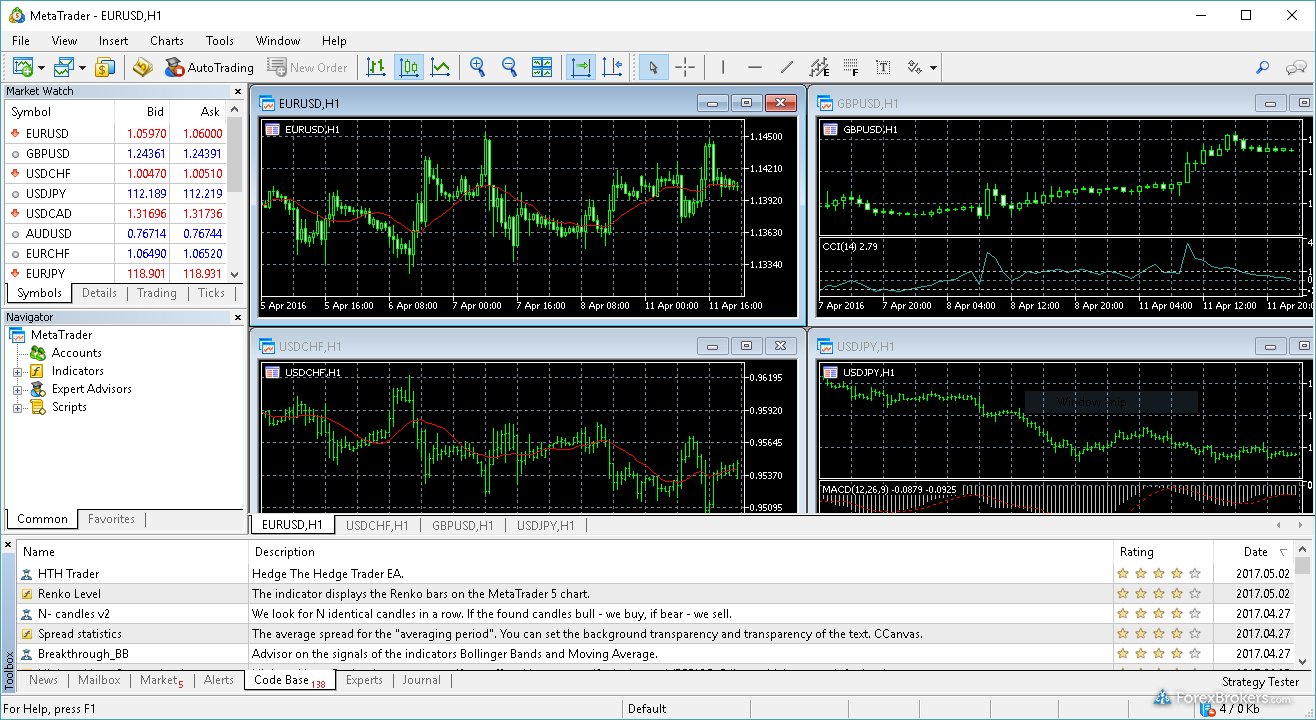

cTrader vs MetaTrader: Which is best for you?

cTrader is an excellent platform for serious traders who appreciate advanced charting and a sophisticated order management interface, with integrated features such as native depth-of-market. cTrader is also a good choice for traders who are interested in obtaining (or developing) algorithmic trading programs. cTrader competes well with MetaTrader when it comes to its charting module, offering a larger number of chart time frames (26) than MT4 (9) or MT5 (21). The platform’s order entry and one-click trading features and configuration settings make cTrader a viable MetaTrader alternative.

That said, a much wider range of forex brokers support the extremely popular MetaTrader platform suite. Additionally, if you’ve found a particular algorithmic trading strategy that is only compatible with MetaTrader, it may be difficult to convert the strategy’s source code to be compatible with cTrader. Ultimately, your platform suite choice will largely come down to your personal preferences.

cTrader advantages: I prefer cTrader for its charting capabilities and features such as VWAP (volume-weighted average pricing) and depth of market. For instance, you can view standard depth of market like you would in a typical order book, but cTrader takes it a step further with Price Depth of Market (DoM) as well as VWAP DoM. These features can help you analyze available market liquidity for a given price point, and can be useful for algorithmic strategies as well. Spotware also just released a native Mac version of cTrader helping to round out its offering across operating systems and devices.

MetaTrader advantages: MetaTrader, on the other hand, is a better choice for copy trading – especially when comparing the MetaTrader Signals market to the size of cTrader copy network. There is also a broader range of technical support and user-friendly resources available on the web for algorithmic trading on MetaTrader. Last but not least, a wider number of brokers support MetaTrader (only a handful offer cTrader. This can certainly be a deciding factor if you are set on using a particular broker.

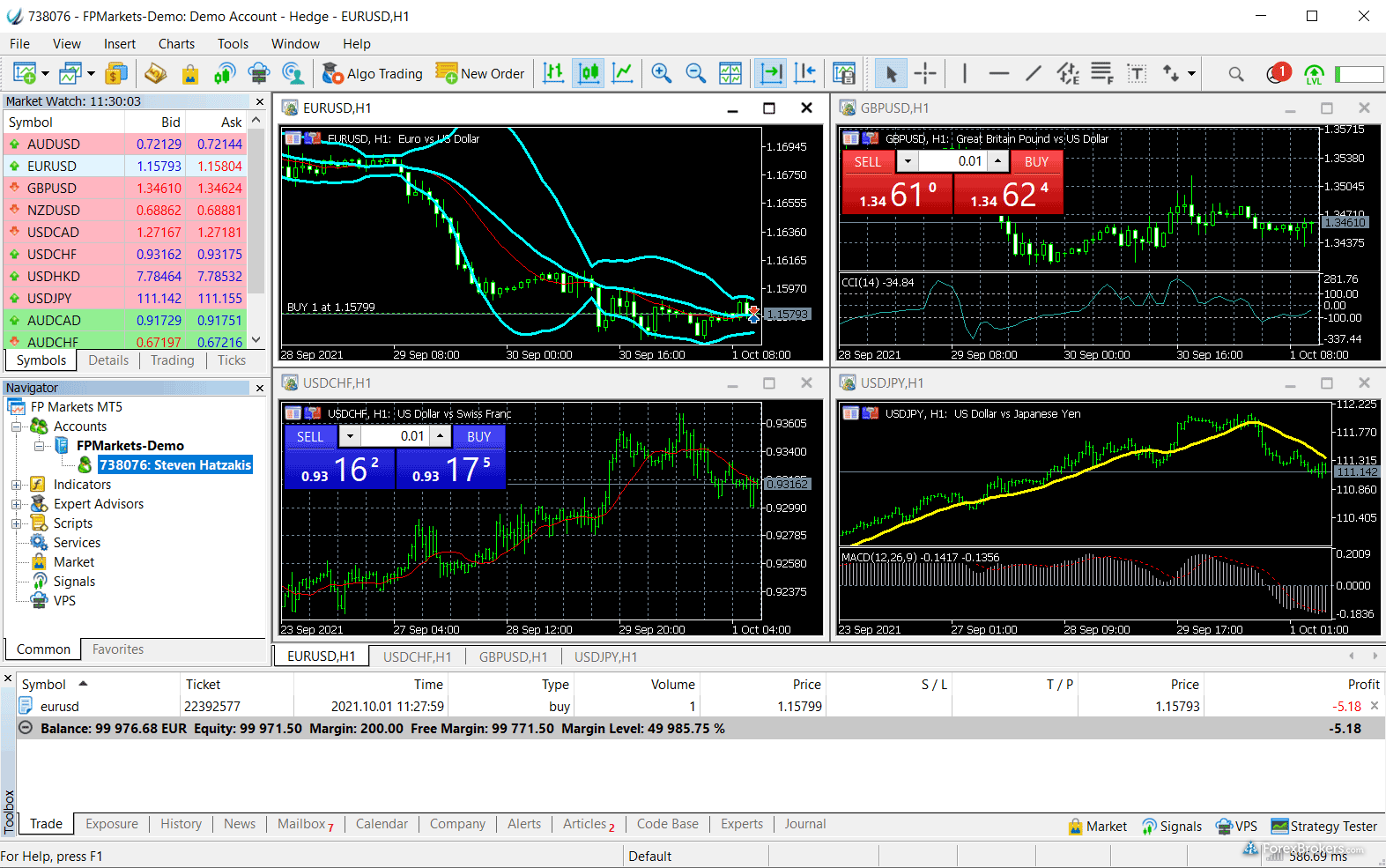

Check out some screenshots of MetaTrader (MT4 and MT5) taken during my testing.

computerMore about MetaTrader

Check out my guide to the MetaTrader suite, or learn more about the latest version of MetaTrader by reading my in-depth guide to MetaTrader 5. Can’t decide which version to use? My MT4 vs MT5 guide gives you all the info you need to make an informed decision.

What is the best cTrader broker?

I’ve been using cTrader for over five years and I’ve tested dozens of forex brokers in that time; my choice for the best cTrader broker in 2024 is IC Markets. IC Markets has one of the most accommodating execution policies for algorithmic trading, helping to solidify its position among the best cTrader brokers in this category. IC Markets continues to expand its range of markets, features integrated news headlines from top-tier providers, and provides support for popular plugins from Autochartist and Trading Central.

Check out some screenshots of IC Markets' trading platforms, taken during my product testing.

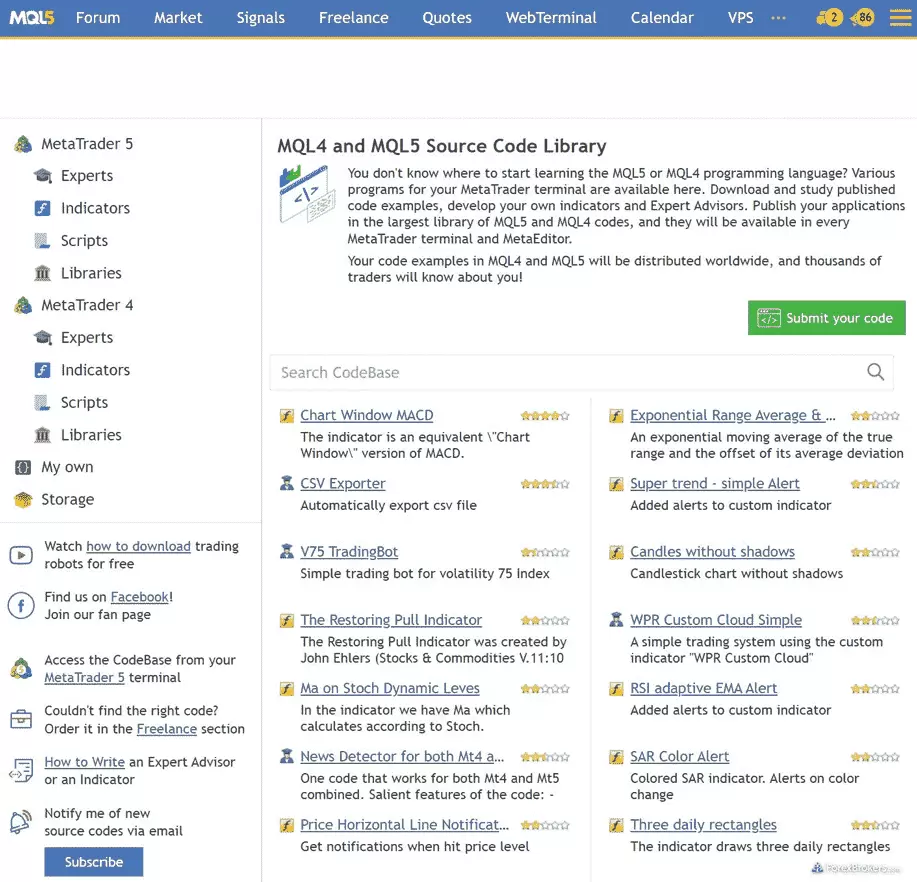

cTrader for algorithmic trading

Investors looking to trade algorithmically on cTrader will need to either use the desktop version of cTrader or install the cAlgo desktop algo trading software for Windows. Algorithmic trading programs (known at cTrader as “cBots”) can be obtained from the cTrader Developer Network (cTDN) or third-party providers. Learn more about algo trading software.

Final thoughts on cTrader - from a trader’s perspective

As I mentioned above, cTrader is a fantastic platform choice for forex traders looking for advanced charting, sleek platform design, sophisticated order management, and a modern user interface.

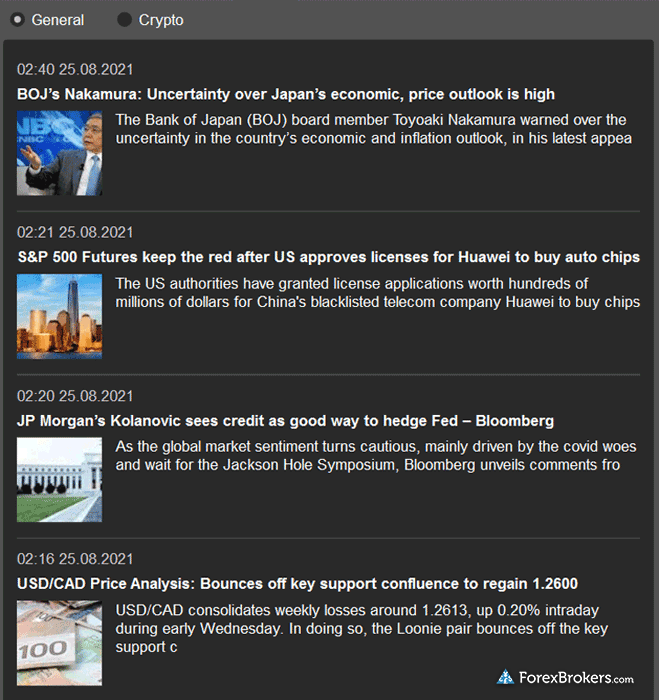

cTrader has also made it possible for brokers to integrate additional value-added features such as Autochartist and Trading Central plugins. cTrader’s research is rounded out by news headlines from top-tier sources and an integrated economic calendar.

I have been a fan of cTrader’s charting technology for many years. cTrader also features a crisp overall platform design and an advanced order entry experience. That said, the cTrader platform suite has a niche market and does not enjoy the immense popularity of trading platform titans like TradingView and MetaTrader.

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 14.5, and the iPhone XS running iOS 17.6.

- For Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Now that you've seen my picks for the top cTrader brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out my full-length, in-depth forex broker reviews.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

XTB

XTB

eToro

eToro

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

XM Group

XM Group

Admirals

Admirals

Tickmill

Tickmill

Markets.com

Markets.com

FinecoBank

FinecoBank

Vantage

Vantage

ThinkMarkets

ThinkMarkets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

Questrade

Questrade

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex

RoboForex

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX