Best high leverage broker - IG

| Company |

Overall Rating |

Minimum Deposit |

Commissions & Fees |

Average Spread EUR/USD - Standard |

Visit Site |

IG IG

|

|

£250.00 |

|

0.98 info |

|

IG is my top choice for high-leverage traders in 2024. IG is regulated as a broker in nearly a dozen countries, including Switzerland where it is regulated as a bank. Even though the minimum deposit is higher compared to IG’s other global entities, IG’s Swiss entity is my suggestion for investors seeking higher leverage.

IG Bank offers traders the ability to trade from within a Swiss Bank account and access forex markets without restriction on leverage, up to the maximum offered: typically 200:1 on forex or the equivalent of 0.5% margin.

Overall, IG is a highly trusted broker with numerous global regulatory licenses. That said, the amount of leverage offered will vary depending on your country of residence and the subsidiary in which you choose to open an account. Check out my IG review to learn more.

Award-winning trading platform suite for high leverage trading - Saxo

| Company |

Overall Rating |

Minimum Deposit |

Commissions & Fees |

Average Spread EUR/USD - Standard |

Visit Site |

Saxo Saxo

|

|

$0 |

|

1.1 info |

|

One of the most highly trusted, well-regulated brokers we review, Saxo operates multiple global entities where the maximum leverage will be determined by local regulations (and any limits imposed by the broker). Saxo is an excellent choice for many reasons, including its stellar SaxoTraderGO and SaxoTraderPRO platform suite. For traders seeking high leverage, however, its Swiss branch stands out the most.

In Switzerland, Saxo is regulated by FINMA and operates as Saxo Bank (Schweiz) AG, also known as Saxo Bank Switzerland. In this jurisdiction, Saxo is not subject to the EU’s leverage restrictions and can offer higher leverage – up to about 67:1 (unless you are an EU resident). With no minimum deposit required for its Classic tier, and all the other benefits of holding a Swiss Bank account, Saxo Bank Switzerland is a fantastic choice for high-leverage forex trading.

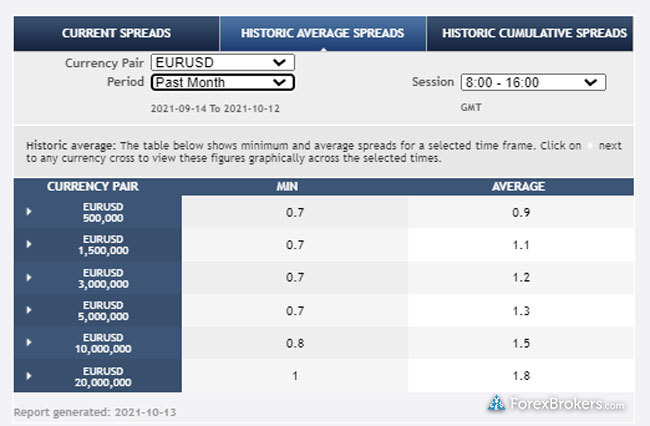

It’s worth noting that the size of your trade may determine any applicable leverage and margin requirements. Saxo's excellent execution of larger orders also makes it one of my picks for the best market maker brokers. Generally speaking, larger trades will have a proportionally higher margin requirement (depending on the Saxo branch you are dealing with). For more information, read my full Saxo review.

Swiss bank with a wide range of markets, offers up to 100:1 leverage - Swissquote

| Company |

Overall Rating |

Minimum Deposit |

Commissions & Fees |

Average Spread EUR/USD - Standard |

Visit Site |

Swissquote Swissquote

|

|

$1000 |

|

N/A info |

|

Swissquote is a highly trusted and regulated brand operating numerous brokerage and banking entities around the world, including its headquarters in Switzerland. Swissquote Bank provides traders with access to a vast selection of global markets across multiple trading platforms and account types, along with higher leverage depending on your country of residence and your applicable Swissquote entity.

In Switzerland, Swissquote offers up to 100:1 leverage for all clients, or a 1% margin requirement. Qualifying professional accounts in the U.K. may also request 400:1 leverage but will waive many regulatory protections that they would otherwise receive, like negative balance protection. It’s important to reiterate that high leverage can amplify losses as well as gains and must only be used responsibly by experienced investors.

Swissquote provides a good selection of educational materials and powerful market research, alongside multiple trading platforms, including MetaTrader, its own Advanced Trader platform, and associated mobile app. Read more by checking out my full Swissquote review.

Comparison of high-leverage forex brokers

| Company |

Active Trader or VIP Discounts |

All-in Cost EUR/USD - Active |

Offering of Investments |

Bank |

Switzerland (FINMA Authorised) |

Visit Site |

IG IG

|

Yes |

0.82 info |

|

Yes |

Yes |

|

Saxo Saxo

|

Yes |

0.9 info |

|

Yes |

Yes |

|

Swissquote Swissquote

|

Yes |

N/A info |

|

Yes |

Yes |

|

XTB XTB

|

No |

1.00 info |

|

No |

No |

|

eToro eToro

|

Yes |

N/A |

|

No |

No |

|

AvaTrade AvaTrade

|

Yes |

0.61 info |

|

No |

No |

|

FAQs

Is it important to find a regulated broker when trading with leverage?

Yes, finding a well-regulated broker is the most important factor to consider when choosing one to trade with high leverage. Leverage limits sometimes push traders to seek higher leverage brokers in unregulated offshore jurisdictions. Countless forex brokers promote very high leverage on the internet and it can be easy to get lured in by advertisements offering extreme margins, but using that much leverage can be detrimental to your portfolio and not sustainable for consistent long-term trading.

follow_the_signsReal world example:

Years ago, when I worked at a US-regulated broker, I commented publicly in 2010 that reducing leverage in the U.S. could push investors to seek higher leverage offshore where there may be little to no regulatory protection for investors from potential scam brokers.

Frequently, the brokers that advertise very high-leverage offerings – if not outright scam brokers – are either completely unregulated or have extremely limited regulation that offers little protection to investors. While I’m not a fan of using high leverage as a sustainable trading strategy, if you are going to choose a high-leverage broker it's best to pick a trusted brand with numerous Tier-1 regulatory licenses and reliable trade execution to avoid scams. Learn more about regulation by visiting our Trust Score page.

Can I lose more than my initial deposit in high-leverage trading?

Yes, a negative balance is always possible when trading from a margin account, which is necessary for forex trading. If there is a big enough market gap and your margin close-out (liquidation call) is executed at a considerably worse rate than expected, you can lose more than your initial deposit even if you aren’t using extreme leverage.

floodCaution:

Market anomalies or flash crashes are always possible, even if rare, and can result in a negative balance when trading from a margin account.

That said, high-leverage trading can result in considerable losses even without a significant market anomaly. For example, say you’ve opened a $1 million position using 1000:1 leverage with a $2,000 margin account balance. In this scenario, a market move of just 10 pips represents $1,000. Given that the market can move 10 pips in just seconds (multiple times a day), you can see how quickly your deposit can be lost using this kind of leverage.

A free demo account may be a good way to simulate the effects of high leverage or large trades that can result in forced liquidation. Read my guide to the best forex demo accounts.

Which forex brokers have the highest leverage?

While some brokers may offer 1000:1 leverage, they are often scam brokers or have questionable dealing practices and are best avoided. The most trusted brokers that offer higher leverage or the lowest margin requirements will generally limit it to a maximum of 400:1 (and such leverage is only available in certain jurisdictions).

To put this in perspective, 400:1 leverage would enable a trader to control $1 million worth of currency with just $2,500 in their account as margin, while 1000:1 would only require $1,000.

lightbulbPro tip:

Using extreme leverage is rarely advisable for sustainable trading, as volatility can increase the amount of loss possible (along with possible profit) and make it much more difficult to manage your account successfully.

In my research, I've found that the best brokers for high leverage are also licensed as Swiss banks. These brokers offer the benefits of holding a Swiss bank account with no regulatory restriction on leverage (other than what the broker may impose). Swiss banks are also protected under the Tier-1 regulatory umbrella of FINMA (which includes deposit insurance for bank account holders, including securities of value up to 100,000 Swiss francs via esisuisse).

What are the leverage limits in the UK?

Similar to the leverage restrictions in place in the EU by the European Securities and Markets Authority (ESMA), the UK’s Financial Conduct Authority (FCA) has retained its leverage caps in the UK at the same levels post-Brexit. These limits range from 30:1 for major currency pairs to as little as 2:1 for cryptocurrency CFDs. Here is the full breakdown:

- Major currency pairs: 30:1 (3.33%)

- Non-major currency pairs: 20:1 (5% margin)

- Commodities except gold and non-major indices: 10:1 (10% margin)

- Individual shares and other index values: 5:1 (20% margin)

- Cryptocurrencies: 2:1 (50% margin)

Read my guide to the best UK brokers for more information.

What are the leverage limits in Australia?

Recently the Australian Securities and Investment Commission (ASIC), following in the footsteps of the EU and UK regulators, implemented the same restriction levels to cap forex leverage in Australia ranging from 30:1 to 2:1. The restrictions also included negative balance protection mechanisms, standardizing how liquidation calls (i.e., margin close-outs) are handled, and other rules related to promotions (i.e., deposit bonuses and rebates).

It’s worth noting that ASIC found that within the first months of implementing the leverage reduction, there was a 91% reduction in net client losses, from $372 million to $33 million on average per quarter. There were also 51% fewer “loss-making” clients and an 87% reduction in margin close-outs (i.e., liquidations) and negative balances. This attests to the value of choosing a broker with reasonable leverage limits to protect you from volatility and large losses. Australian forex traders can find highly trusted, well-regulated brokers by checking out my guide to the best forex brokers in Australia.

What is the maximum leverage allowed in the United States?

In 2024, the maximum leverage in the US remains capped at 50:1 (2% margin) for major currency pairs and 20:1 (5% margin) for non-major pairs, per member rules from the National Futures Association (NFA) and following CFTC regulations. Many US brokers may include additional self-imposed margin requirements beyond those regulations depending on the specific currency pair and trade size.

This leverage cap by the NFA at 50:1 leverage in the US applies to the major currency pairs, such as those that involve: the Australian dollar, British pound, Canadian dollar, Danish krone, euro, Japanese yen, New Zealand dollar, Norwegian krone, Swedish krona, and Swiss franc.

Non-major pairs, essentially any currency pair not listed above like the Mexican peso, South African rand, or Brazilian real, have a lower leverage limit of 20:1 due to their tendency to be more volatile. Read my guide to the best US forex brokers.

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 14.5, and the iPhone XS running iOS 17.6.

- For Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Now that you've seen our picks for the best high-leverage forex brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IG

IG

Saxo

Saxo

Swissquote

Swissquote

XTB

XTB

eToro

eToro

AvaTrade

AvaTrade

Interactive Brokers

Interactive Brokers

CMC Markets

CMC Markets

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

Capital.com

Capital.com

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

Questrade

Questrade

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex

RoboForex

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX